September 12, 2022

Social Democracy waning in Sweden

- The neo-Nazis Sweden Democrats and the Social Dems are neck and neck this morning in the ongoing count in the Sweden election.

- Most of the blame lands squarely on the "Moderates" party and Christian Democrats which are centre-right and will apparently do anything to gain an election victory—including focusing on immigration and harsh USA attack-style ads—while going after the suburban vote.

- While it is hard to blame the social democrats totally for this growth as their numbers actually increased in this election, they have not focused enough on dealing with inflation and lost some fo their political ambitions. The Social Dems have governed for most of the previous century, but have collapsed in support since 2006 when it fully abandoned social democracy and aligned with the USA Democratic Party.

- The abandonment of a left-wing program from the Social Dems has allowed the far-right to take up much of that space.

The style of the campaign was to attack Magdalena Andresson—the head of the Social Dems and the most popular politician in the country. Personal, brutal, and sexist attacks came in a variety of forms, but it was a playbook right out of the last century of whipping-up the worst sentiments of the population.

The lessons for other social democratic parties is becoming clear: the ignoring of bread and butter campaign issues of (affluent) working families is driving them into the arms of the far-right.

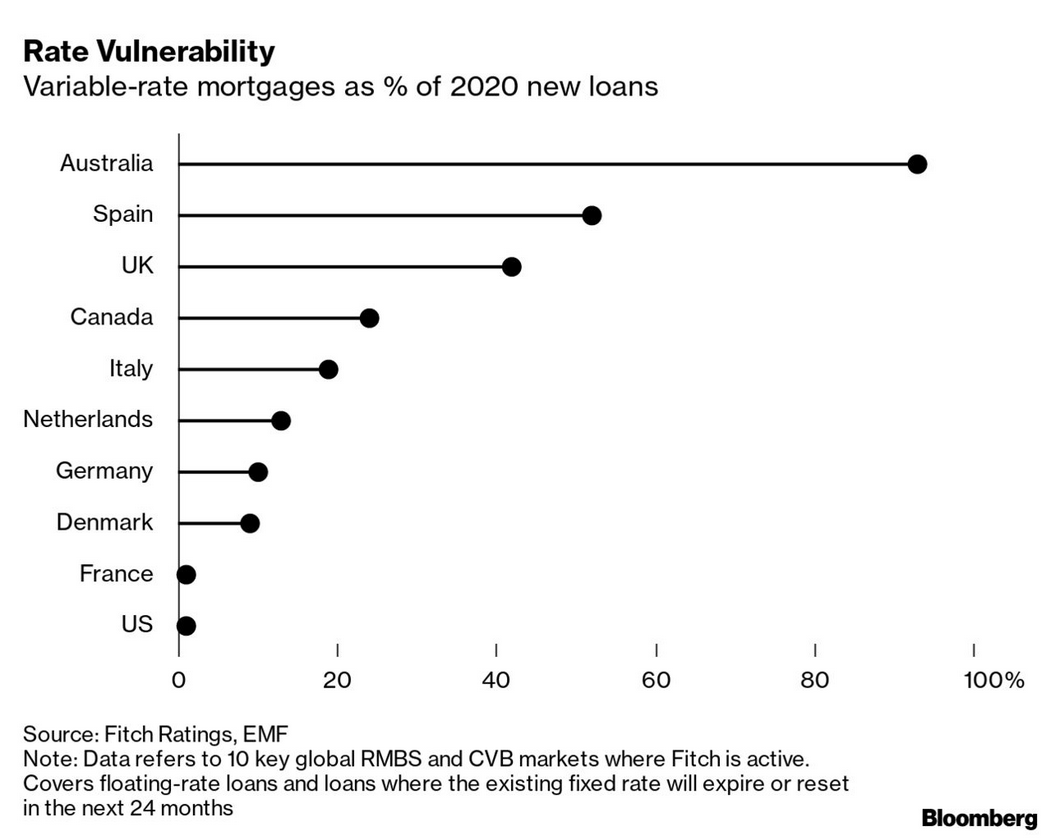

Mortgages and variable rates

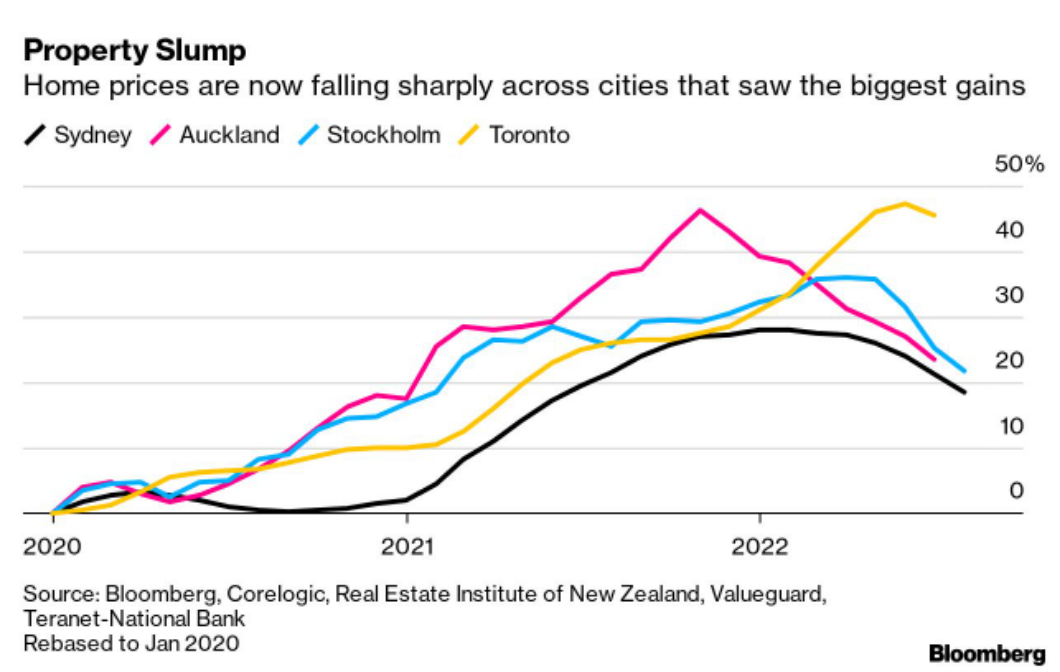

- Losses on paper value of homes and increasing interest rates are putting pressure on home owners in places that made it through the 2009 recession without a housing correction.

- As things get pinched heading into the recession, these paper losses can result in real losses and a real decline in purchasing power of households.

Of the roughly half a trillion Canadian dollars’ worth of variable mortgage debt outstanding, about a third have seen their monthly payments go up in line with the central bank’s benchmark rate, according to research from the National Bank of Canada. Combined with things like lines of credit and fixed-rate mortgages coming up for renewal, these rising interest payments could collectively shave 0.65% off Canadians’ collective disposable income over the next three years, the research shows.(BN)

