September 14, 2022

Markets, wages, and prices

It always amazes me that when profits "disappear" magically from the financial markets, capital so immediately recognizes and states their class position with no hesitancy at all.

The central bank does tough love to save capitalism (again), but relies on capitalists to do the dirty work. In response to increasing cost of debt, capital must now decided which workers to make poor.

- With one (single monthly) measure of inflation announced yesterday running higher than expected, the "markets" are now expecting the central bankers to actually do what had been saying they are going to do: drive the economy into a hole until workers pay the full price for inflation.

- Now that the "market" has decided the economy is not doing well, financial analysts have decided that wages are not just the main problem, but the only problem.

- The nonsensical "wage-price spiral" took a break for about a month or so, but is now back in articles across financial news.

Class conflict is a game won by capital with ease because the other side forgot it was a competition.

The conflict should be most easily seen right now as profits decline but living standards decline faster.

- US stocks are nursing losses of $7.6 trillion this year.

- Larry Summers is among those saying the central bank needs to hike even faster to restore its credibility (BN)

Rail

Some workers are already pushing back. The supply chain workers who have kept the entire system from collapsing through the COVID pandemic are now recognizing their power.

Or, at least they should recognize it soon as the companies that transport those goods halt shipments and try to get the government to impose conditions:

Norfolk Southern Corp. said it plans to halt unit train shipments of bulk commodities on Thursday ahead of a potential US rail worker strike the following day. The railroad also said it would stop accepting autos for transit at its facilities starting Wednesday afternoon. Other railways are likely to follow suit, according to one agriculture group.

Representatives for BNSF Railway Co. and Union Pacific Corp. also signaled they were prepared to curtail service as the deadline looms. “We must take actions to prepare for the eventuality of a labor strike if the remaining unions cannot come to an agreement,” BNSF said in a statement.

Democratic President Joe Biden is personally trying to break the logjam between industry and labor unions.

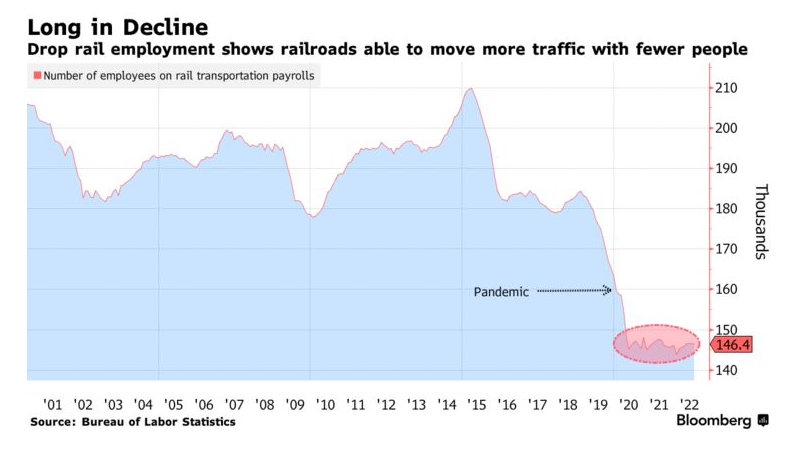

However, the rail industry is heavily investing in automation and new technology (and reduced regulation) that allows it to operate with fewer workers.

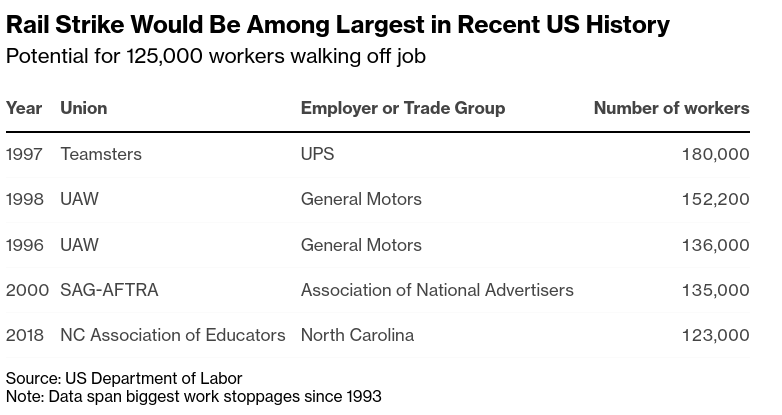

That doesn't make a small strike, however:

Large strikes tend to forecast the decline of an industry as they are usually a response to major changes in employment in that sector. This time is no different, transport and supply chains are changing rapidly and the cost could be high.

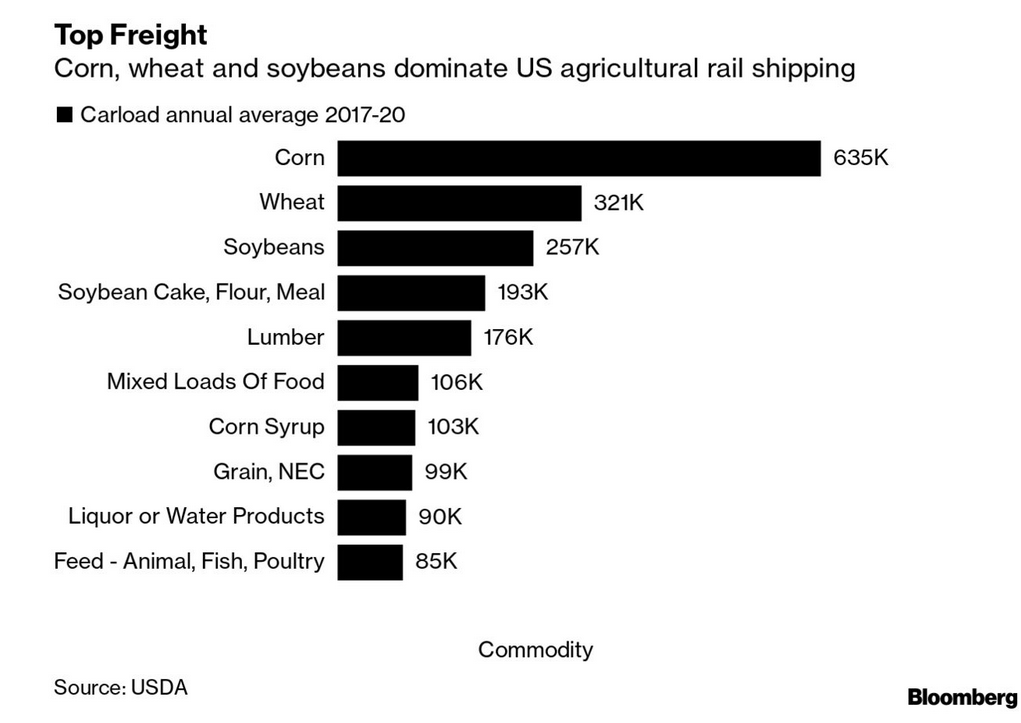

Rail-related transport in the USA is huge:

The only solution in such a situation is for the state to intervene. Biden will take the side of capital, of course. The question is, how hard of a policy will be imposed, what will labour call for as an alternative, and how hard will they fight for it?