September 21, 2022

20.9% of Canadians spend more than 1/3 of their income on rent/housing

The National Housing Strategy Act in 2019 recognized housing as a human right. Though, it is unclear what that means under a private, market driven housing system.

The question for the left needs to be what alternative are we proposing?

As housing (and other real estate) prices stagnate (or decline) municipal government revenue will be affected. This decline in growth and increased costs of borrowing will negatively affect public housing investments.

The long contradictory position that governments are in now when it comes to housing their citizens is in sharp focus. However, the only way forward is the expansion of public housing investment, the expansion of public housing and co-op housing support for middle-income workers, and an industrial strategy that coordinates with housing investment.

The model not to follow is the Long-Term Care housing plan that continues to throw good money after bad in the attempt to get private investment through profit subsidy. The failure to address the crisis in senior living and LTC availability in Ontario should make for easy counter examples to the liberal plan of letting the market decide.

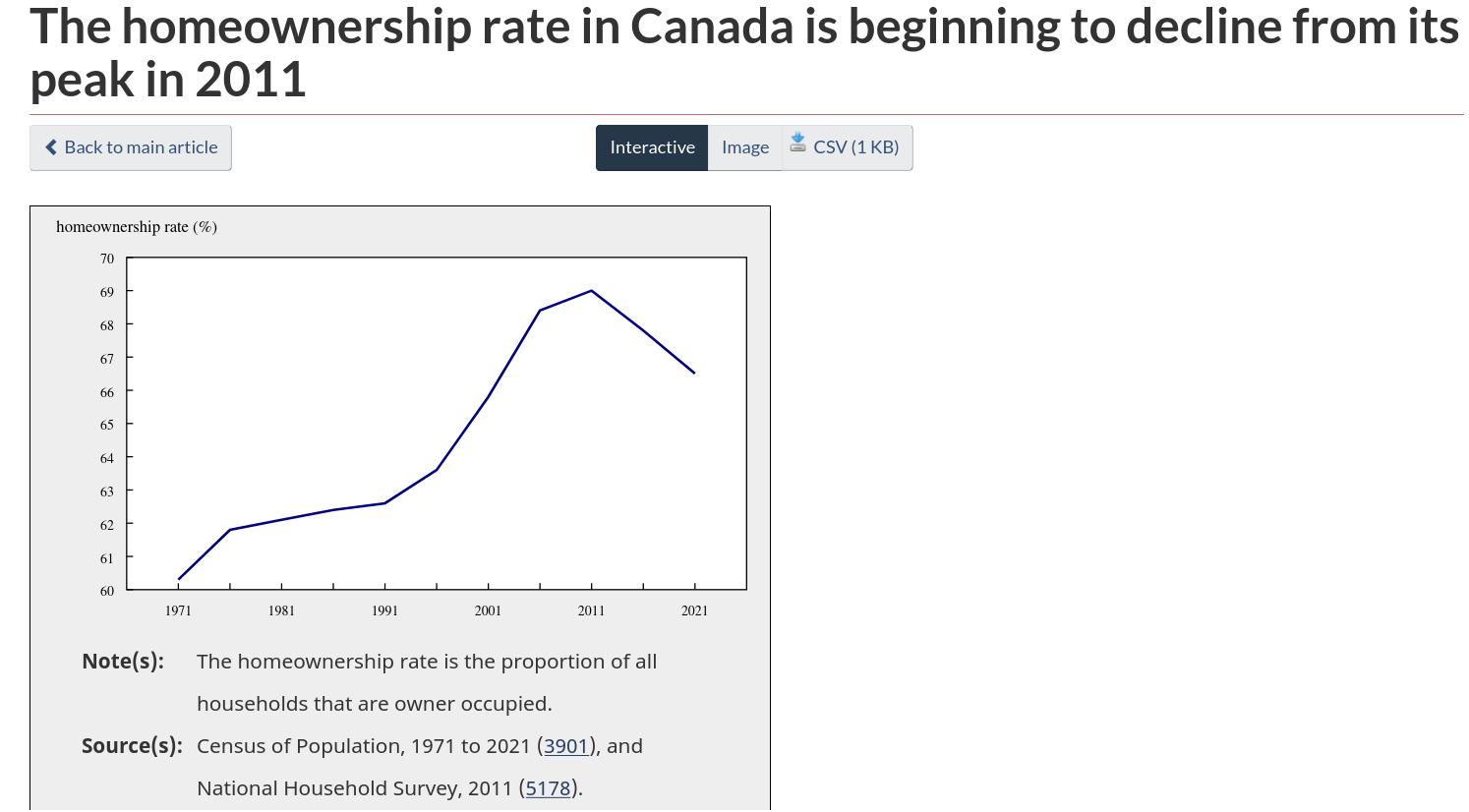

