October 16, 2024

War and climate

A report by the DNV risk management firm points to a conflict between military spending and climate goals.

“There is a growing mismatch between short-term geopolitical and economic priorities versus the need to accelerate the energy transition,” Eriksen added.

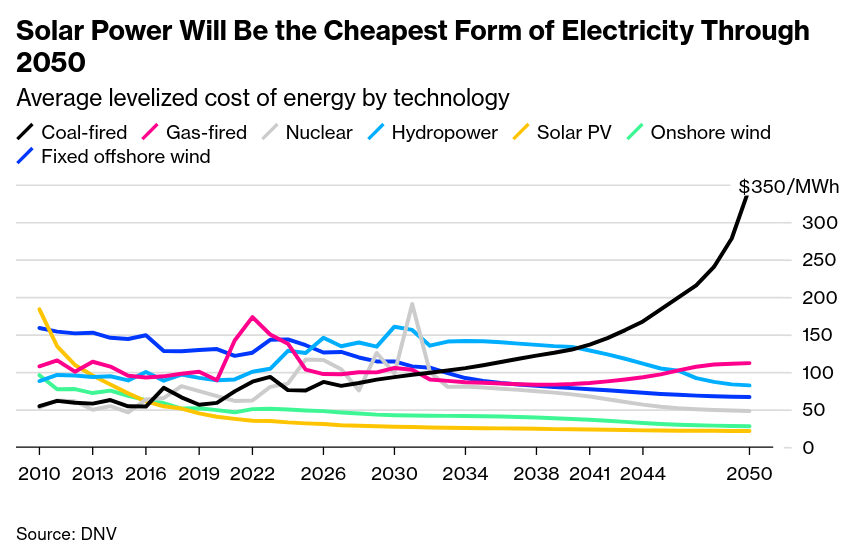

That said, major investments that are already in the pipeline have caused the cost of growing batteries in massive battery assembly plants and adding solar production will decline.

The cost of deploying solar panels and battery technology is due to drop by 19% by 2030, helping deliver record amounts of low carbon power, DNV predicts. A separate report from the International Energy Agency estimates an increase in solar capacity will account for 80% of renewable power growth globally until the end of the decade.

Small and large-scale solar is essential to stopping the growth of fossil fuel generation, but will only work if twinned with base load and energy storage capacity.

Some other obvious points that we have been making are outlined in their risk assessment:

- renewables are due to grow 2.2 times by 2030, well below the tripling set out during the COP28 United Nations Climate Change Conference,

- Hydrogen has been downgraded 21% as an investment opportunity after the flash in the pan profit subsidies subsided

- Hydrogen-related products will only provide 1.5% of global energy by 2040, down from the previous prediction of 2.6%.

- Carbon Capture technology is not expected to be a huge contributor to emissions reductions because of costs.

- Onshore wind expected growth is down 18%.

All these are related to the actual costs of implementing new builds of electricity and a mismatch between wishing for green energy and actually building it.

All this creates a different mix of energy than desired by the IPCC and by those governments promising changes to generation capacity to deal with climate change.

Because of the special mix of private sector investment subsidies and carbon pricing, we have a standard market-driven investment battle. Probably similar to what we would have seen without the complex trading programs put in place, which seem to only enhance private financial capital profitability than push transition to green energy.

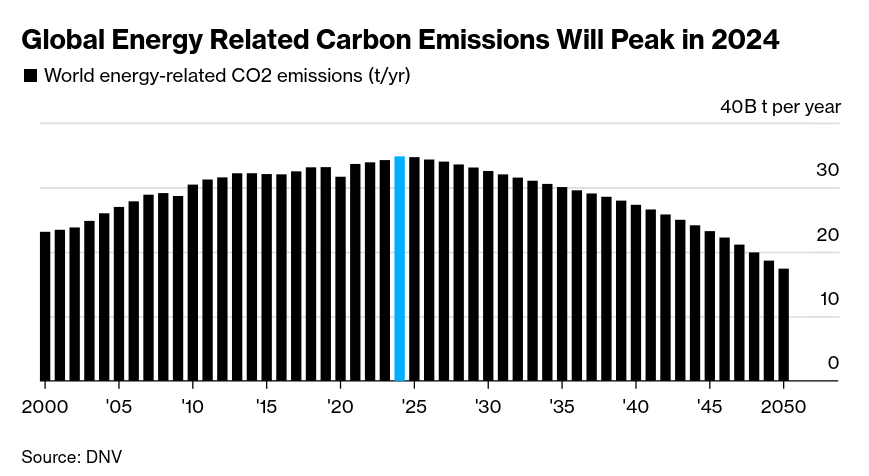

Emissions are now expected to peak this decade, a prediction made by the IEA and other agencies looking at emissions. This assumes that there is not geopolitical conflict and war to destabilize investment and policy focus.

The best case scenario does not get us anywhere near where we need to be. Estimated best case is 2.4 degrees above 1990.