October 21, 2024

International Energy Agency Predictions

Where the IEA think current policies get us:

- spare crude oil production capacity rise to 8 million barrels per day by 2030.

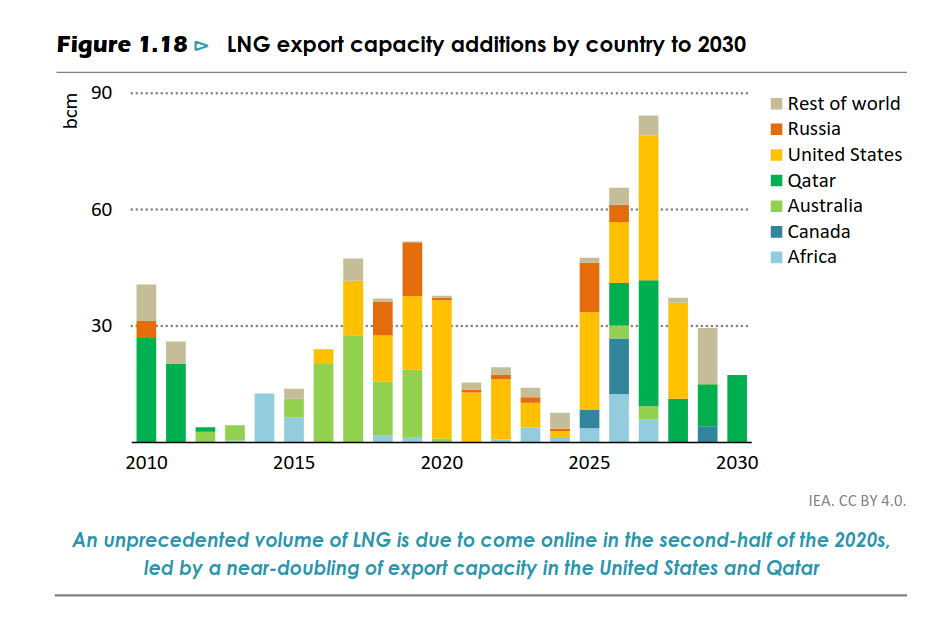

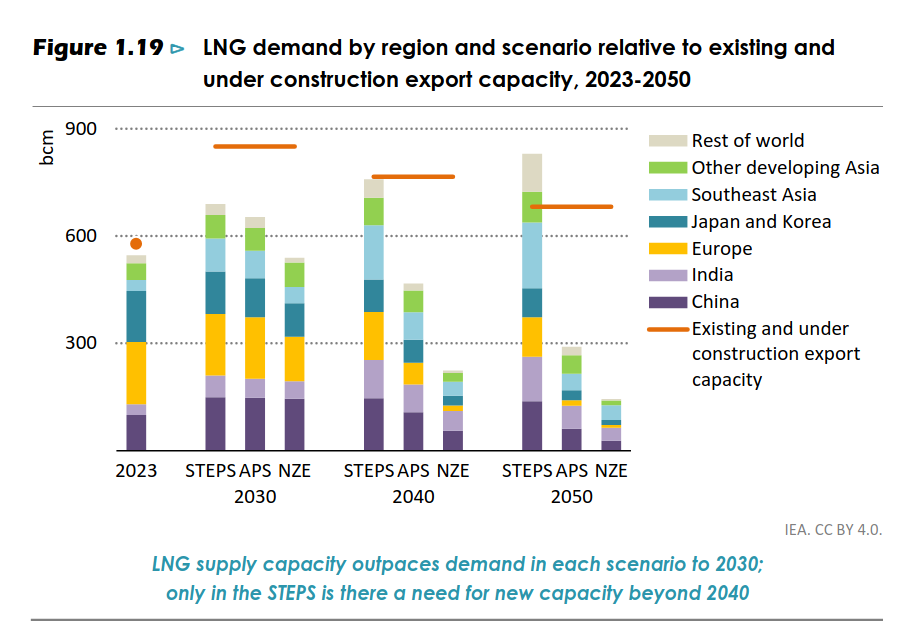

- A wave of new LNG projects is set to add almost 50% to available export capacity by 2030.

