September 4, 2024

Potential dockworkers strike in the USA

- Deadline for deal: September 30

- Facilities affected: Over 30

- Workers affected: 45,000

- Why capital cares: Holiday shopping season

- Major issues: Wages and automation

- Union: International Longshoremen’s Association

- Employer: United States Maritime Alliance (a group of shippers and terminal operators known as USMX)

There is also slight downturn on the local manufacturing sector (from jobs to total output).

It could be that port negotiations present an October surprise, depending on which way they go. Most of the employers are Republican-supporting. Now, I am not saying this will directly affect bargaining, but negotiations and outcomes will be used by both sides to drive a message to support their side.

Employers have already asked Biden for intervention. The employers are complaining that the union is asking for 80% wage increases over the 6-year contract. The profits of the companies barely makes it into the news, but these are the companies that make more profits from every slight supply chain snarl around the world. $10B in the second quarter alone.

Most of those profits are made through driving existing infrastructure to fail, from massive subsidies from the federal and local governments, and the firms using that money to drive job reductions through automation.

If it sounds similar to the rail sector and our own port negotiations here in Canada, you would be correct.

There has not been a strike in over half a century. It is not surprising the union thinks that it has a point to make.

In Canada, the union representing 730 dock foremen is also facing down a strike deadline.

Never has the right to strike been so important to uphold and never have workers been let down so dramatically when it comes to the supposedly "pro-worker" governments upholding that right.

Bank of Canada announcement on interest rate target

- This morning we will see where the decision is, but everyone is pointing to a .25% reduction.

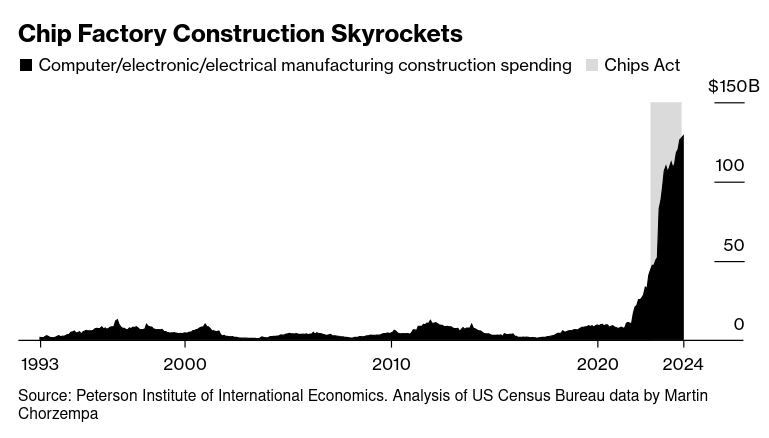

Chips and Acts and (lack of actual) spending

The USA's plan to subsidize private chip manufacturing in the USA, part of its national security plan to combat Chinese chip production, has hit a snag.

> Five months after the president traveled to Arizona to unveil a potential $20 billion package of incentives alongside Chief Executive Officer Pat Gelsinger, there are growing questions around when — or if — Intel will get its hands on that money. (BN)

The entire point of the subsidy was to secure a supply of semiconductors for the Pentagon, ensuring that 1 out of 5 super advanced semiconductors made are made in the USA.

Intel is mired in a sales slump worse than anticipated and hemorrhaging cash, forcing its board to consider increasingly drastic actions — including possibly splitting off its manufacturing division or paring back global factory plans, Bloomberg reported last week.

Subsidies that Intel was supposed to receive:

- $8.5 billion in grants

- $11 billion in loans

It has not received money yet and the entire program could be in jeopardy as the company eliminated 15,000 jobs.

This is an expensive project, but it is not the only one being subsidized:

Part of the issue with the plan is that subsidizing production still depends on capital's interest in investing in production. The Pentagon has outlined this as a major risk to its plans to source its inputs and has a more realistic assessment than most politicians about capital providing for its needs. That is, the military doesn't trust private capital to provide.

This goes along with our analysis that national foundational production needs to be public through the research councils. For semiconductors, we know that we have the ability to produce the ones needed for industry; our politicians just choose not to provide that capacity.

The economics are extremely challenging. Existing trusted foundries “incur significant costs to align their business with DoD requirements,” according to a new congressionally requested report from the National Academies of Sciences. Pentagon purchases frequently “cannot generate the return on investment these firms need to remain suppliers,” the report found. (BN)