October 17, 2022

Unnatural natural disasters

- $75bn: the amount that Hurricane Ian has caused the insurance industry. This does not include the amount of money that different levels of government have had to dish out. Nor does it include the amount of long-term damage and wealth destruction in the region. This is the largest amount the insurance industry has had to pay out since Katrina—even after changes that limited liability of insurance companies to natural disasters. We all pay for this through insurance rate increases, taxes, cuts to services, and the general elimination of wealth.

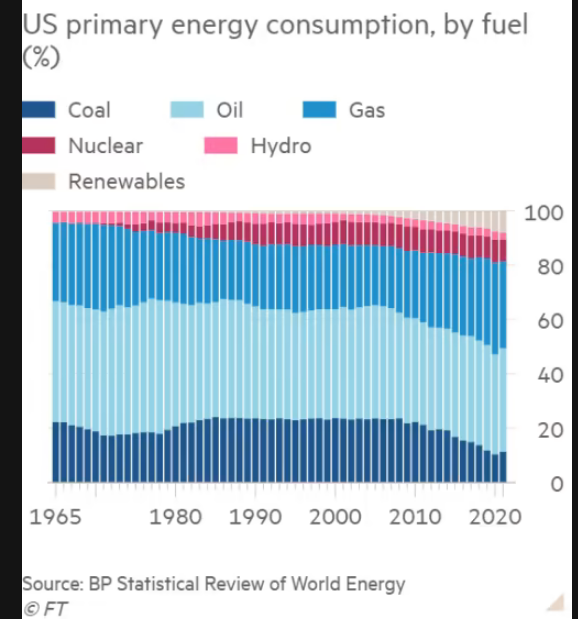

- A rational person might think that this would mean that there is a renewed appreciation of the cost of doing nothing when it comes to energy-related CO2 emissions. At least at a policy level. Unfortunately, while the USA is moving away from coal, investments in green energy are even less than you think.

It is a little surprising. Recession on the way, sky-high inflation, rapidly increasing private debt costs. All these indicate that there is huge potential for public investment for expanding green energy generation and efficiency programs. The centre left always outline how much cheaper public debt is than private debt. Well, it is significantly cheaper now than it has been in the previous two decades.

Pensions and the UK government

It is a very complex pension crisis in the UK that has caused problems for the UK government. That and Truss' blind faith in neoclassic rhetoric over reality.

It shows the complexity of the current budget policy environment. Unfortunately, the increased complexity of the real world seems at odds with the decreased sophistication of the policy debate happening in the public (by politicians and parties).

Also, if you ever wondered why central banks (the Bank of England specifically) exist, you have seen it in real time. It stepped-in to stop the collapse of pension funds struggling to deal with the short-term failing of its leveraged investments—leveraged bets paid for by their long-term investments.

Also, you might also see the massive transfer of wealth from private firms (like Goldman) buying up the rapid selling of longer-term assets from pension funds trying to find liquidity.

You might see that impact today as the BoE stops its direct support for pension funds and the government attempts to undo all announcements made in the previous month. The climbdown will be sold as something else, but the attempt to keep some of the measures originally announced by Truss on Friday did not land well.

The short pension fund crisis was caused by its own odd world of bonds, inflation pegged bonds, leverage (debt) based on estimated (and regulated) 30-year investment returns, equities, and a tonne of money. A decision by the government affected markets in such a way as to cause pension funds to be forced to sell long-term assets to cover its short-term bets. £1.4tn in defined-benefit pension fund liabilities in short-term bets.

The lesson is one that seems to be never learned: government budget policy affects real things beyond the amount of money the government spends on roads.

The liberals have built a government that most simply exists to manage fictitious financial markets which are almost as large as the entire real economy. Unfortunately, these fictitious markets are filled with real people's real money.

Canada

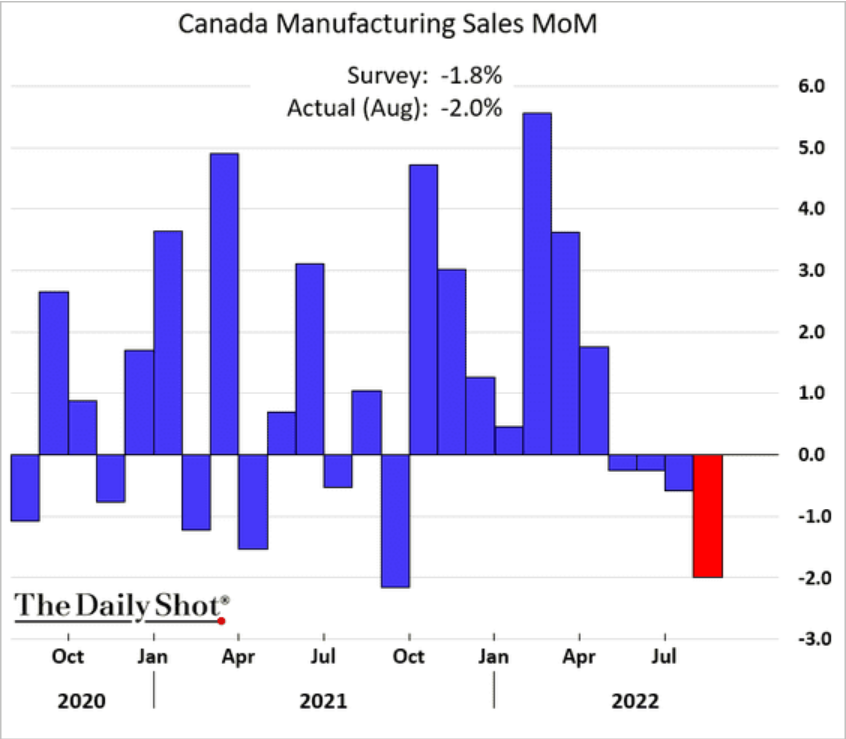

Manufacturing sales are down:

There is a slowing-down of the economy happening. The government borrowing rate is at 3.4% and the amount the Canadian dollar can purchase from those selling in USD is very much in decline:

These are not good things for inflation.

Inflation

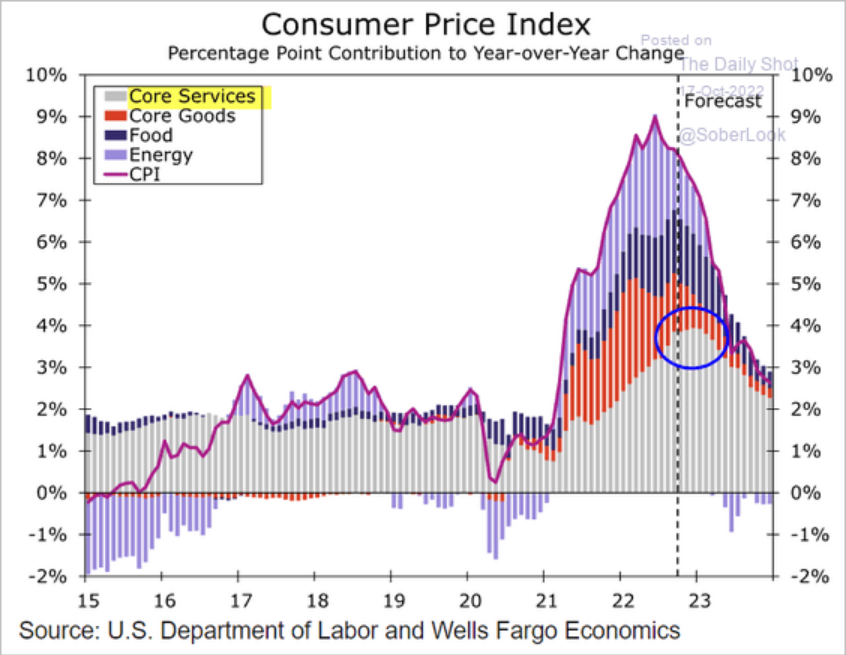

Continuation of the discussion about core inflation and why folks are focused on it. Here is a graph of USA inflation expectations:

Inflation in the pipeline is something that we can kind of see at the moment. There is a reduction in costs of transporting goods, a reduction in the purchasing of goods, increased storage of goods (that have been overproduced), and a slow-down in manufacturing. All this points to slowly decreasing costs.

However, there are things that point to increasing costs that are already in the pipeline as well: energy, rent, personal debt, increased cost of service which we have not seen yet, and food.

So, while "inflation" might be coming down. Real costs as seen by working people are not.