October 2, 2023

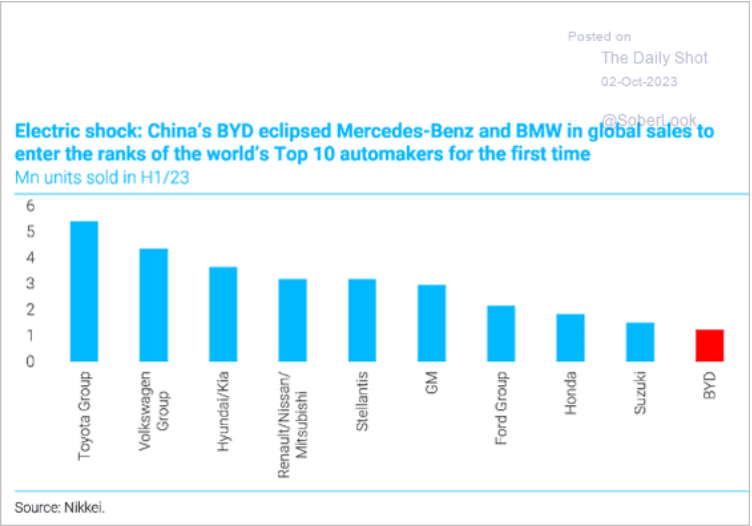

Wind and renewables

The private market in wind is not doing so well.

The S&P Global Clean Energy Index, which is comprised of 100 of the biggest companies in solar, wind power and other renewables-related businesses, has dropped 20.2 per cent over the past two months, putting it on course for its worst annual performance since 2013 (FT)

Compare this with dirty energy:

- S&P 500 Energy Index: up 6%.

Wind energy and other renewables investors have relied on very high levels of debt (since it is building much of this from scratch) and thus the hope for continued low interest rates.

- That debt is maturing and rolling over to high interest rates.

- Most investments in wind rely on massive government (profit) subsidies.

- Government contracts have not increased their subsidies in-line with inflation.

The distance between the subsidies and what are needed for profitable investments in wind?

- Current levels: $30-$40/MWh

- Levels of support needed: $80-$100 per MWh

This doesn't include calculations of shifting production from China to the EU or the USA.

the Asian economy offers project developers 15%-55% lower prices than European wind turbines with deferred payments of up to three years (EU Commissioner Thierry Breton)

The private investment regime on renewable expansion does not have an easy path.

Add to this we have a general decline in the electricity generated by wind and we have an even bigger problem around financial sustainability.

And, while capacity is increasing, generation of electricity per installed turbine has had some troubles. Wind can be fickle (as we saw in Europe last year) and needs equivalent storage capacity growth—which increases costs.

The way we (try to) finance the expansion of wind generation is problematic. The EU, which is fully into the market-based wind through subsidies is lagging behind even as they face increased costs of natural gas electricity production.

The result of the financing model has lead to a decline in investment in new capacity in the EU and the USA for 2024 after some growth this year. The growth this year seemed to be because of the clearing-up of supply chain issues for already purchased and planned investment.

There are a lot of projects planned to come online in the coming years, so it is not like there are no planned builds. The issue is whether these planned builds come online.

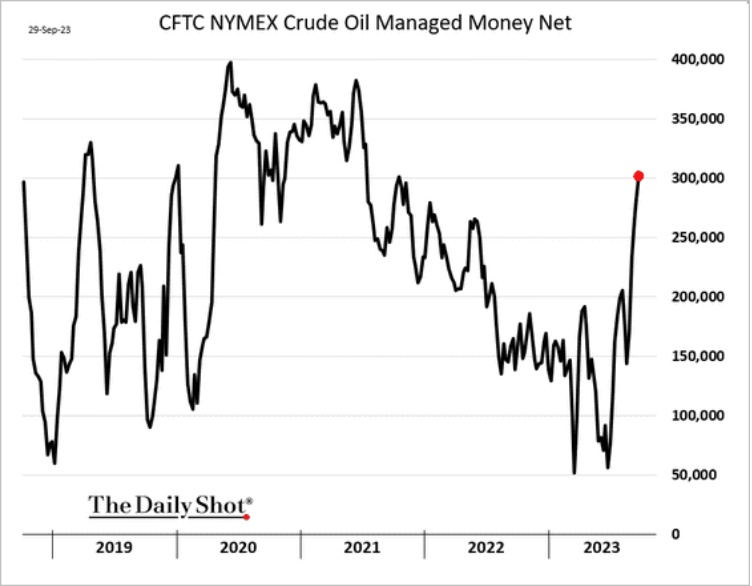

And, there is no indication that the whole "divestment" program is working to shift away from oil.