The proportion of Canadian households who own their home—or the homeownership rate (66.5% in 2021)—is on the decline in Canada after peaking in 2011 (69.0%). The growth in renter households (+21.5%) is more than double the growth in owner households (+8.4%).

Adults under the age of 75 were less likely to own their home in 2021 than adults in that age range a decade earlier—especially young millennials aged 25 to 29 years (36.5% in 2021 vs. 44.1% in 2011).

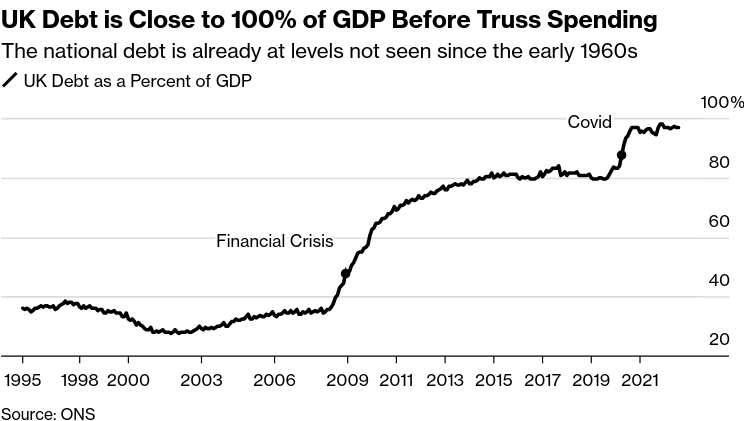

Global capital is very concerned with Truss' spending

The tax cuts and massive profit subsidies to energy companies (erroneously called price caps) is putting the UK economy in a bad position.

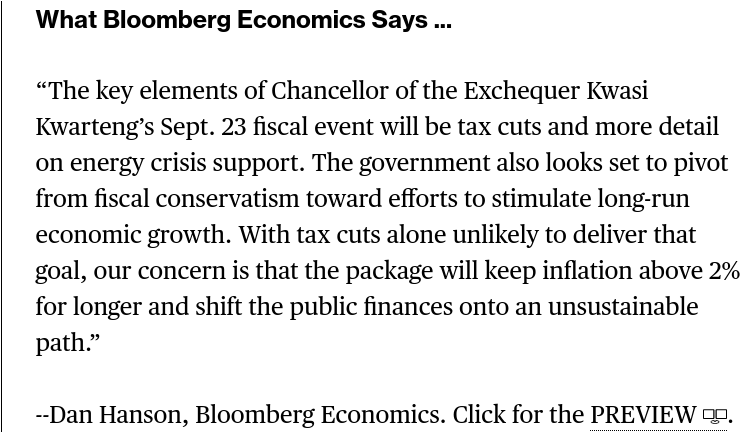

Even finance capital does not believe that tax cuts are going to be able to restart the UK economy. And, they are concerned pumping cash into a volatile economic system through profit subsidies disguised as price caps is going to be a problem:

Further, it sets everything up for a return of austerity in the future:

stabilizing the debt burden would require a fiscal tightening of a little over 1% a year. (BN)

Tories used to know how to grow the economy. All they can do now is read rhetoric from the 1980s and pretend they understand what it all meant.