September 13, 2022

Inflation and housing

There will be a lot of talk today about the inflation as the USA will announce its Consumer Price Index numbers. Their numbers will be down (headline) and up (core) leading to the inevitable debate about which one matters.

The US inflation rate was higher than forecast in August, keeping up pressure on the Federal Reserve for a large interest rate rise this month.

The consumer price index increased 0.1 per cent for the month, above economists’ expectations for a 0.1 per cent drop, as a fall in energy costs failed to fully offset increases in services and other spending categories

On an annual basis, headline inflation is running at 8.3 per cent, down from 8.5 per cent in July, but still near a four-decade high. Economists expected a reading of 8.1 per cent.

Neither of them do when it comes to actually measuring what is causing inflation. What it does mean is that working people continue to face high price growth even if energy prices are being reduced through government fiat.

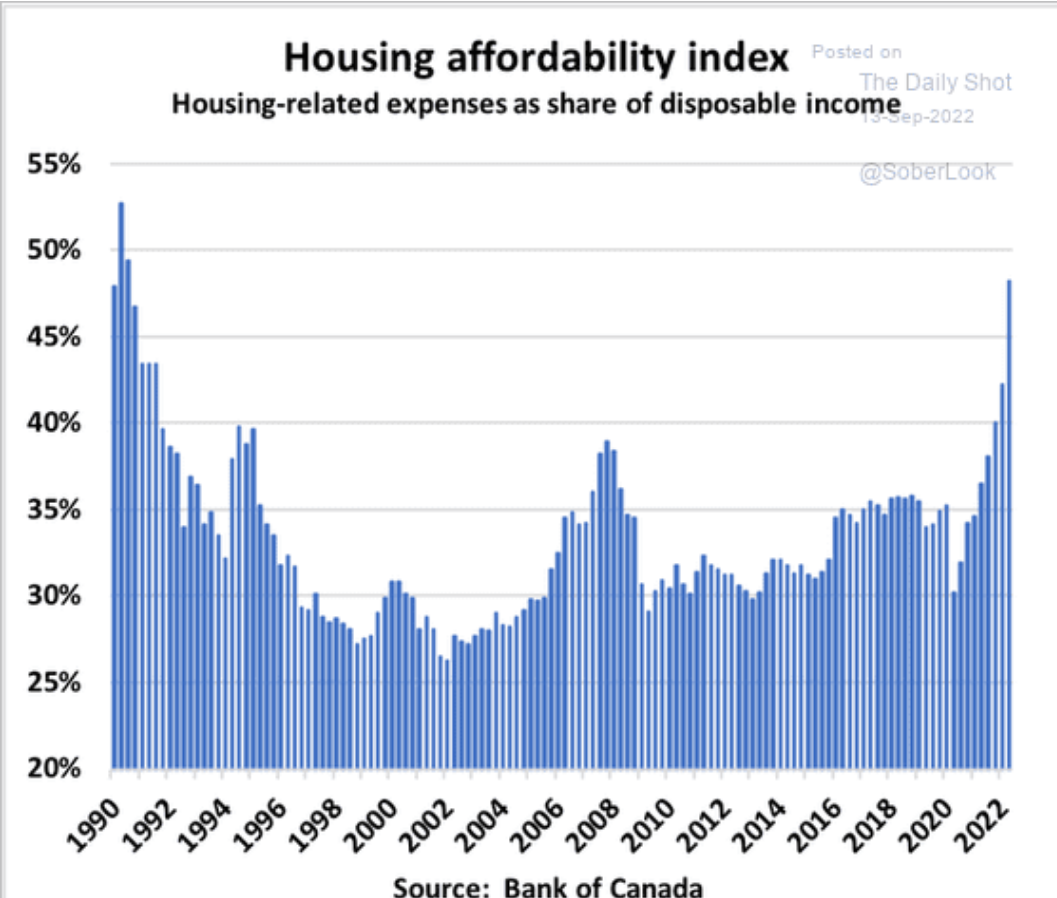

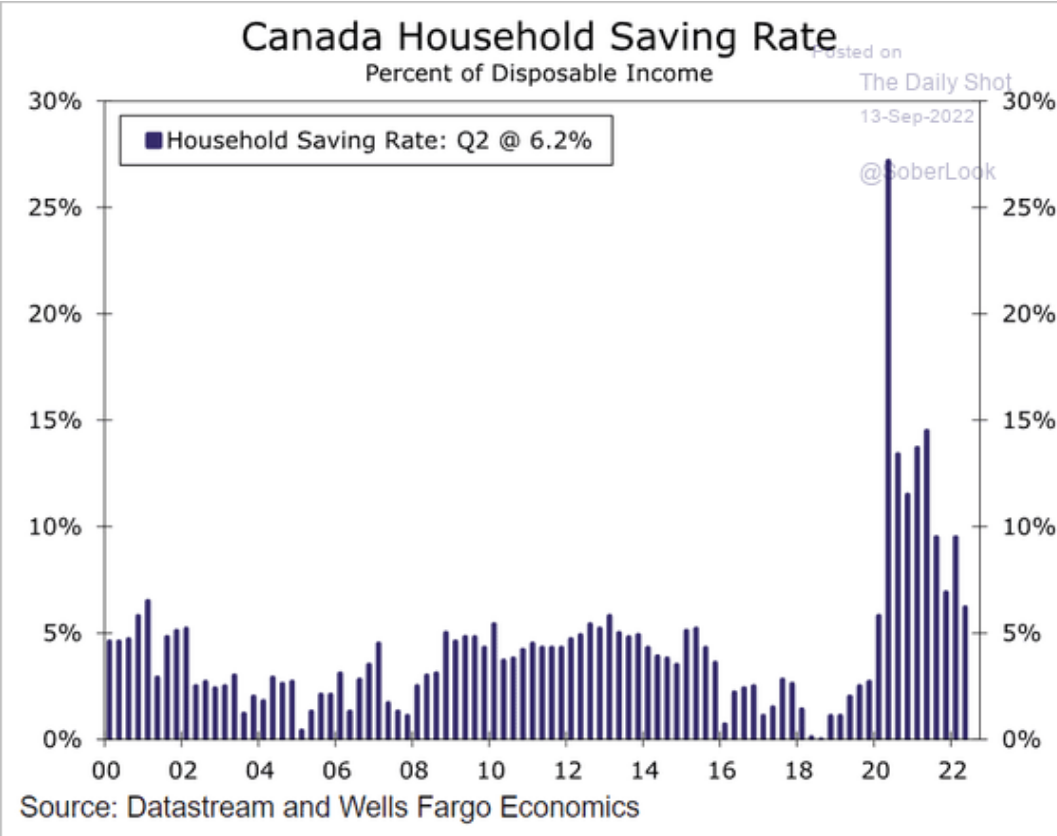

On the housing front it is a different story depending on where you are in the world (again). Housing investment in the USA and Canada are different because the amount of price increase and the history of the type of debt creation is different.

Unfortunately, the world is dependent on decisions of the USA central bankers and they mostly only care about what is happening in the USA.

Some unfun points made in Unheadged this morning about housing prices, inflation, and the way that the Federal Reserve looks at measures of price increases:

Steven Blitz, the head US economist at TS Lombard, argues that house prices, and indeed financial asset prices, have to fall hard if inflation is to come under control.

Wealth was created through the cycle not by credit expansion but by asset price inflation. The result, he says, is that the sensitivity of the economy to the Federal Reserve’s rate increases is going to be different this time. Deleveraging is not going to slow the economy enough to stop inflation. Falling asset prices will have to do the work.

