September 23, 2024

Debt

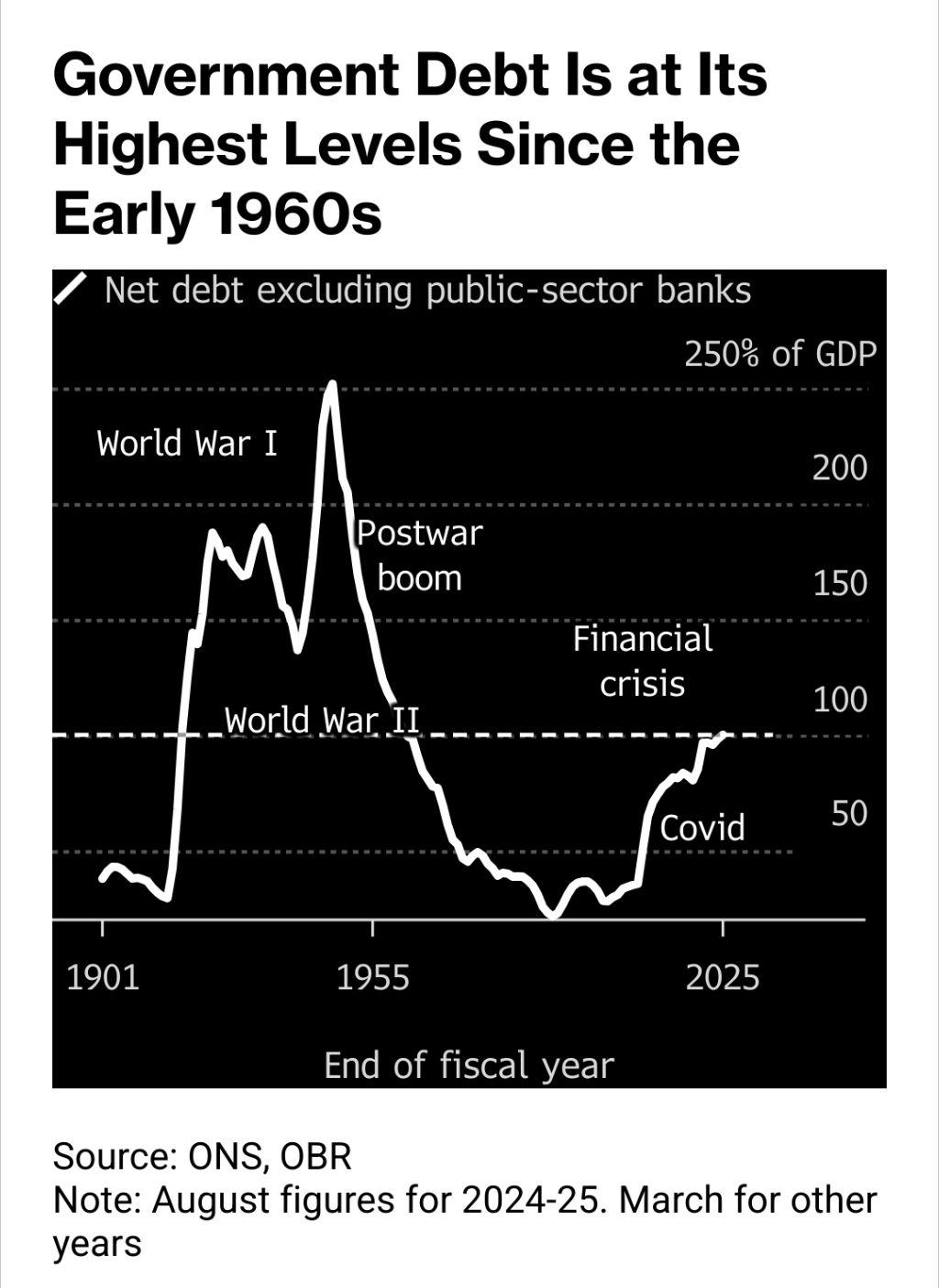

In the UK, the debt has now reached 100% of GDP. This is a level not seen since the World War II, but we could have said the same thing every year since 2008.

