September 15, 2022

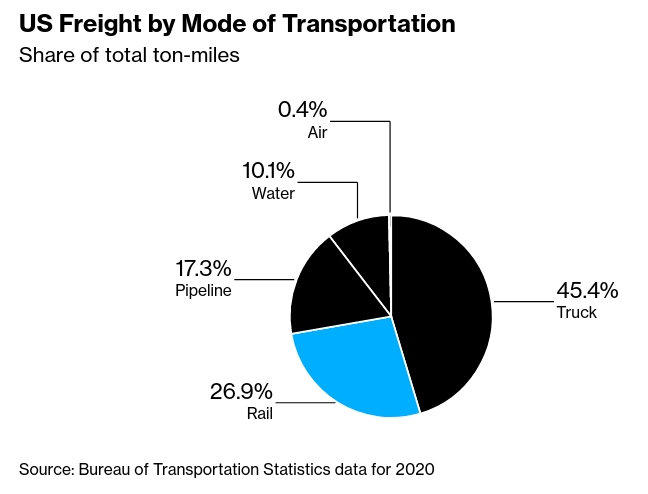

No rail strike in the USA

- Labor Department says it "balances needs of workers, businesses and the nation's economy." We will see what the workers say.

The deal extends the so-called cooling off period, during which the two sides have been negotiating, until union members can ratify it, an administration official said.

“These rail workers will get better pay, improved working conditions, and peace of mind around their health care costs: all hard-earned,” Biden said in a statement. (BN)