Some prices may never return to the soft trends that held in the days of ample cheap labour, ample cheap energy and wide-open global supply chains. Is 3 per cent-ish inflation enough for the Fed? Or will it fight all the way down to 2 per cent? If the latter, a deep recession seems increasingly likely. (FT)

The question for the rest of the world is what will happen to our housing costs as the USA is forcing their economy into a recession based on their measures. Most other countries have much farther to fall on prices, but they may just fall more quickly over a short period of time if the price of debt continues to skyrocket and prices drop.

Housing makes up a significant part of the Canadian economy at the moment and the words about asset price inflation mean even more in our context.

Rents tend to follow this line, but they are already moderating after the steep rise over the previous year. However, there is no reason to think that the price increases will collapse back down to low levels (for similar reasons housing prices will not).

The consumer price index measure of rental inflation should follow, though with a long lag. Detmeister sees rental inflation climbing north of 7% early next year – and even by the end of 2024 it will remain elevated, at about 4.5%, above the pre-pandemic norm. (BN)

Stay tuned for more data as they become available.

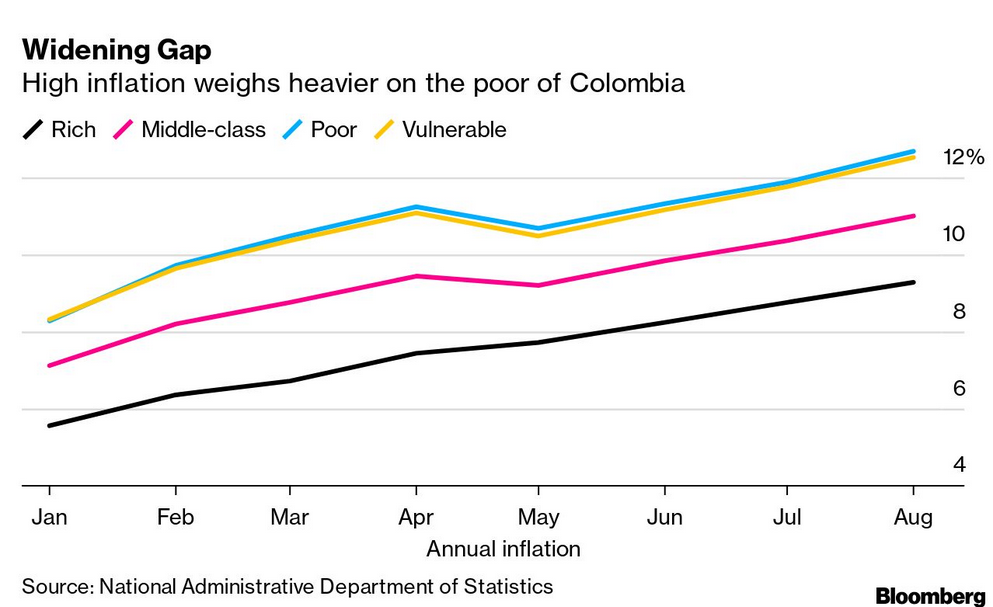

In other parts of the world, price inflation (running a full per cent higher) is leading to what is always predicted: desperation on the bottom half of society leading to violence in some parts (like Panama, Peru, and Ecuador).

UK Strikes and the Queen's death

Ports and Trains Face New Wave of Strikes Once UK Mourning Ends

- Felixstowe docks walkout set to overlap with Liverpool protest

- Rail unions plan to revive action on hold since Queen’s death

- Port of Liverpool will start Sept. 20

- workers at Felixstowe voted against a wage increase to be imposed by the UK arm of CK Hutchison Holdings Ltd.,

- Further rail strikes likely won’t come until October due to a requirement to give two weeks’ notice

The royal death has affected more than just port strike:

- National Union of Rail, Maritime and Transport Workers, Transport Salaried Staffs’ Association and Aslef train drivers’ union last week called off walkouts planned for the next few days to respect the mourning period.

- Around 115,000 Royal Mail Plc staff who ended a two-day strike early after the Queen’s death are due to take two days of action from Sept. 30, according to plans previously announced by the Communication Workers Union.