Alex Kerr, UK economist at Capital Economics, said the borrowing figures were disappointing “but not as dire as the chancellor suggests.” Despite the overshoot, he said Reeves may have as much as £22 billion of headroom in the Autumn budget, £13 billion more than in March, “due to an improvement in the economic backdrop” and the rolling on of the five-year forecast by a year.

Despite the policy of "austerity" budgeting supposedly being long over, the programs that set the foundation for it continue: profit subsidies for capital.

For decades, governments cut taxes on the wealthy and on capital, and sold off state-owned operations, making up for the loss of revenue by borrowing. They paid for the lost revenue through transfers to the private sector in the form of trade rules, privatization, printing money printed and giving it to capital (causing inflation), wage suppression, and underinvestment in public infrastructure.

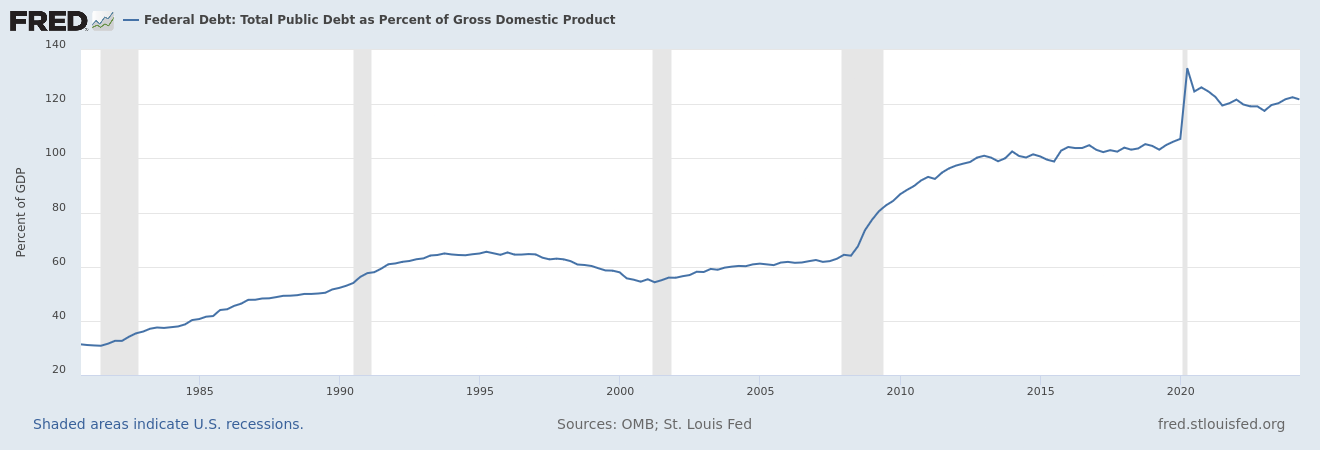

This happened in every "advanced" economy.

USA debt has grown along the same lines even with different overall spending policies and rather stable (though growing) military expenditures.

For the UK, program spending even under Labour will have to be funded through borrowing and hoped for economic growth. This is not a change from the economic policies of the previous 40 years and it is silly to think the outcome will be different just because it is a Labour government (many of those policies were started under Blair's New Labour).

Borrowing to fund private profits only worked for a very short time in the late 1990s and for a few years pre-2009, pushing growth that was barely real through tech and financialized real estate bubbles.

