September 25, 2023

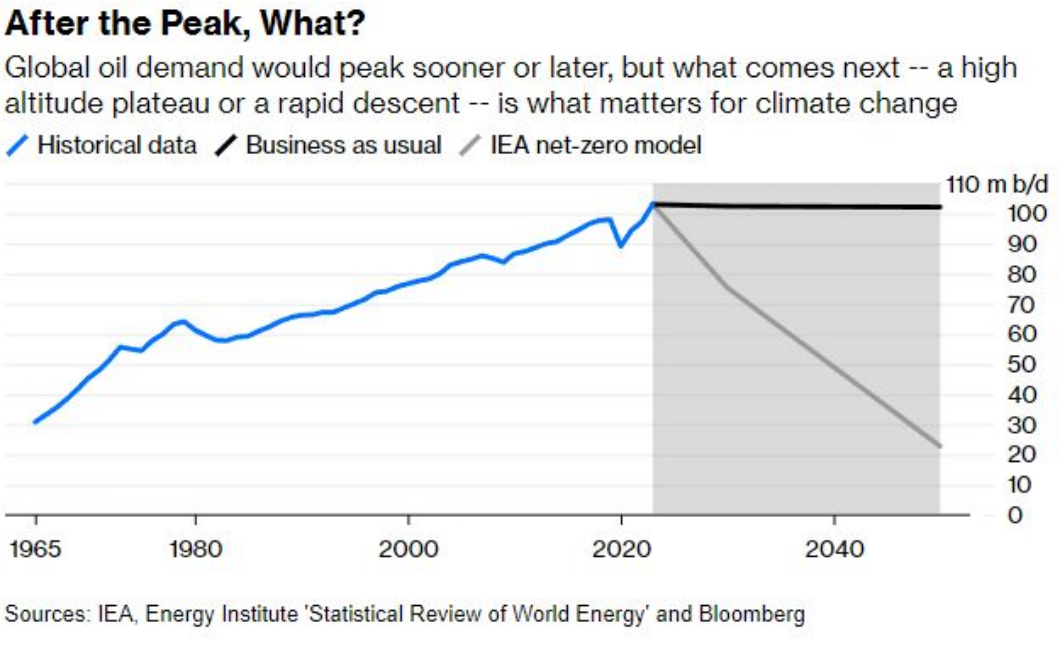

Peak oil consumption, but no reduction

- Peak oil before 2030

- Natural gas will continue to rise.

The International Energy Agency sees the peak of production coming, but it does not think that there will be a reduction in production anytime soon. This is because demand for oil will be sustained.

It is a problem for the climate.

World oil demand remains on track to grow by 2.2 mb/d in 2023 to 101.8 mb/d, led by resurgent Chinese consumption, jet fuel and petrochemical feedstocks. In 2024, naphtha and LPG/ethane, especially in China, will dominate an overall increase of a more modest 990 kb/d, to 102.8 mb/d, reflecting below-trend GDP growth and a structural decline in road transport fuel use in major markets. (IEA)

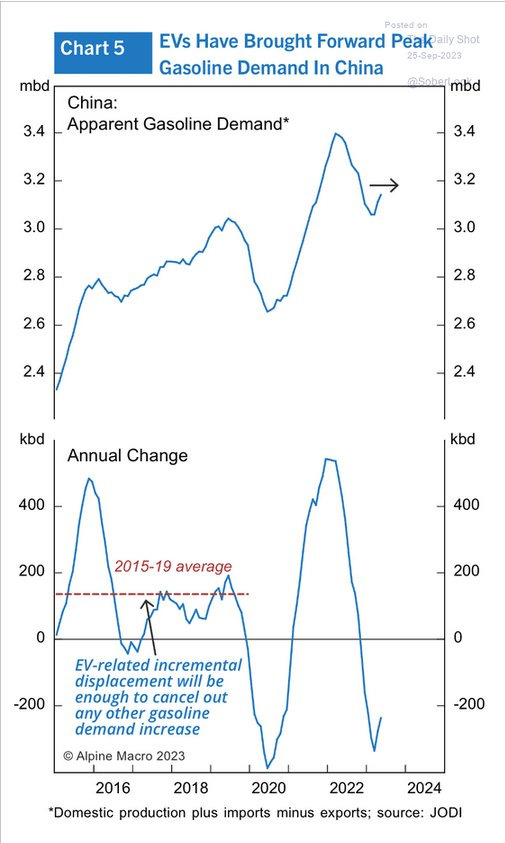

China may have even reached peak petrol demand.

Amazon's $4 billion stake in Anthropic

$4B doesn't buy you much in the AI space these days. Amazon's minority stake in Anthropic is just the latest massive bet on AI and LLMs. Anthropic's Claude is their answer to ChatGPT, but is still in Beta and only available in the US and the UK.

