October 25, 2022

General Economic Situation

- Bad running to worse.

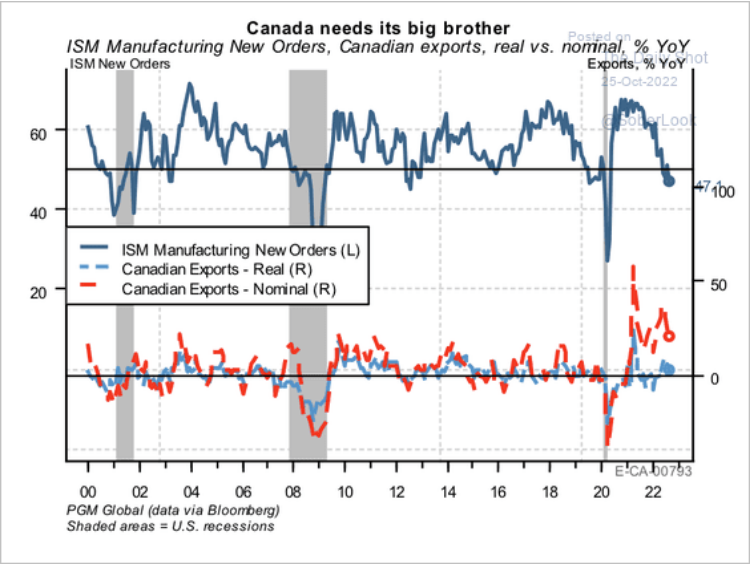

The Canadian economy is tied (too closely) to the world economy. Not just because of our main export (fossil energy), but also our direct relationship with the USA.

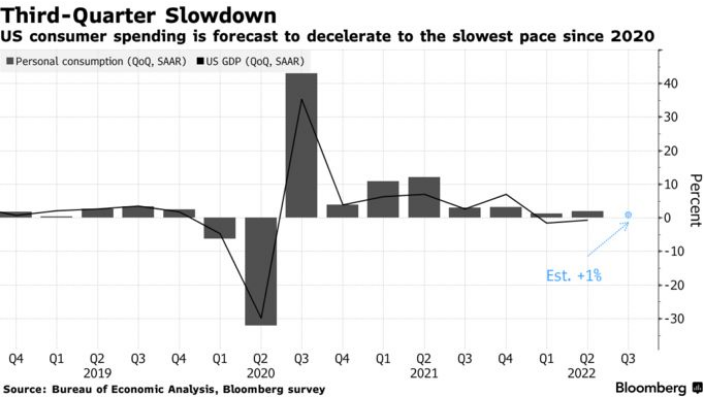

The USA is in recession and when it is in recession it buys less of the stuff we make to make the things they make.