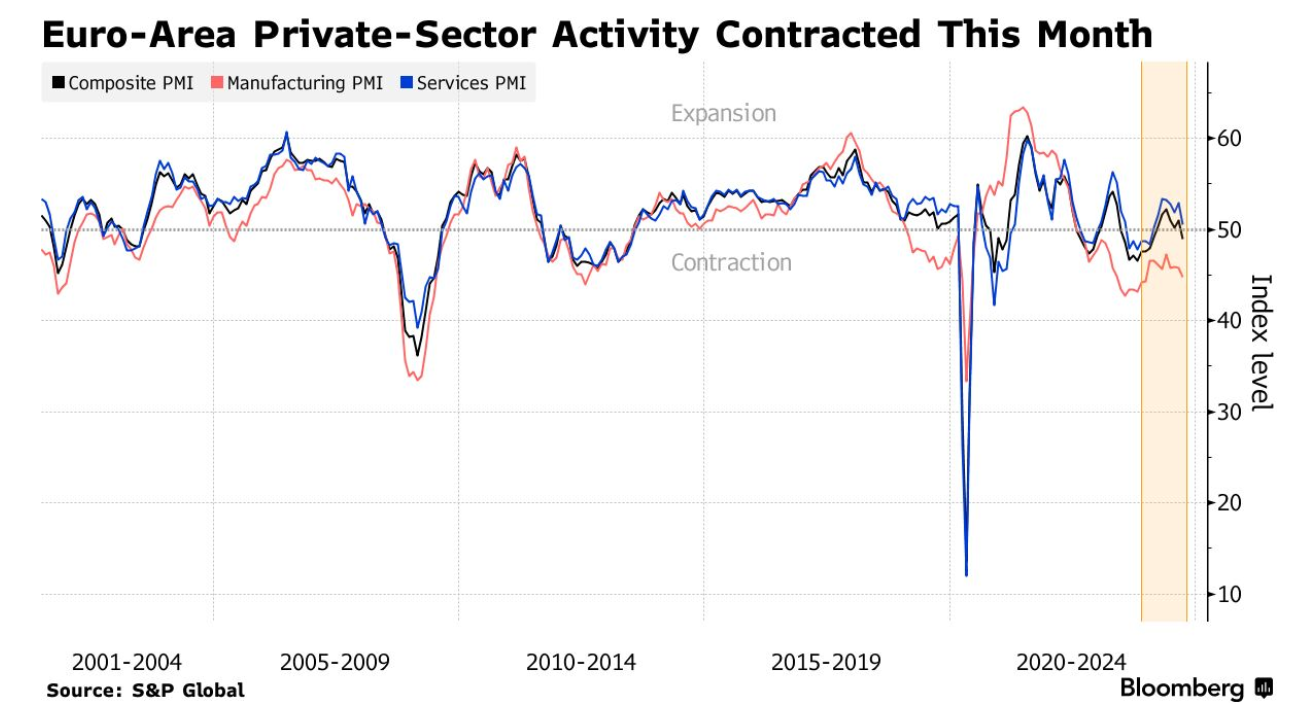

The continuation of this program is a problem for advanced capitalist economies, especially as Europe and other countries continue to flirt with recession. European private sector growth has stalled.

Therefore, we are not going to see fiscal policies (even with increased tax rates) generate revenue growth for governments. Even with the new King of France and his right-wing appointees pushing for large increases in taxes.

A fundamental shift must happen eventually as economies blow past what were once thought to be breaking points. However, we are unlikely to see the kind of tax shift necessary to fill the gap left by the previous 50 years of budget policy, especially given the investments needed in climate change mitigation and response. Not without exploring significantly different revenue options.

War is upon us

This decade is shaping up to be a non-change when it comes to global conflict.