- by 2030, nearly every other car sold in the world is electric, although delays in the roll-out of charging infrastructure or in policy implementation could lead to slower growth

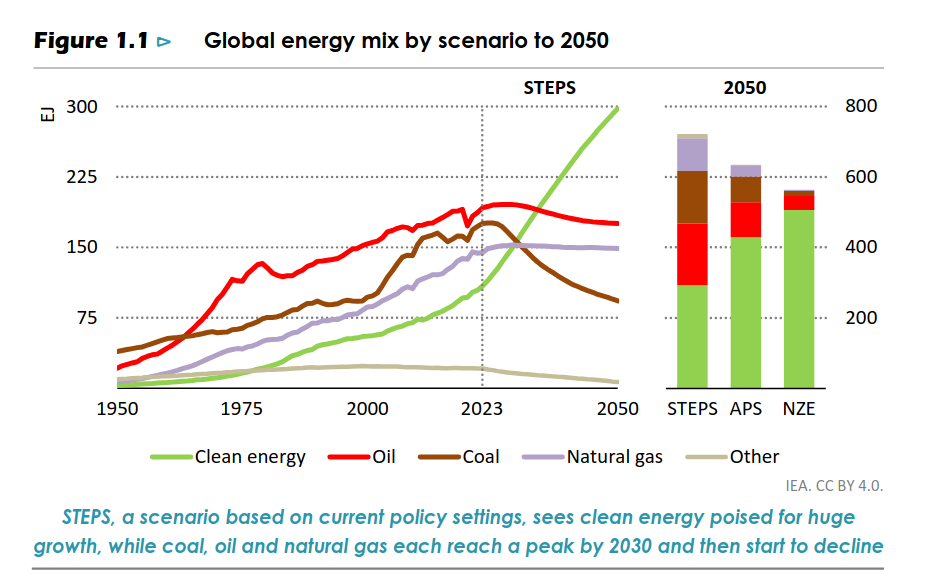

- Clean energy meets virtually all growth in energy demand in aggregate in the STEPS between 2023 and 2035, leading to an overall peak in demand for all three fossil fuels before 2030, although trends vary widely across countries at different stages of economic and energy development.

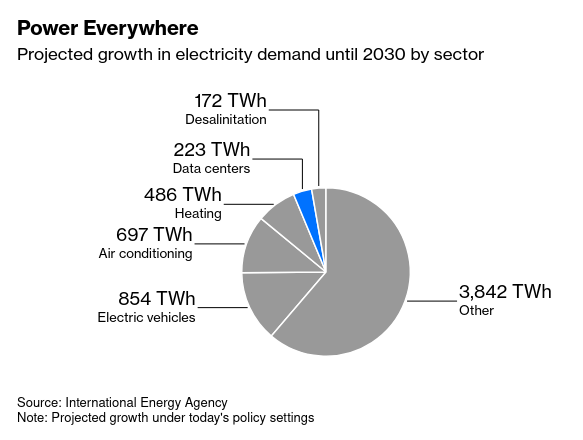

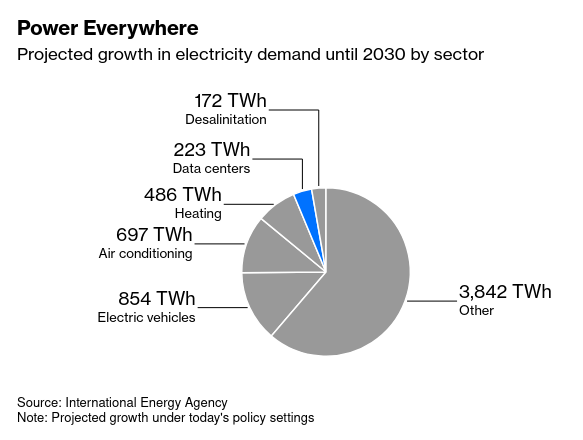

- Electricity demand grows much faster than overall energy demand, thanks to existing uses, notably cooling, and new ones such as electric mobility and data centres.