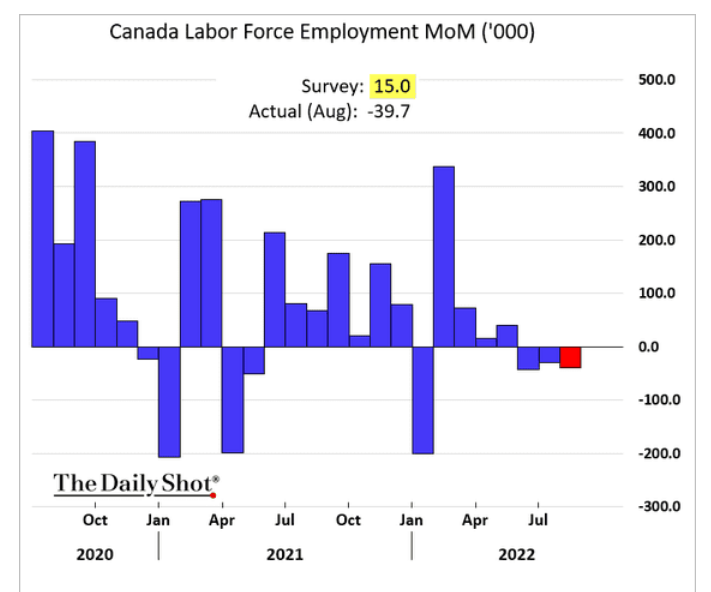

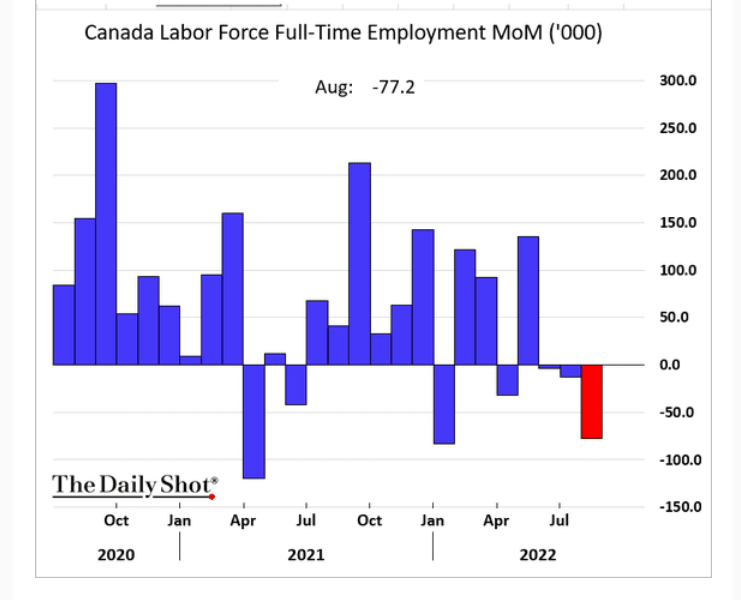

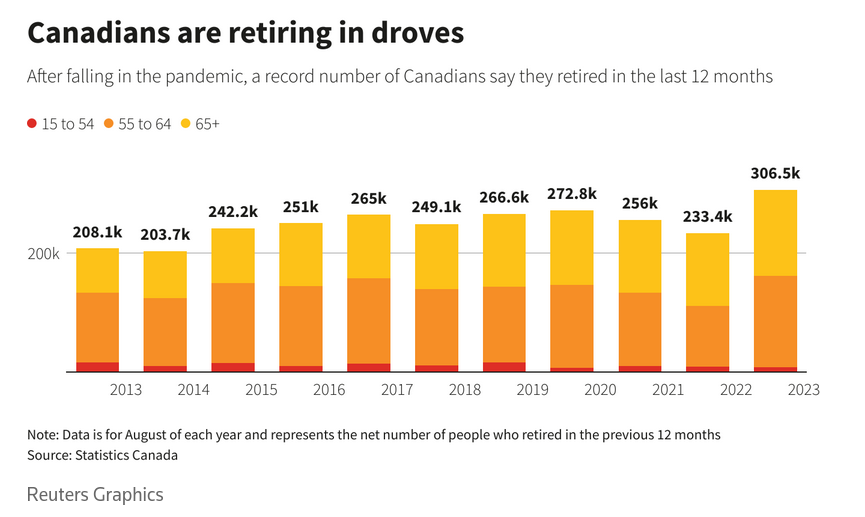

And, there are fewer people with jobs to pay mortgages:

