September 22, 2022

Metals, mining, and climate change

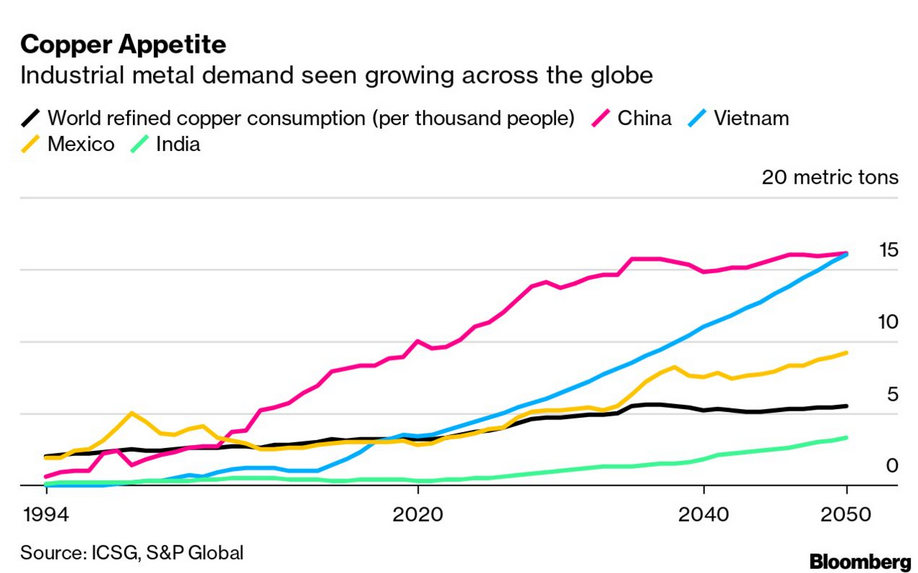

- Copper is not being mined at a rate necessary for the expansion of batteries and other technology that is necessary for the transition to lower emissions.

- It isn't just copper of course. Even lithium is not being mined at a rate that matches the increase demand of batteries to meet even the low regulations in place.

Copper is essential to modern life. There’s about 65 pounds (30 kilograms) in the average car, and more than 400 pounds go into a single-family home.

The metal, considered the benchmark for conducting electricity, is also key to a greener world.

BloombergNEF estimates that demand will increase by more than 50% from 2022 to 2040.

Goldman Sachs Group Inc. estimates that miners need to spend about $150 billion in the next decade to solve an 8 million-ton deficit

(BN)

- Meanwhile, back in reality, mine supply growth of copper will peak by around 2024.

- Recycling is going to be key. If only we had invested in that process.

And, Copper mining is not exactly earth friendly given that it is usually done through open-pit mining and isn't done through electric vehicles.

The battle to move to greener energy, transport, and appliances runs through the same old mining and manufacturing we are using now. Unfortunately, the market continues to be in the way of this process.

And, not always because of money. The World Bank President is a climate change denier. Being opposed to solutions be it right wind ideology or money goes hand in hand.

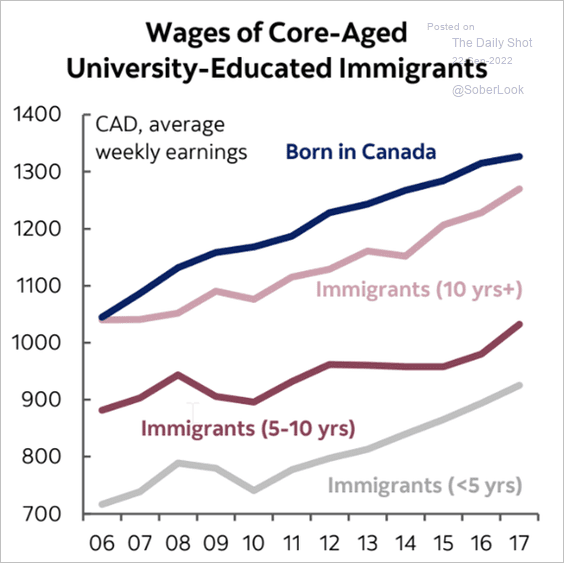

New immigrants in Canada are taking lower waged jobs

And, the gap is getting larger.

It is bad enough that a country that must sustain itself through immigration abuses that to drive down wages. But, to then build a system where the country continues to drive down wages for all immigrants is outrageous.

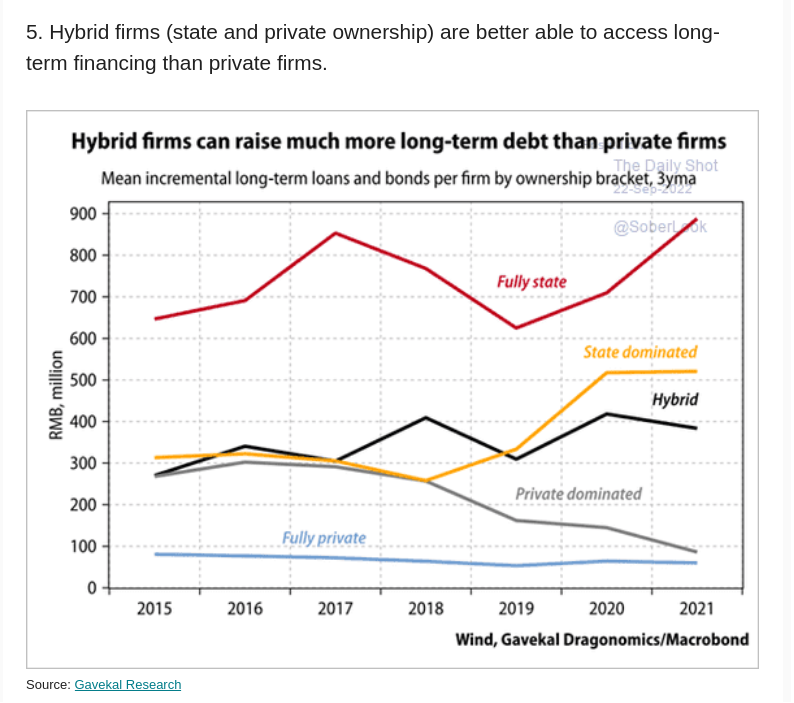

Public-private ownership

Public firms are much better at raising debt for investment. Contrary to popular belief.

