September 9, 2024

Energy costs, but private energy costs more

The Ontario Energy Board Market Surveillance Panel released its annual State of the Market Report. It reads like a report written by a free-market-obsessed second-year economics student, replete with comments about efficient market theory. That alone makes it strange, considering it comes from the state regulator which focuses on state-owned operators. The contradiction between the 1990's throwback free-market rhetoric and the realities in the numbers makes it bizarre reading.

If you have ever wondered who is to blame for the privatization of part of our electricity grid, look no further than the ideologues in the provincial and federal government bureaucracy. Both the OEB Panel and the Competition Bureau are holding strongly to academic articles written before the Great Recession, never mind the Pandemic.

The federal Competition Bureau is cited as the main push to marketize Ontario's electricity system and increase "competition" with Ontario Power Generation. All this privatization language as it constantly compares itself to Quebec's state-monopoly electricity system and is constantly found wanting.

Some interesting points:

- Prices are set by the price of natural gas, because that is the most expensive part of the base load (base load excludes wind and solar).

- Efficiency of innovation and private capital investment is touted as essential, yet an article referenced states that only 19% of promised private capital projects actually come online.

- They talk about efficient markets (in theory) setting prices, but then tell you 85% of the price increase from bringing gas onto the electricity system is paid for through provincial taxes instead of hydro fees.

- All of the blame for not expanding energy production is put at the feet of inefficiencies from the publically-owned monopoly, while admitting that 50% of system capacity is private, but over 65% of generation is public because it is cheaper.

The dissociation from reality is stark.

Does this matter?

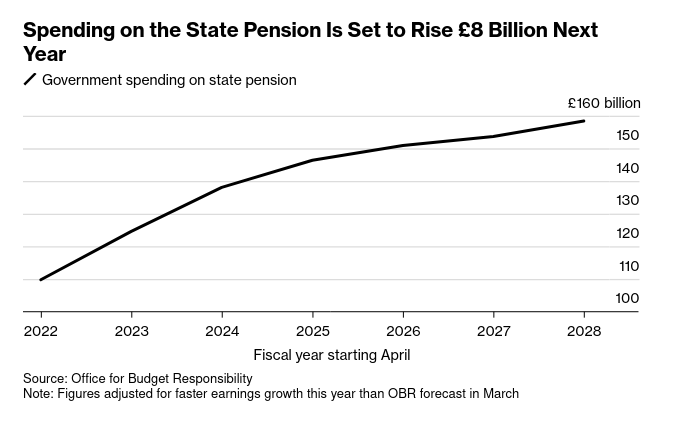

Just look to the UK where the Labour government is in a position where it is increasing pension contributions, but paying for them with cuts to winter fuel (energy) subsidies. This is what happens when a government privatizes revenue-generating capacity: you are left with only slight-of-hand tricks to reduce net spending. Increase pension monies with inflation, but then force retirees to spend that on the higher fuel costs.

The Labour government is doing all it can to make it look like inflation adjustments are "expensive". Of course, they are not expensive since the government's revenue increases in line with inflation (if you don't cut taxes on the wealthy, which they did).

In UK Labour's situation, they are cutting the winter fuel subsidy to poor pensioners to save money, but also entertaining complaints from the uber-wealthy not to increase non-domicile taxes. I am not sure if it is a left-wing position to make poor pensioners pay for gaps in the national government's budget.

If only it were the case that poor pensioners could cover the £22 billion black hole created by Tory tax cuts.

This goes back to the limited capacity of the UK state to create revenue during low growth periods. Taxes cannot be the only solution to government spending.

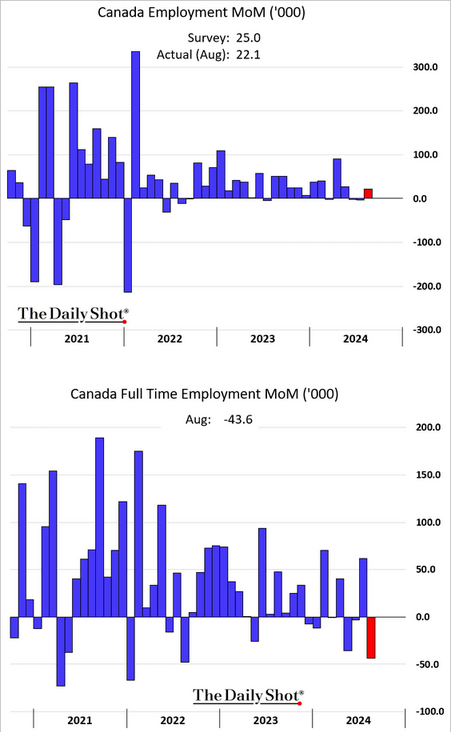

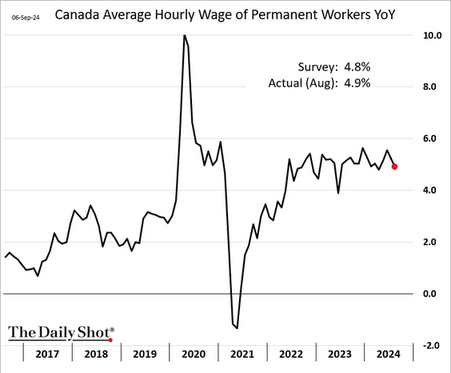

Canada employment

Ivey Purchase Managers Index edged down, meaning a contraction is expected in short-term economic growth by producers. So these numbers do not look surprising: