September 8, 2022

Canada's rate hike and US hawks

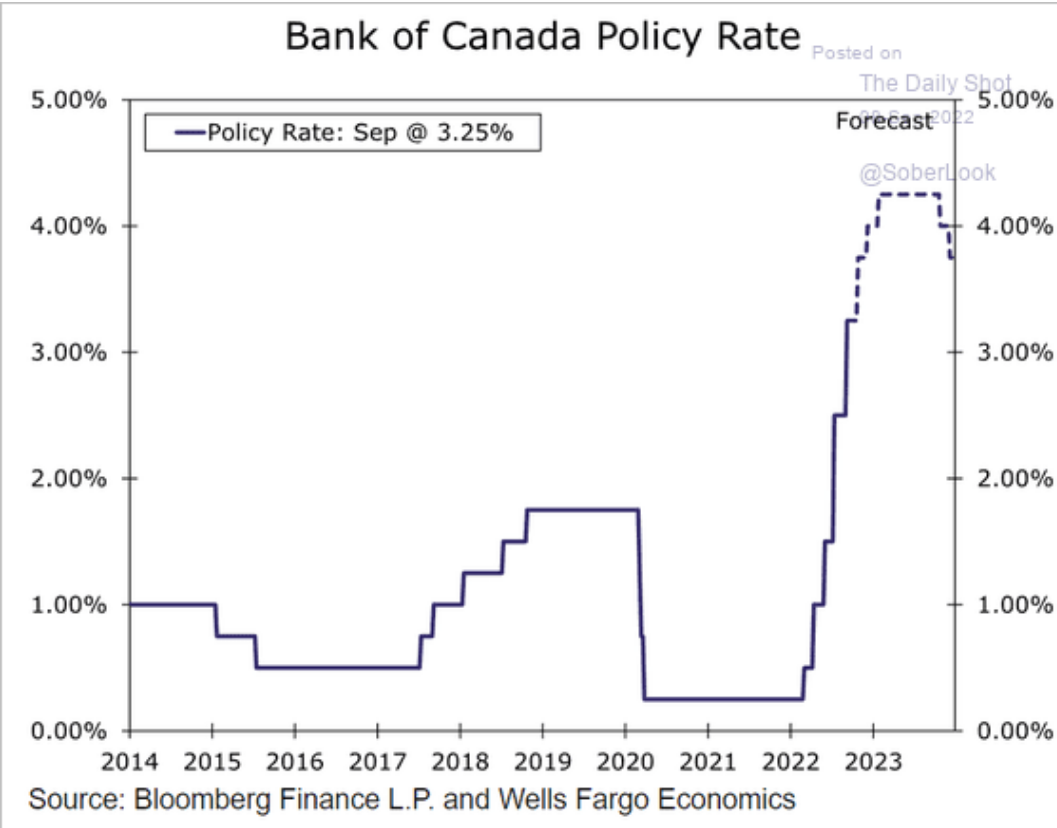

- Bank of Canada raised its target interest rate by 75 basis points to 3.25%, the fourth straight out-sized hike to borrowing costs.

- Tiff "I believe in the Phillips Curve" Macklem also said that more rate hikes will likely come.

- Trudeau looks to announce a spending program today to support families dealing with inflation.

- However, It is rather unlikely "cost of living assistance" from the government will off-set the recession-causing moves of the BoC.

Always wrong neoclassical economists are reaching a point where they are accidentally correct:

"Recession" is a word governments do not like to use. So, they are talking about targeted spending, tax reductions, and hoping that their central banks do not push too hard on the "destroy the economy" lever to bring down inflation.

It doesn't seem like any of these folks live in the real world where working people, seniors, and students are getting poorer by the minute. Job creation and paying the bills metrics might be looking good. Looking closer, and not just at averages, things are starting to look bleak with those jobs not being well paying and people paying down their debts before they cannot.

The Bank of Canada’s decision was a statement-only affair with no new forecasts. Senior Deputy Governor Carolyn Rogers is scheduled to speak and hold a press conference Thursday, where she will likely shed more light on the bank’s thinking. (BN)

Even doves are hawks now in the USA:

Fed vice-chair Brainard said the Fed had “both the capacity and responsibility” to maintain public confidence in its ability to keep inflation in check in the long run, adding higher rates that restrict the economy would be necessary “for some time”. (FT)

The European Central Bank will also raise rates today.

It is a coordinated push by the central bankers to push the economy into the mud.

