Inflation, the Phillips Curve, and wages

Table of Contents

Prices go up because supply is limited or demand has increased faster than supply.

Inflation happens when there is too much money printing happening at the same time there is a decrease in profitability of companies—which results in a increase in production capacity usage and no investment in new capacity. ("Production capacity usage" is the percentage of the machines/capacity you own right now currently in use producing things you sell.)

Both things are happening right now.

1. The Phillips Curve

The Phillips curve is an old idea that inflation and unemployment are directly related—if you can control one it will affect the other.

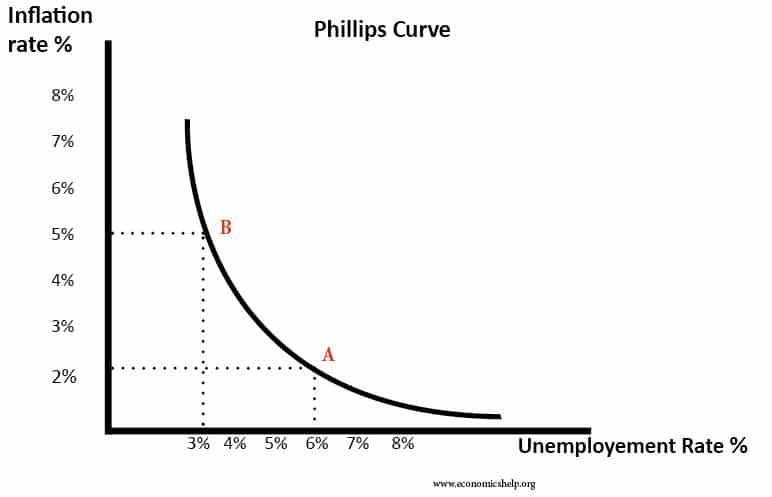

Here is what the mythical Phillips Curve looks like:

See the nice smooth relationship between unemployment and inflation? The idea is that as "unemployment" is reduced, inflation will naturally increase along the curve. The question is, does this happen in reality?

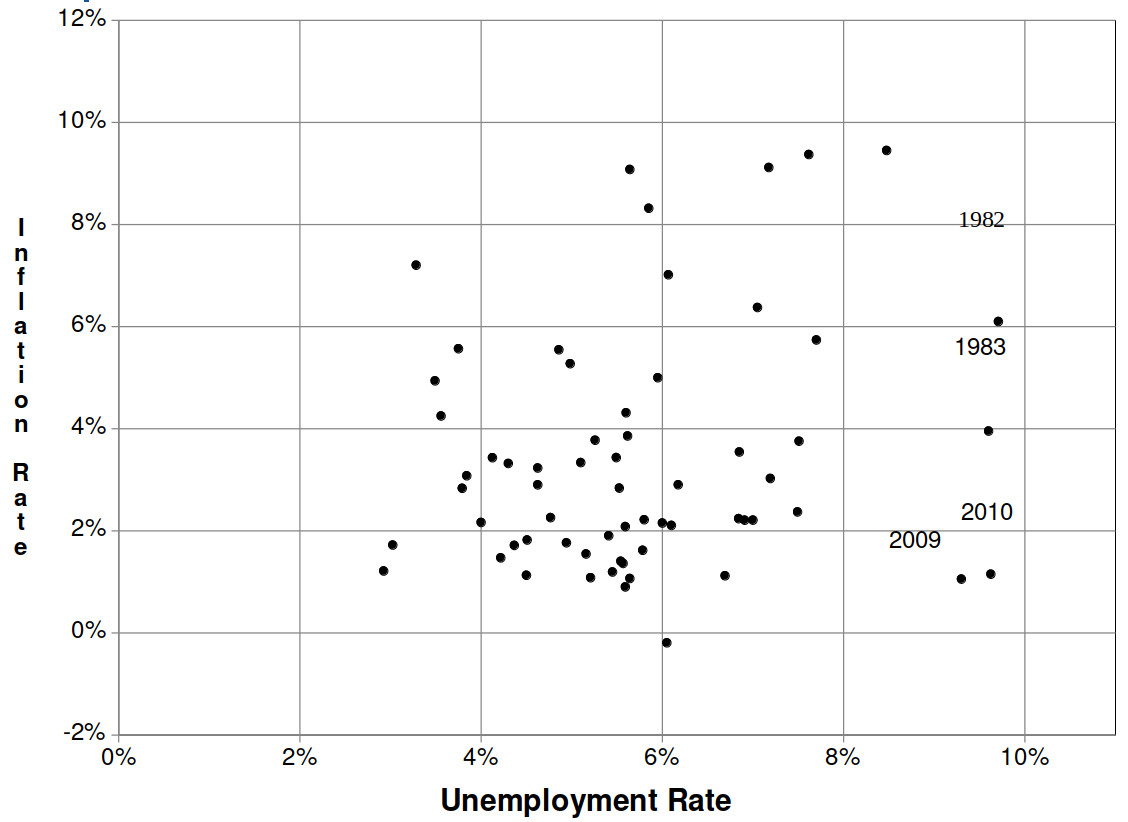

Here is a graph showing the real data (compiled by Anwar Shaikh):

