September 20, 2023

Climate, strikes, and oil and gas

Several disjointed things this morning:

Australian LNG Strike

There is a strike happening at a very large Chevron LNG facility in Australia. The facility produces about 5% of the world's super chilled natural gas. The strike is having near zero effect on the volume of exported LNG.

The limited ability to affect production speaks to Australian labour law allowing non-union workers to do the work of the unionized group and the way that strikes at the facilities have been implemented. Slowdowns that were supposed to target production have failed to cause structural decline in short-term refining capacity.

The result of continued production means that the strike has now been extended into mid October by the union coalition bargaining with Chevron.

Not enough diesel?

There is general concern over not enough diesel (and aviation fuel) being produced because of a lack of investment in new refining capacity. The reasons? Demand for liquid petroleum is going up while war, economic instability, policies to drive down production (only), and climate chaos has reduced capacity of existing global refining 4% to 5% in the last five years.

- Current facilities are running at 88% utilization.

- Investment continues to add some production 1.9M barrels per day added, but 600,000 will be taken off line.

- By 2025, "only" 1.4M barrels will be added per day and 900,000 will be taken offline.

While we may think it is good that diesel is being reduced at point of production, it is driving prices way up while not having an impact on demand—as there is no alternative readily available. These prices are global, so the impact is increased inequality in access to the fuels.

This disjointed slow-down will drive the cost of production and transport of food and other goods.

The issue is not the speed at which we are moving away from diesel, it is that government policies are mostly relying on the market to deliver the transition. It is a recipe for inequality, backlash, and not a just transition at all.

Refining of diesel will be a microcosm for the broader transition that is not linking production reductions with transitions to new energy sources for transport.

- oil is currently trading at $95 a barrel.

UK's Sunak is rolling-back climate policies due to "backlash"

With the broad right-wing mobilization in the UK blaming green policies for the increased costs of goods and negative impact on employment, the Conservatives has pivoted to an anti-environment policy position.

- 2035: new date for the ban on the sale of cars burning petrol and diesel. Five years later than the policy agreed in 2020 to meet 2050 net zero targets set in the Paris Accord.

- Additionally, the UK Tories are rumored to also be weakening the plan for phasing-out gas boilers/heating.

- The "backlash" to Labour's London Mayor's green policies was blamed for recent win in Uxbridge by-elections earlier in the year.

- Even Ford Motor Company criticized the move saying delays endanger the transition to EV.

- Sunak's new statement is that they are not going to bankrupt the "British People" to meet climate targets.

The main concern is that if the UK Tories abandon even these very soft climate initiatives it opens the door for all initiatives to be placed back on the ballot during the election. Instead of focusing on a debate on the way to transition away from fossil fuels, it will again be on if we should transition at all.

Car companies are opposed because major investments in new production facilities have been developed in-line with policies and the profit subsidies that go along with climate targets.

Canadian oil companies meet

There is a large meeting this week of the major oil companies in Calgary. The timing is not a coincidence as the PR companies are flooding the news agencies with their policy options as major climate change protests and discussions happen in NYC (and around the world).

The World Petroleum Council has also re-branded to remove the word "petroleum" and insert the word "energy". Now called WPC Energy.

The oil industry wants subsidies to slow their emissions and they want targets to be flexible.

The conference is the "Path to Net Zero". A bit of a joke since that path has already been agreed to by the world at IPCC events. Press releases from the event focus on energy intensity of oil production.

The Canadian oil industry’s efforts to curb emissions rely heavily on a massive proposed CCS system that would be financed largely by a C$12.4 billion ($9.2 billion) infusion of government funds.

Their main frame is that subsidies to CCS (a fairy tale technology) is justified because 20% of Canada's TSX is the oil and gas industry, generating $200B of revenue per year.

- 6.5% of Canada's GDP if you do not count usage and sales.

- 500,000 workers directly employed.

Some stats from the "WPC Energy" that should make folks concerned:

- 300 years of natural gas reserves with recent LNG investments ranking #1 in private sector spending in Canadian history

- 3rd largest oil reserves in the world 4.7M barrels per day. 162.5B barrels in the oil sands.

