October 10, 2024

Port Strike vs Hurricane

Which did more damage to the USA economy and supply chains?

Even with the notice of arrival of the hurricane, the impact of wind and water will be much higher than the effect of the port strike.

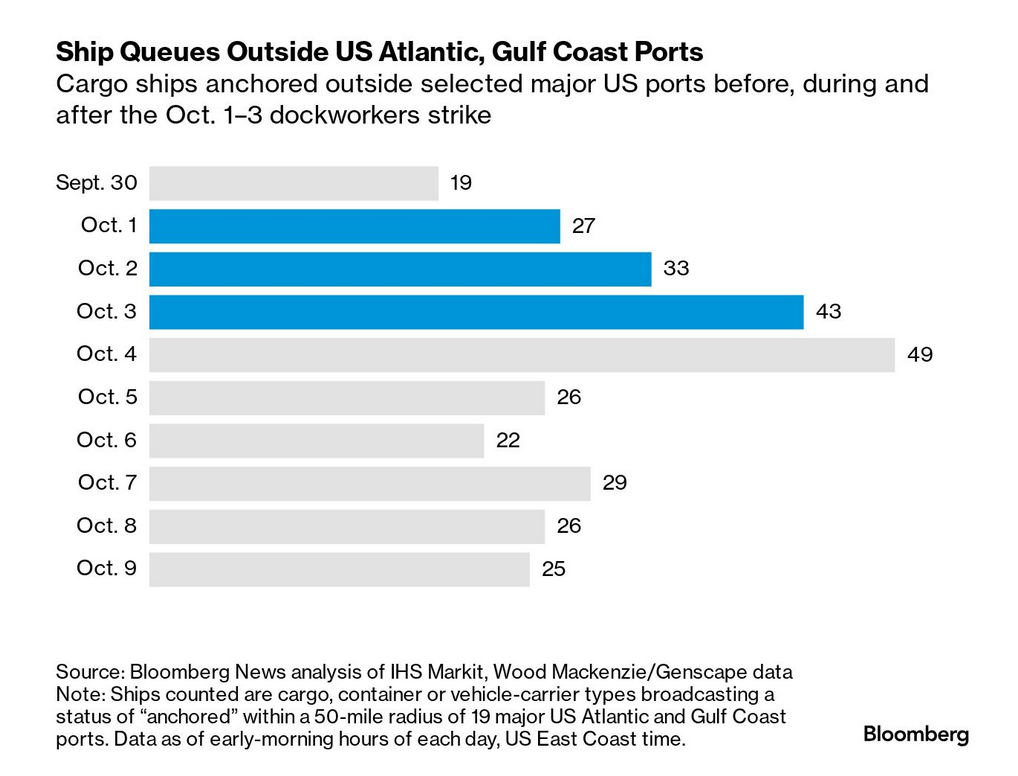

During the lead-up to the industrial action by workers to get a fair settlement from global shipping companies, many numbers were thrown around about the impact on the entire economy of the USA. The actual impact was minimal given that shipping, logistics, routing, and simple delay were cleared almost immediately. The impact was real, but extremely limited in scope.

The impact of Hurricanes Helene and Milton will be significantly higher. If ports are damaged, the delay is not a day or two, it is weeks, and who is impacted and how are not known. The damage would be less if capital was forced to invest in resiliency, alternatives, and—obviously—reduce carbon emissions.

The infrastructure in Florida is mostly built to withstand storms, albeit smaller ones than Milton. But what looks like merely high water and blown-over trees in pictures this morning will cost more than people realize. The knock-on effects of unplanned disruption and ongoing increased risk costs everyone.

“The current decade has already incurred $460 billion in damages [from cyclones], double the total losses from 1980 to 1999,”

– Allianz insurance

France

The technocratic and undemocratic government of France has put forward their pro-capital budget that reigns in spending and increases taxes equalling €60 billion ($66.4 billion US).

- over two-thirds from spending cuts across ministries, local authorities and the social security system

- just less than one-third will come from tax increases on the wealthy and large companies, but also on fossil fuels, driving up costs for workers.

The government plans include delaying the indexation of pensions to July 1 and limiting the rise in healthcare spending to 2.8%, an increase officials said was below trend.

The big concern among the right-leaning elite is that France's debt and deficit are beyond the limits established by the European Union. Those restrictions, while established by technocrats from France, are never adhered to by the French government. They were rules for everyone else. However, the current state of the government's books is terrible after successive waves of tax cuts and business supports brought by Macron's government.

Then they under-estimate economic growth to make the budget look worse. The government is saying that growth will be 1.1% in 2025. Compare this to 1.3% predicted by the always-conservative IMF.

We see this kind of thing everywhere. Tax cuts for the wealthy result in massive deficits, then spending cuts are announced as a way to "deal with the debt issue". Bond traders are then pointed to as "driving up borrowing costs" because if the market does not continue to see profit subsidies, the investors go somewhere else.

We shall see if the French are able to stop this and finally get the government they have consistently voted for since Macron was elected.