September 21, 2023

USA's Federal Reserve

All eyes were on the USA yesterday for the regular adjustment to the central bank's interest rate.

The data comes in many forms:

- central bank interest rate

- a relatively new (since 2012) "dot plot" of the Federal Open Market Committee's guess of where interest rates should be and might be in the future.

- speech by the chair

- answer to questions by the chair clarifying what it all means

Then there is the market response to all of this, happening in real-time.

Then there is the next day's more sober analysis, second thoughts, and reminder that the economy is more than what the central bank thinks will happen.

The take-away are this:

- No change in the interest rate the fed charges.

- The federal reserve would like to keep the interest rates higher for longer, all else being equal. About .5% higher than estimated in June.

- Inflation is more important that growth.

- A "soft landing" (i.e., the high interest rates do not cause a recession) is not guaranteed, but is a "priority".

- The data drive decision making of the fed. What data? No one is really sure, but inflation, spending, and debt are in there somewhere.

- The fed's models show that USA unemployment will be lower and growth will be higher than predicted (thus, the higher for longer on rates).

- The "market" was a little shocked and short-term bonds rose in price as the chair was speaking and the equity markets were reduced.

Oxford Economics sees a "modest recession" in the USA because of the Fed's announcements yesterday.

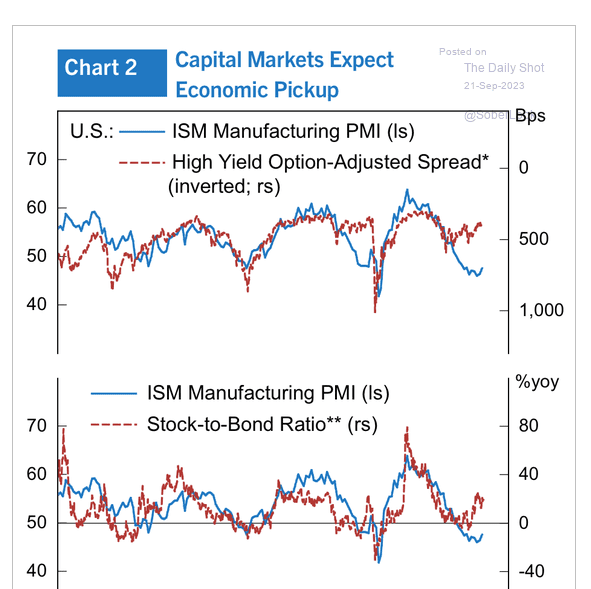

The purchasing managers index indicates that markets may be caught off guard. Goldman thinks that there will be a "pothole" as we head to the end of the year.

All because the chair of the Fed said, they are watching the data.

This is all well and good if you believe the models that the Fed uses. And, while they are likely mostly able to respond to what is going on, they are not predictive. Everyone in the neoclassical tradition to the PostKeynesian world have been wrong about everything to do with the economy and inflation.

Lots of photons have been shed spouting all sorts of predictions. But, the reality is they just do not know.

We do know this: the central banks around the world think that inflation is much more important than positive economic activity. In the question period, Powell stated clearly that fixed income folks at the bottom of the economic scale were his main priority as they were affected more by inflation. While we can quibble about whether we believe this (I do not), it points to the narrative they are using: it is not the jobs that are lost, it is the ability to pay for basic things because money is losing its value that is most important.

Workers may have an issue with that.

The UAW strike weighs on these calculations and came up during the questions. The strike could be so large as to affect central bank decision making. I would say that was significant.

Canada's central bank news

It was released yesterday that the Bank of Canada was lying to folks when it told people it was considering a rate rise before the previous rate announcement.

Turns out our central bank was concerned the market was expecting what they were going to announce and did not want traders betting on it.

Essentially, the central bank was tell people not to trust anything that they say, only what they do.

Then they announced that inflation was too high for their liking.

The response from the markets was to ignore what they said about lying and bet on the statement.

Policymakers next set interest rates on Oct. 25. Traders in overnight swaps put the odds of a hike at that meeting at more than 50%.