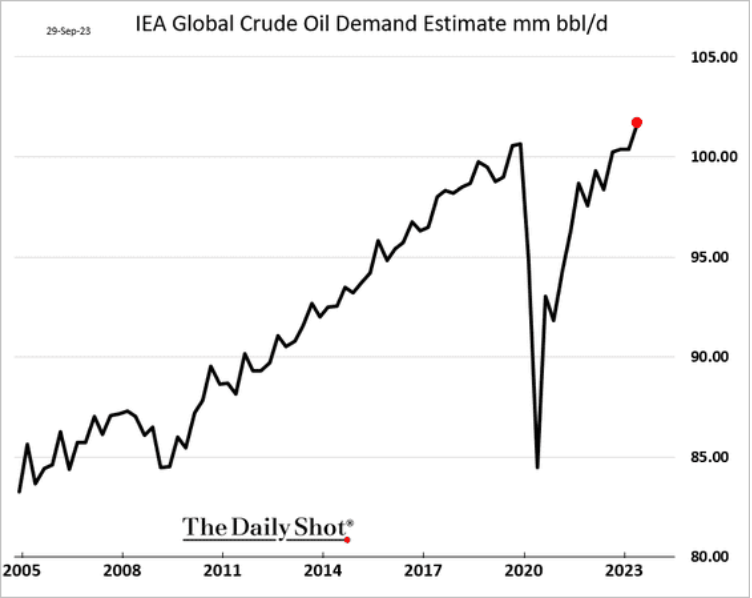

Investment has returned as prices increase:

Demand has returned as the economies continue to return to normal production without alternatives available:

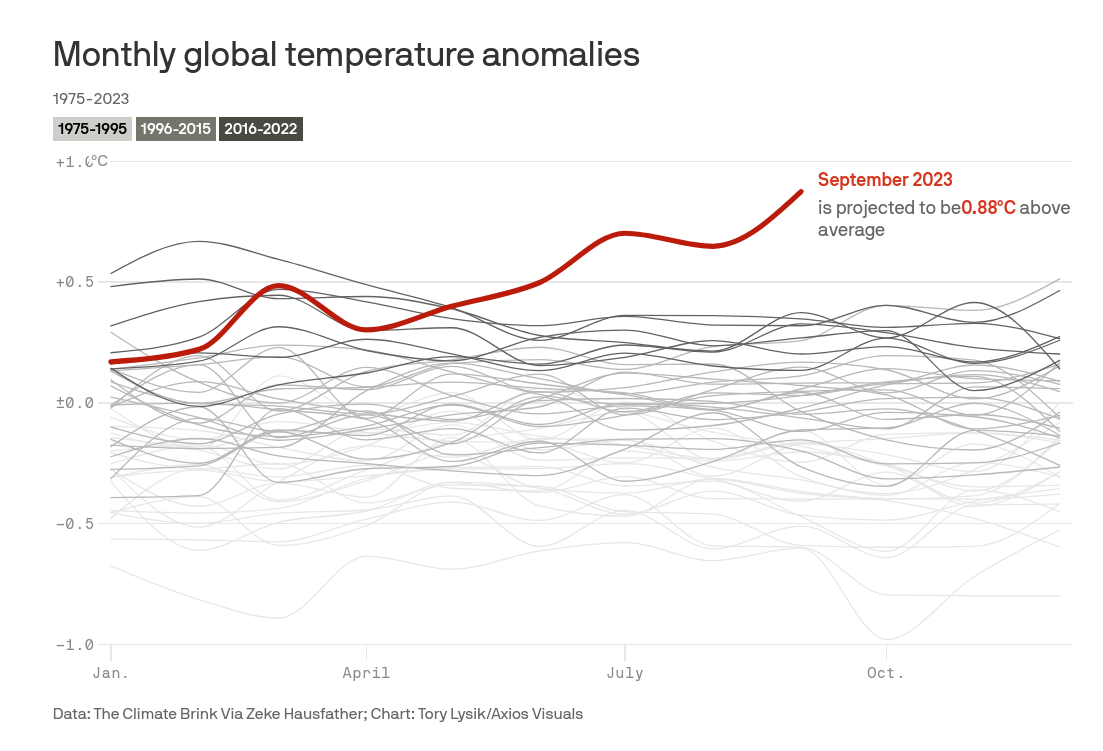

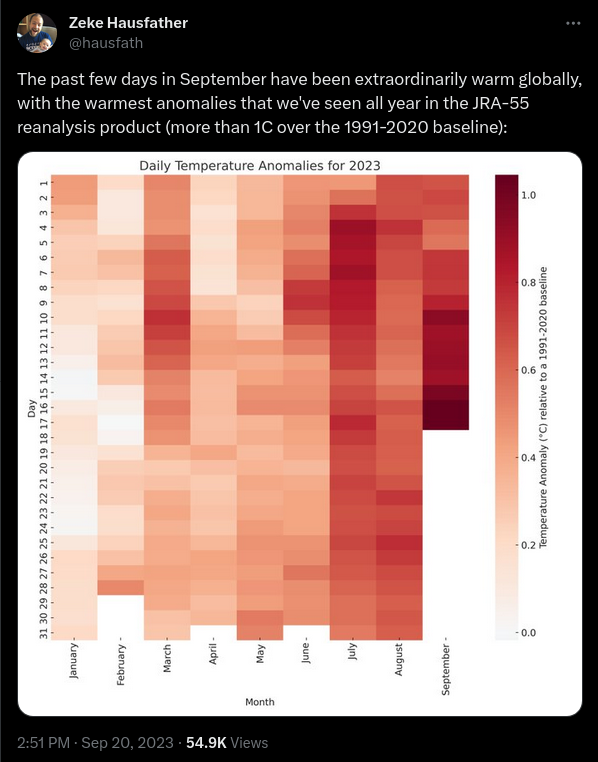

Just a reminder, as if you needed it, that we have had a very warm year so far.

Drought in Panama has reduced trade

Panama Canal has reduced its shipping rate again because of the current drought:

- Normal operations: 36-38 ships per day

- Current operations: 31 (max)

The canal uses fresh water to move ships through the locks.

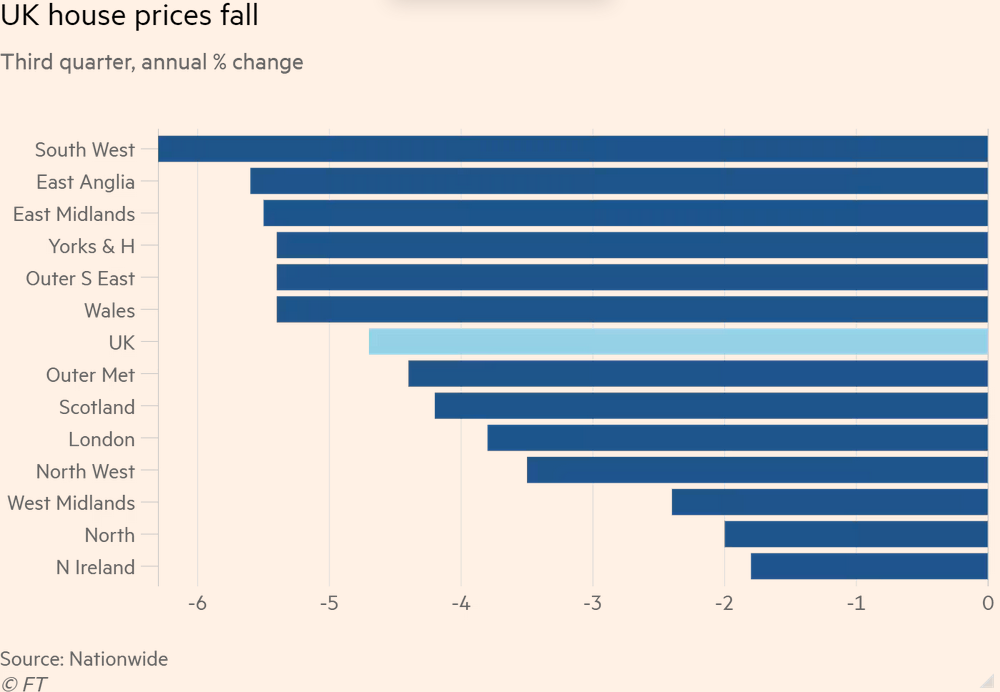

UK Housing

A decline:

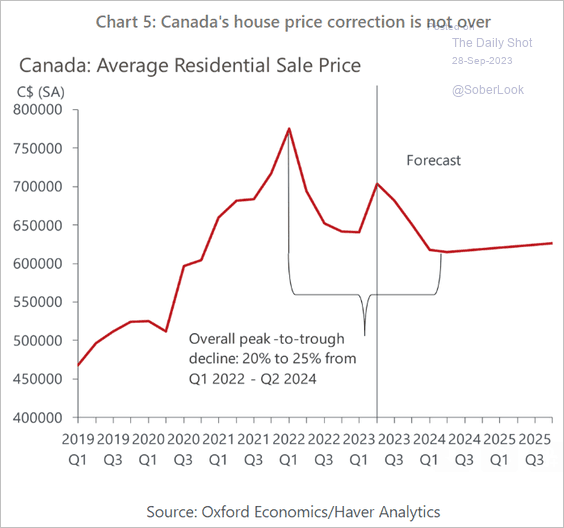

Canada's Housing expectations from Oxford Economics:

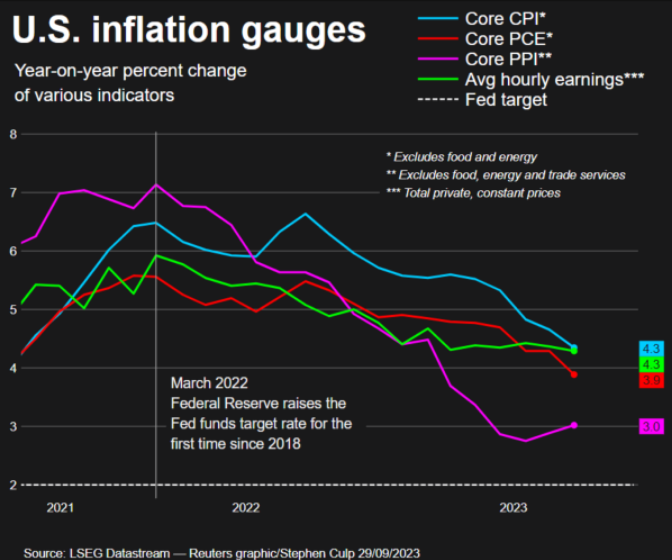

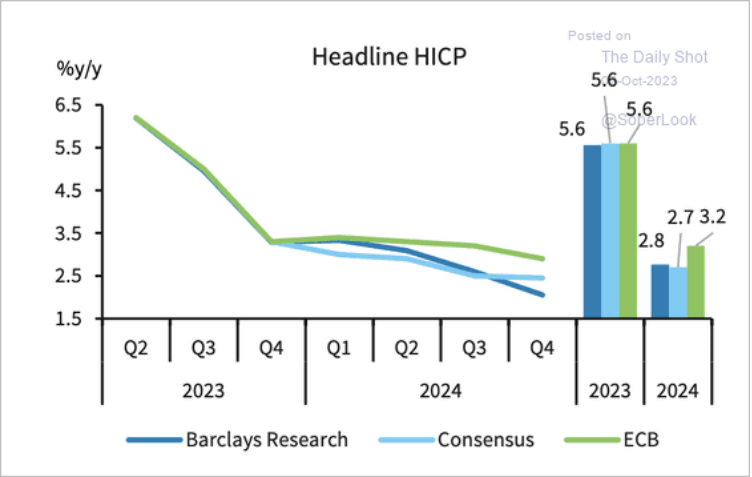

Inflation expectations are falling…

… caused by declining economic prospects:

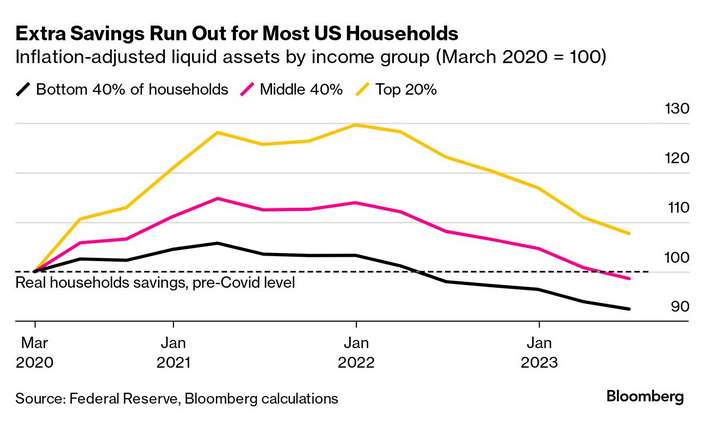

The economy's support of "excess savings" (a measure of if poor people have "too much" money) shows why there is a slowdown in the USA