Anthropic will move most of its systems to AWS and is seeking the money because training these models takes a lot of processor power and time. The connection with Amazon may bring those costs down as they use AWS's (now) in-house developed AI Chips. The chips were designed by Israeli microelectronics company Annapurna Labs which was purchased by Amazon in 2015.

Google also has its own chips that it designs in-house called Tensor Processing Units (using the open source TensorFlow software.)

While AWS, Azure, and Alphabet are some of the only companies large enough with enough data to train these models at scale, open source has answered with competitors.

The development of these systems is extremely fast right now. Many of the larger companies are being overtaken by development from the community which is focused on the efficiency of the training models.

Hugging Face's community continues to release the most powerful models. The limitation is the hardware, but this can be rented by extremely large organizations at scale.

The current (less headline grabbing) push for applied AI is in research and automation of day-to-day processes. But, the concept of Organic Composition of Capital still applies since running these programs is very expensive.

Exporting Electricity

NYC will get electricity from Quebec via a project worth at least $6 billion project with 1250 megawatts of DC hydro electricity.

Champlain Hudson Power Express (or CHPE "chippy") is the company delivering the transmission line, which is a joint venture between HydroQuebec and Transmission Developers. Transmission Developers is owned by Blackstone asset managers.

Blackstone is also involved in the proposed export power line from Quebec to Vermont.

Canada continues to be a major exporter of energy, it is just changing form. The only problem with these projects is that Canada has yet to green its own grid or plan for producing enough renewable energy to meet its future needs.

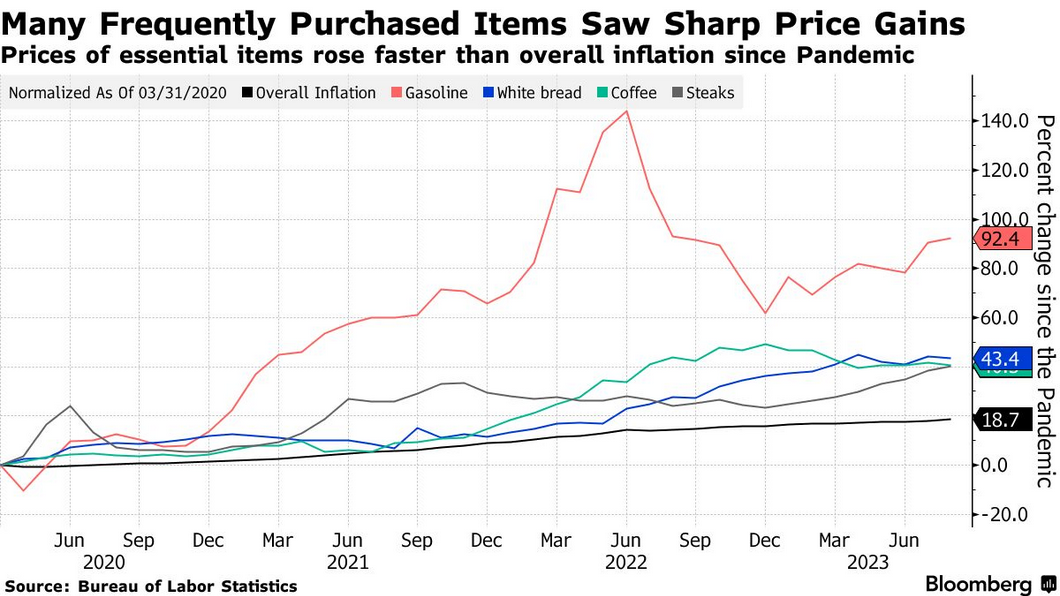

Inflation versus cost increases

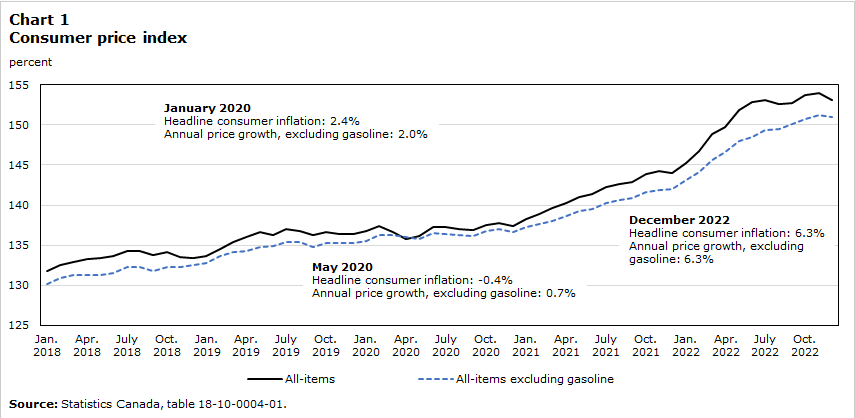

While CPI has been measured as growing very fast, the costs of production and distribution of basic goods continues to outpace the general measures of CPI.

While it might be that we are passed the highest price increases, we are still facing energy and food production cost increases. Both of which are not caused by the same causes of true "inflation".

