November 8, 2024

Canada vs USA economy

The value of the Canadian currency versus the new Trump USD is not doing so well.

When no one is looking, sometimes the bank economists say what they really mean:

When no one is looking, sometimes the bank economists say what they really mean:

While tariffs and a softer loonie might add some upward pressure to prices, economic weakness may still hold inflation below the 2% target, keeping the Bank of Canada in easing mode, the Bank of Montreal economists said.

There is also a large distance between yields on Canadian government two-year notes and US treasuries, widest since 1997.

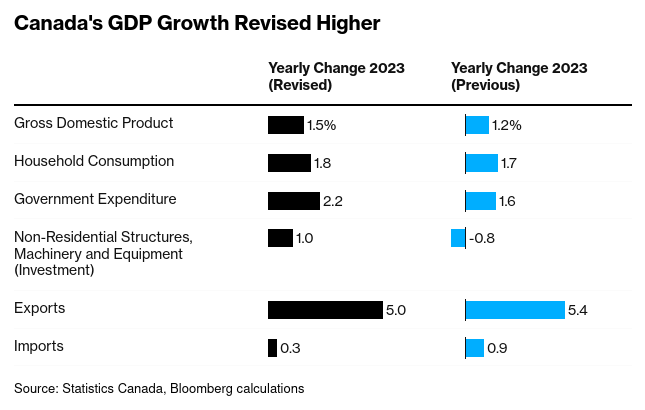

This is even with numbers for economic growth being revised up.

Capital's narrative to the public around this:

- there is a productivity crisis

- it is a worsening productivity crisis because of no investment (high interest rates and lazy workers)

- taxes are too high and hurt the productivity crisis more

- Trudeau's tax program is at odds with the planned tax cuts in the USA and that will make everything on the exchange with the USA worse

- the Bank of Canada now has to balance the currency trade implications of Trump with Canada's lagging corporate investment.

Let's unpack that a bit. We have talked about the productivity issue previously, so we will leave that aside for today.

Capital's narrative masters (let's call them bank analysts) think that

- the Canadian economy has a productivity crisis because lack of interest by capital in investing in Canada.

- lack of interest is because of high taxes

- tax differentials matter to investment decisions because they affect profit rates

- the main thing for Canada to do in response is to provide equal profit subsidies (through low rates and low taxes) as the USA.

- that workers make too much money

This is coming off one of the largest increases in inflation for decades because we gave capital too much money.

And, that this will directly impact our potential GDP.

(Let's put aside that they ignore their own narratives that Trumps spending on tax cuts and profit subsidies are inflationary. Because dealing with internal contradictions of banker narratives is too much for this morning.)

Investment, productivity, and trade is a real problem that we have been consistently talking about.

But, what about exchange rates operate the way these bankers are saying?

In the classical theory, exchange rates between currencies are caused by the difference between profitability of production.

If it is more profitable (not necessarily "cheaper") in one country over another, investment will flow into that country. More investment will result in increased production and increased output.

The result is that there will be a structural imbalance in trade. One country will have a trade surplus (the higher profitability country) and the other will have a deficit (the lower profitability) country. And, that this will be sustained even if the government tries to manipulate its currency.

But, that's not what neoclassical theory says. It says that trade will balance automatically unless the state is intervening to artificially drive down their currency.

Trump and others have consistently said that China is a currency manipulator and "cheating" when it comes to trade.

However, from the classical analysis this is ridiculous. China has a trade surplus because producing things in China is more profitable because it is cheaper to make things there than here.

What Trump has been campaigning on is going to result in a pumping up of production through standard American protectionism and attacks on workers to drive up profitability.

And, we see exactly this with the current exchange rate shifts between Canada and the USA. It is not about currency manipulation, it is about policy on profitability.

Why explain this?

Because neoclassical bankers when writing policy—and when Trump speaks at rallies—articulate a neoclassical view of the world that doesn't match reality.

But, when they both actually say what they are going to do with money, they follow a classical analysis, based on how the world really works.

Now, I am not saying that Trump and investors have an understanding that this is "Classical" economics. Trump rails against Marxists, after all.

But, it does show you that the neoclassical view is not the one held by actual business people and investors.

Real investors invest where profits are highest. And, that is what the bankers say and Trump implicitly knows.

Trump is going to do everything he can to pump up profitability and investment is going to flow into the USA. It is going to be disorderly and highly destructive in the medium and longer term, but it is going to be successful.

How should Canada respond?

Well, we should not take the bait and attempt to pump up profitability in the same way, because competing on profit subsidies with Empire is not a winning strategy.

Reliving the race to the bottom of the 1990s to today is not going to go well for workers or the environment.

But, there will be increasing pressure to do so.

