October 11, 2022

Recession

The IMF (and World Bank) is releasing it's global estimates today. However, statements already released look like it is going to be yet another downgrade:

about one-third of the world economy will have at least two consecutive quarters of contraction this year and next, and that the lost output through 2026 will be $4 trillion.

The big issue is the rising cost of things that are not linked to monetary spending:

At an event later Monday, Georgieva said the IMF estimates that there’s a $9 billion shortfall in balance of payments coverage for middle- and low-income countries. The IMF’s creation last month of a “food shock window” of emergency financing will help meet those needs, she said.

The main price increases right now are not driven by too much money printing, they are systemic issues of production along with rapid changes to supply chains and energy costs.

I think that this is part of the Climate Change Price Inflation. And, there is no reason to think that it will slow down.

The IMF wants to fill the gap between ability to pay and costs with debt. The left liberal (Stiglitz) approach is to push for the IMF to eliminate the disincentives to increase borrowing (surcharges on "excessive" debt) applied to developing countries. While it is clear that these IMF surcharges are unfair, it is not enough to simply allow debt to increase so most countries can feed their population.

Bloomberg Economics released this:

Taken alongside a weak 2022, that points to a loss of more than $5 trillion dollars in global income relative to expectations at the start of the year.

"Re-shoring"

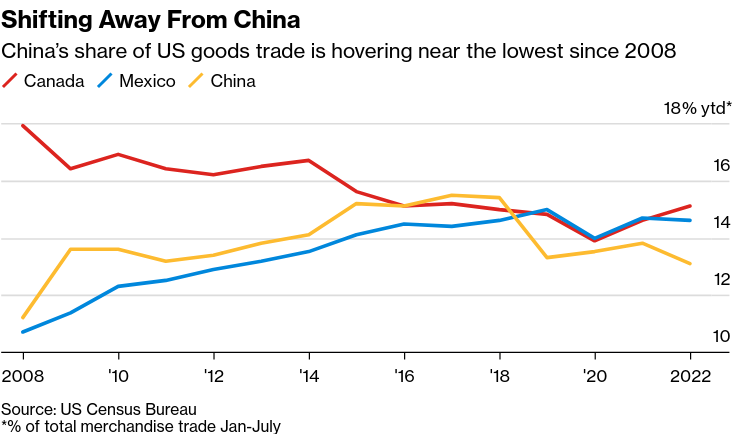

There is a great deal of comment in the USA about the push to re-shoring away from China for industrial production. A trend that really started in about 2015 when USA's overall policy to China shifted.

The USA's cold war that is in full swing with China creates a fog around economic numbers and conversations about "re-shoring". All comment about China's economy must be seen in this odd light of competition.

It is true that USA capital is shifting from China to places closer to the USA's boarders with lower wages—like Mexico. It is not so clear to me that industrial production in the USA is "re-shoring". There is definitely a shift for subsidized production promises of investment. Chip manufacturing, battery production, and mining come to mind, but it is only because of the massive profit subsidies being offered to these industries.

We will only see if there was "re-shoring" sometime in the future—if the profit subsidies were high enough to allow it.

Gilts and the UK economy

The UK's Tory self-harm budget continues to cause problems locally and globally. It puts to lie (again) the idea that the Conservatives are at all good managers of the economy—even for capital.

The funny thing is that the economic field is calling for Truss to "return to economic orthodoxy". Which is funny because Truss' policy is based on the rhetoric of economic orthodoxy instead of its reality. Talking about magic markets driving growth as opposed to the reality of government facilitating wealth transfer causing growth.

It isn't tax cuts that support investment, it is taxes being given to capital that support investment. Capital doesn't want tax cuts, it wants working people's money:

Kwarteng’s problem is that his new economic strategy has created a permanent £43bn fiscal hole — the total size of his unfunded tax cuts — alongside tens of billions of extra public borrowing to fund help for households and businesses with soaring energy bills.

The Bank of England has been in a bit of a situation trying to deal with the fantasy land economic policies the Truss government has been announcing.

The swift decline in the yield on the UK Gilts pushed pension funds to be forced to sell their holdings. This has resulted in some rather excessive market movement all the way across the debt sectors. Traders in bonds are not use to this kind of volatility and are complaining. So are people who follow pension fund investments where inflation linked gilts are supposed to be propped-up by government policy, not undermined by them.

It is a lot of money that is sloshing around and it isn't calming down any time soon no matter how much the Bank of England announces that it will "intervene". The Bank already intervened and bought inflation-pegged gilts—something that doesn't really make sense for it to own since the Bank is supposed to control inflation through setting the bond market. The move was just to try to stop pension fund's automatic selling of gilts.

Also, it is supposed to be unwinding ownership of bonds, not increasing them. Remember, Quantitative Tightening? Not so much.

On the flip side, it is an example of how nationalization of pension fund assets can (and likely should) happen. Pension funds are essentially demanding the UK government and the Bank shore-up their "market".

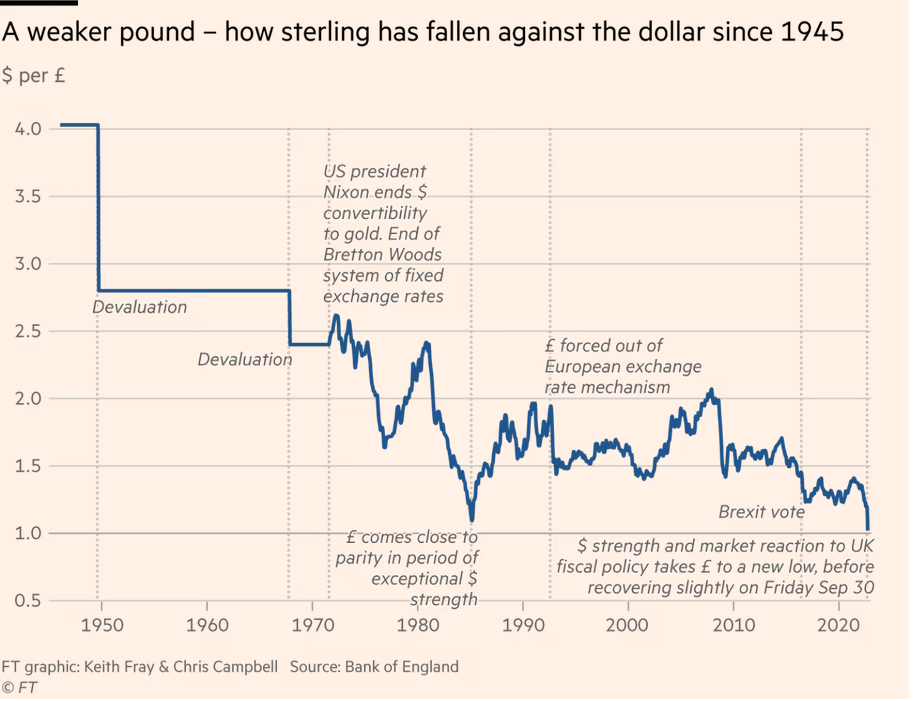

A little history of the Pound: