October 4, 2023

lithium iron phosphate (LFP)

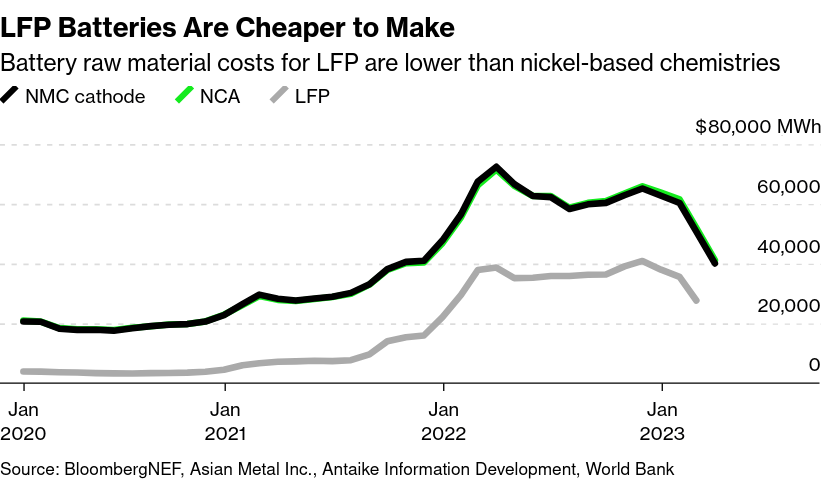

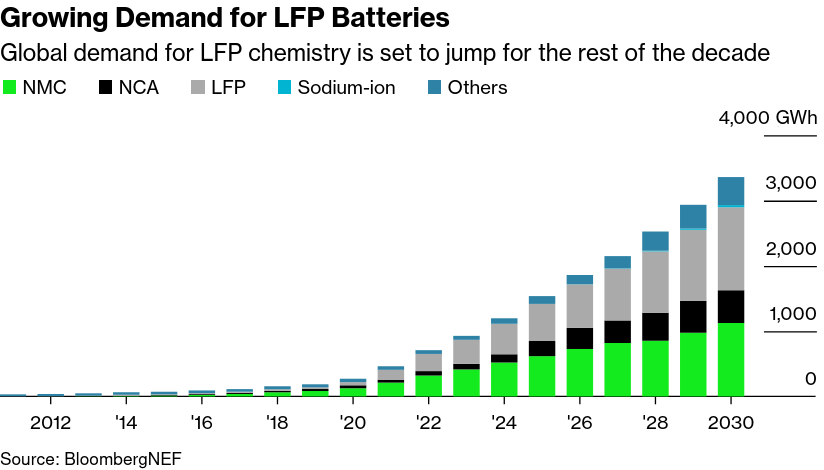

There are different kinds of batteries out there. But, cost is the main driver of technology uptake—even if that uptake undermines the industrial program of countries.

Let's quickly look at LFP batteries versus the traditional batteries. Not as good, but cheaper is the point here.

Why are lithium iron phosphate batteries called "LFP" batteries?

- Because they are actually lithium ferro-phosphate batteries (or LiFePO_4 ). "Ferro" meaning iron with something else.

- Traditional lithium-ion battery cathodes are made of nickel (lithium nickel oxide) and/or cobalt (lithium cobalt oxide)

- LFP batteries use cathodes made with iron instead.

Iron is much cheaper than nickel and cobalt because it is way more abundant (since iron is the fourth most common element on the Earth).

Up sides of LFP:

- Catch fire less often

- Cheaper to make

- Established production cycle and long-ish history in use.

Down sides of LFP:

- Store less energy than Lithium Ion

- Heavier than Lithium Ion

- Chinese companies own the IP for the technology.

LFP used by these companies:

- Tesla (Shanghai)

- Ford (Mustang Mach-E, F-150 Lightning pickup from 2024)

- Mercedes-Benz

- Volkswagen

- Rivian Automotive

China provides 99% of battery stuffs and 50% of the battery market. That battery stuffs amount is only expected to fall to 96% by 2030.

China also owns much of the Intellectual Property to make LFP batteries.

