September 19, 2024

Federal reserve cut rather large

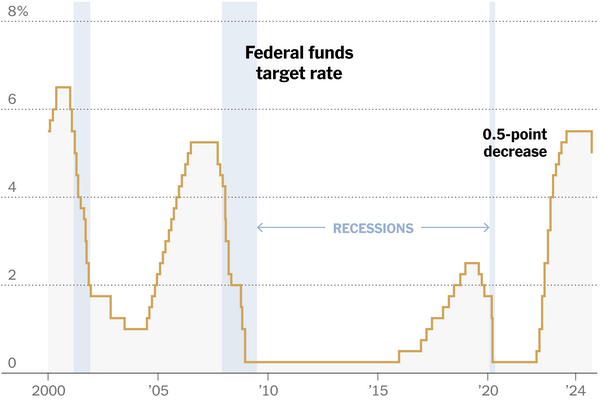

In a sensible universe, the Federal Reserve in the USA cutting their target rate by 0.5% would incite fears that the central bank of the world's capitalist standard-bearer had screwed up.

- Fed rate: ~4.9 percent (down from a more than two-decade high)

Large shifts in the policy interest rate in either direction usually indicate that the bankers are shocked by something happening. Rates only go up that fast when they think that the economy is nearly out of control, and then come down that fast when they think that the economy is stalling – like during the 2009 financial crisis and the start of the COVID pandemic.

The Federal Reserve has announced that there are more declines in the pipeline.

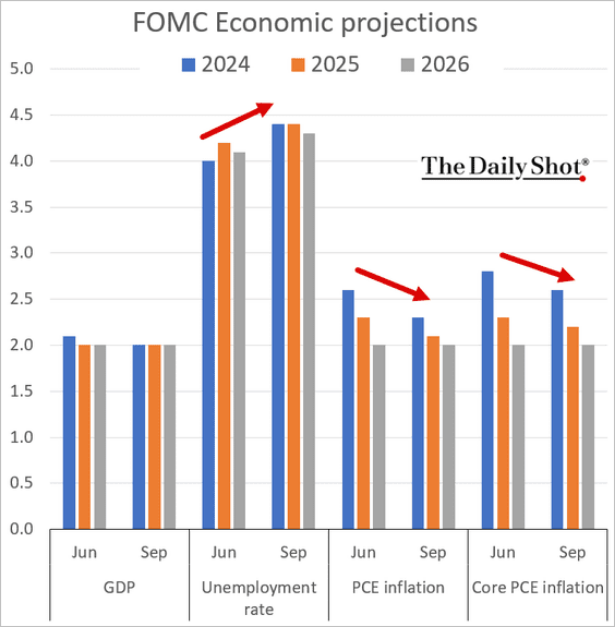

The USA economy is stalling and has been for a while. The unemployment rate has been creeping up since its low in Aug 2022 (appreciably from April 2023).

However, investors are so happy to see a decline in interest rates that they are mostly ignoring that it is in response to faster slowdown in economic activity than they had expected. The rate of slowdown is dipping into recession territory.

