September 29, 2023

Inflation in Europe

Germany has recorded a decline in inflation this month. Hardly surprising giving the rather harsh slow-down in the economy happening there.

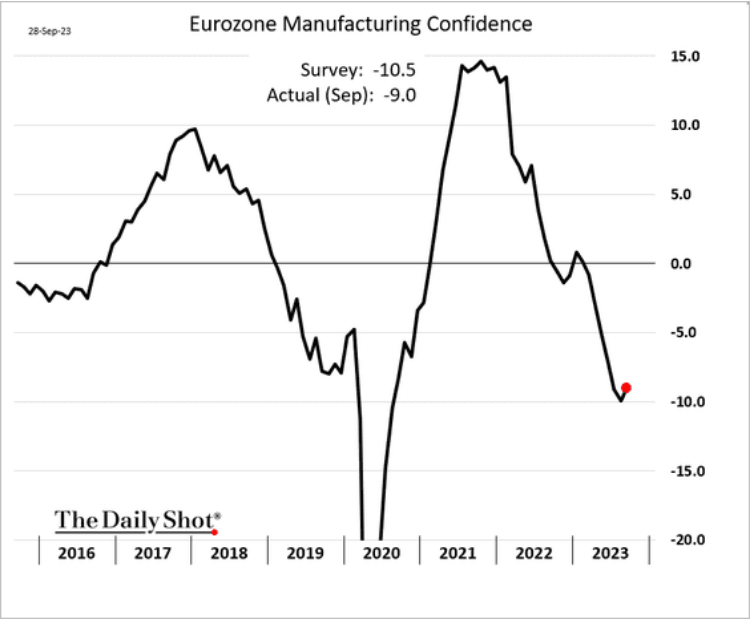

European manufacturing is very much down.

This is leading some in the "New-Keynesian" economics tradition (is it really different from neoclassical?) to call for "patience" in rate tightening:

Veronica Guerrieri, Michala Marcussen, Lucrezia Reichlin, and Silvana Tenreyro have written that the central banks are essentially forgetting that the impacts of their interest rate rises are at least six months out. They suggest that inflation should be allowed to stay higher to allow efficient price setting.

Efficient price setting is one of the reasons given for allowing some inflation. The argument goes that if some inflation is allowed, real prices can fall for some goods without the sticker price changing (which can be hard for firms to adjust).

It is a bizarre position to take given that prices go up and down all the time in real life. But, it is the position of most Post-Keynesians and those who believe firms are price takers except in monopoly situations and the Paradox of Thrift where consumers don't spend money because things will get cheaper. Or, if you believe in the Phillips Curve and unemployment-fighting inflation.

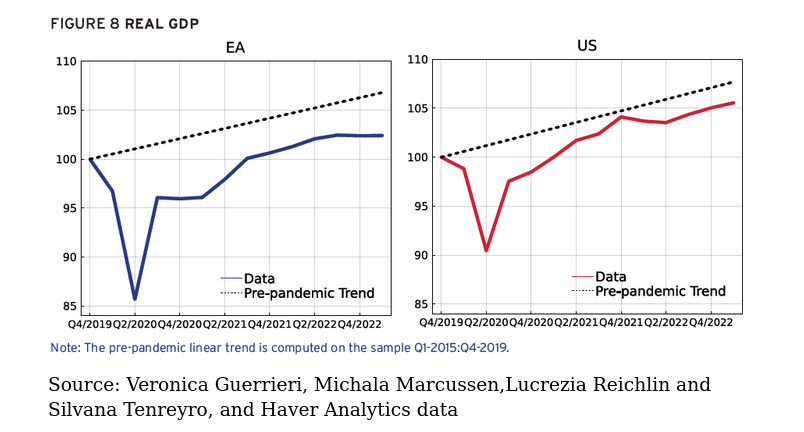

The analysis that rates have no need to go higher come from looking at graphs of real economic growth in the USA and the EU:

Hardly a cash burning rate of growth.

I think that it is less likely that the central bankers have forgotten and more likely that they don't care about that. Inflation is their main goal and they have no interest in saving growth, which they believe is driven by animal spirits, rain gods, and magic invisible hands.

Either way, investment that is necessary to avoid the impacts of higher rates will have to arrive if we want to avoid a recession. At this point, that is going to mean government intervention in spending on production.

The USA gets it. Canada? Not so much.