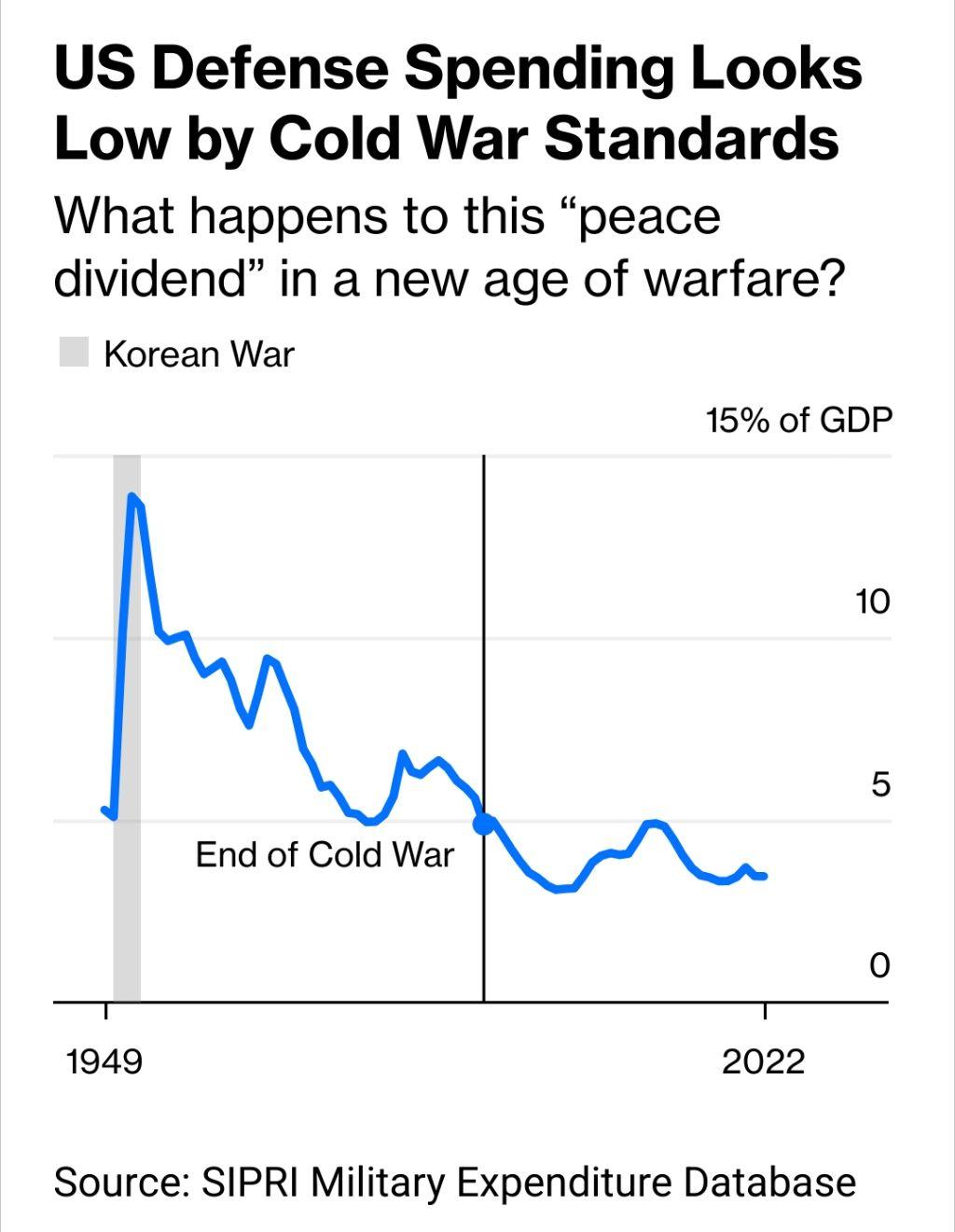

Military spending continues to be front and centre for imperialist powers. It is unlikely that economies can weather a return to the spending levels of the previous Cold War, but wars are now fought in different, more privatized ways.

The USA capital-imposed trade regime is being leveraged in a way that is creating a multipolar world.

The Republicans are pushing a tariff model to "fight" against countries they are calling the "China Axis". The Democrats are leaning more on simply providing profit subsidies to their preferred companies, while Europe is also proposing similar measures.

The Minerals Security Partnership, a coalition of 14 nations and the European Commission, will unveil a new financing network at an event in New York on Monday as they try to ramp up international collaboration and pledge financial support for a huge nickel project in Tanzania, backed by mining company BHP. (FT)

The fine line between aggressive nationalist policies and industrial strategies is important to distinguish. It is important to have domestic production and value added to support local economies and provide revenue for investment in the things we need. However, that does not mean that every dollar spent to support all domestic industries is warranted – especially those set up to incite global conflict.

A multipolar world does not have to mean war, but the USA and its allies are pushing the world in the wrong direction by refusing to acknowledge the history of global conflict.

Aggravating the situation is the fact that some states refuse to behave according to the established rules of engagement, even in regard to their own populations. In the absence of any global rules around conflict, civilians will continue to pay the price.