- 6.6 billion tonnes of coal reserves with 24 operating coal mines.

Inflation

While previous rounds of discussion about inflation and policy rates were important, now is the real test. A wrong move now will have very serious implications. And, central banks have a very long history of only moving in the wrong direction.

Inflation numbers go up and down, but the narrative changes. The recent uptick in inflation has been scoffed at as "choppy data" by the central banks.

A Bank of Canada official said she sees evidence higher rates are working to cool the economy, blaming a hotter-than-expected inflation reading on monthly volatility driven in part by energy and rental costs.

Recent consumer price data indicate that inflationary pressures are still broad-based, she said, and “underlying inflation has experienced little recent downward momentum.”

This is called "talking out of both sides of your mouth".

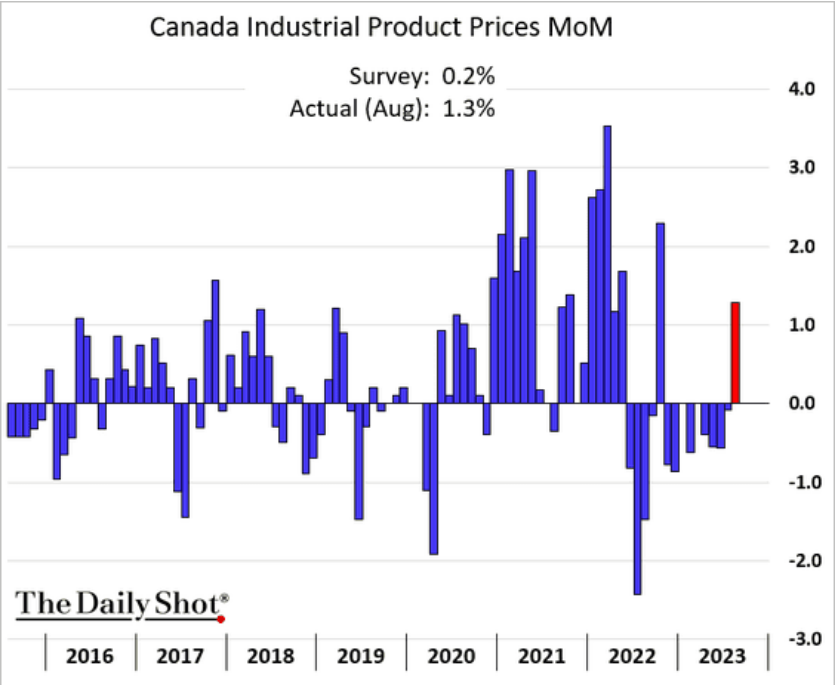

The reality is that the industrial products prices shows a slight up-tick in producer costs.

Add to this:

- energy costs that do not seem to be going anywhere (though, did not drive CPI numbers up this month)

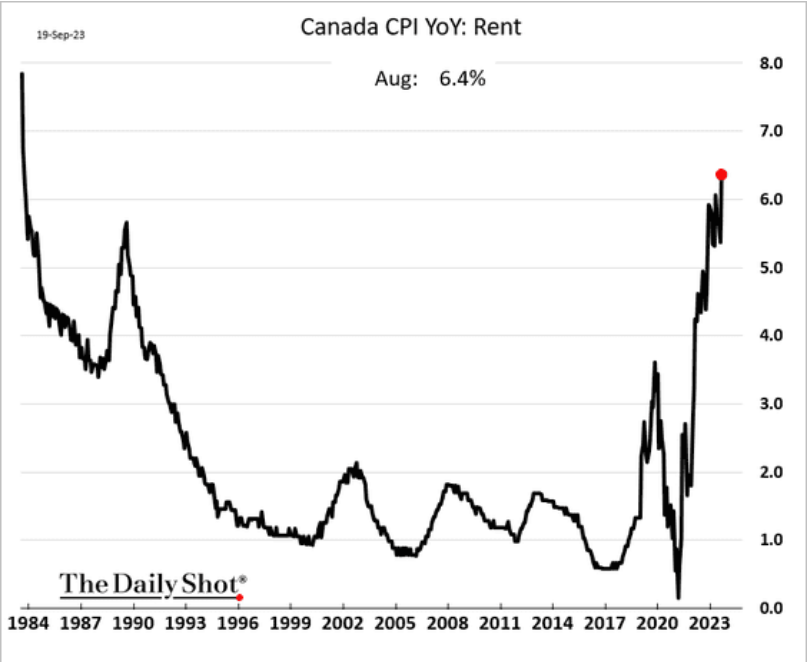

- housing continuing to be a major affordability issue with rents jumping again.

