October 28, 2024

Entrenched car manufacturers are struggling

It was announced this morning that VW will be shuttering some plants in Germany, laying off workers, cutting worker retention bonuses, and attempting to get a 10% wage decrease from workers.

The main issue is the productivity of the plants in Europe, according to the company. What that really means is that they cannot produce the cars that people will buy at a price point where people will buy them.

Mercedes-Benz is also seeing a decline in sales in the face of competition with cheaper Chinese-made luxury cars.

The German Chancellor has announced that he thinks that the country should "diversify" (instead of trying to support its entrenched industries) to soften the blow of the inevitable loss of manufacturing capacity.

It is a mistake to think that the German economy can become a mythical "service" economy. You need only look to the UK to see how that doesn't work.

It is also a misreading of the situation in the actual economy. European industrial production is caught at the low end of the investment cycle—the point in the cycle where it is nearly impossible to get private sector investment. Businesses are too busy paying down debts from previous rounds of borrowing. Changes to the economic program of the company or the state shifting direction on investment is a massive mistake. And one that is made too often by unsophisticated politicians.

Facts ifo Institute.png)

In the auto sector, the "nearshoring" project does not seem to be landing for Germany right now. The question is, can the German public wait long enough and will they demand investment and policies that actually work?

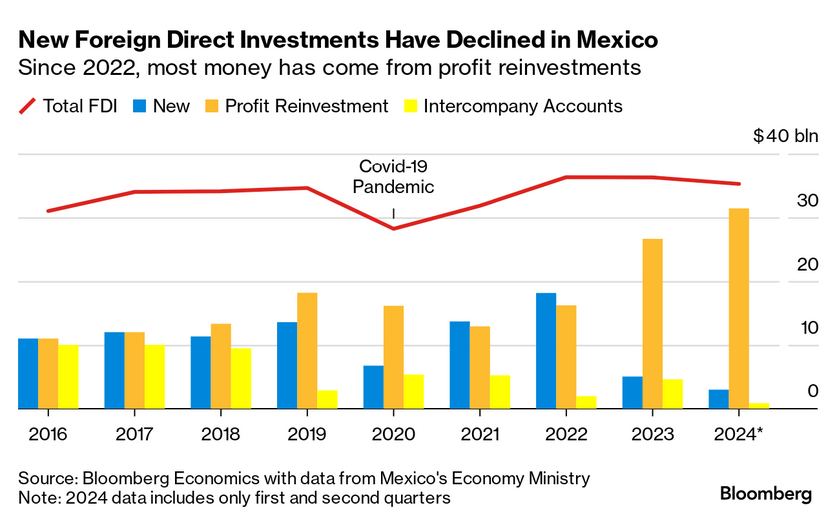

Across the pond, Mexico is also seeing a decline in new foreign direct investment, which also points to questions about nearshoring.

FDI continues to flow for entrenched companies, but there is little evidence that there is a shift in FDI for production from other places in the world.

The popular concept of reshoring is that investments shift because governments threaten to throw up tariffs if they don't. It is, of course, more complicated than that. Nearshoring is more likely than reshoring, and that doesn't mean that jobs flow back to the centre of the empire. It is more likely that they simply diversify overseas. After all, wages and currency prices still mean it is cheaper to manufacture elsewhere.

Elections may be lost partly because workers and populist politicians lean too much into this fallacy.

Oil prices fall

- lower risk to war between Israel and Iran

- slowdown of Chinese economic growth

Oil prices are a poor measure of much of anything except the bets on if there is going to be too much or too little to meet demand.

The downplaying of attacks from Israel on Iran (supported by the USA) have lead oil prices to come back down to $67.21 a barrel.

The October surprise coming from Israel seems to have abated—at least according to markets.

Probably more significant over the medium term are questions about where the Chinese economy will land.

Political ad buys on ex-Twitter collapse

There is a big gap between money raised on ex-Twitter and reality:

Elon Musk’s X is on track to fall well short of its goal of bringing in $100mn in revenue from political advertising in 2024, raising just $15mn in the year to date, largely from an increasing reliance on Republicans and the Trump campaign.

An FT analysis of the top 100 advertisers found 42 Republican candidates or political action committees — accounting for just over half of the spending — and only 13 Democrats. (FT)

For those of you still on the platform, it is important to know who you are hanging out with. The ad buys are targeted and it shows that the site is overrun by the right, far right, and bots imitating those politics.

The Harris campaign has not even bothered running ads on ex-Twitter.

The question for the left is where are we all hanging out? Tiktok and Instagram are the main platforms for ad buys, but there is evidence that the algorithm driving the addiction on those platforms is at odds with the ad revenue goals.

The other answer is chats, of course. Which, thanks to the Signal protocol, are hard to figure out in terms of what is being said and shared.

You have to go back to regular mining of IP addresses and non-homepage page loads. Ads continue to be useless.