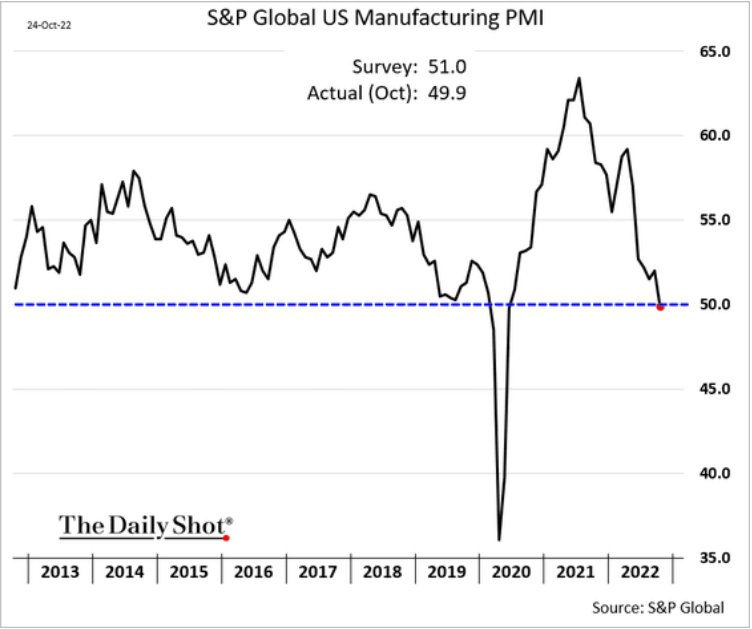

US Business Activity Contracts for Fourth Month, Orders Shrink

- S&P Global’s October flash composite index drops to 47.3

- Outlook hits two-year low on inflation, demand concerns

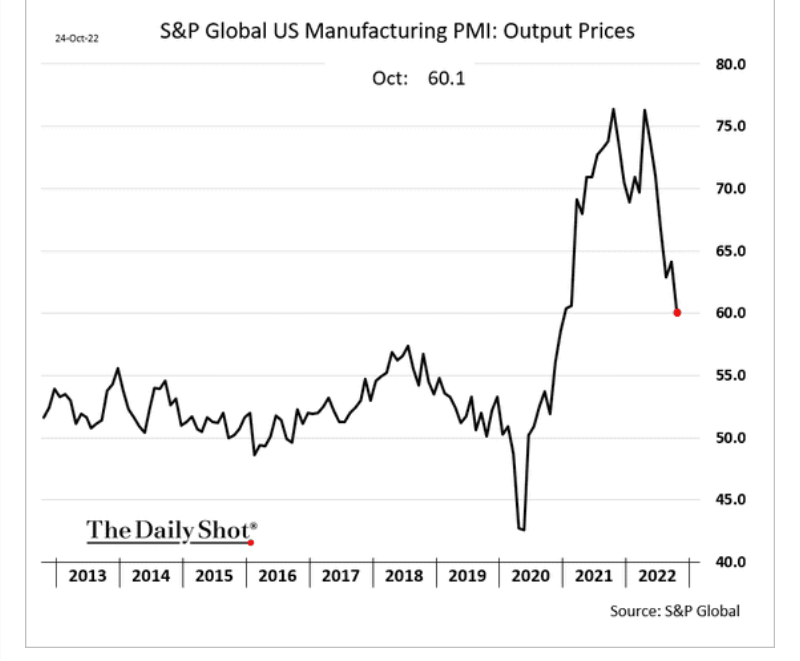

Also, so much for the wage price spiral. There is no indication that wage increases are driving up production prices in USA industry. Not that we would expect such a thing, but the other side does.

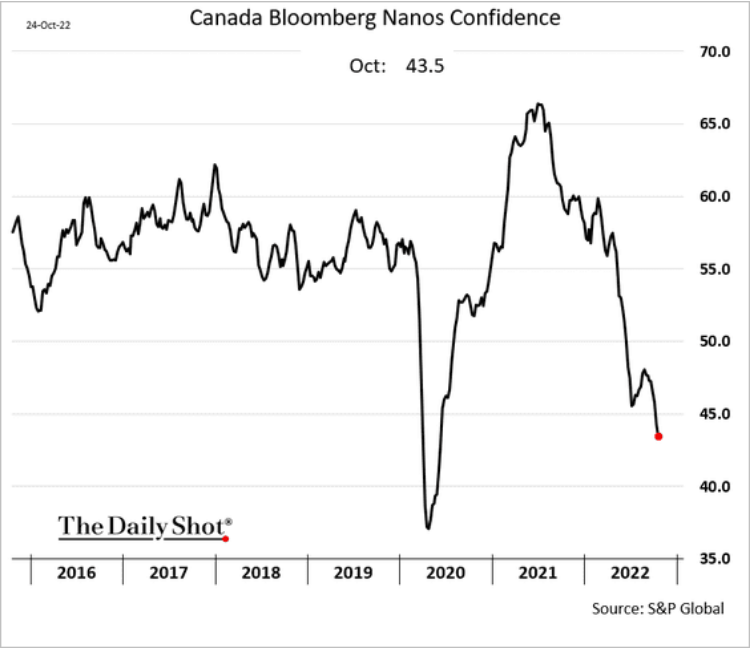

Link that to our own recession, inflation-driven declines in consumer confidence (read: purchasing non-essentials) and you get a rather negative outlook for the coming year.

