September 15, 2023

UAW start strike action

This is more of a place holder for the date

There is not much to say right now other than:

- Capital Economics economists admit that all the anti-union news that the impact of the strike will significantly hurt the broader US economy is mostly nonsense. The impact of the strike is broad during the strike, but by the end of the year, only the automakers are really going to hurt.

That would directly curtail US gross domestic product by as much as 0.3 per cent on an annualised basis, the consultancy said.

Still, the group’s lead US economist Michael Pearce said: “Any hit should be fully unwound once the dispute is over, so the impact on full-quarter GDP would likely be negligible.”

- Shares took a hit this morning at Ford and GM

GM and Ford shares traded down more than 2% before the start of regular trading Friday in New York. Stellantis stock rose 0.5% as of 10:30 a.m. in Paris.

A 40-day strike against GM in 2019 — the longest since the 1970s — cost the company about $3.6 billion in earnings before interest and taxes, according to RBC Capital Markets. The strike dented revenue up and down the automotive supply chain.

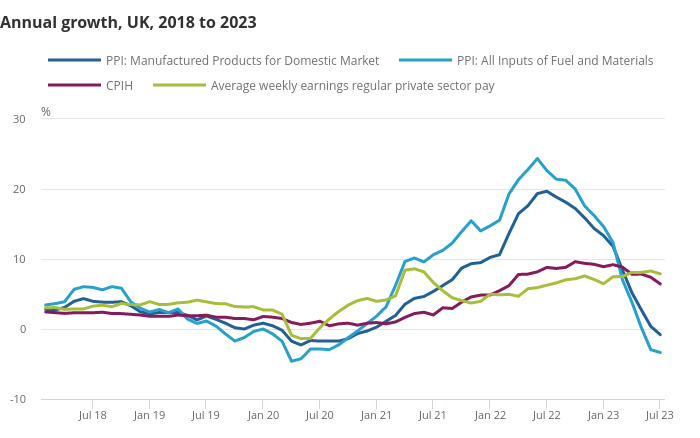

Wages do not drive inflation (in manufacturing) ONS study admits

They are finally admitting that wages do not drive inflation in manufacturing. The ONS then goes on to say that wages are being passed through to prices on the services side.

I am not sure what "services" are here. They seem like they are whatever the part of the economy that economists want it to be to make some dumb point.

The pass-through from wages was particularly strong in law, accounting and management consultancy.

For the ONS study, this is what "services" are. So, what, <2% of the economy?

I think that if we look closer, the wage-price pass through is on services that have very flexible price regimes that are unregulated by the market. Things like legal fees are not really what we call "market determined" and most of the time lawyer's fee is their wage.

Most things in the economy are and those are the things that are unaffected by wage growth.

The ONS study does not look at a mechanism, it simply looks at correlation between prices and wage changes. They also compared other changes.

From a classical perspective, none of this is surprising.