- labour market loosening

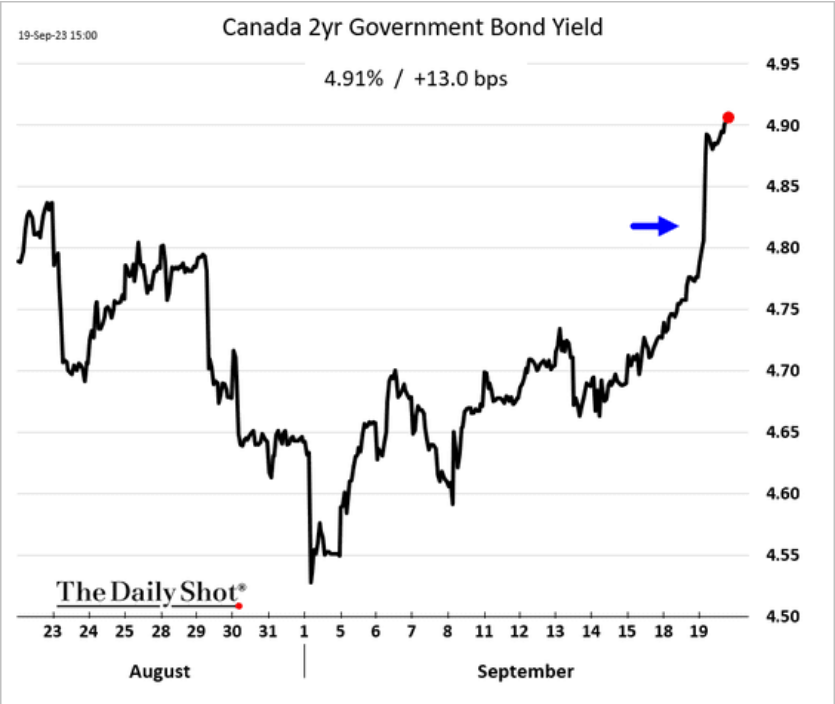

- short-term bond yields skyrocketing back to above August levels

And you have a bit of a problem for the central bank decision making based on the idea that interest rates can solve this problem.

OECD data

New OECD data show that the global economy is starting to show signs of stress.

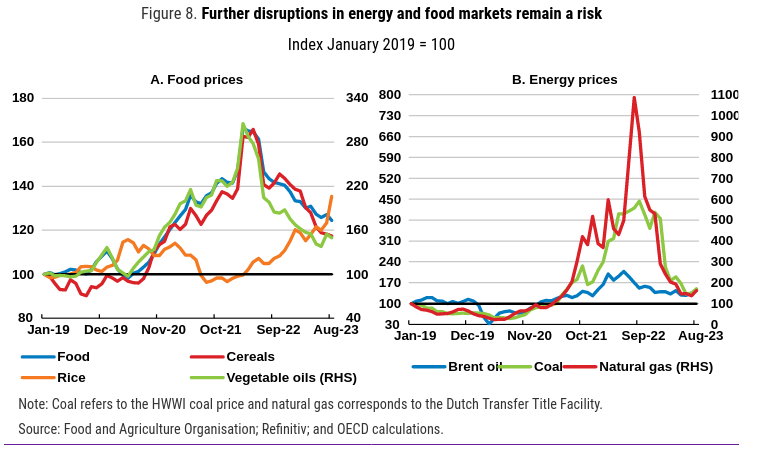

There is broad concern that costs are real with even small disruptions in the food and energy markets translating into price pressures:

OECD's numbers have consumer prices staying higher for longer in their new projections. And, they have revised down their numbers for country-by-country growth.

Canada is on track for 1.2 real GDP in 2023 and 1.4 in 2024. A revision down from just a few months ago.