Canadian technocrats—both Liberal and Conservative—are neoclassical ideologues; they are True Believers in this theory of myth.

If we are going to survive Full Trump, we are going to have to start thinking about investment in Canada that is not totally reliant on private capital. Just as we should have been when fighting over investment with companies in China.

This is what we mean by industrial strategies. Private capital is going to be limited here by decisions of the USA government. To combat that, we are going to have to prop-up industries we want to keep and engage in trade programs that support that.

This means protecting some industries and looking to expand export markets with Not the USA. Other countries are going to have to do similar things.

And, we can have a look at the recent numbers from the Canadian economy to learn these lessons.

Investment in Canada is soft partly because we do did not respond even to the new realities of the IRA and CHIPS Act in the USA.

The growth drivers are natural resource extraction without value addition and direct government profit subsidies.

Canada's economy was revised up in growth because of these two things, but this is not sustainable under the current policy model

To sustain that, it will mean a different kind of tax and spend regime, one that focuses on productive aspects of our economy in addition to social supports.

If the situation normal continues, it will be a continuation of low investment, low productivity, and sliding standards of living because of bad tax policy.

Some data

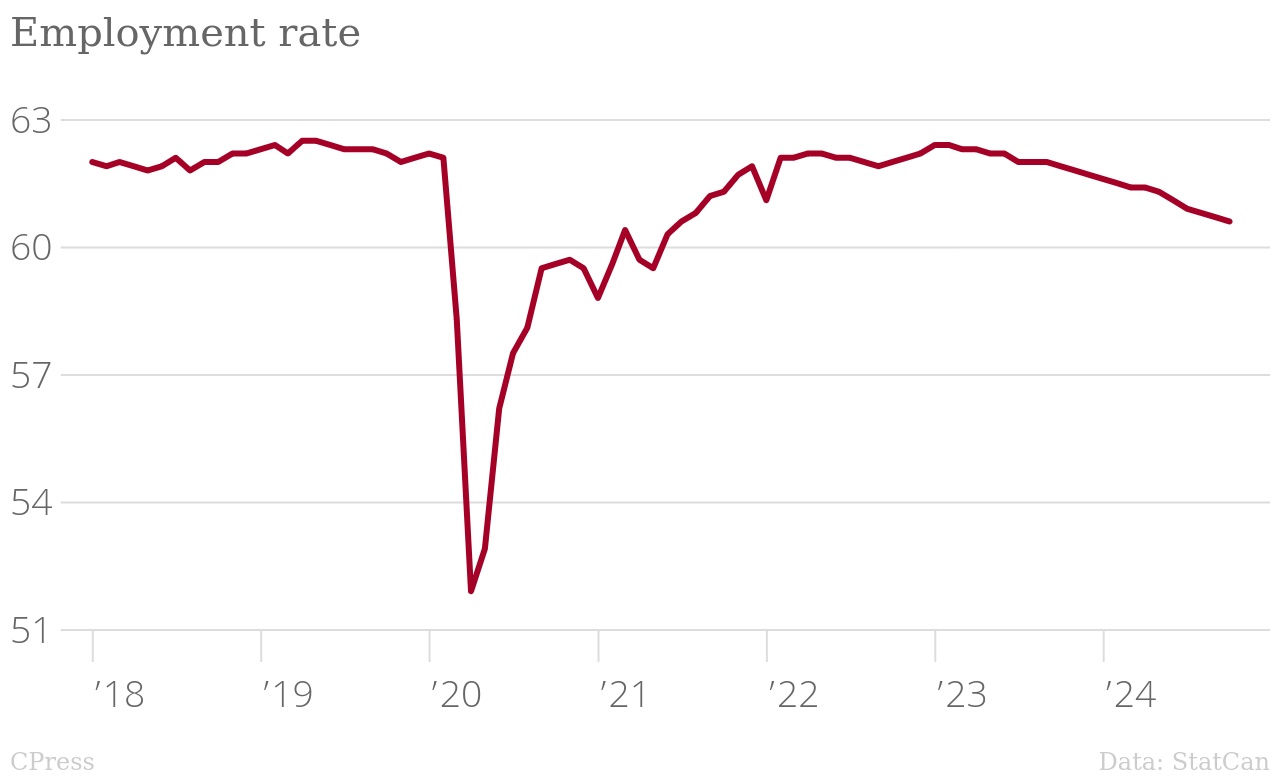

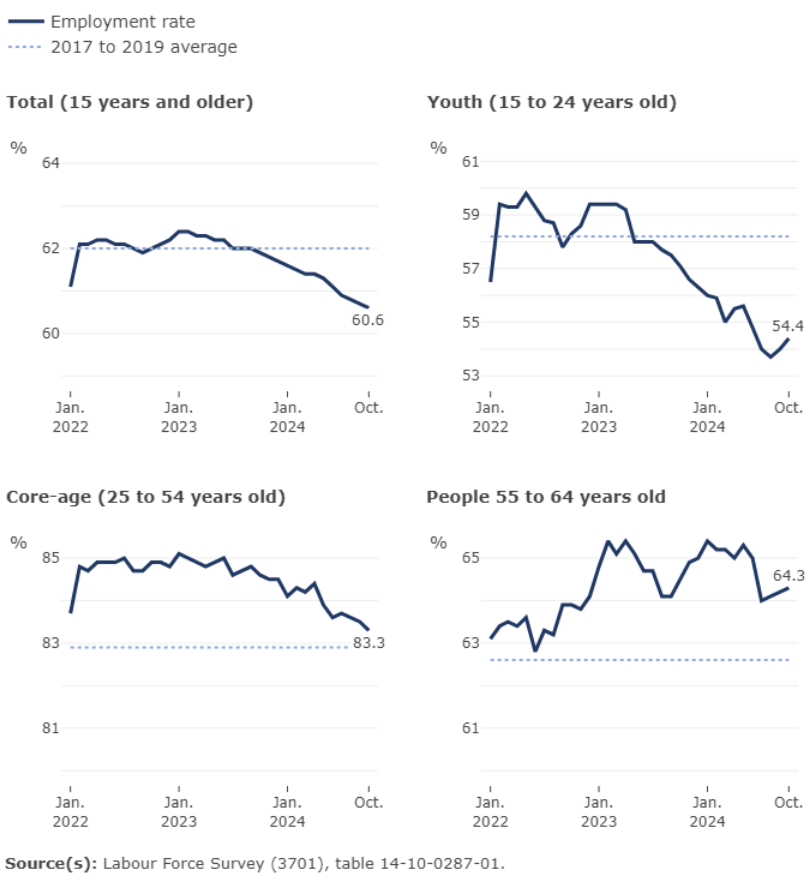

Canadian Employment numbers show that immigration will stay in the headlines pushed by politicians who blame people instead of policies and investment.

Working class anger continues to drive general sentiment. People do not like their jobs. This sustains some capacity for labour militancy. Unions have room to sustain that push for wages for a little while longer, even in the face of declining inflation and looser job markets.

just over 6 in 10 workers (61.3%) reported that they were very satisfied with their job; that is, they rated their job satisfaction 8, 9 or 10 out of 10. This was down 0.9 percentage points from October 2023 (62.2%). (StatCan)

In the USA:

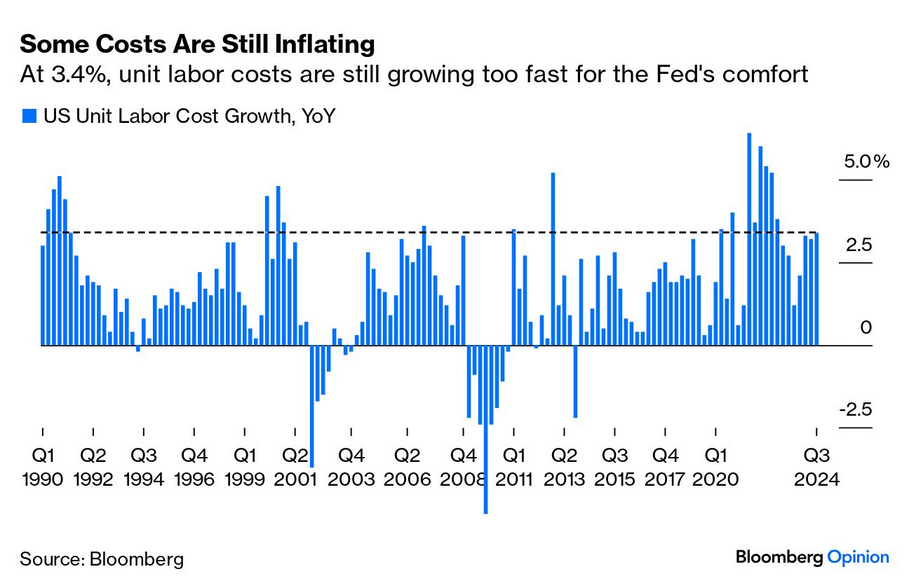

In the weird politics of Trump and Central Banks. The US Federal Reserve is saying that wage gains in that country are too high. (Remember wage-price spiral nonsense, well it is still there).

The "independent" federal reserve will work with Trump to lower wages even as it pretends to be at odds with the rest of his policies supporting capital.

revisions to prior data suggested that labor costs had been rising faster than previously thought. That should be good news for the strength of the economy and living standards, but suggests inflationary pressure is still around. (BN)