UK leaves rates unchanged

- First time in almost two years. Still 5.25%

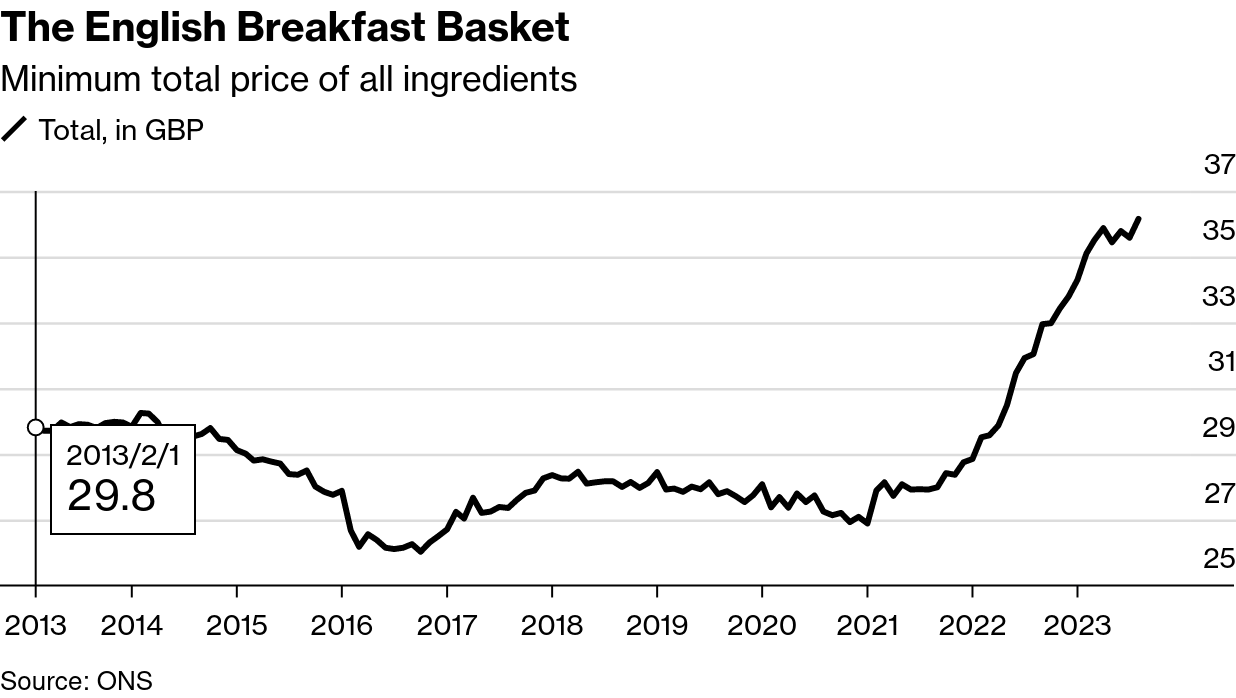

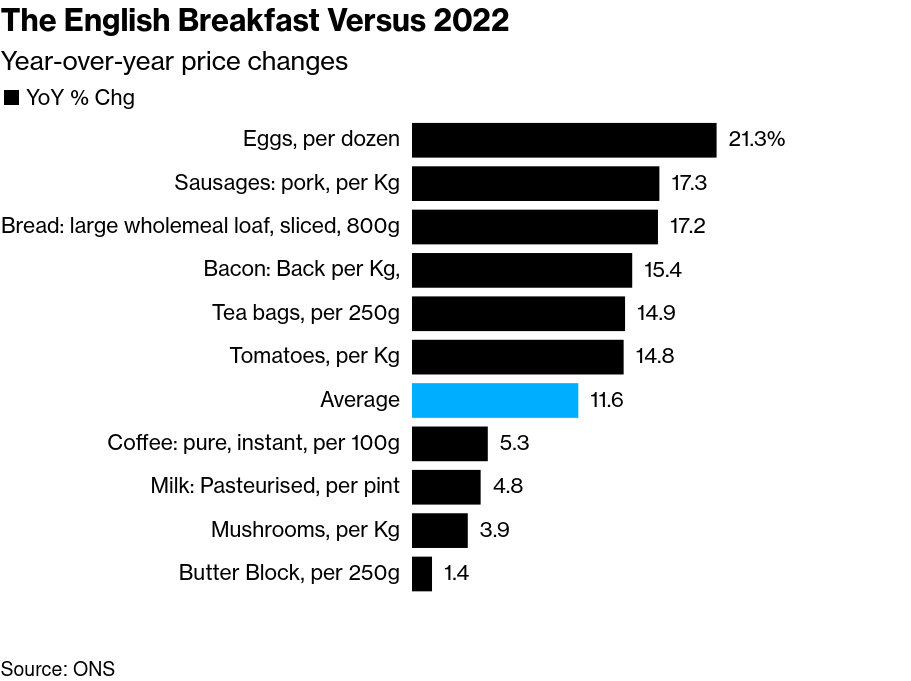

- Response to not increase probably driven by the fact that their interest rate hikes are having no effect on the things driving inflation. Namely food prices:

Large Australian Chevron LNG strike update

Chevron has agreed to a regulator (Fair Work Commission) proposal for a mediated settlement to the strike.

The union has not responded yet.

If the unions reject the commission’s proposals, which include revised terms on pay, travel and expenses, a hearing will be held at 10 a.m. in Sydney to decide on so-called intractable bargaining declarations — meaning the regulator would be able to end the dispute by independently setting new terms and conditions of employment. (BN)

Chevron's LNG distribution has not been impacted so far, but are about to be.

Chevron asked the regulator to intervene.

Not a whole lot of choice there and not really a balanced bargaining process.

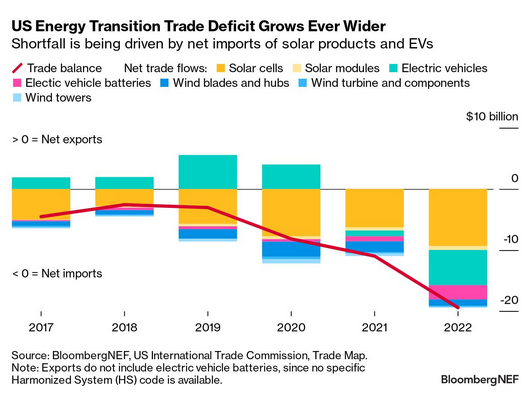

A Trade Deficit in the USA driven by energy transition

With the IRA, there is a lot of talk about local production, but here is the graph of the current path of a trade deficit caused by importing clean energy products.

Local production is necessary if any country wants to offset the economic implications of energy transition.

Oil going to $100 a barrel?

Goldman Sachs thinks so.

Bank sees deficit of 2 million barrels a day over this quarter (BN)

- Hedge funds of all sizes are betting on continued growth in the price.