September 9, 2022

Energy markets, failure, and we told you so

- Prices, insurance against price drops, derivative markets, collateral, margin calls, and €1.5tn in paper losses.

- A gas derivatives market crisis could cost more than 5 per cent of Europe’s GDP.

- The proposal now is a broad price cap on all gas.

Capping the price of energy is a hammer response to a complex problem, but it is also a response to many other things. Letting the price of gas go too high too quick is not something the markets are able to deal with (even though we are told the opposite).

Markets need liquidity for central clearing houses to operate. What is supposed to be a mechanism for efficient price movement becomes an existential threat during crises.

Meddling around the edges of private markets like oil and gas in response a single outside threat leads to many knock-on effects and risks. And, because the public sector has little capacity left to know what those are they risk causing even larger crises.

From the FT's Tett this morning talking about derivative markets:

There are at least three steps they could take. One would be to ask exchanges to stop raising margin calls, given the crisis. A second would be to widen the list of collateral that utilities can use to meet margin calls, to create more breathing room. A third would be to ask governments to bail out the utilities, either by providing the collateral for derivatives deals, offering bridging loans to replenish their working capital — or, in extremis, nationalising some companies.

[The second option will still require] the third option — taxpayer support — since banks are unlikely to provide credit lines without a public sector backstop; and even then, such credit lines may not suffice.

That's right. Nationalization as an option to deal with this kind of risk from the mouthpiece of financial capital.

Pretend markets set-up and regulated to benefit large capital and financial organizations (not consumers) usually profit in the shadows where regular people do not feel their impacts. Not so during crises they have a hand in creating.

The "far" left have been talking about how these markets are systemic risks that regular people will end-up paying twice for eventually since before they were implemented. Now, this prediction is coming true right at a time the world cannot really deal with it.

Unfortunately, nationalization in this context is the public bailing out capital, but without much choice than to do so.

Final note: don't expect anything sophisticated to happen. As much as Europe has put out an air of highly skilled technocrats running the place, they are just a bunch of whiny liberals who do not know how the world works:

Fast forward seven days to today’s emergency meeting of energy ministers and there appears to be lots of outward expressions of EU unity but little expectation that anything concrete will be done soon.

“It’s a bit of a messy situation,” said one diplomat. “It’s hard to say what the picture is [among ambassadors] because proposals moved so fast. And none of the papers are detailed on how each measure would work.”

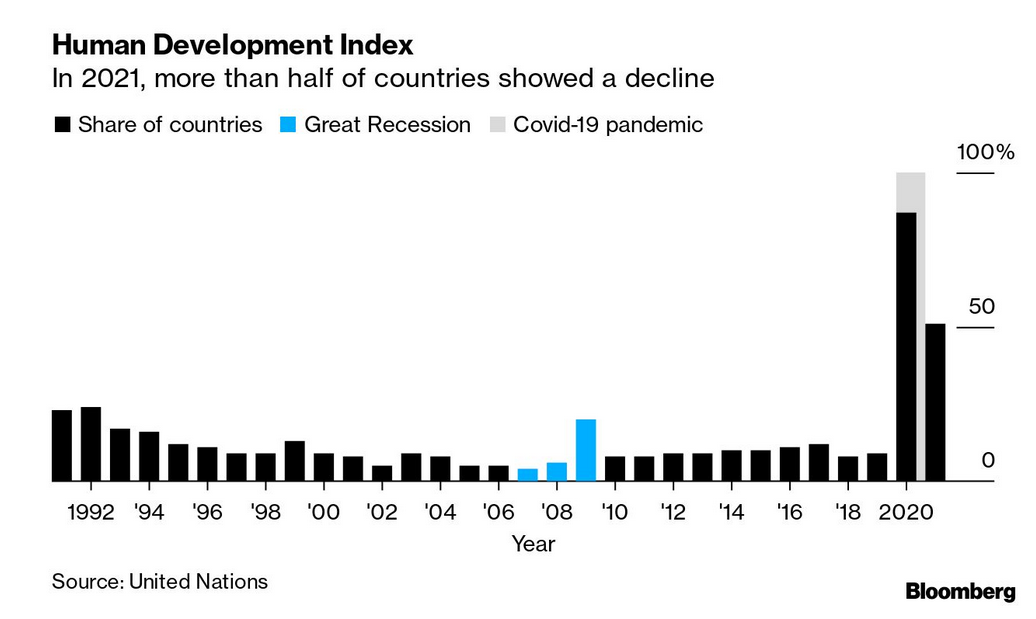

Going backwards

The world is going backwards very quickly. The "growth" that we have seen in the human development index is being exposed as fictitious as the financial trickery that was supporting it:

Not to mention war, climate change, and general economic imperialism.

According to the United Nations, its gauge of health, education and standards of living is now back to 2016 levels having declined in each of the past two years.

Another market failure: food

You may have missed this headline because of the death of an old God whisperer:

Fuel prices, climate change, and an aging population of farmers is creating a slow moving catastrophe.