All together, this means that the cheapest batteries are just that much cheaper when they come from China:

- North America: 24% more expensive than China

- Europe: 33% more expensive than China

The solution? Canada should be investing heavily in sodium-ion batteries. They work better in colder climates and, once at scale, could be much cheaper to make. Plus, we still need a cold-climate solution to electricity storage and traditional batteries are not great for us to do that.

Re-examining inflation?

There have been an increasing number of articles in the financial papers wondering if we have this whole inflation thing correct.

In the U.K., economist Ann Pettifor has argued central banks have been obsessed with crushing demand and "disciplining" workers. Meanwhile, Wharton School emeritus professor of finance, Jeremy Siegel has called the U.S. Federal Reserve's focus on the labour market "misguided."

Keynesians and Post Keynesians are in the spotlight until the media has to focus on and explain the central bank raising rates again. At which point they will dust off the Phillips Curve again.

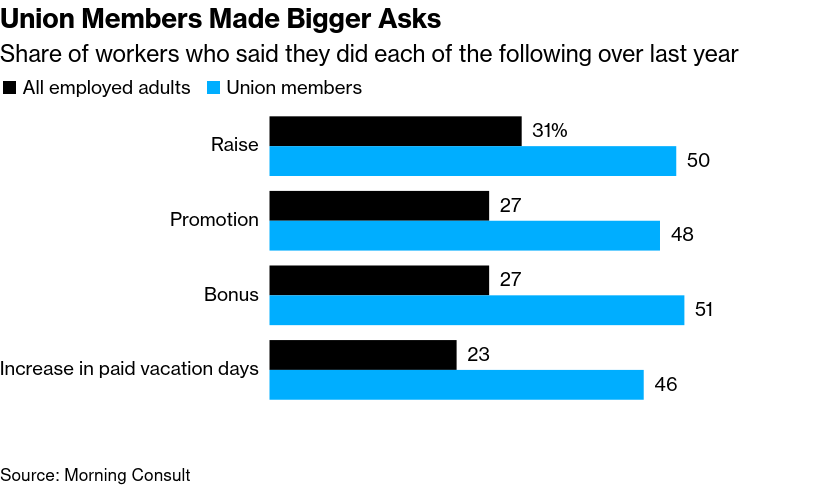

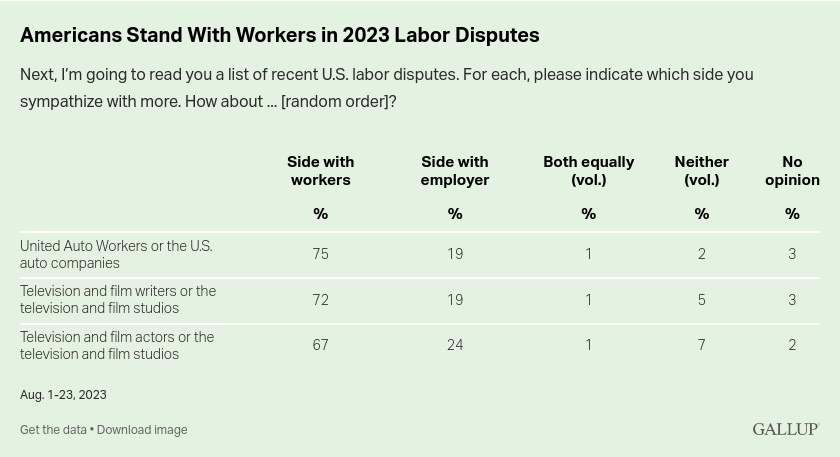

Unions play a role in setting this narrative right now. Union wage demands are well up and pushing back on the stupid, ridiculous, and data vacuous notion that wages drive inflation is part of this story.

There is a classic graph of this somewhere—I am trying to find it. Unionized wages increase with a lag behind the increase in inflation. The reason is obvious: contracts are multi-year and inflation happens before the end of the contract.

Still. Good to see the obvious is happening.

