September 11, 2024

Price of oil, inflation, and electric cars

USA inflation numbers are out today. They will be largely affected by the price of oil (and food, which is made by burning oil).

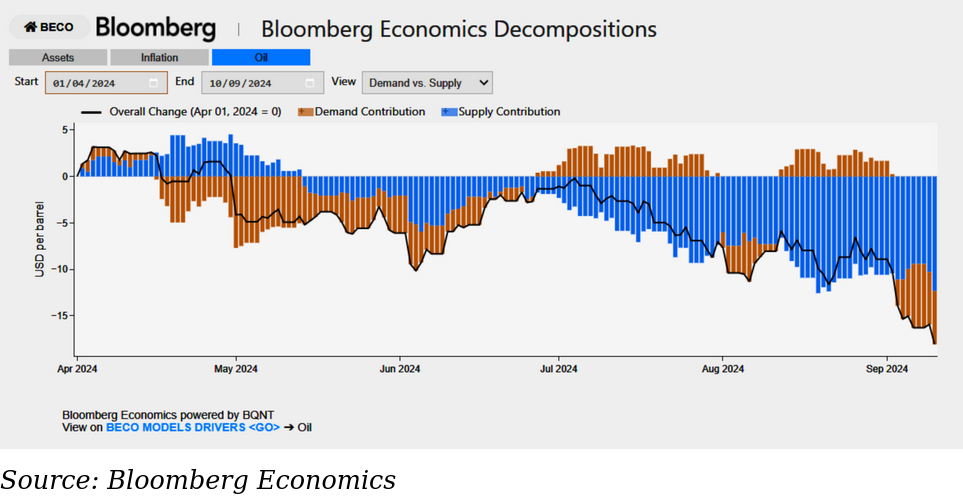

The oil trading price has declined significantly over the previous six months with a drop of almost $20 per barrel since July.

Lower oil prices are good for consumers, bad for the planet, and a bit of a disaster for the (failing) market-driven transition to alternative transport fuels.

The Spanish Prime Minister is one of the first to change his mind on tariffs on imported Chinese EVs. Part of the reason is that Spain does not make many cars, but is worried about a trade war that undermines its exports to China.

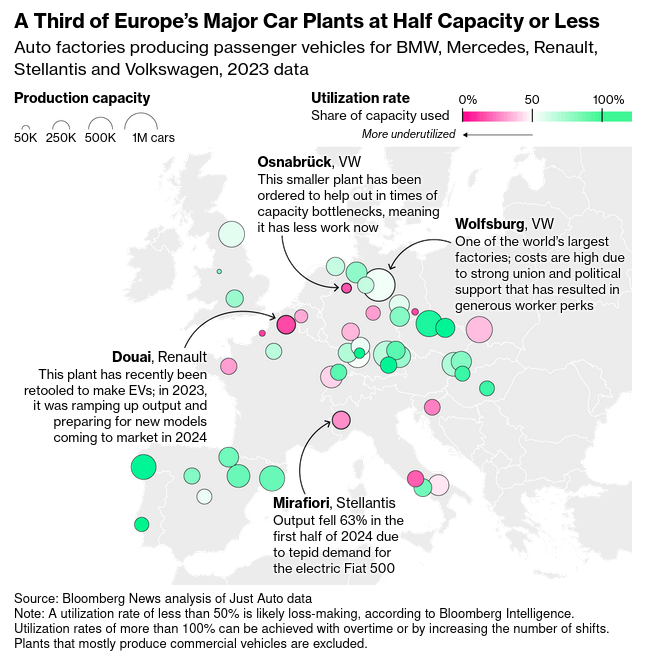

Other countries in Europe may not see the benefits of increasing tariffs on Chinese-made EVs given that domestic auto manufacturers are shuttering battery plants and rethinking last year's rapid shift to electric vehicles. "Hybrids!" they now chant, as if no one had thought that the mid-way technology was mid-way along the journey to adoption.

Unfortunately, in a global trading system, local epiphanies around production shifts usually come too late. Someone else is likely already producing that product.

Why were the Spanish so concerned? Politicians and CEOs were convinced that advertising, the high price of oil, and Tech Bro narratives on the internet would shift consumer demand quickly. That wishful thinking drove massive state profit subsidies and big announcements of local EV production. It turns out that even with these, the biggest problems are the real-world costs of making and buying EVs and the massive costs of building the alternative energy infrastructure to charge them.

The price of oil dropping (as production is increased around the world) is a good reminder that hoping for market-driven investments – even when the state throws nearly endless subsidies at them – does not change the way capitalism works.

Subsidy regimes from carbon taxes, prices on carbon, blanket profit subsidies, grants, tax cuts, etc. are not enough to bring down the real price of a giant EV car and do not increase the price of driving the car you already own.

Oil is also a good example of secure supply chain investment. The infrastructure to extract oil, ship it around the world, refine it, and build machines that use it must be twinned. Unlike the fantasies of the global liberals, you cannot just turn it off one day while turning on the alternative.

It also cost huge amounts of money to build the oil infrastructure we have. Replacing it has barely started yet.

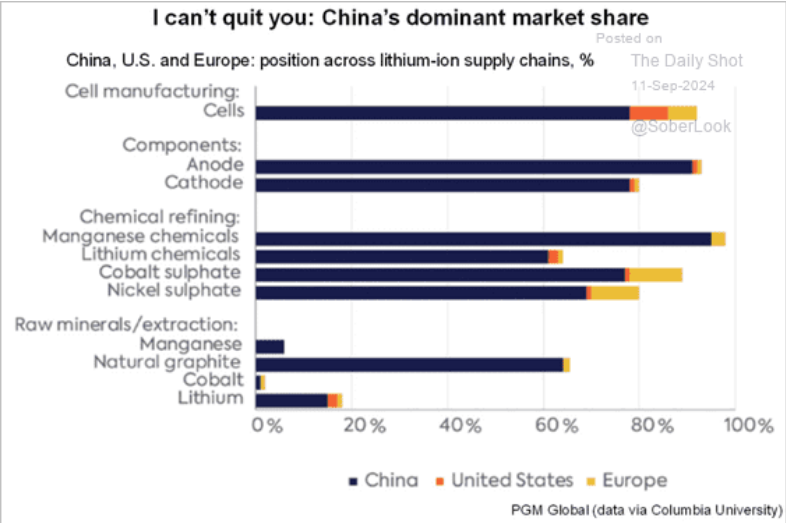

China has been building the alternative, not through simple market forces, but by the state driving investment in production of the entire alternative supply chain. It produces all the parts of its electric-powered transport system. The benefit of doing this is that it overproduces the things that it makes and can export them. European and the US liberals call this "unfair" competition. The only thing unfair about it is that the USA and Europe were late figuring out that having an industrial strategy was necessary to compete.

What is the answer? Is it to follow the short-term decisions based on local production interests that Spain is following? Or is it to build an industrial strategy around a future that we need and want?

It is going to be both. The gyrations of trade policy are going to continue. But the only way for economies to develop during this level of disruption to the energy status quo is to stop relying on the "market"; it is not to fiddle with the edges of price setting through the tax system, but to invest directly in production.