September 7, 2022

Recession?

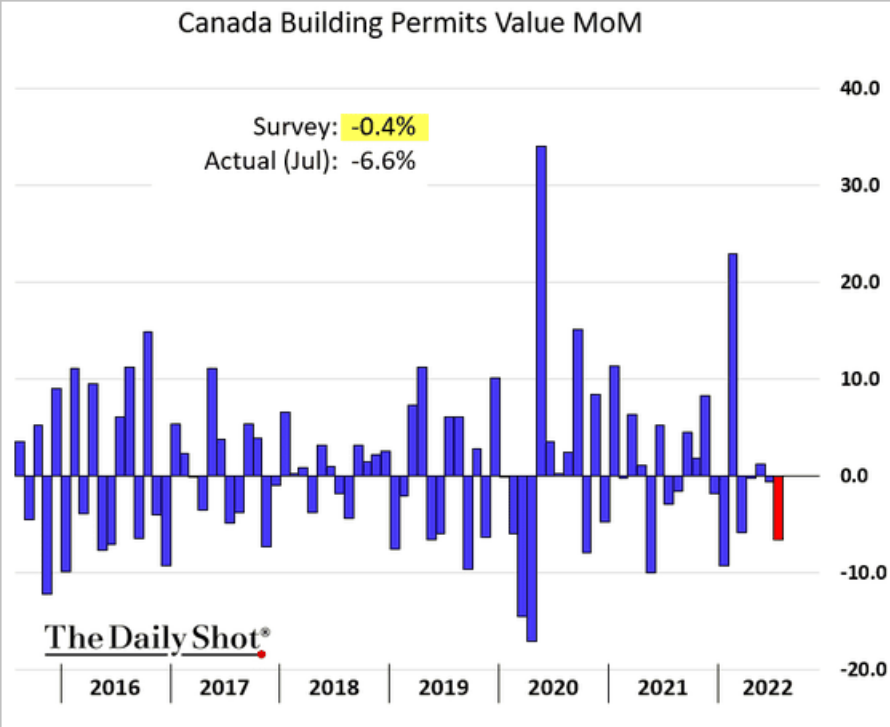

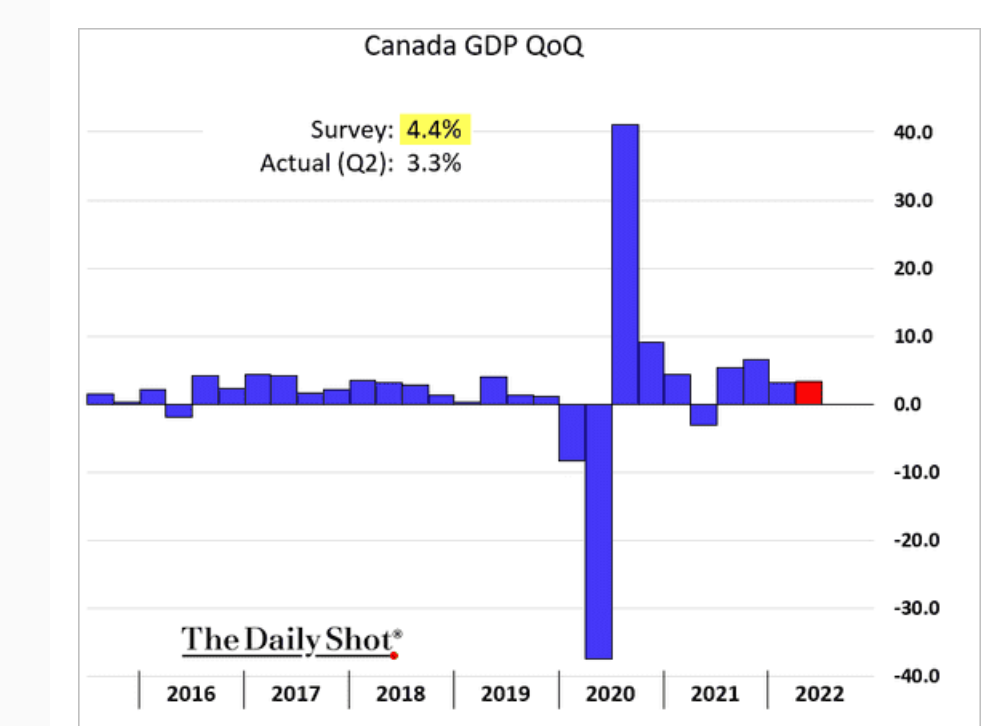

In Canada, many of the signs point to a slowdown underway:

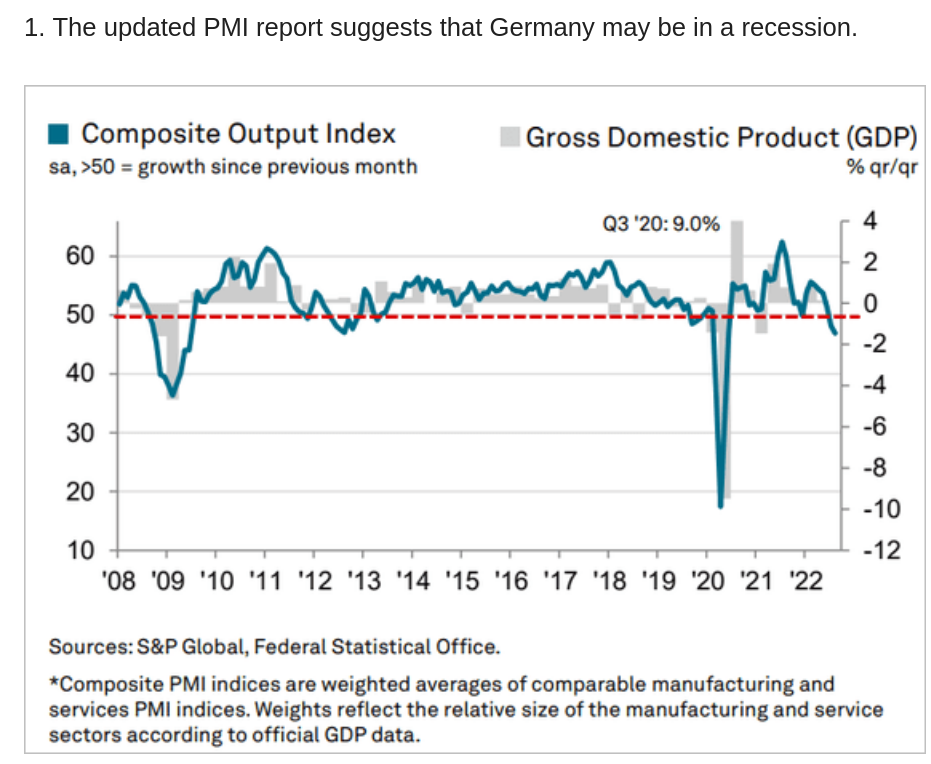

They follow similar data in Germany:

Add to this the continued sell-off of stocks and there is no escape from the slow-down. Goldman's analysis of equity markets is that they have not reached their bottom yet.

[Outside of energy] real second-quarter sales growth for the S&P came in under 1 per cent, according to Bank of America.

- However, most of the USA financial system is convinced that they have not dipped into a true recession yet and likely will not. Except Jeremy Grantham, who according to Unhedged is channeling the Kalecki Profit Equation:

Government deficits and corporate profits are on opposite sides of a ledger that sums to zero. Historically, there’s been a powerful statistical relationship between changes in the government deficit and subsequent changes in profit margins: major increases in deficits have led to rising profit margins over the next few years, and major decreases in deficits have led to falling profit margins. We have just seen one of the biggest decreases in the government deficit in history. It is very likely to be matched by a subsequent drop in profits.

- This seems correct to me. However, the mechanism is a little off. Government and corporate investment isn't detached from the reality of potential profit rates. So, it isn't as causative as the financial folks think.