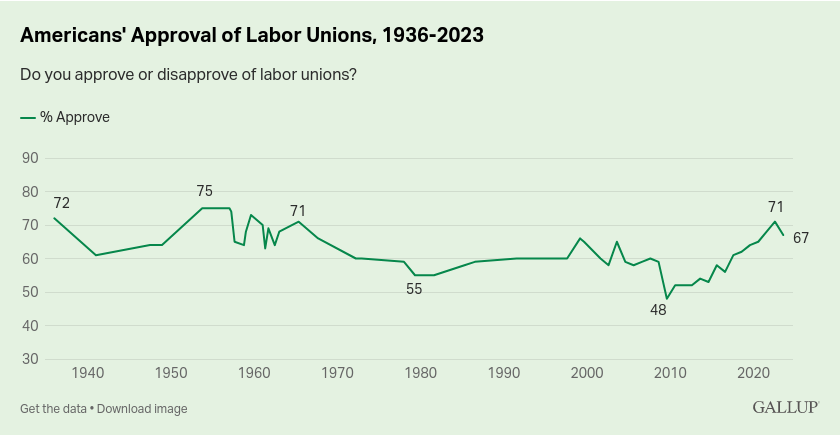

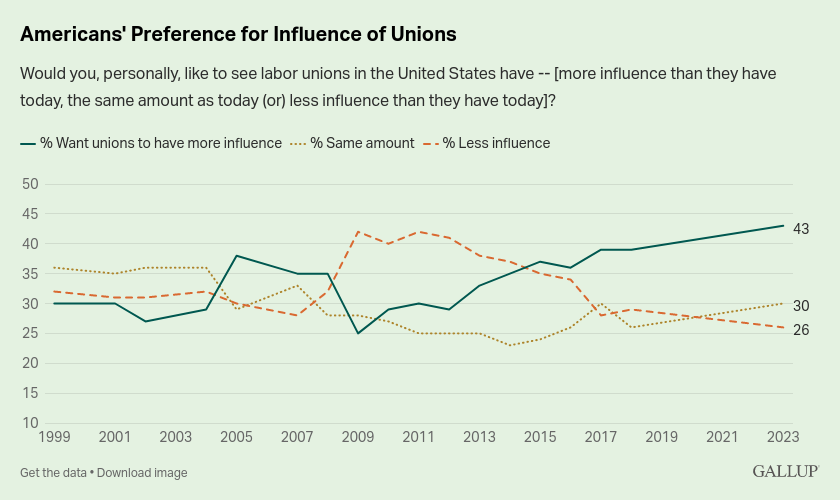

The increase in union wage demands might have something to do with the increased positive impression of unions.

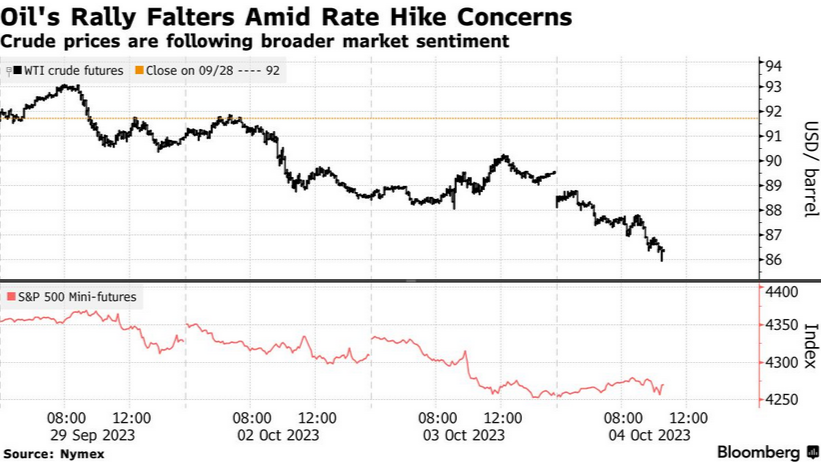

Oil Prices

Oil Prices (WTI) declines as recession worries hit market. Up and down the price goes. It will stabilize as the cuts from the OPEC+ kick in.

'We have never consumed more oil in history than we have today': Eric Nuttall

There is a reason why we are still burning tonnes of oil.

- While more than 40% of global electricity was zero-carbon last year.

