September 3, 2024

Canada's GDP

Quarterly reports of Canada's GDP show stronger growth than "expected" by the market measures.

- 2.1% growth over the summer

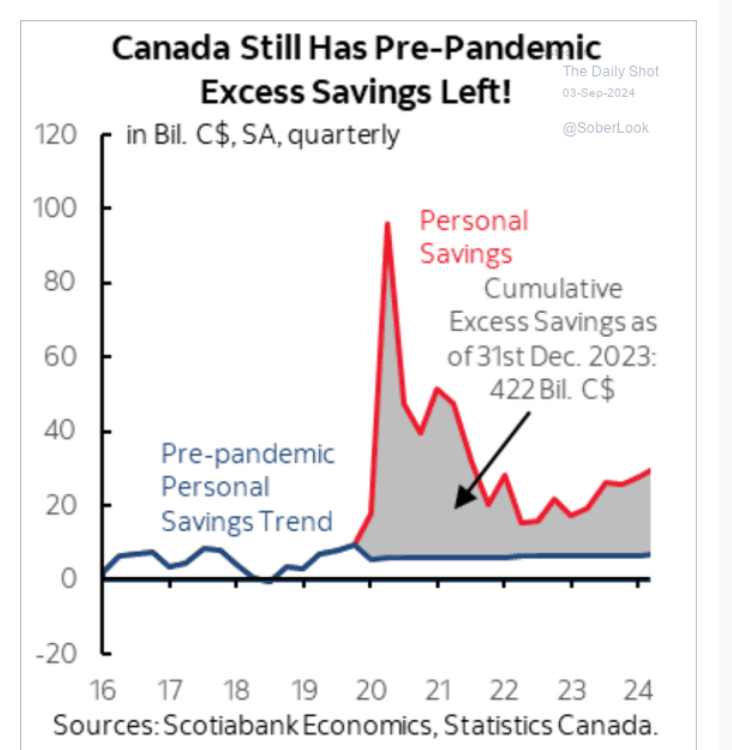

The banks are pretending that they believe that there are "excess savings" still from the pandemic by publishing graphs like this:

The constant search for offloading blame when it comes to inflation.

The take home message from the banks in Canada is that the working class have too much money and are taking home too much money.

The reality is that the "excess savings" is not in the working class' bank account, but in investment accounts of capital. The savings rate does not account for changing wage rates in response to inflation.

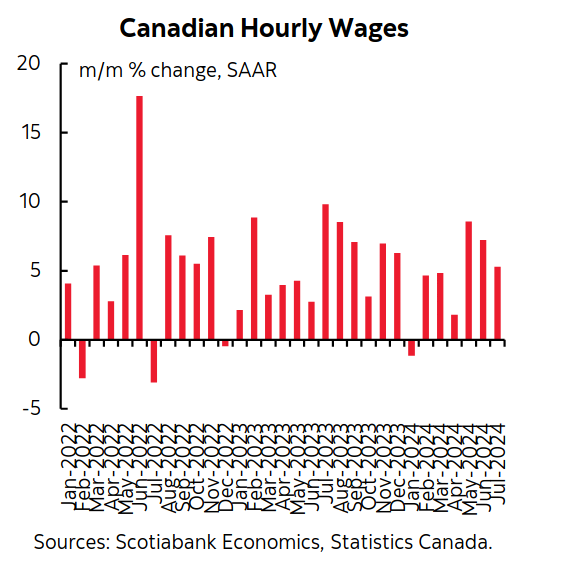

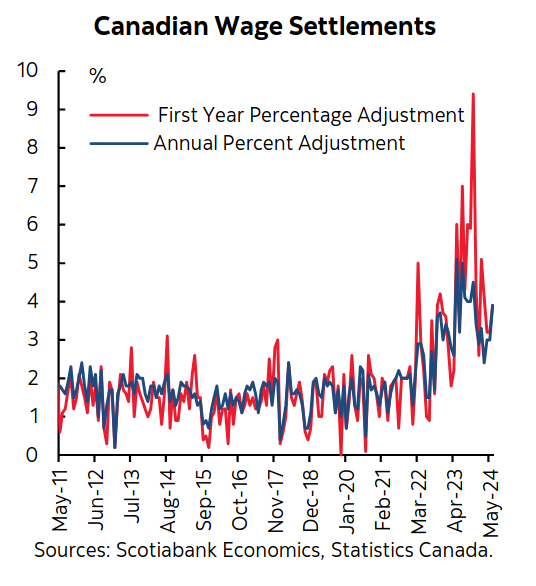

Change in wage rates continue to track inflation felt by workers are union wage settlements stay higher relative to the headline and core inflation rates. However, workers in union positions face different average price pressures than the headline rates reported by the news.

