October 26, 2022

Canadian recession and inflation

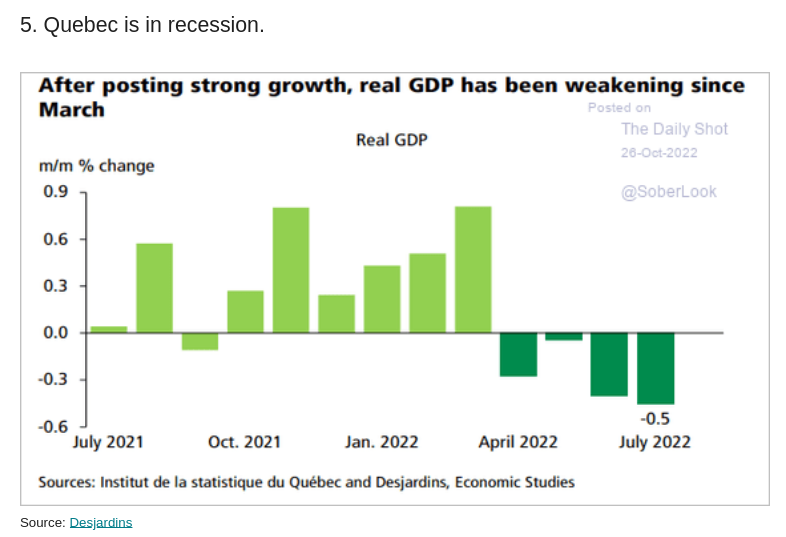

Quebec is in technical recession. If you think that elections are timed accidentally, you are naive.

Expectations of price growth by Canadian consumers still points to increased costs.

_ Twitter.png)

Central Banks

Investors constantly under-estimate where central banks will go. There continues to be confusion about which way the central banks are going to go when it comes to setting their target interest rates. This is because of the fast pivot of analysis over the previous year from one of careful increases and—more recently—aggressive rate hikes.

These pivots and resulting confusion expose the silly lie we tell about central bank independence. There is a spectrum of independence of central banks. A better term would be the level of privatization of the bank. And, it happened along with ideology-driven, neoliberal privatization of other state assets and companies.

The idea was that if you privatize your central bank, you get lower inflation. And, lower inflation over the long-term was considered better than higher inflation of your competitive (capitalist) countries. The spectre of hyper-inflation was also used as a push towards privatization of the central banks. Basically saying that the public should not be trusted to elect politicians because politicians might make promises of spending that might drive inflation.

It all comes back to inflation. And, as we have discussed over the previous few years, we do not have a common understanding of the definition of or the cause of "inflation".

The question for the left is what does a renewed central bank system look like given we have a divergent understanding of inflation and economic policy implications from the made-up fantasy world of orthodox economics?

As a note: I think we must be careful here as we do not want to fall into the "parroting the right" situation. The far-right around the world has taken-up (as per usual) the left-wing, worker-focused economic narrative. Things like blaming the "elite", attacking central bank independence, talking about freedom or liberty, and blaming wrong kind of rich tech tycoons.

The only solution is to (re)build class consciousness around these economic issues so that the focus becomes on the answer to these cries of angst against economic crisis rather than trying to direct the emotion "in the right direction".

What does this look like in real life? I think that the organizations on the left have to re-establish their relationship with economic analysis. It is not good enough to just talk about the "profits of Loblaws CEOs" or the "independence of the central bank". We must put forward calls for change and those must be rooted in our historical analysis.

Policy alternatives should be the goal, not (just) the race to blame the elite before the other folks do.

On the issue of central bank independence, it is clear that the left is opposed to complete independence of the central bank. The left generally opposes the privatization of state function and the central bank is an obvious necessary state function. However, it is not good enough to say this alone. If we call for more political direction of central banks, we must have an answer to the questions of inflation, investment, state ownership, profit, and state versus capital's role in the economy.

In this context, the growing calls for the central bank to "reduce interest rates" are wrong on so many levels. The call assumes many things about investment, profit, inflation, and wages that are rooted in the (frankly, debunked) neoclassical view of inflation and central banks.

In short, we must be much more sophisticated when talking about complex policy options like central bank independence.