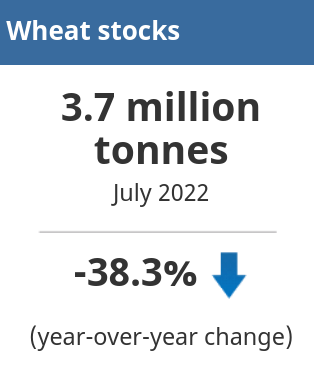

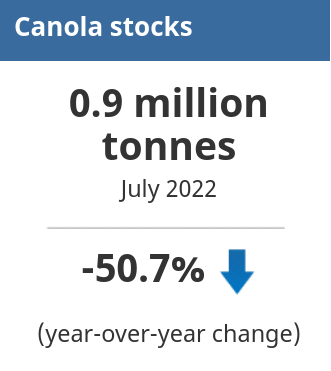

- Stocks of principal field crops are an indicator of where prices are going to go for food staples:

Lower stocks were largely the result of lower total supply for the 2021/2022 crop year, which was because of low production in 2021, which was caused by drought in Western Canada.

Because of lower total supply, grain movements decreased for most crops, with year-over-year movements of grain by rail falling roughly 40%. Generally, exports also decreased compared with the same period ending July 31 one year earlier because of constrained supply. (StatsCan)

- Wheat: Total stocks of wheat fell 38.3% year over year

- Dry peas and lentils: Total stocks of dry peas dropped 31.1% year over year

- Canola: Total stocks of canola decreased 50.7%

- Barley: For the second year in a row, barley stocks fell to their lowest level on record as of July 31, down 29.1%

- Oats: Total stocks of oats were down 51.6% year

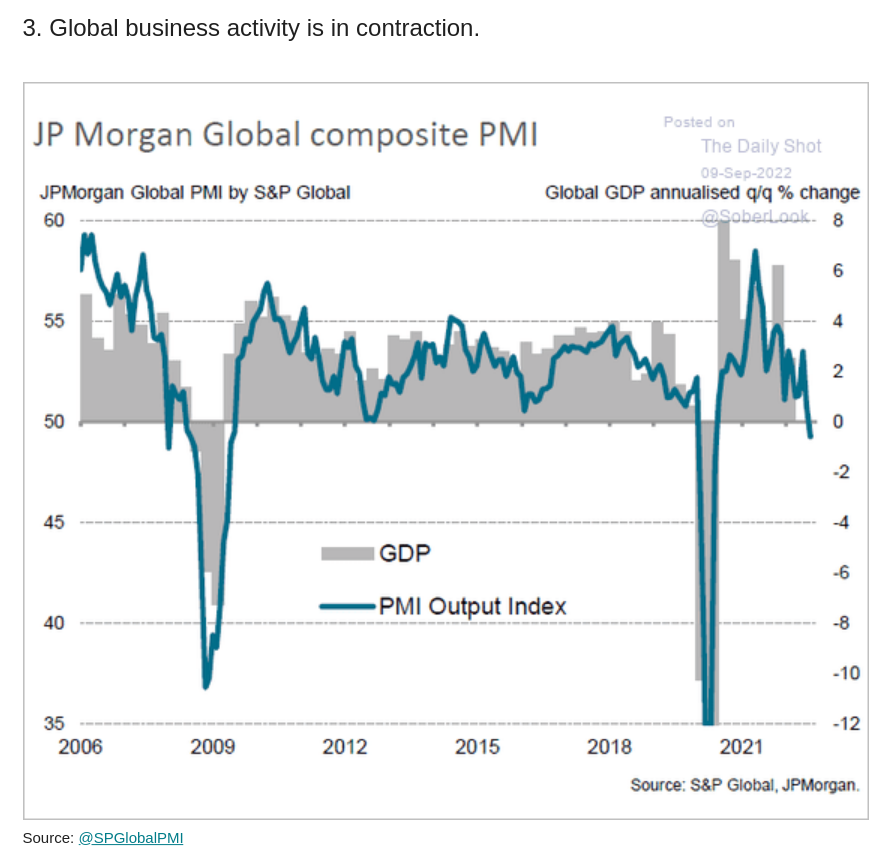

Global economy

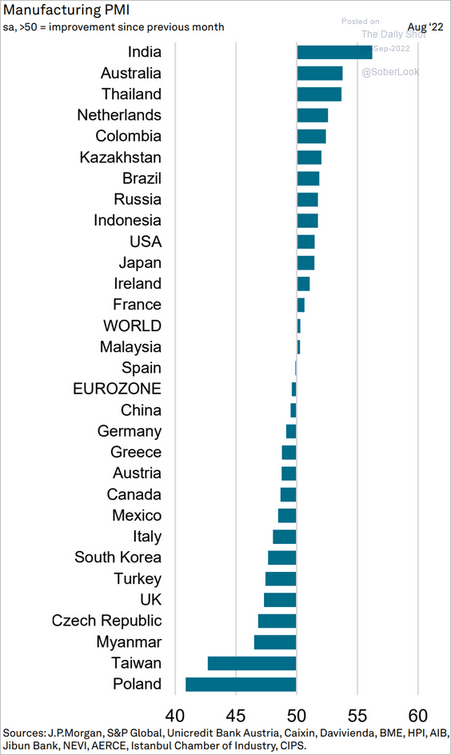

It isn't the only graph you need, but it is probably the most telling right now:

Late additions

New StatCan numbers on capacity utilization in Canada

- Industrial capacity utilization rates, second quarter 2022

- Connected to money supply, this is a good indication that inflation is not pausing.

- There was a 13.4% increase in electricity sellers index since MARCH(!) in Canada.

- Unemployment crept up too in August lead by public sector employment declines.