- EVs made up only 1.7% of passenger vehicle kilometers driven.

That's a long way to go for carbon neutrality.

There has been growth in EVs, but long-range EVs are still 30% more expensive than ICE cars.

What about Hydrogen? Only 16,000 vehicles were sold worldwide in 2022 use fuel cells. It just isn't going to happen.

e-Fuels are another option being pushed by the industry in certain parts of the world where charging a battery might be challenging. e-fuels are synthetic fuels burned in engines similar to current ICE engines. Engines mean more jobs, so some areas are also interested in that. However, making synthetic fuels is usually not very clean and competes with the electricity sector. Also, not really going to be the mass market solution.

Mortgages and homes

What is going on in the Canadian housing market?

- Toronto: sales slid 7.1% last month year over year and slid 12.1% per cent month-over-month.

- benchmark prices dropped 0.8% in September to C$1.15 million ($840,200), following a 0.2% decline the previous month, according to data released Wednesday by the Toronto Regional Real Estate Board.

- Meanwhile, the average home price reached $1,119,428. 3.4% growth in a month and 3% over the year.

- New listings are up too (44.1%, 16,258) year over year.

Could be those interest rates are about to have an impact on the market? Could be that housing is just not being invested in at the right part of the market to affect price. Could be gremlins.

Calgary?

- sales up 29%.

- Inventory 24% down year over year.

- The unadjusted residential benchmark price: $570,300, up 9% year over year.

No help there.

In the USA, 30 year mortgage rates hit 7.5%. Mortgage application rates hit the lowest point since 1995.

Space junk

We tend to treat the space between the clouds and outer space much like we treat the planet and it is a clear example of what happens when corporations are unregulated.

Junk is just thrown wherever.

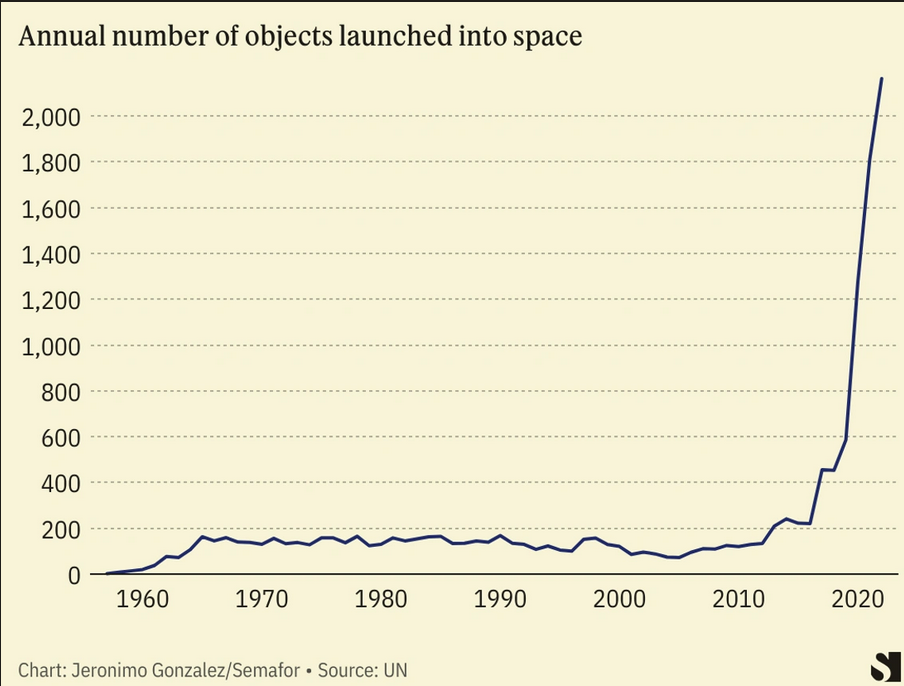

In June, the UN Summit for Space Sustainability happened. They demanded that people start paying attention. This was the same time that Musk was announcing more junk in space.

There are more than 500,000 pieces of space debris circling Earth.

This is a computer generated example what it looks like. 95% of this garbage are not active satellites.