September 5, 2023

Where are we at?

You might have missed it, but the Canadian economy contracted over the previous quarter.

- GDP declined 0.2% in the second quarter of the year. Real GDP was unchanged from the previous quarter.

This compared with the economists' prediction of growth of 1.2%.

The cause? Likely the high interest rates driven by the Bank of Canada, wildfires curtailing production of oil, gas, and mining, and slower international exports of these goods.

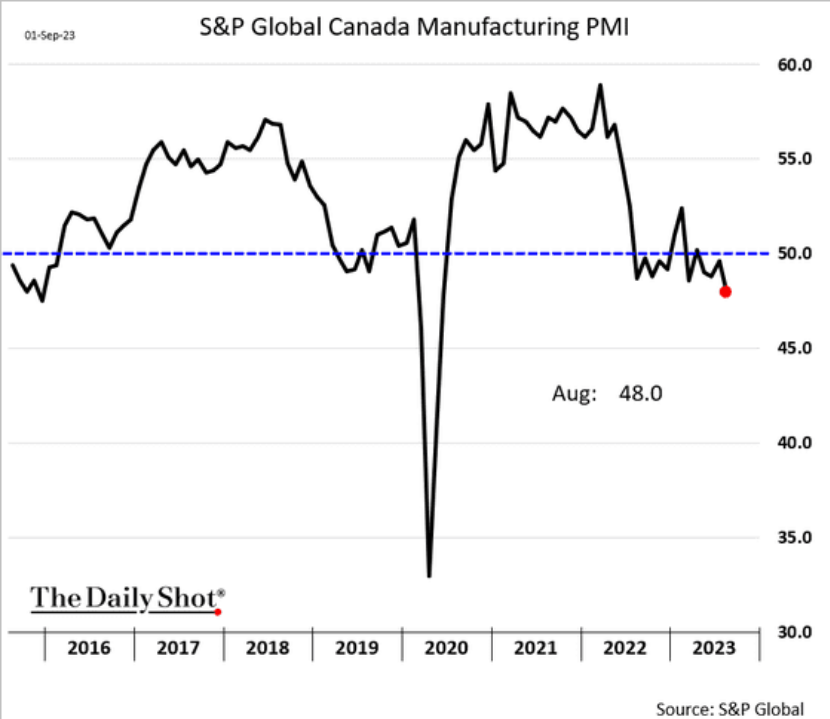

However, manufacturing also declined:

The output index fell to its lowest level since December at 47.7, down from 51.1 in July, while the new orders index also posted a reading of 47.7, falling from 49.2.

Staffing levels were cut for a fourth straight month and inflation pressures persisted - the input and output price indexes both climbed to 53.9.

(Reuters)

Construction, wholesale, hospitality (general), and even retail showed a slowdown as well.

So, inflation and interest rates still up; output and employment down.

The only thing doing well in the economy is information, arts, and recreation. Things that do not really drive our economy.

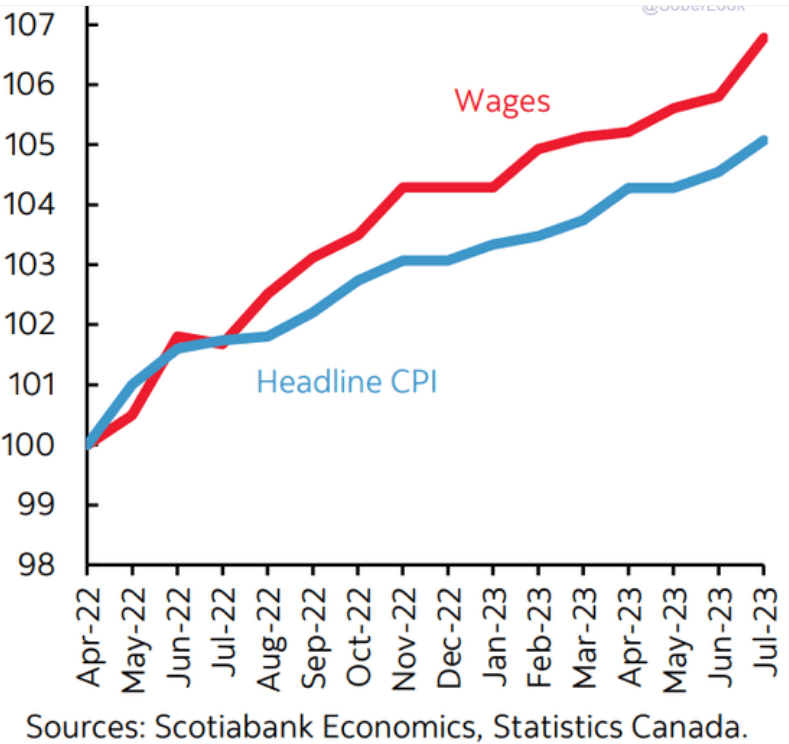

Scotia Bank has wage growth faster than inflation since July 2022. Of course, this has not made-up for the deficit in wage growth compared to inflation since the "end" of the pandemic lockdowns.

For Canada, this does not bode well. But, I guess it is not surprising given the aggressive central bank actions versus the rather meek investment program of the government.

USA

Risk of full recession is lower, but still there, according to Goldman Sachs. This even as inflation looks to be sustained at a higher level.

The economy in the USA is doing fine so far. It is slowing, but being held-up by the IRA, AI implementation and financial investment, and re-shoring technological production (CHIPS Act). Food production is down and is importing much more than usual compared to exports for the middle of August.

- USA corporate debt is high. This should indicate investment, but there is not a corresponding increase in investment to be found as global factory activity remains in contraction.

Does this point to some trouble? Are companies borrowing to stay afloat?

Other parts

The rest of the industrialized world is not doing so great.

-

UK PMI down similar to Canada (though, manufacturing is up)

- There was a massive readjustment to UK's economic growth numbers over the previous year. Turns out the economy was doing much better than the official numbers and economists were saying.

- Housing prices in the UK are falling (the most in 14 years) because of mortgage costs.

-

EU is in full decline: PMI down, manufacturing down, employment dropping.

- New research shows that employment is tight because people are working fewer hours. Interesting.

- Australia inflation remains high

- China's government is in stimulous mode.

- India is doing well, growth is eating China's lunch.

- Vietnam is flat.

- ASEAN manufacturing is just above water.

-

Brazil and Mexico PMI is creeping back to growth.

- Both have bank policy rates lower than the US/G20

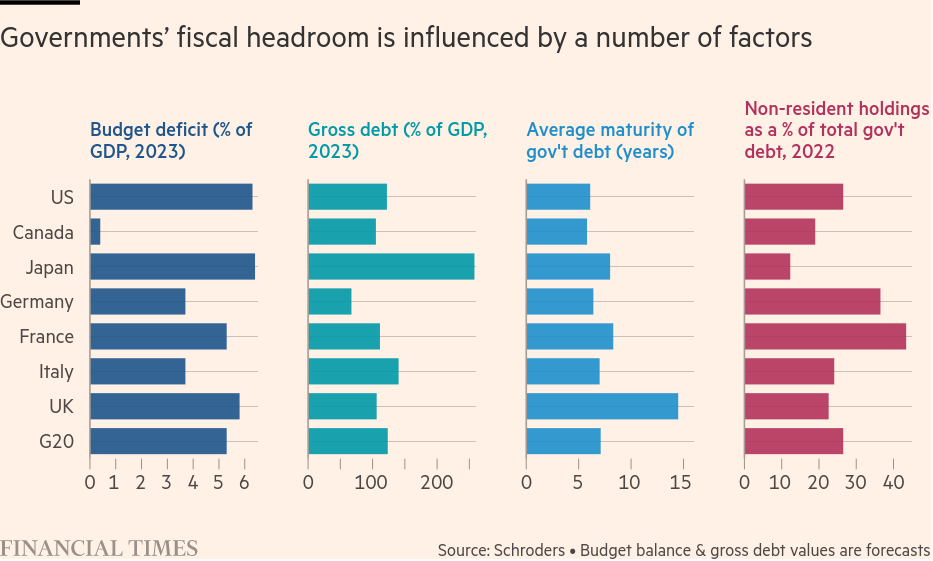

Plenty of Room to Spend

G20 is in India this week

It did not start on a positive note:

Klaas Knot, chair of the Basel-based Financial Stability Board, said: “The global economic recovery is losing momentum and the effects of the rise in interest rates in major economies are increasingly being felt.”

“There will certainly be further challenges and shocks facing the global financial system in the months and years to come,” (FT)

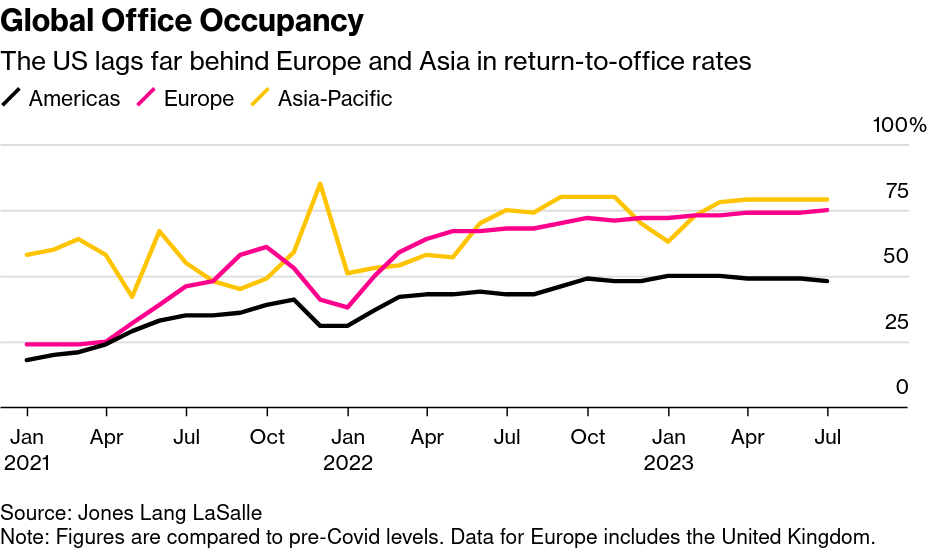

Never go back

The reality is, workers are back in the office where they feel they can. If you break-down who is at home, it is women and others who do not have access to affordable childcare, homecare, and those who have realized commute kills.

People keep making arguments about "returning to the office", as if we can go back in time. Nothing works that way.

Work changes all the time, remote work is no different.