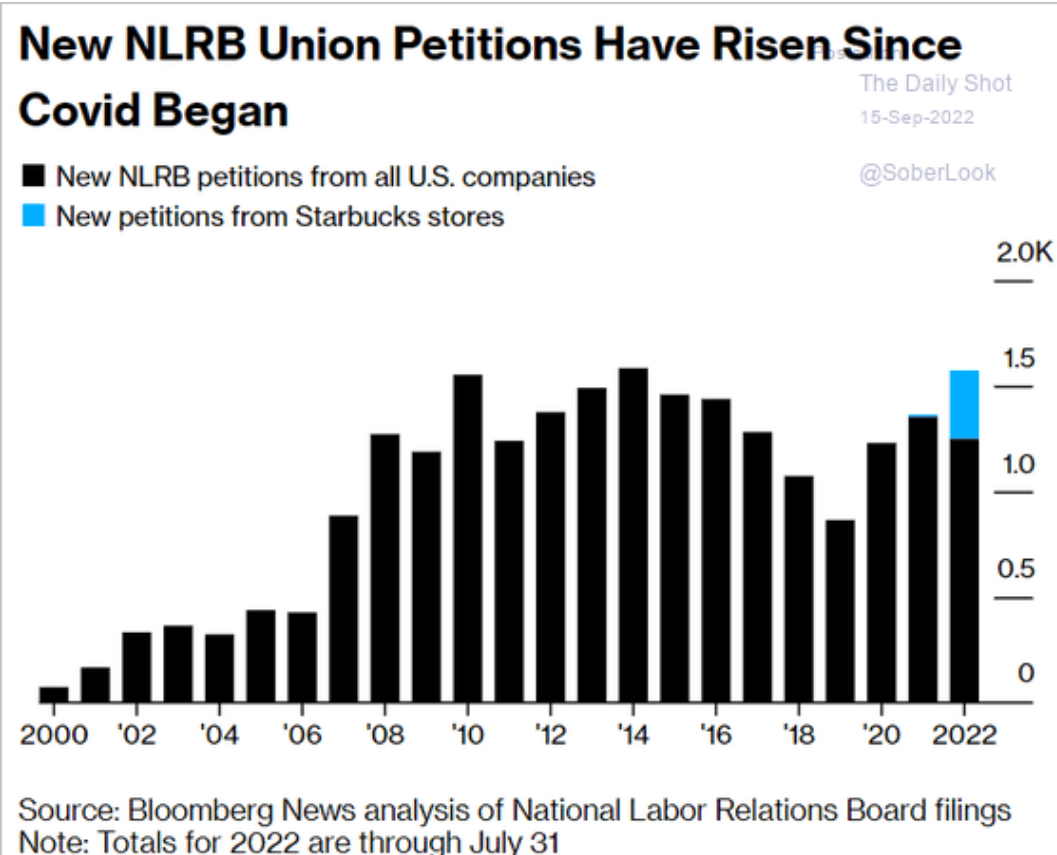

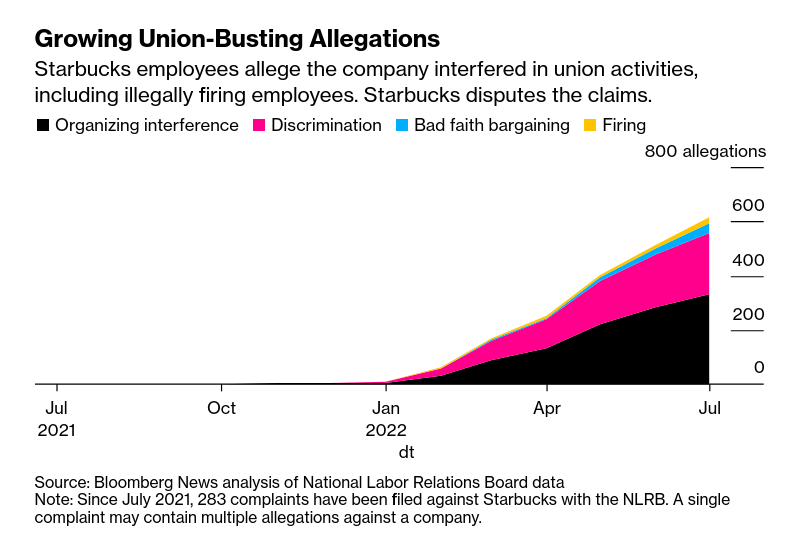

Union attempted and full certs in the USA

There has been a small bump, largely thanks to increased unionization at Starbucks stores:

However, it is well below trend.

Bankers concerned with inflation-adjusted pay

The Bank for International Settlements is 100 per cent opposed to indexing and determined to tell everyone that their inflation fight is dependent on workers being pushed into poverty.

The BIS is the bank for central banks and is, of course, parroting the country-level central bankers.

In Spain, where annual inflation in August was 10.5 per cent and electricity bills are up by 70 per cent over the same period, unions are winning negotiations for more of their members’ contracts to be indexed to prices.

Such contracts already cover almost a third of Spanish collective wage agreements, up from less than a fifth at the end of 2021, and are expected to reach half next year, according to the country’s central bank.

Bank of Spain governor Pablo Hernández de Cos warned earlier this year about the risk of a dreaded “wage-price feedback loop”, where inflation becomes harder for central banks to control and feeds through into even more pressure for higher wages.

Defending the deals, the UGT, one of Spain’s biggest unions with 960,000 members, said workers should not be “once again the ones to pay the cost of a crisis.” (FT)

The buried lede here is that wages are still well below inflation:

CaixaBank's wage tracker showed wages went up only 2.5% per cent in the year to June and 2.4 per cent in May.

This is because their "indexing" language isn't a full one-to-one and wage gains are not even close to inflation in the first place.

Wage-inflation indexation is fine to negotiate, but you still need to negotiate and in the end isn't a panacea—no matter how much it makes bankers nervous.

Brazil, on the other hand, has gotten some above inflation wage growth AND indexation:

Profits in banking

The UK may scrap a cap on banker bounty in a controversial move to boost the City of London. The cap, introduced by the EU after the 2008 crash, limits bonuses to two times bankers' salary. An announcement may come next week, people familiar said.(BN)

Energy Nationalizations

Uniper (natural gas company) in nationalisation talks with German government

- Energy group suffering huge losses discusses deal for Berlin to take more than 50% stake

- In July the government agreed on a €15bn rescue package and took a 30 per cent stake in the company. But Uniper requested more financial help in August, raising the bill for its bailout to €19bn.(FT)

- Bloomberg reports that Germany is open to full nationalization.

Uniper had used all €9bn it was given in August, all €7.7bn in July. Money given to it by the German Development Bank (KfW). This is government-backed bailout money given to it before it was nationalized.

Shares have gone down since the announcement, but given to it while it stock price collapsed after dividends were given in May.

The company might be cheap to buy for the government, but they are essentially bailing out capital from a company about to go bust.

Greenwashing

A Democrat-led Congressional Committee said internal documents from Exxon Mobil, Chevron, Shell and BP reveal that their public promises on climate change amount to greenwashing.

- 90% of World’s Biggest Firms Will Have at Least One Asset Exposed to Climate Risk, Fresh Data Show. (S&P Global)

The S&P Global Sustainable1 product looks at over 870,000 corporate assets such as warehouses and data centers. Close to 10% of the S&P 500’s total assets would be financially impacted by climate hazards by the 2050s under a business-as-usual scenario, with water stress and extreme heat having the highest impact, it found. (BN)