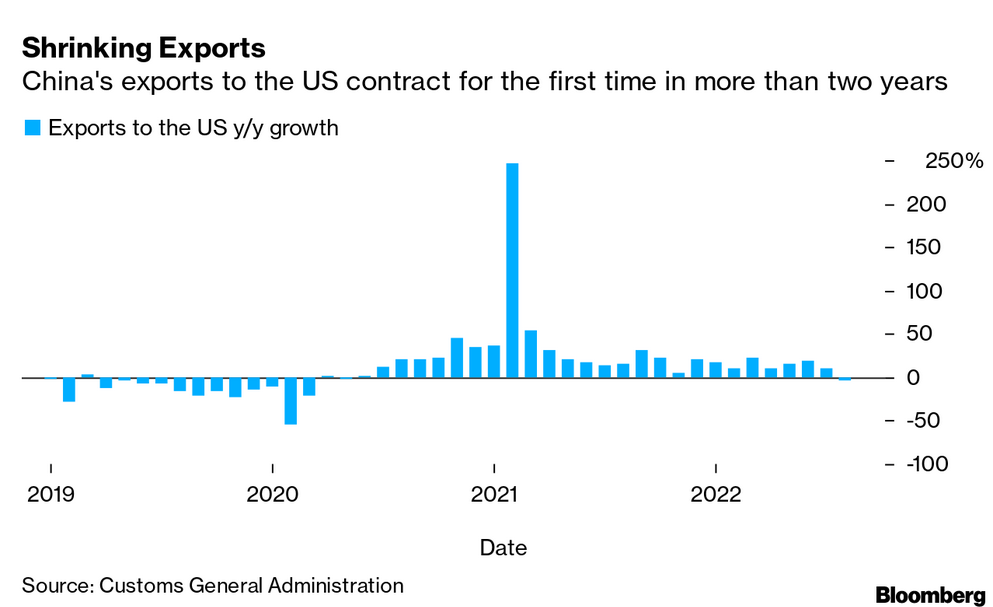

And, again, add to this the way that the cold war with China is starting-out. China is reducing its production and exports to the USA:

There are a lot of things driving this in addition to the strange and expensive attack on China from the USA, but it is not going to help with solving some of the world's most pressing matters.

Expensive Debt

- Interest rates are going up. And, they are going to stay up.

The world is in the hands of drunk economists whose steering wheel isn't attached to anything.

- the Fed's Thomas Barkin … told the FT that rates at 4% wouldn't surprise him.(BN)

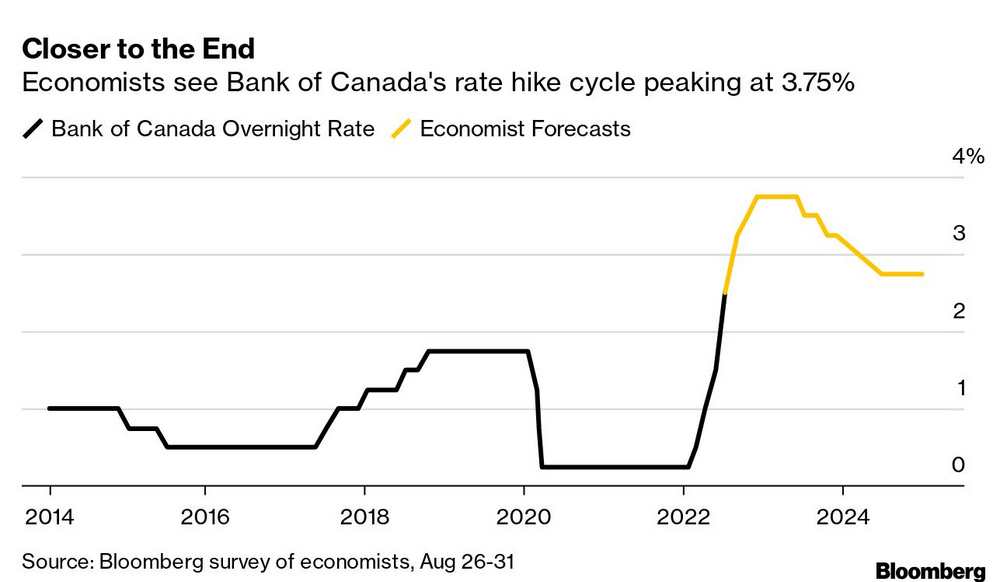

Canadian interest rate decision Canada’s central bank is expected to raise its benchmark interest rate 0.75 percentage points to 3.25 per cent at its policy meeting today, according to economists polled by Refinitiv. Figures are also expected to confirm that Canada’s trade balance widened in July. (FT)

Climate and energy

Once again we are seeing a part of the world deal with climate change related hot weather push the energy sector to its edge.

California is in a heat wave and they have not fixed their energy issues from the Enron and their market deregulation crisis and the resulting electricity crisis of 2000.

In Europe, the loss of regular shipments of natural gas and oil from Russia has meant that the price of energy is driving regular costs way up. Why is the price going up? Because of supply, but the profits are the target of even right-wing politicians.

So, why are profits up? Because of privatization. The idea that you can tax this and make it all fine is silly. Politicians are keen on driving costs down, but taxing companies and giving that money to consumers doesn't solve the production problem.

What we need is more production of energy that was invested in years ago. If we start taking money out of the system, keep it private, and then subsidize prices through public spending, then we are not going to have that money to invest in new production. This makes things worse, not better.