October 23, 2024

Volvo and cars

Northvolt, the battery company aligned with Volvo Cars and majority-owned by Chinese car maker Geely, which makes Polstar and Smart cars, continues to be in trouble. Estimates of the growth of electric vehicles have been overly optimistic

Volvo Cars said it would not invest in its struggling partner Northvolt as the Swedish group halved its annual sales growth forecast amid a slowdown in vehicle demand and geopolitical turbulence.

… Volvo's retail sales to rise 7 to 8 per cent this year, down from guidance in July of 12 to 15 per cent — itself a downward revision. As a result, the company now expects its free cash flow to remain negative for the year.

Like many other major car manufacturers, Volvo has abandoned electric car transition by 2030. Its focus now is on a mix of hybrid electric with other gas-powered cars. A much less profitable option even in the face of investments needed for batteries.

Cars are a focus for the press as they are one of the few remaining examples of civilian domestic industrial strategies. It is also why "Chinese automakers" is a tag seen everywhere when describing the different companies. The ownership of these automakers is confused with where the cars are made amidst ongoing geopolitical conflicts.

However, at this point they are mostly just brands of giant conglomerates of capital. Volvo was making cars in China, owned by Asia-based capital, which is also invested in by US-based capital. The same goes for US automakers.

Geely is China's second largest car maker after BYD. Beyond its Volvo ownership, it owns stakes in Aston Martin and Mercedes-Benz.

The tariff program is not going to change these ownership stakes in what are really all global automakers. The only thing that the tariffs change is where the sizeable portion of the cars and parts are assembled.

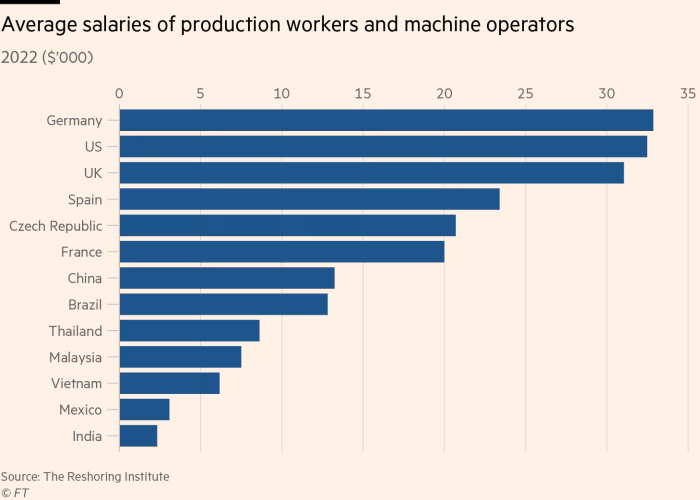

But there is a limit to the reshoring that will happen even with tariffs. Those jobs were offshored from Europe and the US to Asia and Mexico because of differential costs:

Additionally, there has been a slow rollout of charging infrastructure because people are simply not buying as many cars.

Shifts in production of so-called "Chinese" automakers are not even driven by domestic production. Geely and other automakers have started to move production to Vietnam, India, and Mexico, as wage growth in China and currency exchange values make it more expensive to make cars there.

Tariffs

While the tariff war is the focus of the day, it is a very short-term "solution" to the issue of retaining some manufacturing in the face of globalized production. Automation, major changes in technology, and differences in cost between countries (because of all the differences in regulations) brought by free trade will continue to affect investment decisions.

The longer-term solution to ensuring manufacturing is fairly distributed across all of the world's economies – ensuring, like with food and agriculture, resilient production – is a much more complex endeavour. Even "friendshoring" seems fraught with problems as "friend" countries change as geopolitics shifts.

This all assumes that endemic manufacturing production and capacity is essential to the economy – a position not universally supported across orthodox neoclassical economics. Usually, those who celebrate the expansion of the "service" economy are those who support the free-trade and low-wage (higher profit seeking) tendencies of private capital.

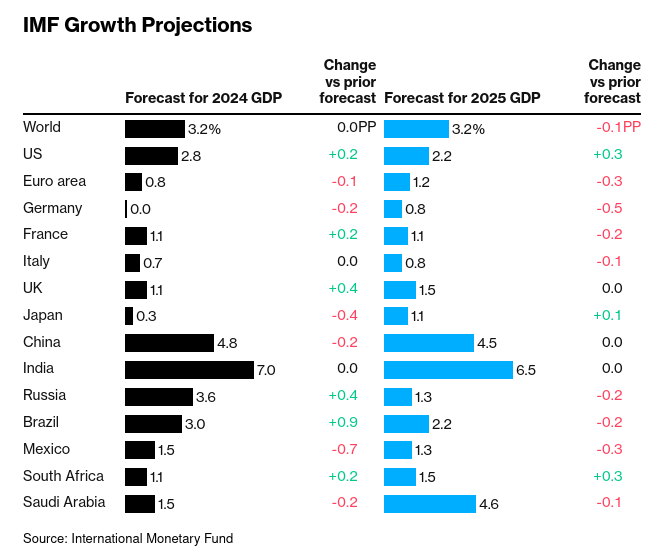

The IMF is even in the process of rebranding "Free Trade" as "Fair Trade" – because tariffs are "unfair" to global capital. Their economists do this without shame as they also forecast:

the euro area was downgraded to 1.2%, 0.3% lower than in July, due to persistent weakness in manufacturing in Germany and Italy.

For the sake of workers and a stable economy, an industrial program is essential. Production of a diverse array of value-added products that can be used/purchased by those who make them is important for maintaining a healthy economy and ensuring that the economy is not dependent on specific export and import markets that can easily be disrupted.

Such a program is not about "USA" or "Chinese" or any other kind of companies building things. It is about an industrial program aimed at ensuring production of needed goods (including the goods that power services).

Capital has decided that it is not interested in continuing the previous few years of discussions about industrial strategy. Now that it has been saved from pandemic profit subsidies and made profits from the resulting inflation, it wants the return of the free-trade program.

As such, the left must push beyond the simplistic debate over tariffs, and start explaining how domestic production has been gutted through automation, deskilling, and lack of public investment. Public ownership of "critical" productive capacity ensures a stable net level of production in the face of shifting investment.

Interest rates and Canadian Banks

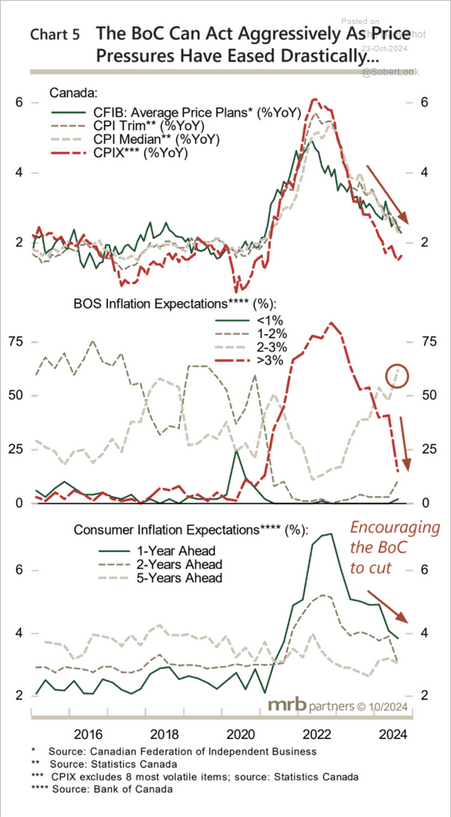

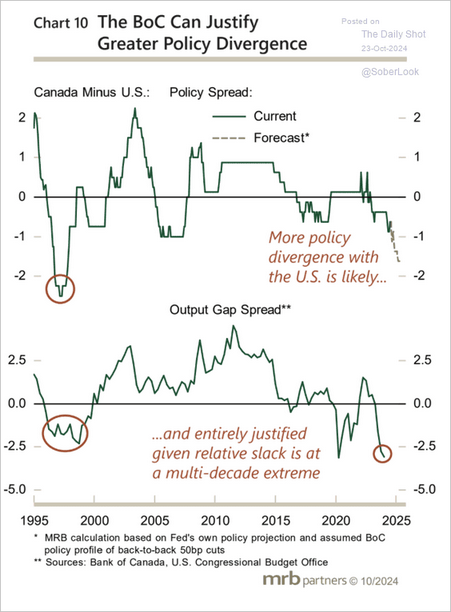

The economy is doing so poorly that the Bank of Canada has telegraphed that it is going to be reducing its target interest rate by likely half a percent. That's probably not enough.