October 28, 2022

Economic Slowdowns

- The top 5 publicly traded tech companies lost $800bn off their valuations this week. Down nearly a trillion dollars since the beginning of the year.

- Facebook lost 20% of its "value" in one day.

-

Amazon announced earning "$15bn less than the $155bn analysts were expecting, according to S&P Capital IQ"(FT)

- "Shares of Amazon, already down 35 per cent this year, fell as much as 20 per cent in after-hours trading on Thursday before recovering to trade 13 per cent lower." (FT)

- That's a lot of fake "value" that evaporated.

- Apple seems to be the only tech giant that is doing well—mostly because it sells things directly to consumers rather than provide services to other companies.

Tech companies are also controlled by people who have structured their companies (and essentially play investors like fiddles) to run outside realities face by most companies. Check out Facebook, for example:

Other companies would be changing tack very quickly right now. Not Facebook. The question is, will investors continue to give free money to Zuckerberg to make big bets on losing propositions?

Technology stocks were basically the only thing holding-up the markets this year. That fantasy has now come to an end. This is reality, except in the minds of the folks who run tech giants:

Like Meta, Google also said its massive capital spending would continue, intensifying the race by the biggest tech companies to meet the growing demands of AI. (FT)

Alphabet (Google) has hired people at a faster rate this year than at any time in its history.

Why? Competition. There is intense competition in the tech world around the implementation of artificial intelligence and machine learning as it applies to business processes.

One problem for these companies is still that many of the promises of AI will not come true and much of the money being spent will result in no positive returns. The start of this is the collapse of the promise of "self-driving" cars.

Car companies (Ford and VW this week, Uber last week) have quietly announced winding-down the self-driving research units after billions have been spent on trying to make the technology work. Most technologists in the space have long acknowledged that it is basically impossible to do without bankrupting society. Has not stopped people who do not understand these things pumping huge sums of real money into it.

The other problem is cheap debt. Or, rather, the lack of it. Investment in what we have called "innovation" for the previous decade is dependent on very cheap debt. The debt is used to fund ideas in the private sector that do not play out—cheap debt is cheap failure.

Without cheap debt, the mounting failures in AI become ever more impossible to continue to finance. It has landed these companies in a version of the Sunk Cost Fallacy. All promises, all the money, but nothing to show for it yet so they keep promising more and spending more.

This part of the AI crisis has yet to play out.

Did we miss recession?

Funny how when we are in a technical recession the neoclassical economists point to all the reasons that it might not be a recession, but when we are technically not in recession they jump on the numbers.

France and Germany are not in recession. That is, they have narrowly avoided the technical recession definition for this quarter. Same goes for the USA which surprised on the upside this month.

Germany defies recession fears with 0.3% growth in third quarter

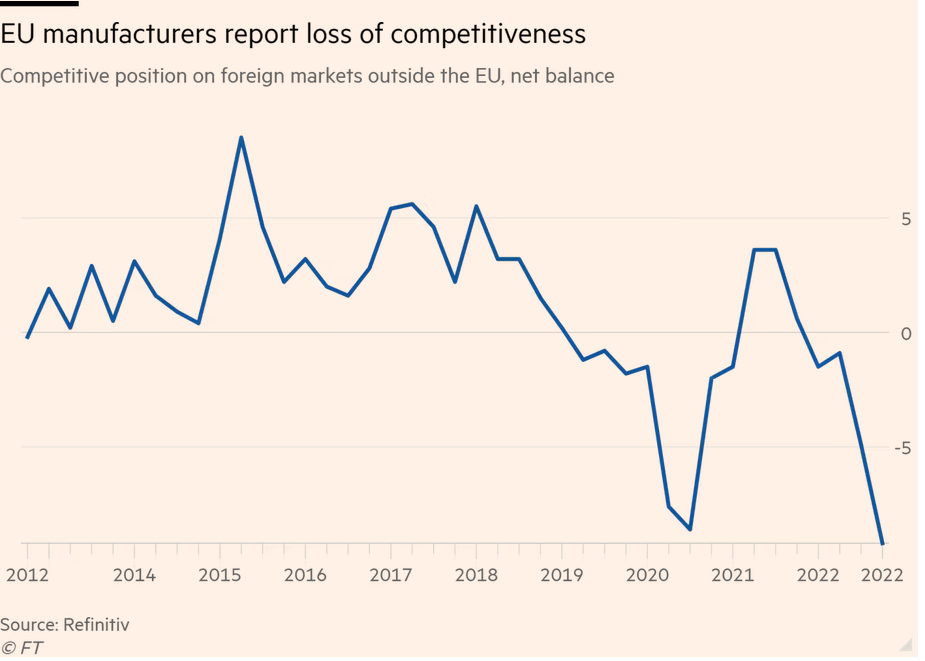

Does this look like Germany is doing well:

OK, not all economists believe the numbers. Investors claim to know better:

German leading indicators “point to a further weakening of the economy in the fourth quarter and there doesn’t seem to be any improvement in sight,” said Carsten Brzeski, economist at ING. “The recession is only delayed, not cancelled,” he added. (FT)

EU business sentiment—one measure of "will companies invest"—is at the lowest level in two years. Thinking about what has happened in the previous two years, that should concern anyone thinking the EU is going to have economic growth any time soon.

Where are the profits?

Oil companies

- ExxonMobil quarterly profit triples to record $20bn

- Italy's Eni’s profits for the year to date to €10.81bn, four times higher than its earnings in the first nine months of 2022.

- Chevron’s $11.2bn third-quarter profit was 80 per cent higher than the same period last year and beat Wall Street expectations of $9.5bn. Just shy of the record $11.6bn quarterly profit it posted last year.

- ExxonMobil, Chevron, Shell, BP and TotalEnergies — post combined profit of more than $60bn.

That's a lot of money being made on destroying the planet's livable climate.