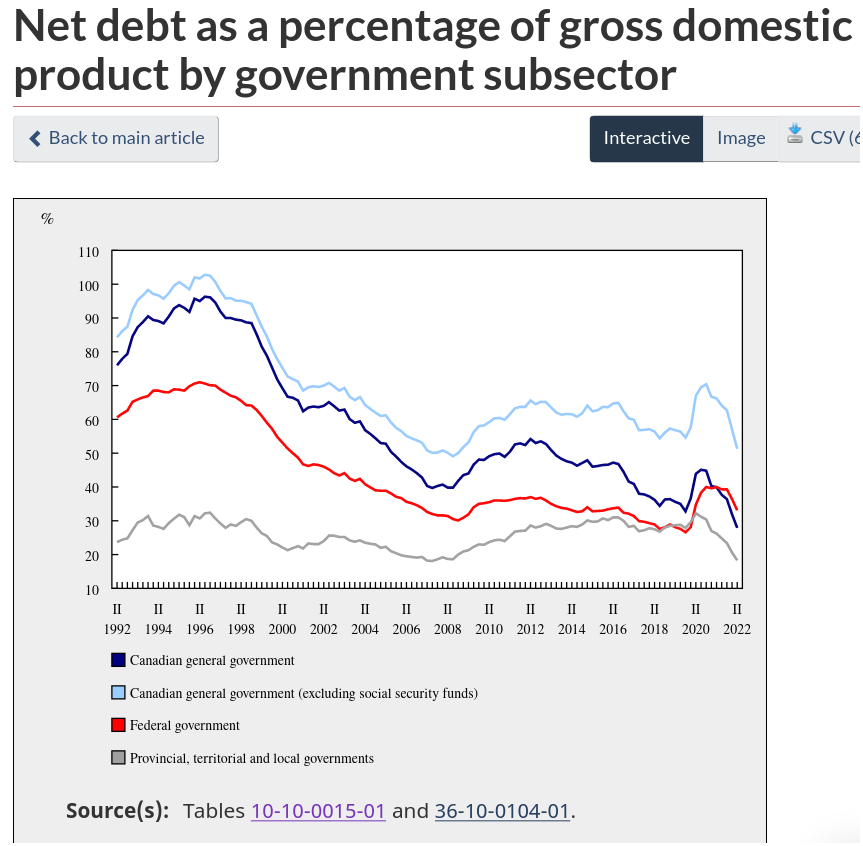

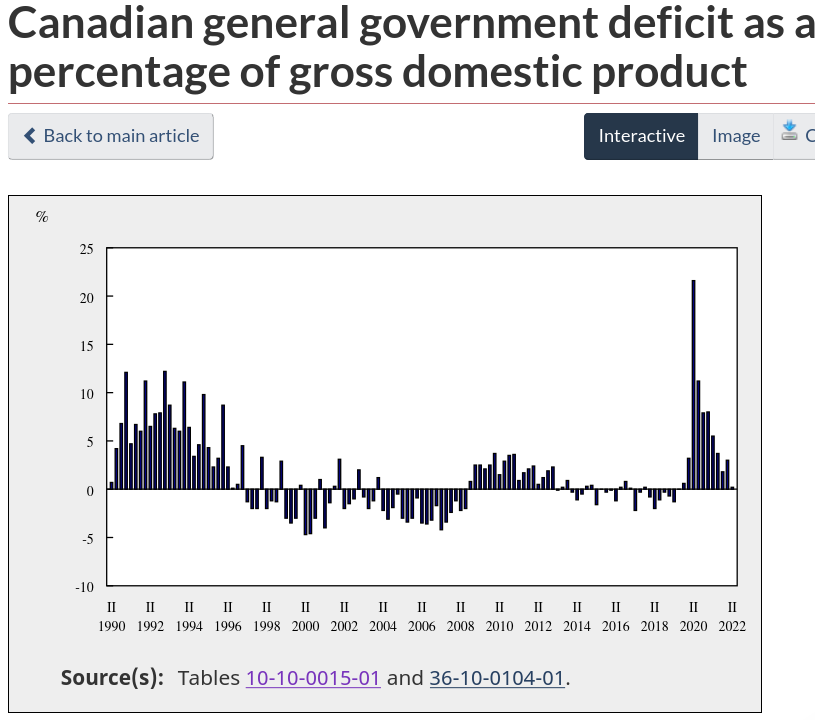

Government deficit

Net debt as a percentage of gross domestic product is at its lowest level in over 30 years

Net debt of the Canadian general government totalled $737.6 billion in the second quarter, down $200.4 billion from the second quarter of 2021. This decline is firstly explained by a decrease in government liabilities (-1.9%), caused by a drop in the market value of outstanding debt securities.

This fluctuation is primarily due to interest rates increasing quickly. Meanwhile, the value of financial assets held by governments rose 5.6% from the second quarter of 2021.

The rapid increase in interest expenses in the second quarter of 2022—a direct consequence of the recent rise in interest rates and outstanding debt securities—resulted in an additional expense of $3.7 billion from the second quarter of 2021. However, over the same period, government revenue, which is sensitive to economic growth and inflation, jumped $17.9 billion (+7.1%).