October 18, 2024

Costs of cleaning-up oil

Investors and the Environmental Protection Agency in the USA have both raised concern that there is a growing unaccounted for cost of fossil fuel sites in North America.

The accusation is that USA-based fossil fuel companies are not accounting for the clean-up costs of the end of life of their facilities when compared to their European counterparts who are forced to do so.

I would go one step farther and say that they are not accounting for the costs of maintaining their infrastructure as it moves to end-of-life.

The result is an overly rosy picture when it comes to their profits and stock valuations.

This is a classic game: pretend that the stuff you have to pay for later does not exist so it looks like you have more money today.

Unfortunately, when it comes to clean-up costs and the regulatory environment in North America, the USA-based companies may actually be correct. The way that investors get out of paying for site remediation is through large gaps in accountability when assets are sold.

The investors sell the asset just before it collapses to a (usually) corrupt business model that then declare bankrupt, offloading the costs onto investors that did not get out, workers, and the state.

We see this action over and over again in the USA and Canada. There are examples of it in Europe as well. Take the current dispute at Best Theratronics in Ottawa with Unifor.

Best is an extremely shady company that takes the offloaded assets from companies about to go bankrupt, pretends that it is going to invest to get public grants, runs the asset to fail, and then declares full bankruptcy while blaming "regulation" or "workers" at such a time that the previous owner no longer has liability on the site.

They did this in Belgium and look to be doing it now in Ottawa.

This isn't a new game, but it is one that regulators seem to be uninterested in ending.

For fossil fuel companies this is likely where they are going to go. We already have a slew of shutdowns of end-of-life infrastructure facing this:

- INEOS Styrene in Sarnia

- Berry Global plastics

- Polyester production just outside Montreal

All of these are either run to fail or bankruptcies that could have been easily avoided had investments been made or real buyers found as opposed to the scam outlined above.

In the end, the public are going to be on the hook for clean-up of these facilities where the ill gotten profits have been extracted by investors years earlier.

In Belgium, where Best shutdown their facility in dramatic fashion, the government has spent over a decade and €15M to clean up a very small site with many more years to come.

The costs to the public of shutting down these facilities should not be underestimated and investors making profits from these companies should have to pay into a fund now to support remediation.