- Clean energy investment in emerging market and developing economies outside of China remains stuck at 15% of the total

Remember, current policies do not land us anywhere near where we need to be on climate change as they put us near the 3 degree increase scenario.

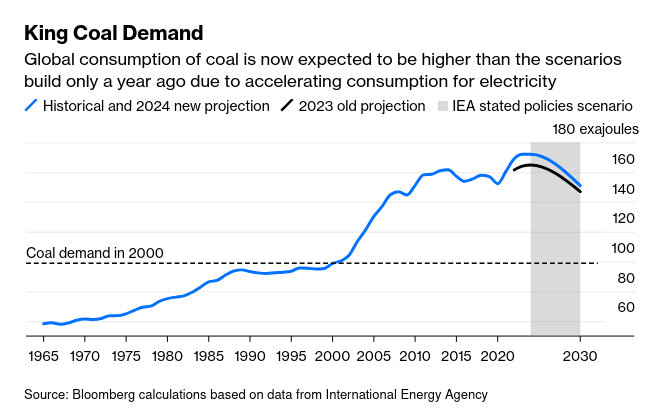

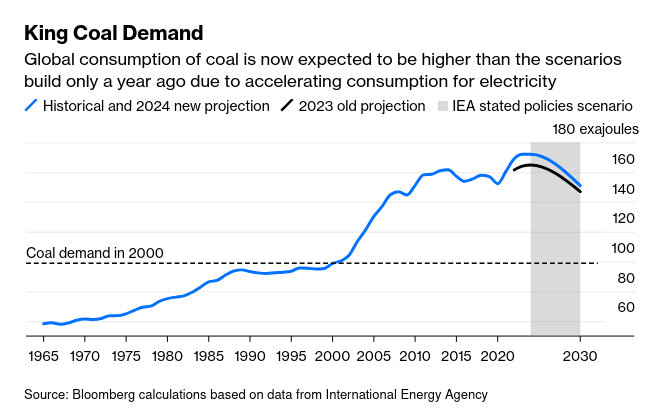

Coal continues to fill the gap in generation.

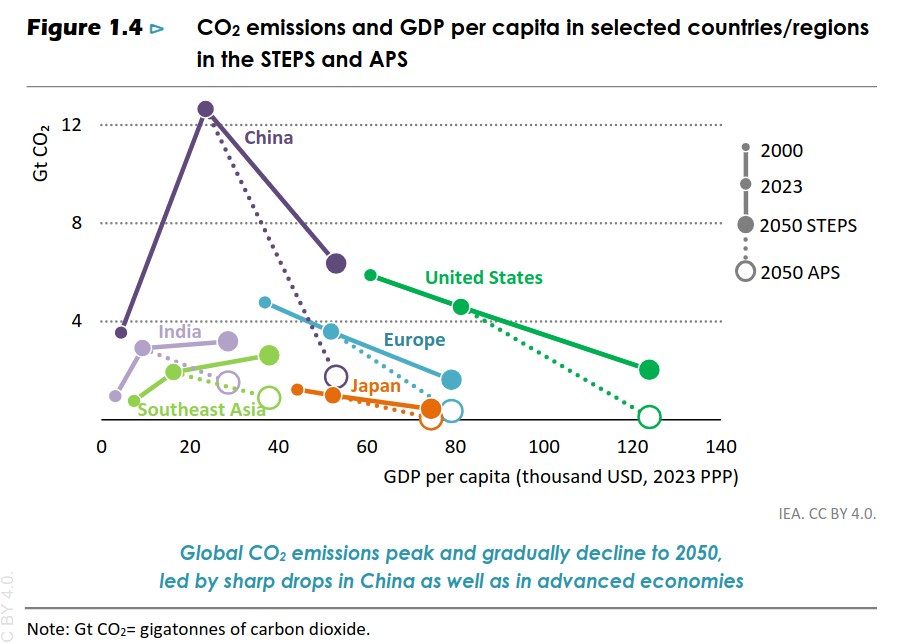

While emissions are set to peak soon, that says nothing about how fast they will fall. And, falling is something that is necessary to reach a sustainable planet.

Energy growth also hides the uncomfortable reality of the growing inequality in access to electricity. While the data centres and the advanced capitalist countries grow their electricity demands, it is just increasing the gap between rich countries and poor countries in access to energy.

While rich countries get better at being efficient, countries with lower growth are unable to transition while it becoming increasingly expensive to scale up access.

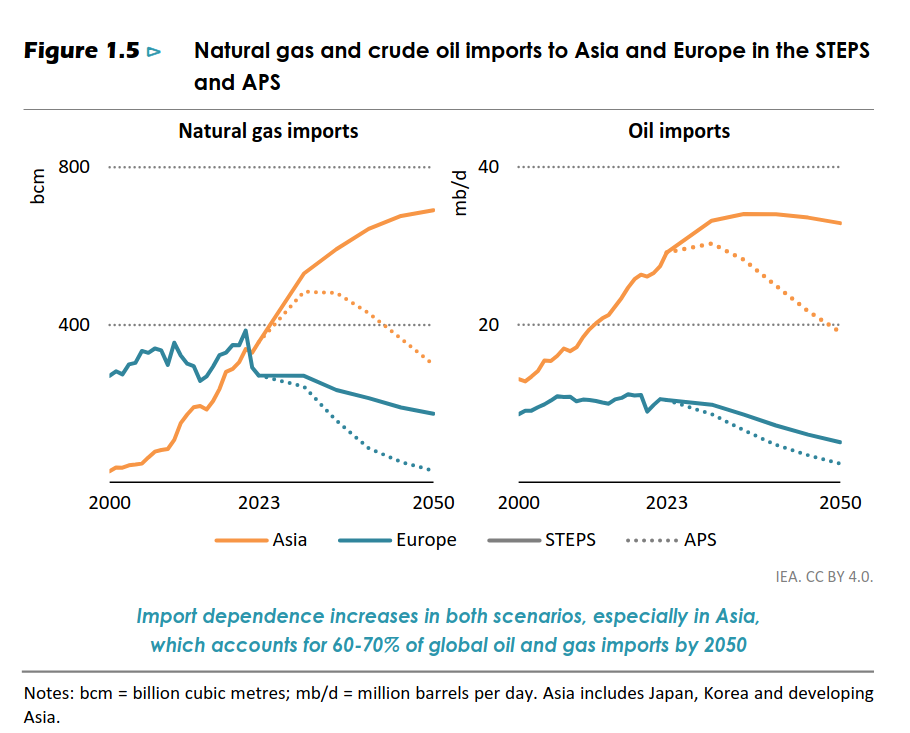

Natural gas and oil imports to Asia and Europe will likely plateau in their absolute numbers, but the decline in use, even under optimistic measures is slow.

But, that has not stopped the massive increase in the export capacity development.

It is a world that is different than the one we are living in now, but not in the way that most people think about.

The economics supporting the infrastructure for natural gas and oil has a large component based on growth of use built into it. The shift to sustaining that infrastructure as opposed to growing it will make fossil fuel companies look more like legacy telecom companies in terms of economics.

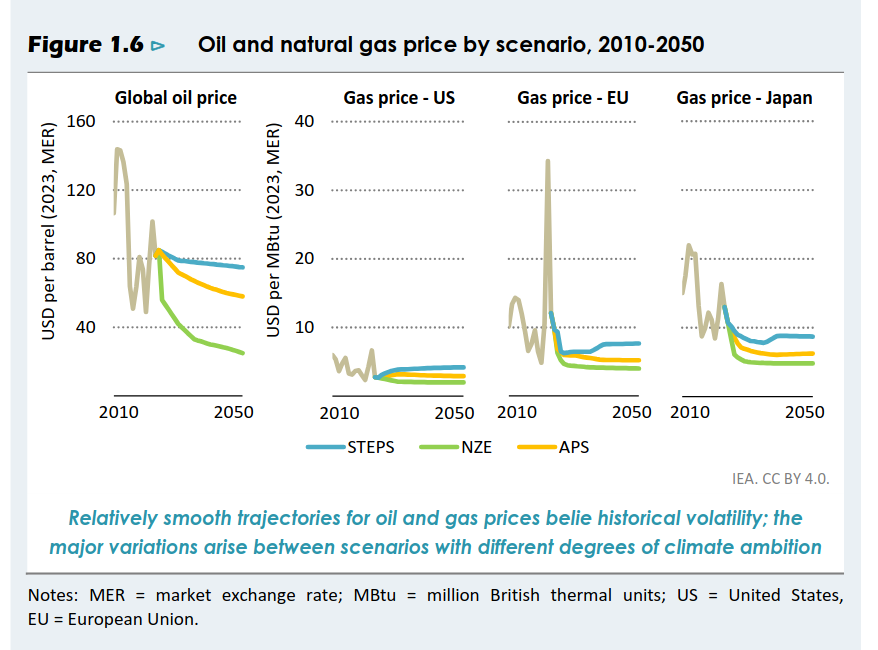

However, the demand depends on where you think that we end up on policy. The current policy framework results in underproduction of gas. Climate saving policies result in over capacity.

This is the debate that is happening between environmentalists focused on LNG and everyone else. Essentially, the environmentalists are pointing to the Net Zero and climate saving policies and saying we are over capacity on production. Everyone else (that is policy makers and capital) is saying "we will never meet that objective".

The reality looks like this:

The "everyone else" scenario above creates an economic problem.

While the liberal environmental movement will cheer thinking this means that these companies will not be able to sustain output, they are missing that much of this infrastructure needs to continue to operate as we bring alternatives online. And, that products from oil and gas are tied directly to the rest of the life sustaining industries on the planet. Food, pharma, transport (beyond burning it), and manufacturing sectors are all dependent on chemical, plastics, and burning this stuff.

If there are reduced profitability in these industries on the horizon and there is a need to sustain some of this infrastructure then there is a problem we will hit on the way there.

And, this assumes that we do not all abandon these targets in the face of geopolitical conflict, war, and whatever other things (climate related crises) pop-up in the mean time.

I would argue that the alternative—where we actually build what we need on the green energy side—is something that we need to strive for in either case. We must expand alternatives or there will be a point where we are subsidizing both sides of the energy transition with public money and doing so under a very messy economic situation. One where companies providing life-sustaining infrastructure abandon that life sustaining infrastructure.

Similar to what we have been arguing for a while, enforced investment right now—that reduces profitability (or simply takes it over)—is necessary to make the transition. The money that is being extracted from the energy system needs to be invested in a way that sustains what we have enough so that it can make it through to 2050 without failing. We cannot wait until there is no positive net revenue from the system to do that.

Wireless vs Wired infrastructure

Finance driving investment decisions (with consumers choosing the cheapest offering) in the internet and broadcast areas is undermining resiliency in that infrastructure. While the consumer side applies mostly in the USA right now, the investment side also applies to Canada.

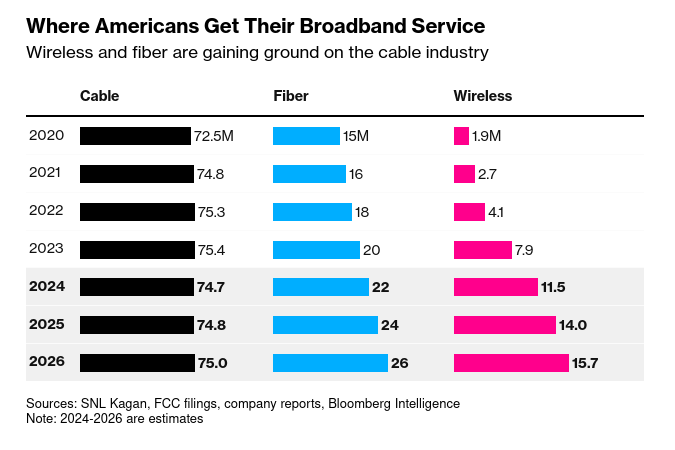

Currently, there is competition in the space between wireless and fibre/cable connection companies.

