September 7, 2023

European economy starting to crack along with China's

We were warned, but policy makers were not willing to abandon their eternal hope. There are many signs that the high interest rates along with the long-delayed recession is starting to peek through.

China's economy (as seen by its currency valuation) is slowing in spite of a raft of policy maneuvers by the government.

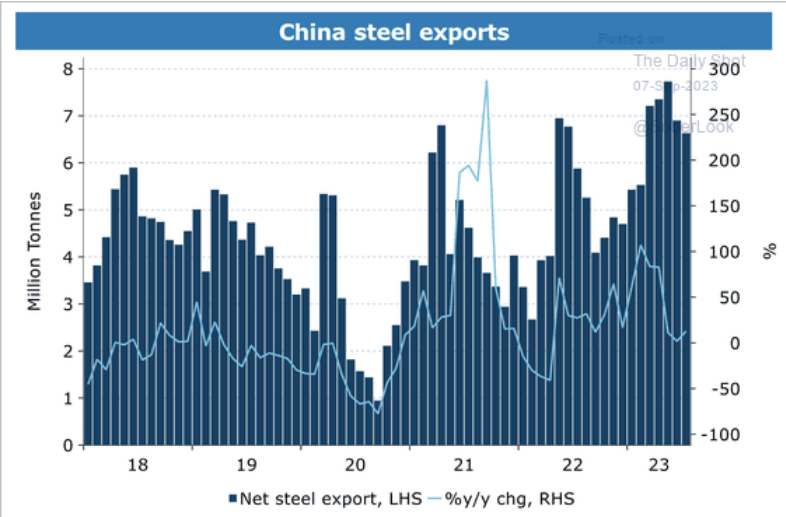

However, the declining Chinese currency value means that they have been able to sustain steel and other commodity exports.

However, these exports are not to the EU and the USA—which have been declining for a decade.

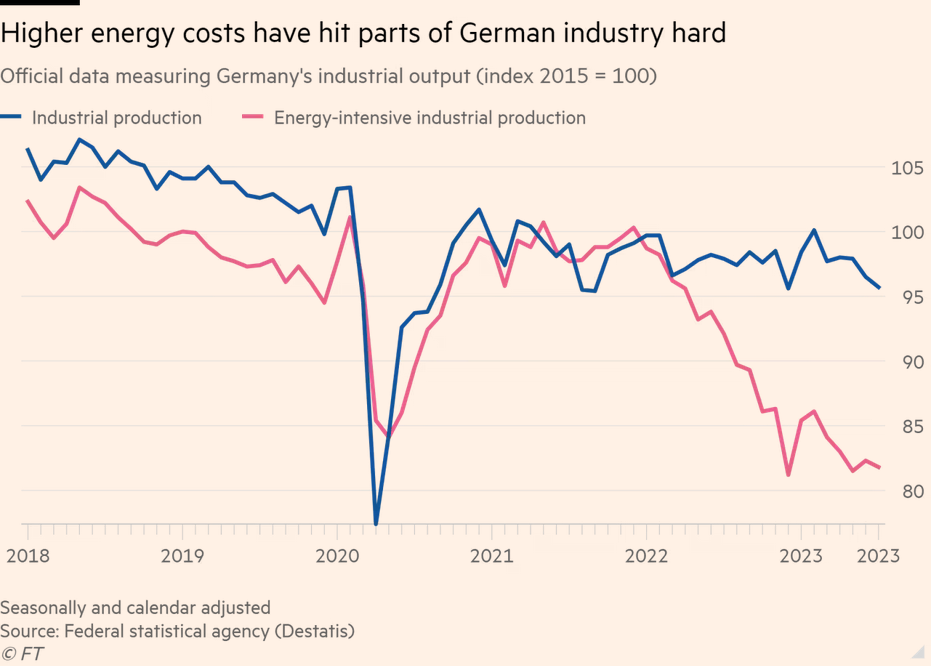

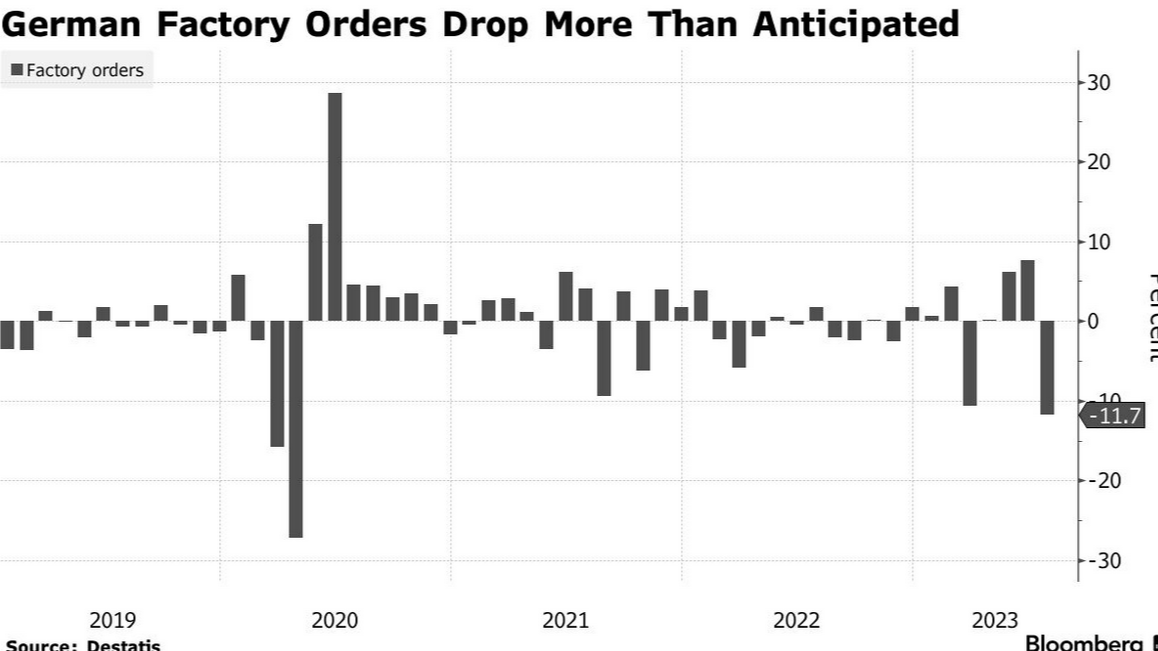

Europe continues to have high inflation. Germany's production metrics continue to decline.

The institute also lowered its outlook for this year and next, anticipating a contraction of 0.5% and followed by a weaker rebound in 2024.

Folks came back from vacation with a few days of undeserved optimism. That has now gone.

- Equities are down.

- Debt markets are concerned that there is too much debt (likely not true), but it effects decisions.

- The cost of the summer's climate catastrophes are being assess (and the economic damage is worse than expected)

According to the Beige Book released by the Federal Reserve system in the USA:

- The demand for debt is down in the corporate sector indicating low amounts of investment to come.

This matches the data on productivity which continues to decline. But, it also points to no magical solution coming to bump that back up.

Even AI is losing some of its shine. Many company leaders are concerned that while the technology offers some very good options for increasing productivity, managers and business leaders have no idea how to implement it.

Lack of imagination, it appears, is a problem in corporate board rooms.