Notice that in the real world inflation and unemployment are not even correlated. They never really were and they are certainly not causative.

Why do we care to point this out? Because the wages argument is related to this understanding of economics.

At a very basic level, Neoclassical economics says that:

- wages are not in competition with profits

- that prices always include some "natural" rate of profit

- that there is some relationship between unemployment and inflation

- that there is a direct relationship between price and wages

- that lower unemployment also results in higher wages (and that higher unemployment result in lower wages)

So, in this economic theory, if wages go up, prices will go up to maintain the normal rate of profit. This is where the "wage-price spiral" nonsense comes from.

2. Wages and the Phillips Curve

What does this have to do with the Phillips Curve? Under neoclassical economics, wages are simply taken by workers and are a direct function of labour markets and unemployment.

The natural state of neoclassical mythology is a situation where there is no involuntary unemployment in capitalism. Unemployment is just a function of government interventionist policy—a result of voluntary unemployment. That is governments intervene in labour markets, the more they intervene to lower unemployment, the higher inflation.

They also believe that the more government allows workers to fight for wage increase (that is, they unionize) the higher the artificial employment rate, the more wages they get, and thus the higher inflation and prices go.

In the neoclassical economic tradition, wages go up and down depending on supply and demand of labour and rational choices by workers to work or not work at this or that wage. Just like consumers make rational choices to buy this or that food stuff. (And, families make rational choices to live or die depending on the price of food and housing.)

It is all nonsense and few serious economist actually believe the economy is this simple. But, you would never know that reading the newspapers/blogs/websites.

Larry Summers thinks the Phillips Curve should drive government economic policy. He wants to get back to "A" on the graph above. The problem is that the curve doesn't exist, so there is no "A" to go back to and we are not at "B" right now.

It is difficult for many people to understand that this Phillips Curve does not exist because central bank economists only talk about interest rates and its effect on inflation. A central bank only has a few levers they can control, the main one being their target interest rate.

The response to inflation from a central bank to try to drive interest rates up, which drives unemployment up, and hopefully brings inflation down. This is based very specifically on the Phillips Curve: more unemployment means lower inflation.

For central banks, interest rates going up drives up unemployment by making debt more expensive thus reducing private economic investment activity and driving people out of work.

The central bank cannot do anything else because it does not have mandate to do anything else. It can only set interest rates by attempting to affect the price of debt (and the printing of money).

This is not the only solution to inflation, it is just the only solution to inflation that the central bank has. Indeed, as we have clearly shown above it is not an actual solution to inflation at all. All driving interest rates up does is drives the economy into crisis which creates a bigger problem than whatever was causing inflation. Eventually, the new crisis will likely result in enough economic and social destruction to bring inflation down—if you wait long enough.

3. Real world example

In the real world, the answer from the data is clear and not at all related to this Phillips Curve idea.

Wages and profits compete with each other. If wages go up, profits go down. There is no ability to "just increase prices" and get your profits back. Prices are regulated by competition with other firms.

There may be oligopolies and monopolies involved in price setting, but there are so few situations like this that their impact on general price increases are limited.

So, do wages drive prices? No. Prices are driven by a bunch of things, wages not really being interesting to much of that. Prices are driven by competition between firms, bounded by input costs (expenditures of production, leases, wages, maintenance of machines, electricity, etc) and debt payments.

So, do wages drive the costs paid by companies? Yes. Costs are driven by the costs of inputs, which includes wages (making up, on average, about 30% of costs)—but this does not directly drive prices paid by consumers and it certainly does not drive inflation. The costs of inputs do not determine the price, but they do bound the price. Take oil/gas. The costs of production have almost nothing to do with price you pay at the pump.

What happens when real costs of a company increase? Profits go down.

What if everyone's costs increase? Prices go up and profits of some producers go up—but only in the short run as profits can increase faster than wages. Eventually workers demand more wages when they see the increased profits. Then profits come back down if workers win in their wage demands.