Wireless companies have an incentive to fill up the wireless spectrum they have purchased as unused spectrum is a waste. The result is a strange economics where the cost of filling that spectrum and the per customer added does not really match up.

In addition, the costs of sustaining the physical backbone of the internet, the fastest connection (fibre), the legacy lines (cable, DSL), and the physical phone and TV systems (also cable and phone lines) is much higher than the wireless-only firms.

The entire system needs to have physical lines of fibre to connect parts of the infrastructure together. And, most of the longer-distance fibre optic infrastructure is not owned by the last-mile and distribution network providers.

For mobile network companies, wireless continues to be faster and faster, but the infrastructure and spectrum has a limit to the number of people that can connect.

The situation is running to a similar story we see under these deregulated, enforced "competition" markets.

Wireless companies are newer (in the USA) and there is more competition between them in the USA and Europe than between the physical line companies. This makes sense, there is an enforced oligopoly on the limited number of fibre lines (cost and space) that can be strung about, but almost anyone can string a bunch of wireless antennae around.

There is an ongoing breakdown of revenue and legacy infrastructure include the legacy cable/TV/phone companies which also own media, news, TV, and legacy broadcasting companies. The legacy companies compete with low initial cost companies backed by venture capital money that have higher profit rates on the broadcast side and fly-by-night mobile companies that have no real physical infrastructure and are based on an firm-level economy of rapid growth rather than continued existence.

So, large legacy media companies are facing a rather large challenge to sustain their businesses.

The issue comes when you look at the sustainability of a growth model in internet connection. Wireless spectrum is limited.

… wireless offerings won’t be profitable on their own in the long term, unless carriers change their business models and use their networks more efficiently. That’s because home fixed-wireless users consume more than 20 times the amount of data than the average mobile customer …

Acquiring more spectrum could give carriers room to grow the fixed-wireless business, but availability is scarce. They’ve already snapped up as many licenses as they could in several spectrum auctions from 2020 to 2022, and more can’t be sold until Congress renews the Federal Communications Commission’s authority to conduct spectrum auctions. (BN)

We need terrestrial fibre lines to sustain connections to the internet. They are more reliable than wireless systems, they are more secure than wireless systems, and the offer an essential redundancy to our network.

Unfortunately, the competition is driving down that resiliency and we are not getting even the kind of use and access we need. We still do not have regular calling over wifi. We still do not have proper TV news and broadcast over the internet. All because we have these walled gardens between the two frames of private investment in the internet and broadcast space.

The state gave up its control over this infrastructure when it privatized and then deregulated the industry to get innovation. With innovation mostly undermining the public instead expanding capacity these days, this is not a great trade off for us.

Similar to our transport and energy systems, it needs to bring those industries under more democratic control.

