(Digital) Advertising markets

Monopoly, ads, exchanges, and competition bureaus

Technology changes the way people interact. Sometimes it can do it through surprising ways. But, sometimes it does it in the exact same way for every new mode of work it interacts with.

Take advertising. Advertising is a necessary part of capitalism. It allows competition. And, it creates and drives demand for products you did not think you needed (usually destroying the planet in the meantime). It is hucksterism and capitalism has refined it to a point that it can be extremely dangerous at times. Look no farther than the previous misuse of social media in spreading lies around COVID, election, and fascism.

Dominance in online and digital advertising has been a focus of open market committees and government competition watchdogs since the rise of large social media companies. Social media companies are actually just digital ad companies that just happen to offer some other service.

Their emergence in the ad space is of interest to regulators of capital to ensure "fair" access to the ad market.

The service these social media ad companies offer is perfecting capture of consumers on their platforms through psychological warfare. Showing you enough cat videos, nearly naked good looking people, or neofascist videos their algorithms think will keep you scrolling.

The power of digital social media companies has had a direct impact on other media who used to have a monopoly on this kind of eyeball capture. Namely newspaper owners think that it is unfair that the tabloid social media (Facebook/Twitter/Insta) has replaced more serious media (Globe and Mail, NYTimes, Sun News). It is a complaint that these companies now have the eyes of the population.

However, advertising shifts are not responsible for all the decline in newspaper revenue. Much of the decline in revenue is the collapse of ad prices through digitization and price setting through more open markets.

"Legacy" media companies like to blame their new digital competitors' "unfair behaviour" for revenue loss turn to the competition bureaus to see if they can call "monopoly" on this behaviour. Their goal is to turn the clock back to where newspapers were the (near) monopoly and could set prices for ad space and reap the revenue rewards for that.

However, the competition bureau is not a friend if this is your goal. The competition bureaus of governments have the opposite mandate to sustaining revenue for important industries (like news media).

Let's take a look at a recent example.

The Canadian competition watchdog describes their recent activity "against" Google like this:

Safeguarding competitive markets in the digital economy is a priority for the Bureau. This year, our enforcement efforts were plentiful in this area. We advanced our investigation of whether Google is engaging in certain practices that harm competition in the online display advertising industry in Canada. This industry includes many technology products coordinated to display advertisements to users when they visit websites or use apps. – October 12, 2022

Google owns and operates the technology that allows publishers of ad space to get an ad and those who want to place their ads in that space place their ad.

Google also owns an exchange where prices are found according to the demand for a particular space and the supply of that particular space. For example, if a bunch of organizations want to advertise to people whom Google's algorithms have tagged as needing a red t-shirt, but there is only one company offering a space that will reach those people, the "fair market price" is found on the Google-run exchange.

It also happens that Google owns the digital infrastructure that places the ad on the website and the interface that where an organization pays for that ad to be placed.

On the publishing side, Google also has exclusive information about who wants—in the above example—a red t-shirt. They collected this information via "cookies" on websites, search results, and online discussions about red t-shirts.

The tracking technology changes at a rapid pace in response to privacy demands of the public and technologies that ensure online privacy (like Firefox). There are only a handful of companies who have the infrastructure to move at the pace of this change to keep collecting information on consumers.

We are back to talking about "monopolies" in this ad space. There are monopolies, but not across the entire ad market. The monopolies exist on the specific platforms. For example, Meta has a monopoly on ad purchasing and selling markets on Facebook and Instagram. Google has a monopoly on ad purchasing and selling markets on Google search, shopping, and Google Maps.

But, if you want to place an ad, there are many companies and captured markets to do that. So, "monopoly" does not really describe the entire ad market.

There was a big push around investigating Google in the digital ad space in the USA and EU at the beginning of the year.

These regulatory investigative actions stem from work of a few people.

One group is at Stanford Law looking at how financial market regulation needs to be brought to the ad market place: https://law.stanford.edu/publications/why-google-dominates-advertising-markets/ (from Dec, 2020)

The argument—bringing-us back to the original statement that sometimes tech affects things the same—is that digital technology has done the same thing for ad markets as financial trading.

Regulators are concerned about the closed nature of price setting on these ad markets. It is the profits made from facilitating price setting happening on the exchange itself that is the target of competition bureaus, not just the price of ads themselves.

The price of ads and the profits made off the mechanism of price setting are two very different issues.

One is ad revenue for publications.

The other is access to a fair exchange for trading ad space prices.

In the financial world, it is as different as the New York Stock Exchange vs the price of companies traded on the New York Stock Exchange. Vs the price of buying apples.

The question for the competition bureau is around the price of the trade. Specifically whether Google, Facebook, and Twitter are locking other actors out from that price setting (ie, on their infrastructure). This is similar to the concern over the price of getting a mobile application on Android Play Store or the Apple Store. Regulators are not concerned with the price of the Apps, they are concerned that Apple was taking such a high margin to place the app on their monopoly app store.

Regulation of markets

While it is interesting to think about regulating a (necessary) evil of capitalism (advertising markets), it has nearly no impact on the form of advertizing changing from local paper formats to digital/online ad space.

Indeed, it could be argued that this has absolutely nothing to do with the revenue from ads that small newspapers get. That revenue stream ship sailed long ago.

All advertising is a scam. Online advertising is just cheaper and more targeted, so it is where all the money flowed into.

It is also easier to get more people's eyes on your ad (in theory). It is this capture of eyes why Facebook, etc spend so much time and money building "personalized" ads using browsing history and other privacy invading techniques.

