October 17, 2023

Cross-country Mexico Train to compete with Panama Canal?

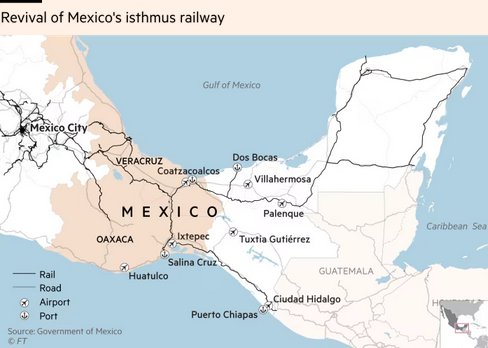

A project has been announced to reestablish a train across Mexico to transport goods from the Atlantic (Gulf of Mexico) to the Pacific and back again.

Panama Canal, which uses fresh water to run its locks, is not doing very well given the drought conditions it is experiencing.

While these trains could not move as many goods as a supersized Panamax sized boat, it would dent the industry's monopoly. That is, if they can build some ports in Mexico and if the price point is competitive.

This will be difficult to predict, but Mexico is leaning on the "build it and they will come" approach at the moment.

But, more important, it is a nation building infrastructure project that will create opportunities for transport within Mexico. It will also provide an opportunity for Mexico to build internal capacity to build modern rail.

Something that Canada could learn from.

Searching for ridiculous solutions to greener energy

Why do we keep dreaming bigger when we have not even implemented the solutions available to us.

Space-based directed microwave sun energy collection dishes.

Things are so expensive to build on earth that some folks are looking at these as a legitimate investment opportunity.

If you thing that the economics of this cannot possibly make sense, you should be correct. But, you are not.

USA's Air Force is looking at building one.

Some numbers:

- estimated cost of building a 2GW plant: $36B

- estimated diameter of satellite: 1.5 to 2 kilometres

- estimated diameter of Earth based collector: 13 kilometres

- Length of operation: 30 years

Of course, forget about how you get the stuff up there that would make this work. And that the thing would just become space junk. Also forget how such a thing could be used as a weapon.

Just why would we do this when we have technology available that doesn't require all that?

Bad economics. That's why.

Bad economics and transition to electric vehicles

Spot prices for the inputs to batteries for electric vehicles (such as lithium) have taken a nose dive. While this might be seen as a good thing for car prices, it is actually an indication of collapse in demand for electric vehicles.

This collapse in demand is from the struggling global economy. And, it is generally bad for the shift to non-climate destroying forms of transport.

China is a big part of this market and where much of the slow-down is affecting prices of these commodities. However, we have seen a pull-back even in the USA on estimates of demand for these cars. This is happening during the UAW strike and may affect union demands.

Battery materials are now expected to be in oversupply until 2030. This is a sharp turn of affairs since last year's supply chain snarls.

“Cobalt is one of the worst markets I’ve ever seen. I can’t remember a similar level of oversupply,” said Jim Lennon, senior commodities consultant at Macquarie. “For the next three or four years, the projected supply increase is almost double the market size.”

This shift is going have a direct effect on which projects for lithium and other rare minerals are going to go ahead. The cost of mining some of these minerals (like with the price of oil and the oil sands) need to be above a certain level to be economic commercially.

This is a good sign that the "market" is not going to be able to mediate the production of these inputs (and the outputs) to the needed levels.

Modeling risks of climate change

The Office of the Superintendent of Financial Institutions released a draft methodology for determining the risk of climate change on the financial sector.

Pension funds are not part of this program, but are likely impacted by the regulator's program.

The program is about a establishing a standard measure of risk under a changing climate. We hear about increased risk of climate catastrophes—and are already witnessing them—through the UN's IPCC and other forums. But, it is through these risk model exercises that we learn just how much it could cost the economy.

The regulator, unfortunately, is uninterested in doing a full modeling of the impact of climate change as it says that should be done by each financial firm. However, it is likely because it is so bad.

Regulated aspects under the model that are exposed to increased risk under climate change:

- commercial transition costs

- credit risk of firms

- real estate transition

- existing real estate impacted by catastrophe

All the things you would think a regulator like this would look at.

The real question I have is who is amassing the results of these risk models and adding them all together?

The broad impact of these real costs will have to be paid for and the "market" is not set-up to deal with such changes in costs.

Supply Chain by Amazon

Keep an eye on this project by Amazon.

The company has announced that it is expanding access to its massive logistics system to companies that do not sell on Amazon. This puts it in direct competition with not just the likes of DHL, FedEx, UPS, Less Than Truckload companies, etc., but also up against international shipping conglomerates like Transforce.

The company's announcement will further fracture the global logistics sector. Already some 25% of shipping is done through "platform" delivery. Platform mediated (or "freight brokerage" mediated) delivery resulting from deregulation has driven down costs of shipping through wage suppression.

The announcement of this comes at a time when companies are already oversupplied after panicked hiring just after the pandemic and a global economic slowdown.