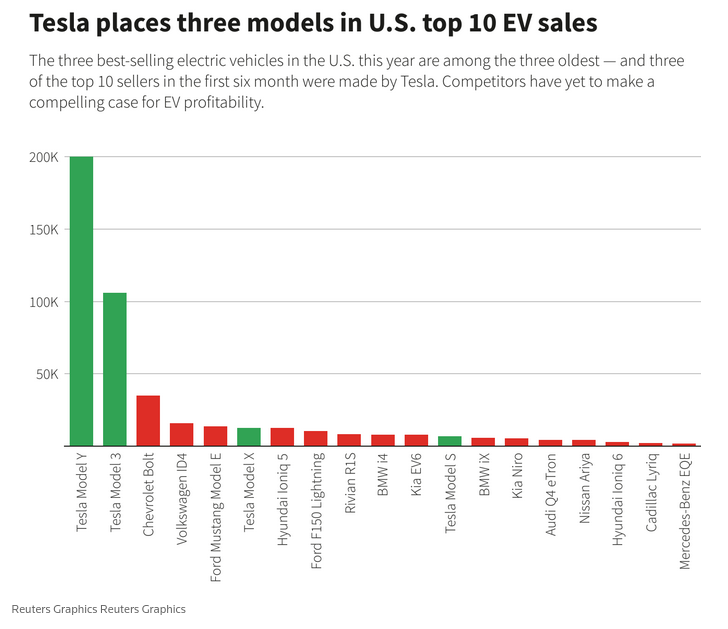

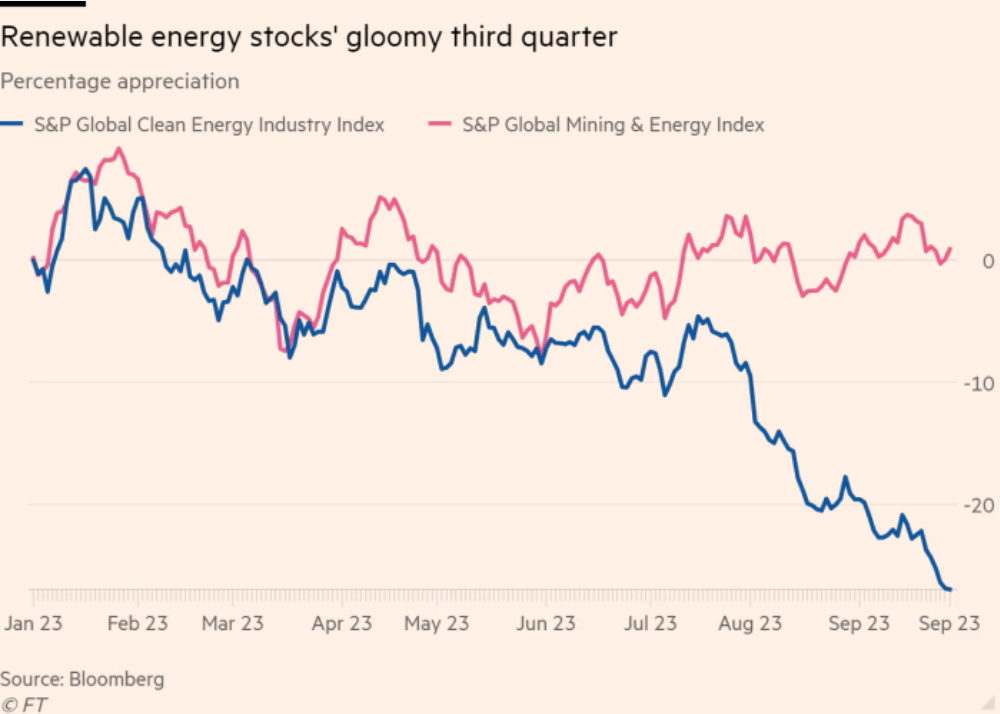

Electric car information