Canada vs others economics

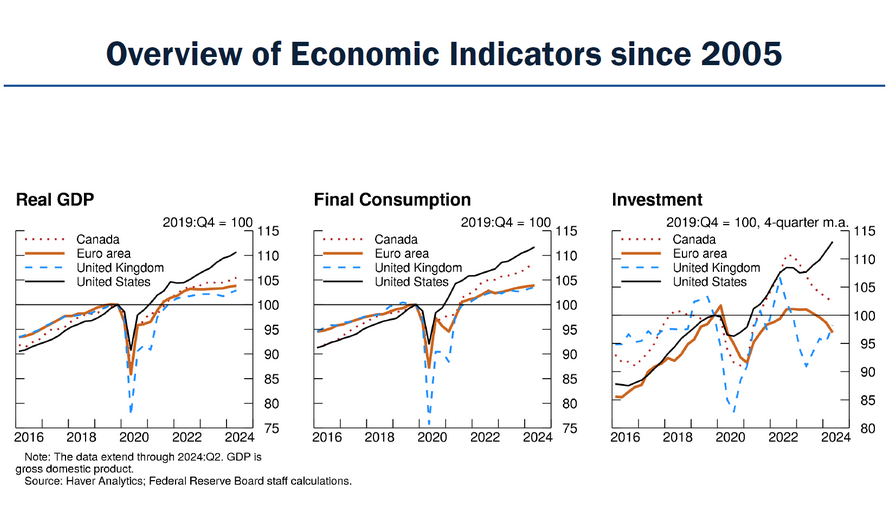

Three graphs from the federal reserve in the USA this morning worth having a look at.

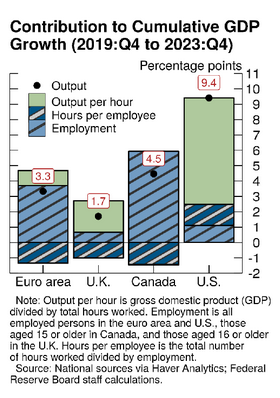

The economic indicators graph kind of shows the negative economic impacts of bad policies by the federal government. While we are producing more and consuming more on a total mass of consumption value (because we have more people now), our investment is lacking and growth seems to be tied to simply having more folks around doing work.

Our economic output has been entirely related to increased employment from net positive immigration. This graph does not measure the negative impacts brought by an unplanned massive speed-up of net immigration, but does show that it is a bit of an economic fudge. We are just increasing employment levels.

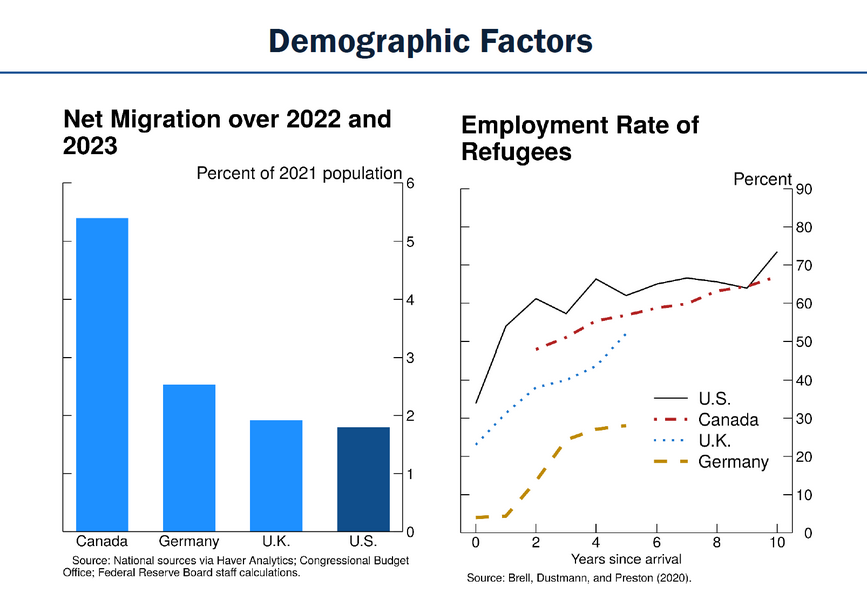

The demographics of refugees and their employment in Canada. Our refugee system seems to only let in highly skilled refugees that are able to find jobs. If you are a refugee, come to Canada.

If our economic growth is going to be totally dependent on the growth in the number of workers through immigration, then our policies need to match to support that growth. On the flip side, the lack of investment means that we are not doing that. The result is far-right rhetoric, policy, and hate.

The left must square this circle for the sake of all workers in Canada new and established alike.