The question for the left is whether active open markets are better or worse for workers. Do monopolies really hurt anything other than the sensibilities of free market economists?

Take the example of Ticket Master. People complain about it because it allows intermediaries to buy-up tickets and artificially increase the costs of tickets to music (and other) artists. The artists complain because they are not getting all the revenue and their fans are not getting access to their shows for the "sticker price". Thus it shuts some people out of the market and a layer of scam artists insert themselves into the process profiting from other's work.

This kind of monopoly market system seems bad.

That is not currently the case in online advertising.

In an open advertising market you can compete with Coke in looking for advertising space. But, monopoly or no, you are always going to be at a disadvantage over trying to buy that space.

Small papers can compete with the Globe and Mail, but you will be at a disadvantage over ad revenue generated by bigger players in the market.

Newspapers used to be able to sell ads to companies because they were the near monopoly space for eyes. But, then it digitized.

Small papers cannot compete with the other ad space (google, facebook, twitter, Insta, etc) because they charge too much and do not have the technology that comes with large capital players.

That will not be changed with "increased competition" in the marketplace.

In the same way as before the NYSE digitized, companies sold stocks directly to investors.

The digitization of exchanges ended that and increased competition in the stock marketplace. That didn't drive down prices of the stocks, but it did drive down the costs of buying and selling stocks.

And that reduction in price of buying and selling (not the price of the ad) is what Google (and now Facebook and Twitter) have done with their online market places. You cannot undo that. And those who buy ad space do not want that.

The only answer to look for different forms of revenue for small publishers.

One option, if we want to simply focus on ads and markets for ads is to demand and Ad Transaction Tax. The government could collect a charge every time an ad is bought and sold on any exchange. This money could go directly to the content creators be they newspapers, music, or video media artists.

One other way is for a tax-funded government commission to directly support Canadian content for news/print/publishing. This would be similar to ensuring Canadian content is sustained similarly with music, the arts, and academic publishing.

There really isn't an alternative to these two models for keeping Canadian content in a private globally competitive market.

The take home is that focusing on competition is a nonsensical solution to the revenue problem. Our smaller content companies cannot compete with large USA capital.

Indeed, many on the left used to demand less competitive markets for Canadian content through tariffs and other limits on the percentage of non-Canadian based content in legacy radio and TV platforms.

Back to ad exchanges

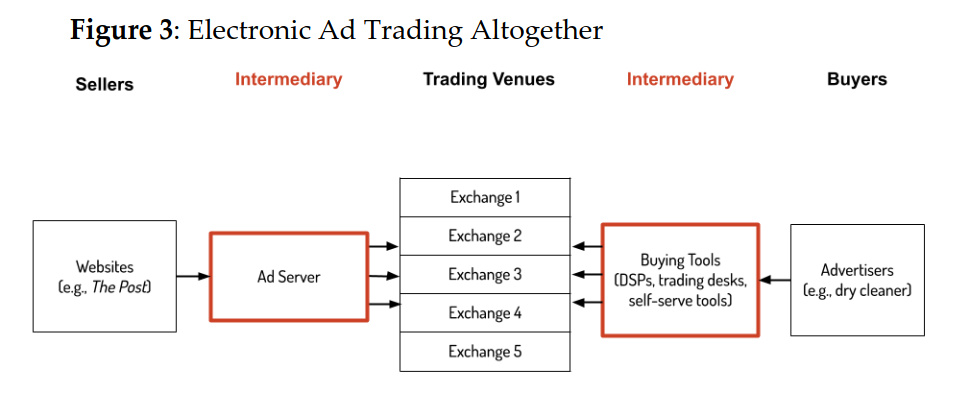

This image from the Stanford paper linked above.

There are buyers and sellers of ads. Google is under investigation because it operates an exchange, operates an ad server, and it operates a trading desk.

The ad server and the trading desk are labelled "intermediary" above.

Here it is clear, the competition issue is not the buyer and seller demand and supply of ads, but the maintenance of and access to the exchange or price-setting system.

One could argue here that more competition will actually drive-down the price of ads through reducing the value of ad space on our local news paper.

Think of it this way:

You buy ads. How do you determine where to place your ads? There is an interaction between audience and price that you base your decision of where to try to buy your ads.

While you may complain that TTC buses are expensive you are not upset that TTC has a monopoly on ad space on their buses and calling for more competition in the bus ad space.

You are also not considering putting your ad in a local newspaper in Timmins when you want to advertise to consumers in Barrie.

No matter how cheap the ad space is in Timmins, it is not where you are looking to buy.

That there is no competition in Timmins newspaper space does not matter. This monopoly does not help the paper in Timmins get ad revenue.

However, you might complain there are only a few companies that make ads that fit on the sides of busses. This is a legitimate issue and one that is the same as the ad market place competition. Ad makers are not placing the ad, but a monopoly here means they can charge you whatever they want to make the ad for you.

This ad making monopoly is unlikely to hurt the demand for TTC's ad space.

I am not saying this an uninteresting issue. However, the above is the reason the left generally fall on the "regulate things", not "we want more competition" side of things.

I think that greater regulation of the market place for online ads is a good one. Though, it is an international issue. You cannot regulate online market places just in Canada because the internet is not just in Canada. Though, you can tax it that way.

If the left are going to talk to a competition regulators, we need to make sure they are considering (and us exposing) how market regulation impacts industry revenue streams, creative workers, and the employers in the ad space.

Google and other digital platforms out-competed local news for ad revenue. Not because of anti-competitive behaviour, but because of competition in the form of displaying ads.