Food and housing prices continue to stay high, meaning that workers demand higher compensation increases.

Also, 2024 saw some higher than average settlements as well, as union contracts only come up for renewal every (on average) three years. This means that there are wage rates that are being sought to make-up for the real wage losses over the bout of higher inflation.

There are a lot of moving parts to the wage settlements in Canada and immigration, the number of workers per job, and the age of those workers has impacted the competition between businesses for those workers. Sometimes decreasing wage growth and sometimes increasing it. We have passed through the peak immigration boost that drove down wage growth in 2023.

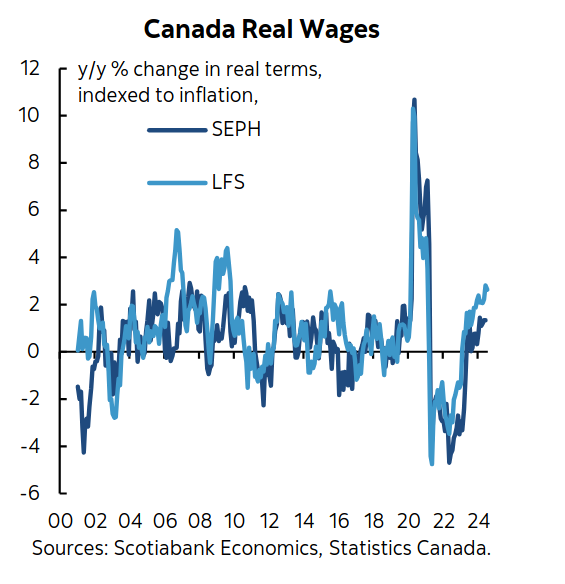

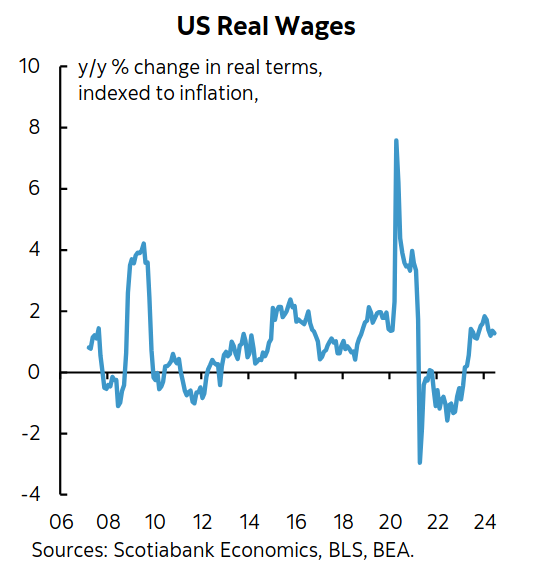

You can see above that real wage gains (which include more than just union workers) have returned to historical average rates of growth.

The same goes for the USA. Orthodox economists working for companies do not like to see any real wage growth since that is in competition with profits, but there is nothing unusual about the wage growth being experienced.

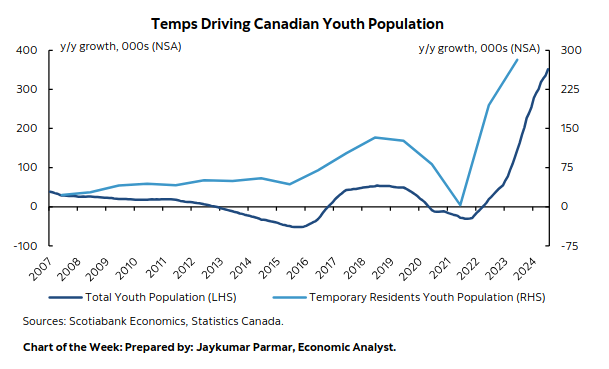

Since we are back to school, some reports from Stat Can are pointing to the downward pressure on youth wages and youth employment was likely a result of temporary youth immigration.

With the waged-directed policy to support an influx of temporary workers since 2022, we had a large increase in the number of younger temporary workers.