Central bank actions will continue to make these costs worse.

In the USA:

It costs $734 more each month to buy the same goods and services as two years ago for households that earn the median income

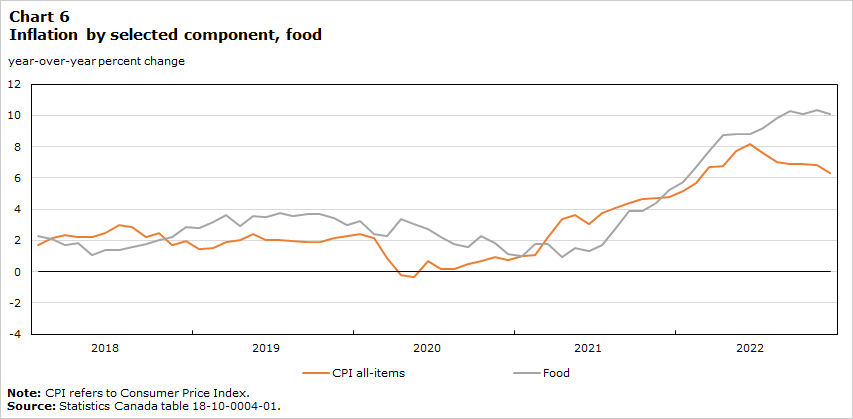

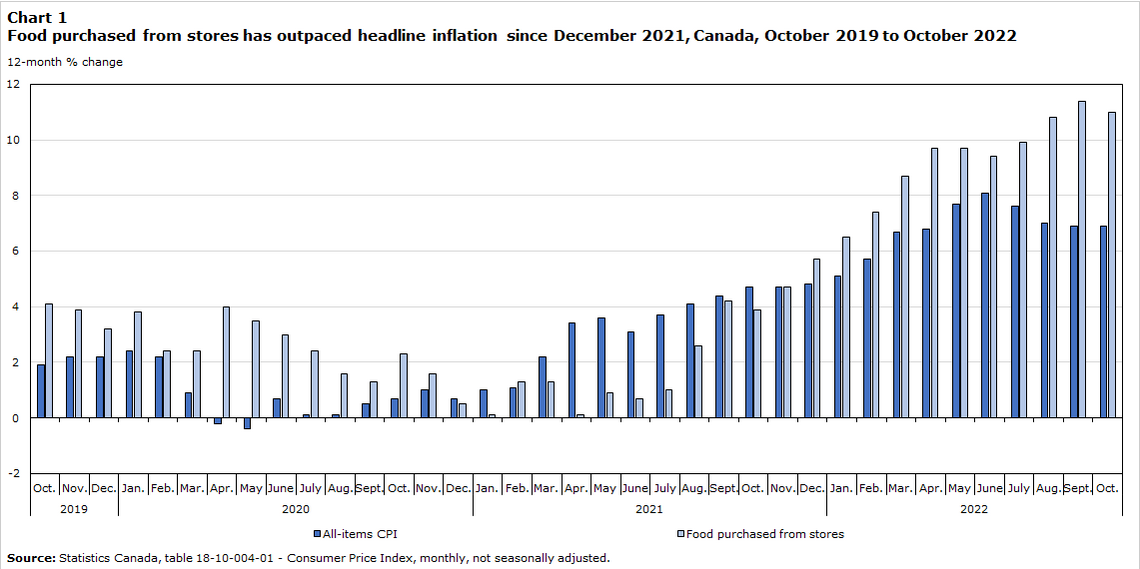

We see this in Canada as well. Inflation high in "Core Goods", i.e., goods excluding energy and food, but food was a main driver of costs for working people.

Through the pandemic we heard that food prices were driven by supply chain disruptions and the war in Ukraine. This is partly true, but the cost of production has risen because of droughts and other shifts in climate-related shocks. Those prices have not come back down.

By the middle of 2022, 43% of the price pressures faced by Canadians was food costs.

Asteroid mining

- The Asteroid miner OSIRIS-REx has returned.

While the program collected over 60 grams on its journey to see what asteroids are really made of (including if they carry organic material), it is essentially mining the asteroid with a vacuum cleaner. Many of the private space companies are keen on repeating this.

The asteroid that they mined was 1,000 feet wide and will miss the earth by 20,000 miles, passing between the earth and the moon.

Hydrogen update by the IEA

IEA still thinks green Hydrogen could grow. But, no one is investing in it. So, it won't. This even by the IEA's terrible projection models which fail to appreciate any real world scenarios.

Only 4% of this potential production has at least taken a final investment decision (FID) (IEA)

4%. That's such a low success rate as to be a near statistical tie with zero.

low-emission hydrogen still accounts for less than 1% of global hydrogen production and use

That's right, 99% of hydrogen production is dirtier than natural gas.

Hydrogen is like Carbon Capture and Storage. A fantasy.