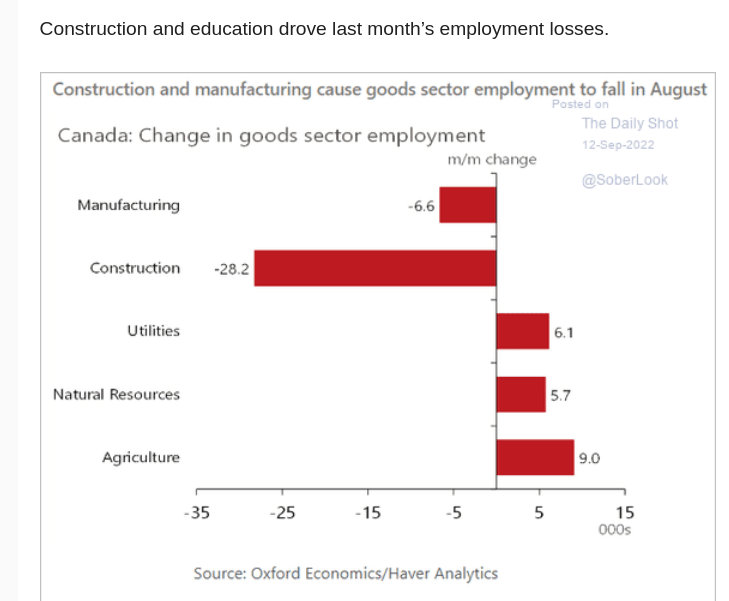

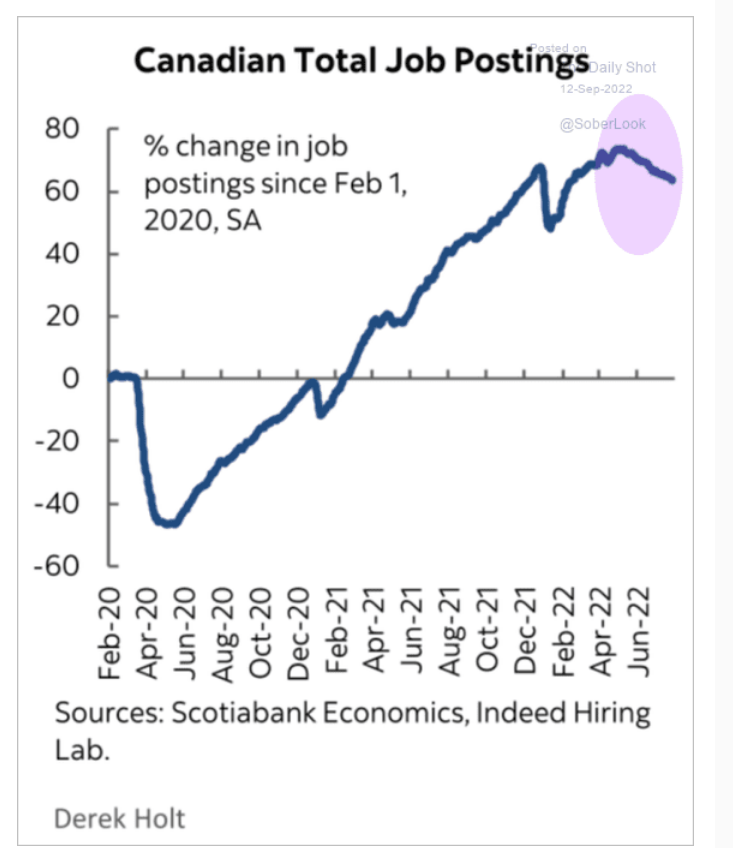

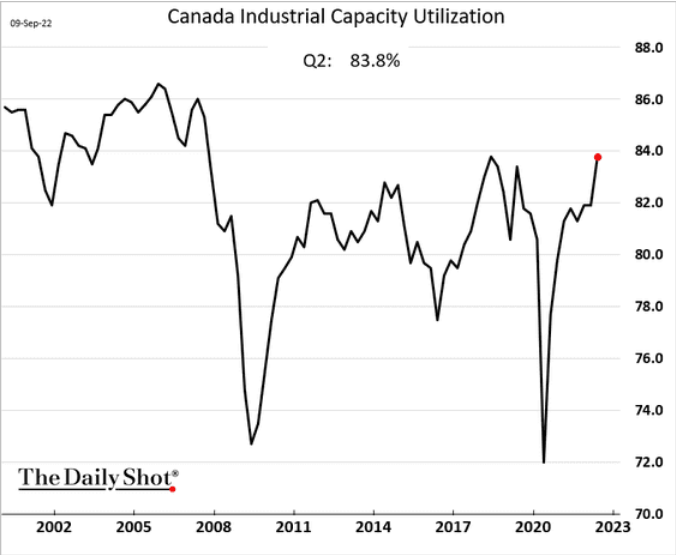

Some more graphs of the Canadian economy showing things are not going so well:

Cost of Living

The UK is well ahead of others when it comes to low economic growth and massive rising costs of living.

Most countries are not far behind, however.

UK output was flat over the period, according to data from the Office for National Statistics released on Monday, with growth down from the 0.3 per cent registered in the three months to April.

According to the latest PMI index, economic activity has been contracting since August when consumer confidence dropped to the lowest level since records began.

Trade deficit is at an all-time high:

Potential Rail Strike in the USA

- Two of 12 major rail unions holding out for working conditions—covering some 57,000 engineers and conductors. (SMART Transportation Division and the Brotherhood of Locomotive Engineers and Trainmen)

- Railroads threaten to limit some shipments starting Monday.

Railroads and workers have faced years of challenging negotiations, which began in January 2020, shortly after the labor contract froze at 2019 levels. After the National Mediation Board failed to carve out an agreement this summer, the Biden administration’s Presidential Emergency Board recommended a 24% compounded wage hike by 2024 and $5,000 in bonuses, including some retroactive elements. The AAR said such a wage gain would be the biggest in at least 40 years.

Larger rail unions are upset that Biden’s emergency board’s recommendations didn’t go far enough.