In this reality-based model, profits and wages battle for the larger mass of revenue from the prices increases, but this battle is not driving prices. Prices were driven-up by the value of money declining (inflation) and—in the current situation—the supply chain and production disruptions that have dragged on supply of needed things, driving the price of good up.

In this reality-based story of real economics, prices are not related at all to wages.

But, you can see why capital wants you to think that wages are the problem—they want to keep the short-run profit spike going.

The problem with this reality is that profits do not drive prices either. Unfortunately for our side (the Left), we love the narrative of profits driving price increases as a response to those pushing the "wage-price spiral", but it is not technically true. If it were, it would be equally true that wages drive prices. What we mean to say is "profit subsidies of the kind created since 2009 have driven inflation (this time)". Well, splitting hairs? Maybe.

This is one of the problems with (post)Keynesian analysis.

However, on a political level there is a conversation about equitable distribution of that excess profit being created by the current situation. Working families are struggling to make ends meet while profits are increasing. The answer is the redistribution of those profits to those in need—those who have nothing to do with the causes of general price increases we find ourselves facing.

4. References

These are a list of papers and articles critiquing the concept of wages driving prices and critiquing the Phillips Curve.

Compiled with thanks to Angella MacEwen.

- Debunking 5 top inflation myths

Economics Policy Institute

https://www.epi.org/blog/debunking-5-top-inflation-myths/ - Wages, Unemployment And Social Structure: A New Phillips Curve

Anwar Shaikh

https://www.anwarshaikhecon.org/sortable/images/docs/publications/macroeconomic_theory/2013/Wages,%20Unemployment%20and%20Social%20Structure%20A%20New%20Phillips%20Curve.pdf - Does Wage Inflation Cause Price Inflation?

Gregory D. Hess, CESifo (Center for Economic Studies and Ifo Institute for Economic Research)

Mark Schweitzer, Federal Reserve Banks - Federal Reserve Bank of Cleveland

April 2000:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1025464 - Inflation Drives Wages Down, Not Up

Judge Glock

Wall Street Journal

01/31/2022

https://ciceroinstitute.org/inflation-drives-wages-down-not-up/ - Business Profits from Inflation, but Workers Will Pay to Bring it Down

Jim Stanford

https://centreforfuturework.ca/2022/06/01/business-profits-from-inflation-but-workers-will-pay-to-bring-it-down/ - Causal relationships between prices, wages, and economic activity are difficult to identify

Federal Reserve Bank of Cleveland

2014

https://www.clevelandfed.org/newsroom-and-events/publications/economic-commentary/2014-economic-commentaries/ec-201414-on-the-relationships-between-wages-prices-and-economic-activity - Link between labour costs and price inflation has weakened over the past three decades.

European Central Bank

2021

Part of the reason is because labour's share of GDP has fallen over that time period, because of increased trade integration and rising firm market power. In the Keynesian view, wages are not inflationary until they outstrip productivity, and there is substantial room for wages to rise before they get to this level.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3902304 - Inflation Dynamic: Dead, Dormant, or Determined Abroad?

Kristin Forbes

2019

Global factors such as commodity prices, exchange rates & global value chains mean that the biggest drivers of CPI changes are determined abroad.

https://www.nber.org/papers/w26496 - The missing inflation puzzle

2021

Price inflation depends on markups and pass-through, which depends on firms' market shares. Increased import competition and rising market concentration reduce pass-through from wages to prices - meaning, our current global market structure has reduced the importance of domestic wages in price setting & therefore in inflation.

https://onlinelibrary.wiley.com/doi/abs/10.1111/jmcb.12896 - No, Rising Prices Are Not Being Driven by Rising Wages

Grace Blakeley

Jacobin

https://jacobin.com/2022/06/inflation-wage-price-spiral-bank-england - Do Central Bankers use Economic Analysis?

Beatrice Cherrier, UK Economic and Social Research Council

May 28, 2019

https://www.rebuildingmacroeconomics.ac.uk/post/do-central-bankers-use-economic-analysis - Is There a Phillips Curve? If So, Which One? Debates on unemployment and inflation

https://economistsview.typepad.com/economistsview/2014/07/is-there-a-phillips-curve-if-so-which-one.html - Has the Great Recession killed the traditional Phillips Curve?

Simon Wren-Lewis, Emeritus Professor of Economics and Fellow of Merton College, University of Oxford.

14 July, 2014

https://mainlymacro.blogspot.com/2014/07/has-great-recession-killed-traditional.html