UK energy subsidy

Truss' first announcement:

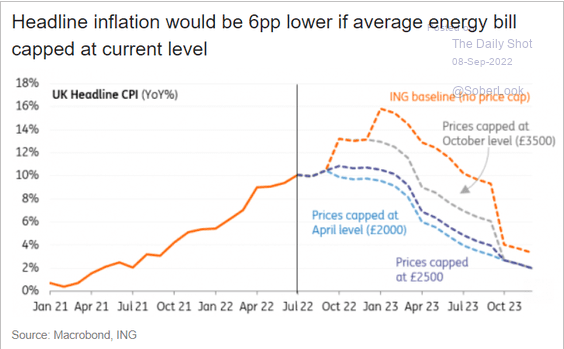

- Price guarantee of £2,500 over two years for consumers.

- More UK shale fracking

- "Reforms" to the energy market, wanting to somehow "persuade nuclear and renewable energy generators to voluntarily take new 15-year contracts at fixed prices well below the current rates that give them profits linked to vastly inflated gas prices."

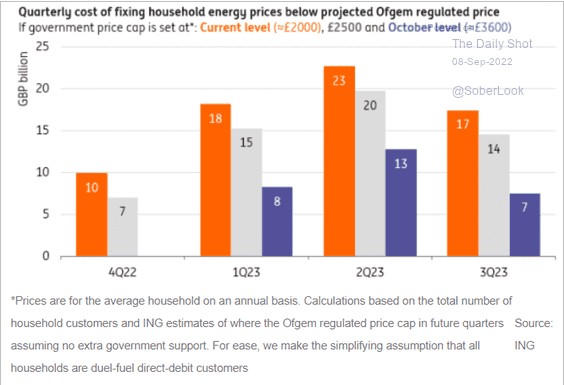

- an estimated £150bn, £90bn for consumers.

- 6 month reprieve for businesses and public sector bodies like schools.

The maximum amount for typical household energy use had previously been due to rise to more than £3,500 in October with some projections showing that bills would have topped £6,000 next year.(FT)

Will it work? No.

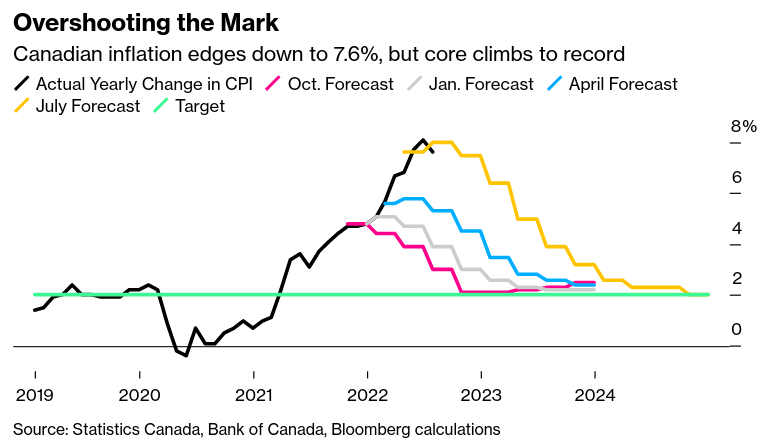

Price caps on private industry that are funded do not drive inflation down. It works in the short term to provide a CPI decline, but simply pushes the pain out farther. This may be all that is necessary if inflation is truly short-lived—which no one really thinks is the case. But, the likelihood is that the Tories have more cuts to programs in the future and a recession plan to actually drive inflation down.

The cost of uncapped, unregulated market prices for consumers could have exceeded £200bn. But, this is going to cost almost as much as that. So, what gives in the calculation? The idea is that if inflation can be brought down the cost of debt payments would also come down. Of course, Tories are ignoring the other side of that equation: mainly, that debt payment is longer than 2 years.

People seem to get the promises from Truss are thin:

- the opposition Labour party has a 46-29 point lead over the Tories.

Australia passes climate bill

The Labor Party has opted for

mandates that the country reduce carbon emissions by 43 per cent from 2005 levels by 2030 and reach net zero emissions by 2050.

Which doesn't sound spectacular given that it is what Canada has promised—until you consider where they were under the previous right-wing regime.

The Labor Party is beholden to gas companies, unlike the Liberals who were beholden to coal. So, it is a step forward if just a small one.

The main issue is that the Labor Party is still stuck on the incredibly flawed notion that the "market" will respond through "investors" getting the "signals" from the government about wanting more green energy.

The plan reads like some throw-back to bad neoliberal math of 2008 where private capital is the answer to everything. We know it doesn't work that way, but try telling politicians that.

The prime minister’s office said the country had “missed out on billions of dollars in public and private clean energy investment” and the new legislation would “provide the energy policy and investment certainty needed to usher in economic growth and opportunity in a decarbonising global economy”. (FT)

Work from home

Workers like it so much they are willing to take a pay cut. This is a severe misunderstanding of why work from home is sticking around.

