October 7, 2024

Reshoring USA style

Some numbers:

- CHIPS Act: $53bn of public money and nearly $400bn worth of private investment into incentivising domestic production of semiconductors.

- September: Taiwan Semiconductor Manufacturing Company, which plans to start mass producing chips in Arizona by 2025, achieved production yields similar to what it can do in established plants back home.

- USA: Signed a memorandum of terms with Micron Technology, which plans to invest around $100bn in chip production over 20 years.

But it is also happening elsewhere.

- TSMC and Samsung are considering building massive high-end chip production facilities in the UAE.

Folks would be forgiven for thinking that this is "reshoring". It is friendshoring, and while a lot of that production will make it to the USA, it is also going to not-so-friendly (to its their people) regimes.

The lack of (correctly) skilled labour in the USA and slow growth in energy production continue to be the bottleneck for scaling up industrial production in these sectors. Firms are seeking to develop in areas where the wages are lowest and the energy is subsidized the most. Those also happen to be areas where there are fewer accessible universities and so fewer already-skilled workers.

That means migration is necessary from higher paying areas to lower paying areas. And that requires higher unemployment.

Even with the size of dollar subsidies pouring in, they cannot create a university program, trained graduates, and skilled workers in those sectors overnight. And even with high interest rates, workers in the USA are finding jobs and driving wage increases.

The lack of capacity is an important factor to consider when eliminating jobs or moving production offshore. Bringing it back is very, very expensive.

Retail traders and ETFs

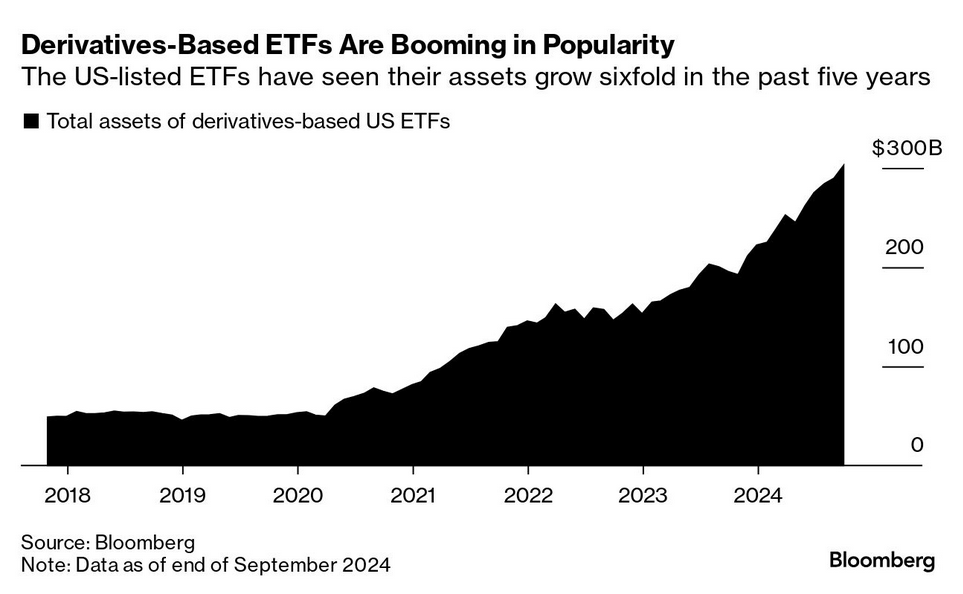

Exchange Traded Funds are starting to advertise more to retail investors. Such things as derivative-enhanced ETFs have made their way into the popular lexicon. Sounds so much better than "leveraged ETFs" or "investments based entirely on massive debt multiples, making big bets on ETF fund movement". We have seen this before.

Using ridiculous new terminology, these funds are pretending that they protect retail investors' money and sound like they are promising guaranteed returns.

Self-styled Youtube investment gurus, short video social media posts, and reddit threads are there to capture the money from wage increases. A generation that is looking for some retirement savings from personal investment (since that's all they have) are being sucked in.

The US Financial Industry Regulatory Authority looked into the social-media activity of paid financial influencers recently and found 70% of the postings in its review were non-compliant with the agency's regulation. (The research encompassed a wide variety of strategies, not derivatives-enhanced ETFs specifically.) More than half failed to disclose that the communication was a paid advertisement, while 38% failed to detail risks including those related to the use of margin, securities lending and options.

It is the classic fallacy of "short-term past predicts the long-term future" that will almost ensure the massive wealth transfer to capital from working people who get swept up in it.

It is important to remember, ETFs frequently trail the market or stocks they are linked to.

No landing in the USA?

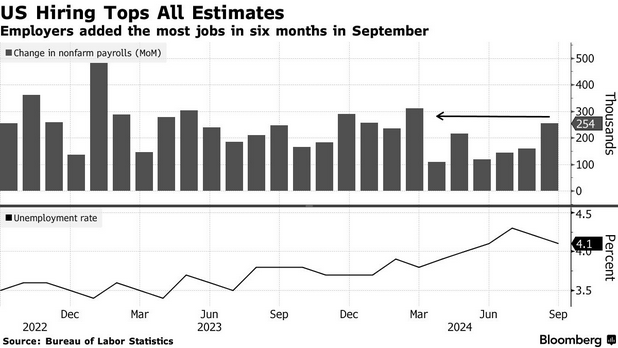

No one should have been surprised at the September jobs metrics being high. But that does not stop the commentators or investors hand-wringing about whether or not the central bank can reduce interest rates.

The so-called "no landing" is when "the economy" is doing too well while interest rates remain too high. Too well and too high for capital, not workers. In this case, the economy is the amount of tightness in the labour market: more unemployment means higher profits. More tightness, higher wages, lower profits.

From the classical perspective, the "no landing" scenario is mostly unrelated to the job market. There are other reasons that interest rates may have to stay higher than "recent history" and that is because costs (and increasing costs) for banks remains high.

Remember, real interest rates are simply the price of banking. The central bank cannot bring down interest rates below the real price of banking without subsidizing the banks. And it cannot do that if it wants inflation to remain under control.

On can point to many reasons why bank costs would continue to be high: geopolitics, reshoring, wage growth, massive investments in AI and energy. There is also this very large issue of climate change affecting insurance payouts, increasing costs for investment in resilience, and the massive shift in energy generation and use. These costs affect banks directly.

For the central banks (who operate under some strange mix of New Keynesian and neoclassical economic dogma), it is looking at those job numbers and wondering why it seems people continue to have jobs to show up to. It is doing everything it can to put its thumb on the scales in favour of capital.

The unemployment rate fell to 4.1% and hourly earnings increased 4% from a year earlier, according to Bureau of Labor Statistics’ figures released Friday. The participation rate — the share of the population that is working or looking for work — held at 62.7% for a third month. The rate for workers ages 25-54, also known as prime-age workers, dropped to 83.8%. (BN)

It takes about 18 months for decisions of the central bank to be felt in the broader economy. But we pretend it is dealing with issues now as if it is steering a car. The economy is not a car; it is a very very large oil tanker where directions are given but it takes substantial time to shift direction. And that is only if you believe the central bank can actually do much right now. Most likely, it is pushing on a string.

Equity values are sky-high because of AI and (over)excitement about investment in new technologies. Commodity prices are high because Israel and Russia keep bombing their neighbours.

All that said, anything can disrupt employment going forward. Say, the election of Trump, an expanding war in the Middle East, conflict in the South China Sea, major shifts in the war in Ukraine. (Re)election of Nazis in Austria.

Oh, wait! That last one already happened.