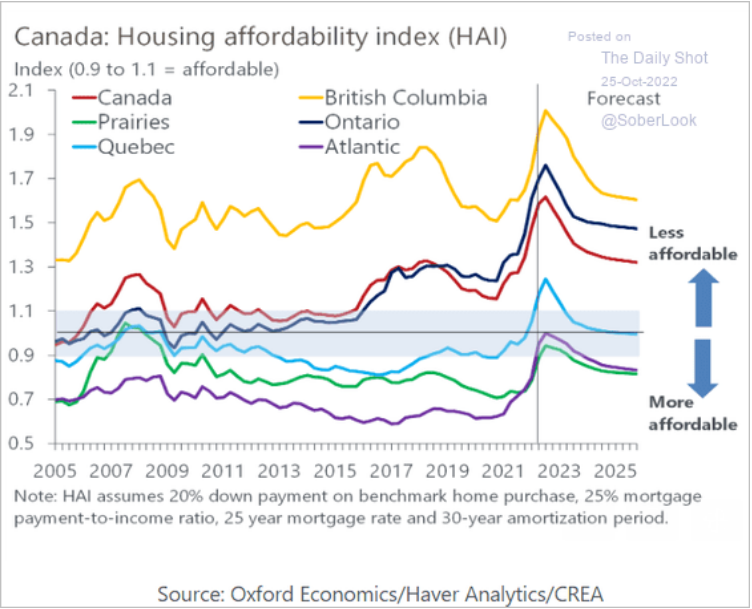

Even housing is not going to be affordable (according to Oxford Economics).

Where does this leave us?

Kind of in the same place we have been for the previous decade, unfortunately. The only way to revive the capitalist economy is to drive profitability. The only thing that was keeping that afloat was the tech sector. Now, even that is declining as it was only possible to grow when debt was cheap.

The economy was a techno-Utopian fantasy and it is starting to unravel on the edges quickly.

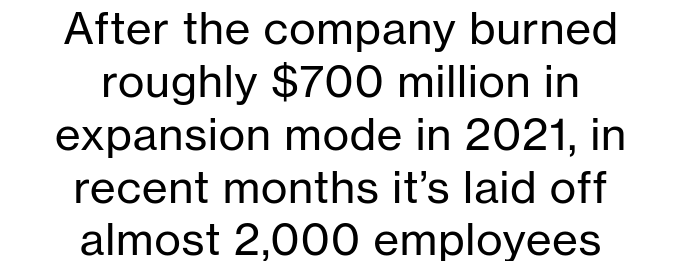

Take urban instant delivery (also known as turning stores you used to walk to into local delivery hubs):

By 2021 its valuation had risen to a hyperbolic $15 billion, and the founders had cashed out by selling some of their shares to investors. They bought a private plane and decamped from Philadelphia to intracoastal mansions in Miami. (BN)

It is not economically feasible to pay someone to deliver food to you from across the street—mostly because you do not make enough to have a servant and the waste generated by the inefficiency is immense. It is only possible because someone else is picking up the bill through debt. That someone else was Future You and we are now paying the price through economic slowdown.

Does that mean that everyone suffers? No. Capital got away clean as you can see from the headline above.

The fake economic growth we have experienced is simply wealth transfer over time. The borrowing from future economic growth works if you produce value, but paying someone to do something you are too lazy (or busy) to do is not value creating.