These workers often engage in long shifts and sometimes spend weeks away from their families, and because of that have doubled down on the safety and time-off parts of the negotiations.

The rail dispute follows a series of strike authorizations and work stoppages partially motivated by workers’ concerns about their jobs overtaking their lives. (BN)

COVID Vaccine Procurement Audit

- The European Union will release its audit into the COVID-19 vaccine procurement today.

- The audit will look at costs, where the money went, and value for dollar spent. Recommendations are likely.

- The support was a massive profit subsidies to private pharmaceutical companies and risk mitigation.

- While it may have support the rapid commercialization of vaccine, the main issue we will look for is whether public production would have been a better way to ramp-up and maintain production.

- There is currently only one public pharma companies in Europe (Sweden's Apoteket AB—a pharmacy chain and drug producer that in 2015 returned a dividend of approximately $133.5 million to its sole owner — the Swedish state) and only one (under the Defence Department) in the USA. Other publicly owned companies exist in Cuba, South Africa, and Brazil.

By November 2021, the Commission had signed contracts to the value of €71 billion on behalf of the Member States to purchase up to 4.6 billion COVID-19 vaccine doses. Most of these contracts were advance purchase agreements, in which the Commission shared the development risk of a vaccine with the vaccine manufacturers and supported the preparation of at-scale production capacity through upfront payments from the EU budget.