October 4, 2024

EU Tariffs

A strange vote happened around China and tariffs in the EU yesterday.

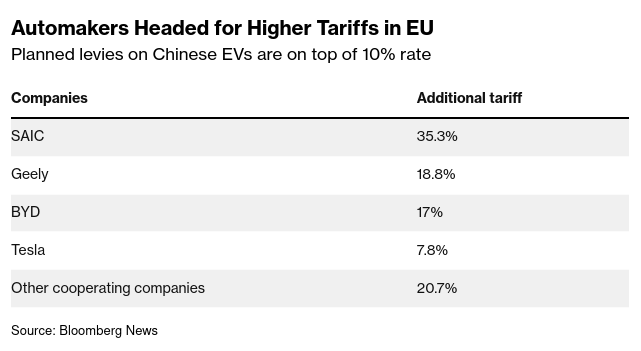

The European Union approved tariffs on Chinese-made electric vehicles.

But Germany – the country that makes most of the cars in Europe – voted against.

Four other countries also voted against.

12 abstained.

Only 10 voted in favour.

The "EU" has complained that China is engaging in "unfair" production tactics. I do wonder, however, if most of Europe is not really emboldened enough to vote for these tariffs, especially given how strong they are.

This really ranks more on a par with a soft negotiating tactic than the actual implementation of tariffs. The EU trade negotiators are still meeting with Chinese officials to implement a system that allows the EU to "track subsidies" to the auto sector in China.

This tracking may expose some subsidies, but it is more than likely that the Chinese advantage is simply that it is cheaper to make cars in China. And then what? It isn't a trade violation to make things in a country where those things are cheaper. That's what international free trade was supposed to be about.

The answer from these companies might just be to raise prices as they grow their European production centres. Either way, they are cheaper than the standard European-made EVs.

In Germany and Sweden, many of the domestically manufactured vehicles are actually assembled from Chinese-made parts, so BMW and Volvo actually campaigned against the tariffs. These companies also sell vehicles in China and do not want the export market undermined.

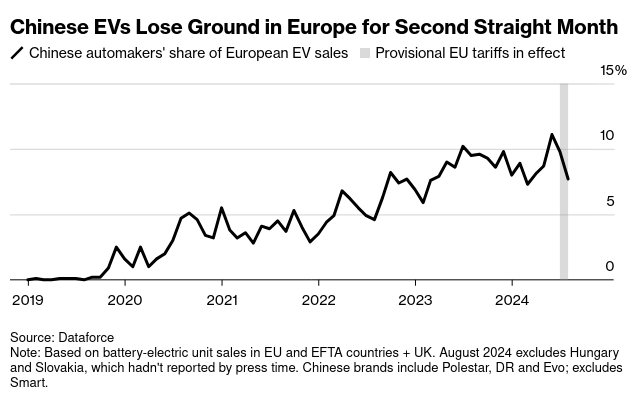

However, the anti-China rhetoric is having somewhat of an effect.

The strange thing is that while these are called "Chinese" companies, BYD is a widely held global financialized company. This means that US and EU-based capital owns a sizeable chunk of the company's equity – including BerkshireHathaway and BlackRock. The largest part of the company (about 18%) is held by its main investor, who is an ex-Chinese state banker. While this kind of crony capitalism is found across modern China, it is not dissimilar from American crony capitalism. Another large chunk (11%) is held by one other founder. Again, nothing dissimilar from US tech start-ups.

The expansion of companies like BYD is similar to the expansion of Japanese and Korean car manufacturers decades ago. This looks increasingly like basic liberal capitalist competition, not "unfair" competition.

In response, the West has shifted focus back to protectionist measures from free trade programs. The geopolitical ground has shifted because it suits American capital to shift it. Imperialism isn't just a game of rhetoric, it is a war. Other capitalist countries have followed suit.

But Europe and Canada seem to be stuck in the ideas of the free-trade dogmas of the 1990s, namely that free trade was good for everyone. It is a strange naïveté that drove this line of thinking from the beginning, but now it looks particularly silly.

Canadian global economic interests are particular to Canada. It is not necessarily good for the country simply to follow the USA in this line. Instead, we should be developing real industrial strategies through thoughtful economic and political research into what kind of country Canada wants to be. That means balancing the pressures from the USA with a focus on unique Canadian economic and social needs.

It is something that the far right are blabbering about all the time; they are winning the battle of rhetoric, but they would sell the country out for a dime. The response from the left must be to put forward an economic program that would actually build the economy we need.