National Banks are coming for a hand-out

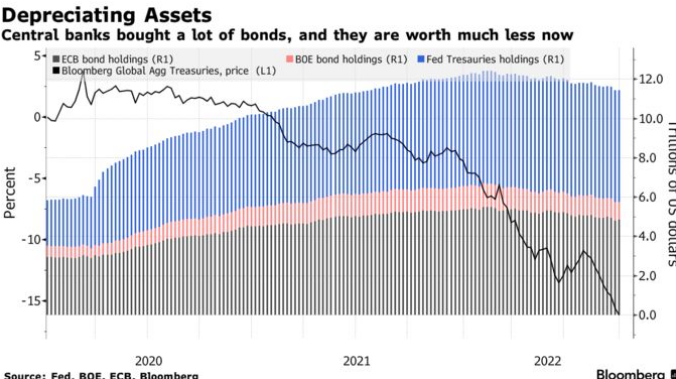

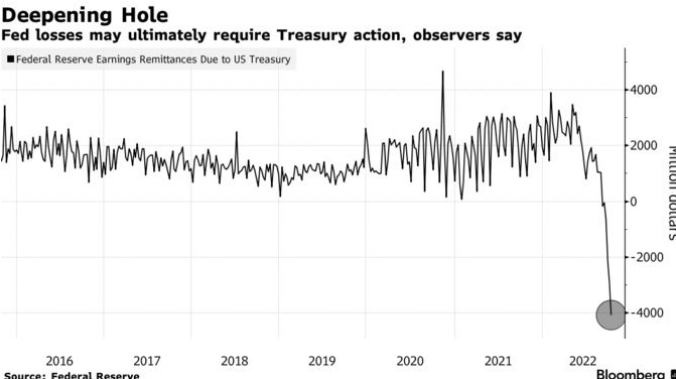

After bailing-out capital profits, causing inflation, and putting people out of work, national banks around the world are coming to the government for a hand-out.

Here are some quotes from this morning review of central bank borrowing that should scare working people:

Profits and losses aren’t usually thought of as a consideration for central banks, but rapidly mounting red ink at the Federal Reserve and many peers risks becoming more than just an accounting oddity. (BN)

The Reserve Bank of Australia posted an accounting loss of A$36.7 billion ($23 billion) for the 12 months through June, leaving it with a A$12.4 billion negative-equity position.

For the European Central Bank, the potential for mounting losses comes after years of purchases of government bonds conducted despite the reservations of conservative officials arguing they blurred the lines between monetary and fiscal policy.

Without the income from the Fed, the Treasury then needs to sell more debt to the public to fund government spending.

Sunak

He is Prime Minister, but don't believe the "stability returning" hype. He is rich, has a degree in PPE from Oxford, an MBA from Stanford (which eliminates most of what you learn at Oxford), backed Brexit from the far right, supports low-tax free ports, gave money to people to eat out at pubs during the pandemic before the vaccine, thinks "scientists" had too much influence over government policy, and has a history of losses in the private banking sector where he comes from.

Take-home? Not the savior for anyone but bond buyers.

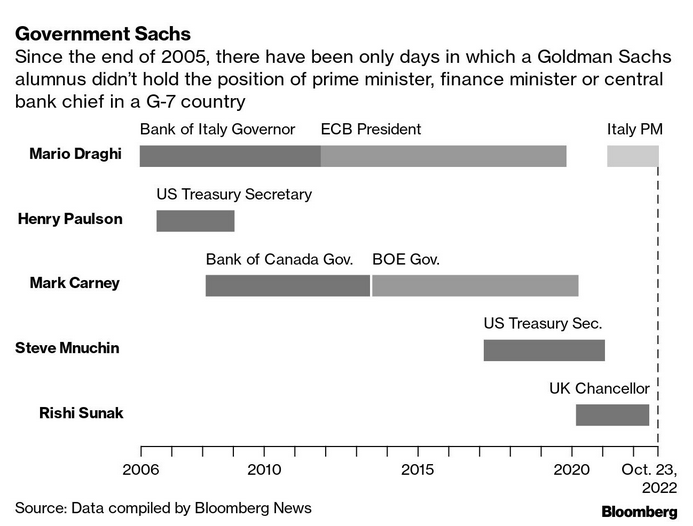

Sunak worked at Goldman for a hot second (3 years). Here is a chart that should make you wonder who really is running things. Hint: rich bankers are ending up in government a lot.