Spending, inflation, and inequality

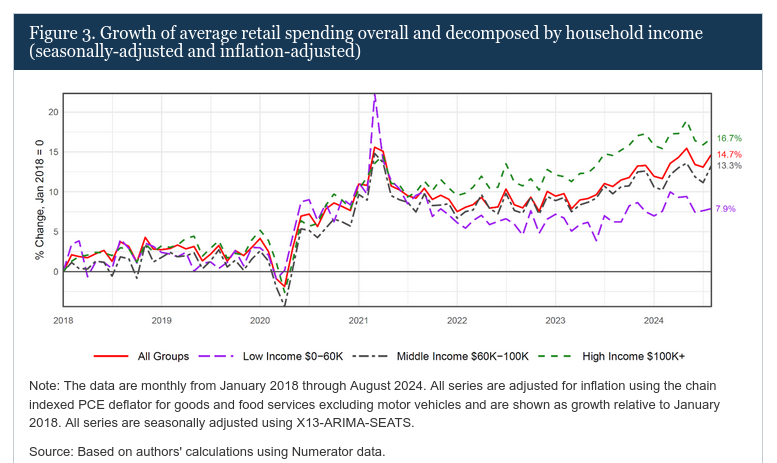

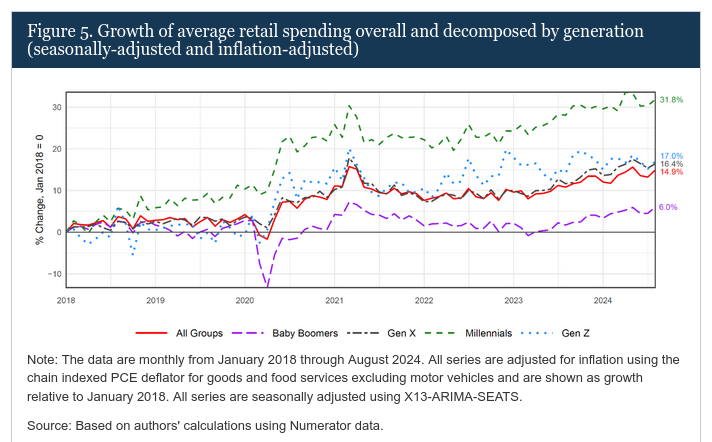

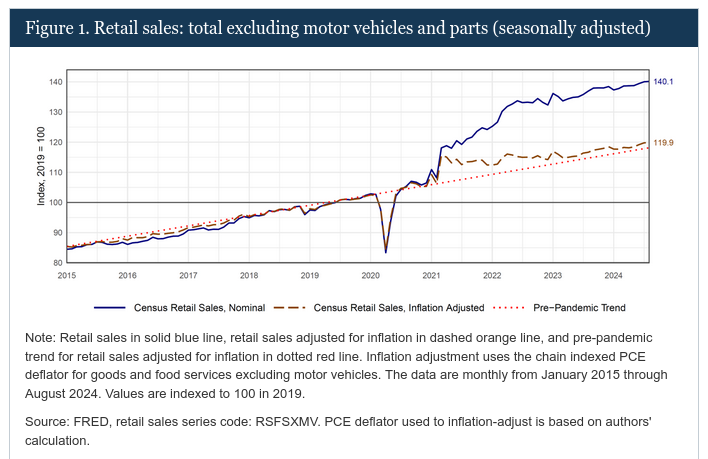

USA GDP-driving spending is being maintained by Millennials who have money to spend—because they are not saving for the future or because they are rich.

There is no surprise that it is the Millennial generation driving that spending since they are the demographic that have jobs and a need to spend. What is surprising is the size of the difference.

This is not new or unusual spending amounts in aggregate compared to the historical trend when adjusted for inflation, but given that it is only those who are affluent who are spending, it makes it clear that income inequality and wealth inequality has grown significantly since the pandemic.

Canada and immigration

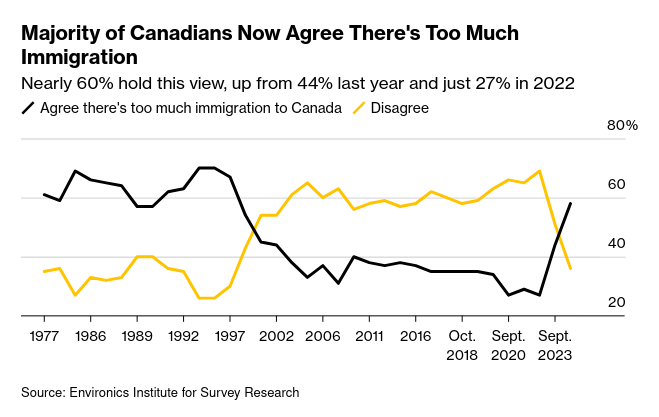

A lot is being made about changing attitudes towards immigration in Canada. The question is being asked incorrectly, however. It is not that Canadians are opposed to immigration, they are responding to the rate of immigration as it relates to their own economic prospects. This just means Canadians are just like everyone else in the world.

These stats have nothing to do with "immigration", it has everything to do with immigration being used as a proxy for economic sentiment.

The right-wing are all in on focusing on immigration as it is an old hate-focused rhetorical device of the right wing populist. However, I think that the Liberals and even the NDP are falling victim to the proxy discussion instead of the underlying issue: economic activity in Canada and the abuse of immigration systems to attempt to control wage growth and subsidize profits (as we have discussed before).

This graph remains very concerning given that this kind of attitude directed towards newcomers leads to very bad things.

Central Banks and inflation sentiment

Best quote from the back pages of the financial news this morning. It is in response to several papers from the federal reserve system in the USA talking about inflation expectations.

"The most crucial task of central banks is arguably not to keep inflation down, but to control people’s expectations on how prices will develop."

We are back to this narrative to explain how the Central Banks are really just sentiment drivers, not the organs of the state with their fingers on the employment and inflation dials.