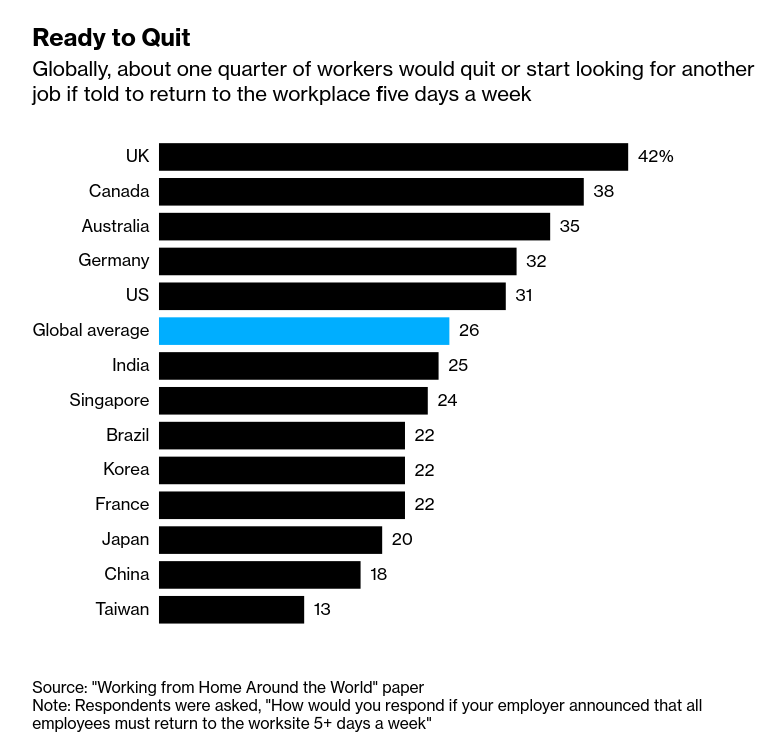

About one-third of US (and more in Canadian) workers would quit or start looking for another job if told to return to the workplace five days a week, higher than the global average.

Here is the problem:

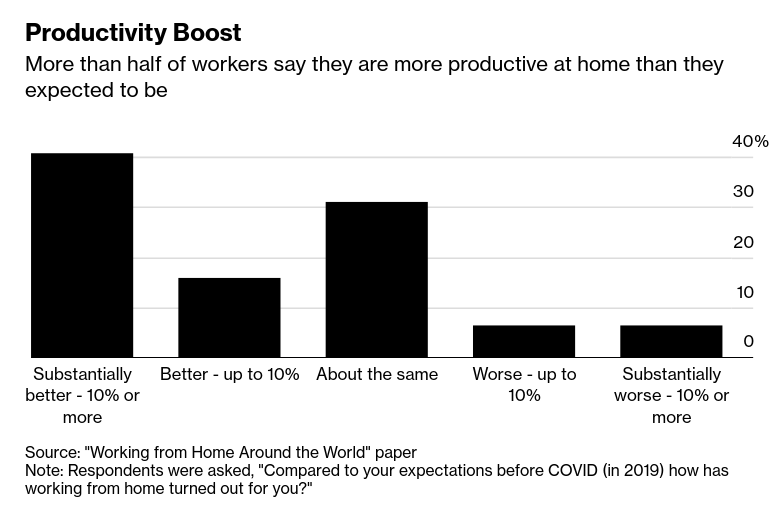

We must look at work from home as technological change. If productivity is higher—and it is—then workers should not be seeking a pay cut to work from home, but should be seeking more money.

The labour movement must demystify and talk clearly about these issues, or we cannot bargain effectively around them.

For example, we are in favour of increased quality of life and quality/safety of work. And, we try to bargain those things. However, we are opposed to the implementation of increased productivity for the sake of capital profits. Working from home can be both things.

In the same way as we support some automation in the workplace that can make things safer and easier for workers (supports for lifting, efficiencies in safely completing jobs on time), we are not so keen on that technology being implemented to deskill our jobs and replace workers just to drive savings and profits.

Managers are keen to keep this increase in productivity (not seen in 30 years) going and that is because increased productivity means more profits.

Managers are now trying to fine-tune that productivity increase by "hybrid" models of work from home and the office part time.

This is where unions need to focus bargaining.

We want more of the benefits and less of the enforced high-level productivity that degrades our work from the implementation of this technology.

So, we must convince workers to not just keep at their jobs and demand work from home, but we should be seeking a greater share of the benefits generated from this move too.