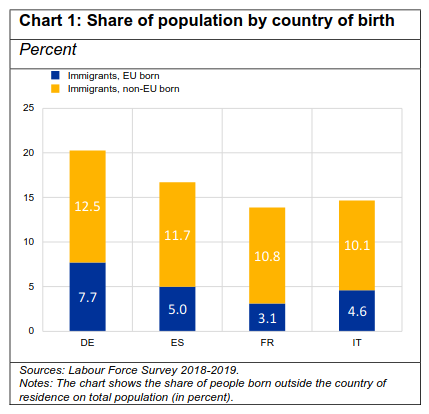

EU immigrant worker economy

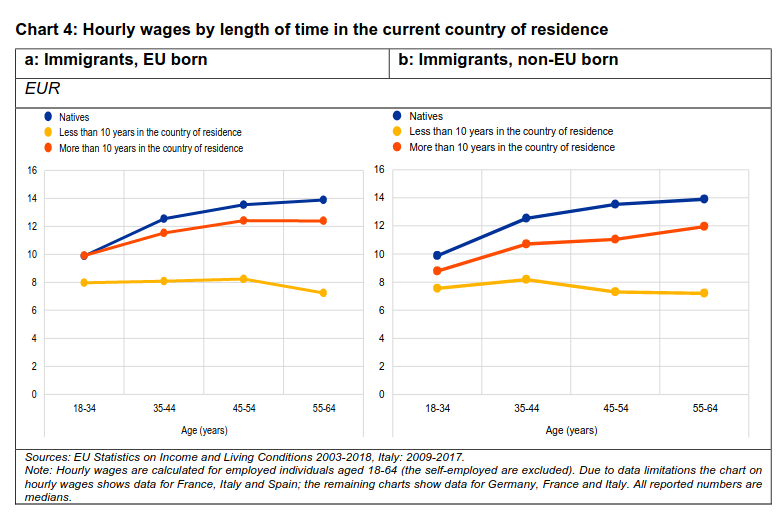

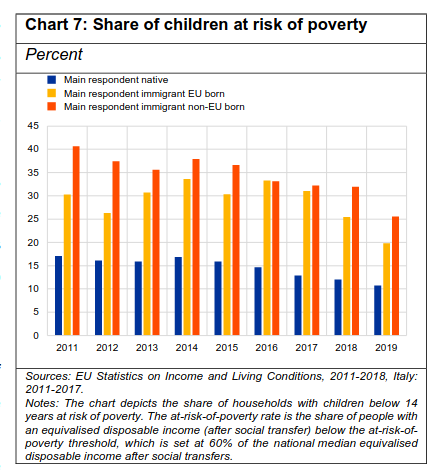

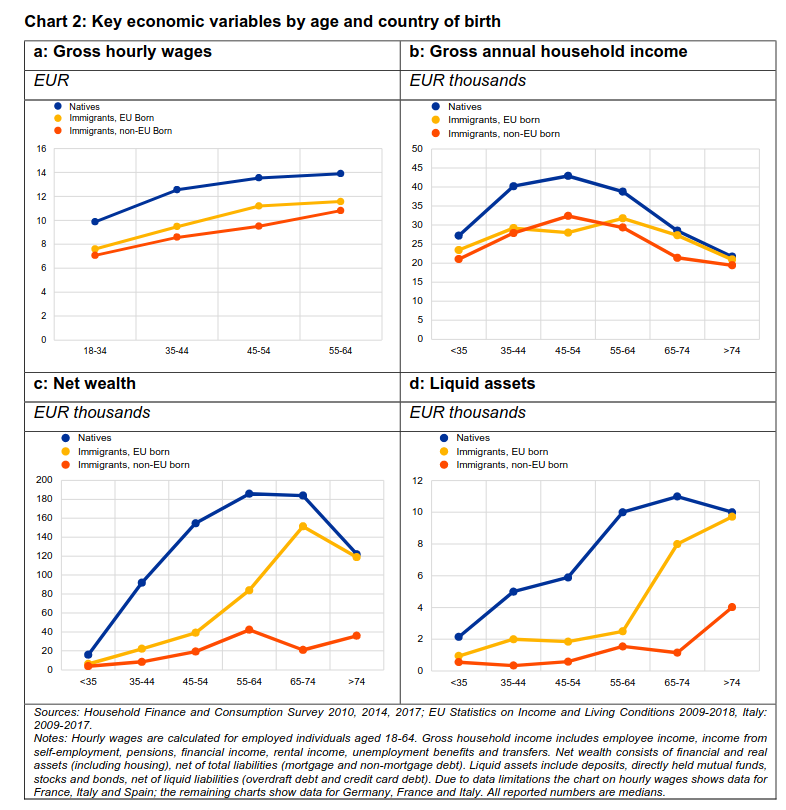

The EU has released a report looking at the economic well-being of immigrant workers in their countries. The answer was that they are not doing so well, are facing serious opposition from far-right populist parties, and are also helping to prop-up their ailing economies.

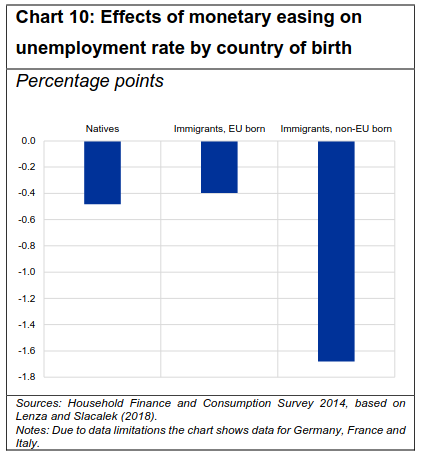

And, since immigrants are in a more precarious economic situation, monetary policy drives them into poverty faster.

In addition to having a direct impact on welfare of households, lower income and wealth also affect the transmission of monetary policy to those households and the response of the economy to cyclical shocks. We document that people born abroad are much more likely to be constrained (i.e., accumulate much less liquid assets), their employment is particularly sensitive to the business cycle, and their unemployment declines strongly following a monetary easing.