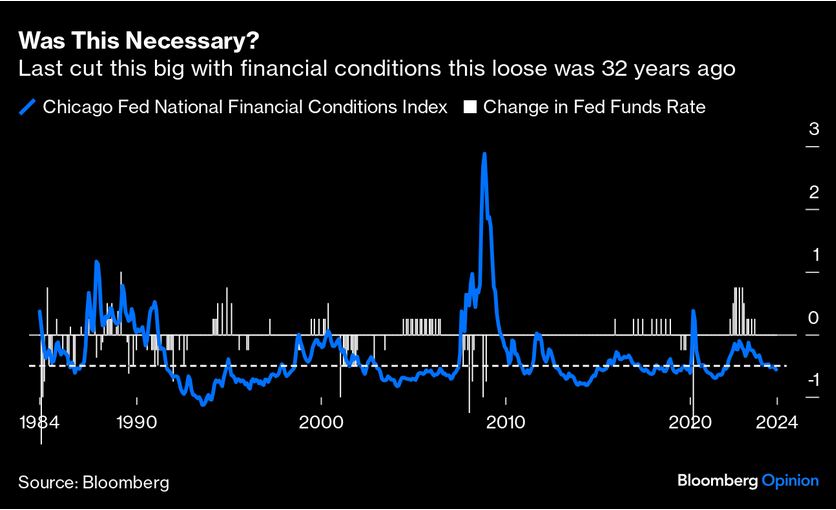

Analysts in the back pages of the news are saying that the large drop in the interest rate is actually because they screwed up by not bringing down the rate at the last meeting in July.

“The Fed also doesn’t like to admit policy errors, but some of the decision for a larger cut in September is likely to get caught up as the central bank found itself behind the curve by one meeting,” – Oxford Economics

On the other side of things, the narrative presented indicates that some have forgotten that it takes months for policy rates to have any real effect on the economy. In the meantime, the Federal Reserve is betting that capital will see it as a sign that the central banks will keep the economy from sinking enough to damage profitability, indicating that investors should start investing in production.

Now, that's for recessions as defined by capital's metrics. Workers in the USA have been living through their own recession since 2022. All the programs of the Federal Reserve have been organized to make workers, and not capital, pay for inflation.

As we know, they have mostly succeeded in this.

The media is talking about the American Consumer. This class of being is disassociated from "working" because they spend fake money (debt) on goods not usually made in the USA. American Consumers are just workers who have to spend money to live and that is what they continued to do. Even if they do not have proper-sized homes to live in and all that "consuming" was just to stay above the water line.

But on the production side of things, even the considerable profit subsidies provided by the federal government to production have failed to provide as large a bump as would be expected. Many of the large-scale projects announced by the government have failed to materialize (not that we are surprised). Projects ranging from electricity infrastructure upgrades to shifts to electric vehicles, from rail infrastructure to microprocessor development and new mining projects.

While there has been some uptick in local production, these policy measures for domestic production were designed to offset the high interest rate for debt-funded investments. Again, providing support for capital that workers pay for.

So where are we now? High interest rates were supposed to cool the economy by slowing down investment and consumption. The working class has paid more of the bill than capital, since capital's profits were subsidized through the Federal Government's debt-funded spending programs. From this angle, the policy has been a success.

The question from capital is, "Will a capital recession occur that limits profitability now that inflation has been dragged down?" Or will it be a so-called "soft landing", in which only workers face the brunt of the Federal Reserve's actions?

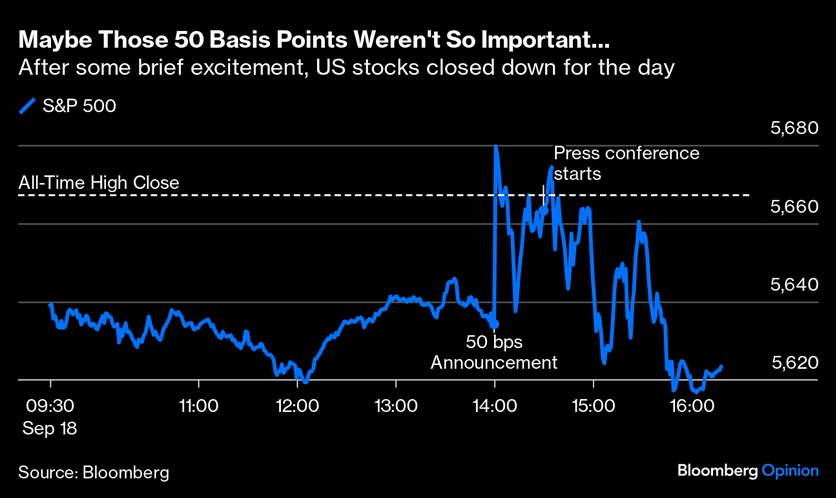

This is less clear. At the end of the day yesterday, the stock markets were down as the investor sugar rush was supplanted with a little bit of real data.