It is generally well known in labour market economics that youth are the first pushed out of the labour market and keeping the percentage of young workers in employment compared to other demographics is generally dependent on wage subsidies. Subsidy programs did not keep up with the spike in temporary worker migration and so you saw lopsided increases in youth unemployment. However, the mechanism driving employment numbers was the same across the demographic bands.

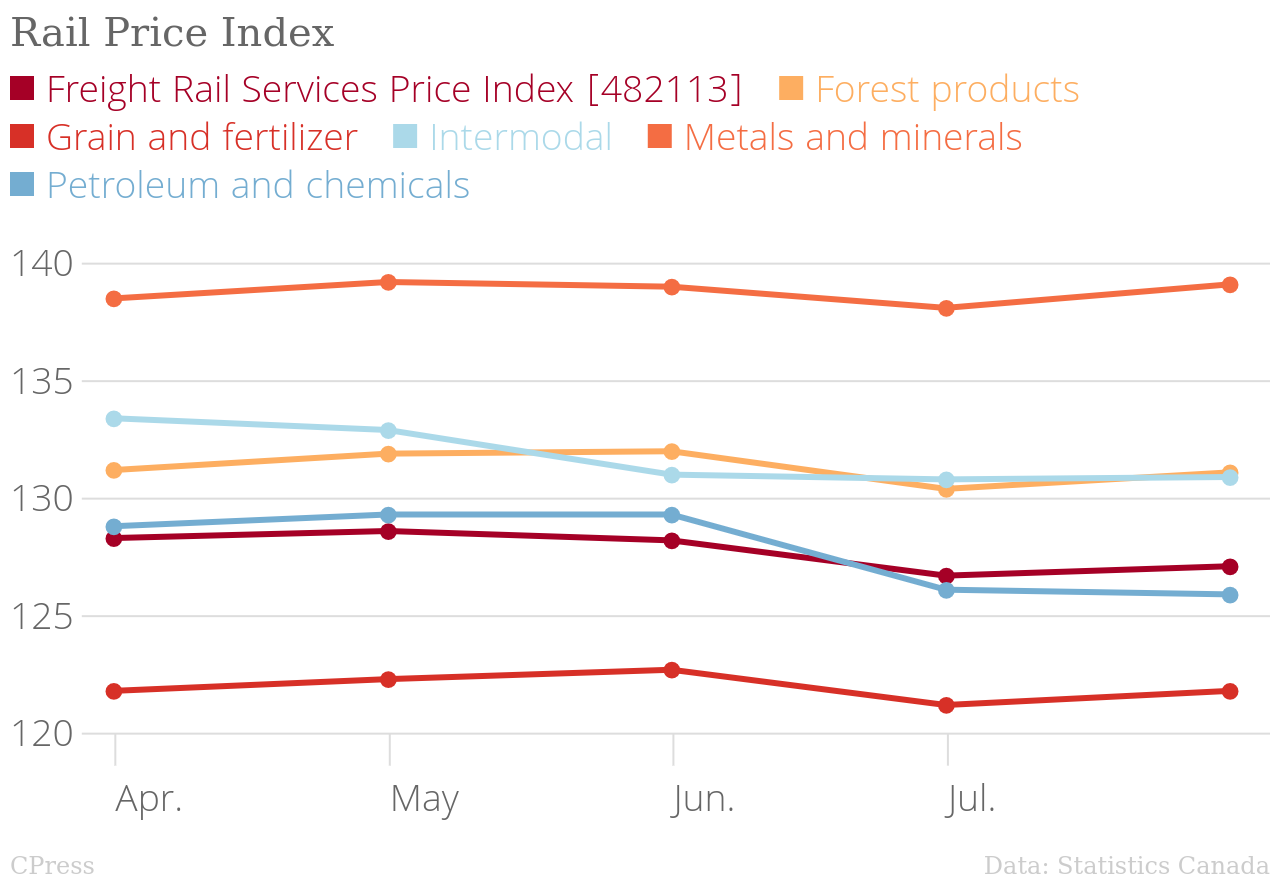

Rail lockout had no impact on prices

Even with the planned shutdown by our Rail Cartel, the price for shipping stuff along rail has saw no significant change. The result will be unaffected profits for CN and CPKC from Canadian freight.

The companies got what they wanted from the state-forced end to the strike through interest arbitration.