November 7, 2024

Trump's impact on equities and markets

You can tell exactly what the investor class thinks a Trump presidency will be like.

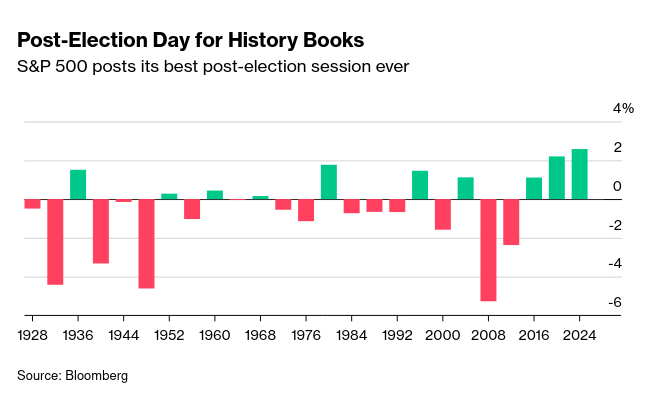

Equities had the single biggest growth day ever (post-election).

Trump's promise of pumping up the economy with workers' money has equity markets in ecstasy.

Private prison company stocks surged on the expectation that more people will end up there.

Furthermore, if we look only at onshoring-related stocks, we see some very large movement upwards, including transportation stocks.

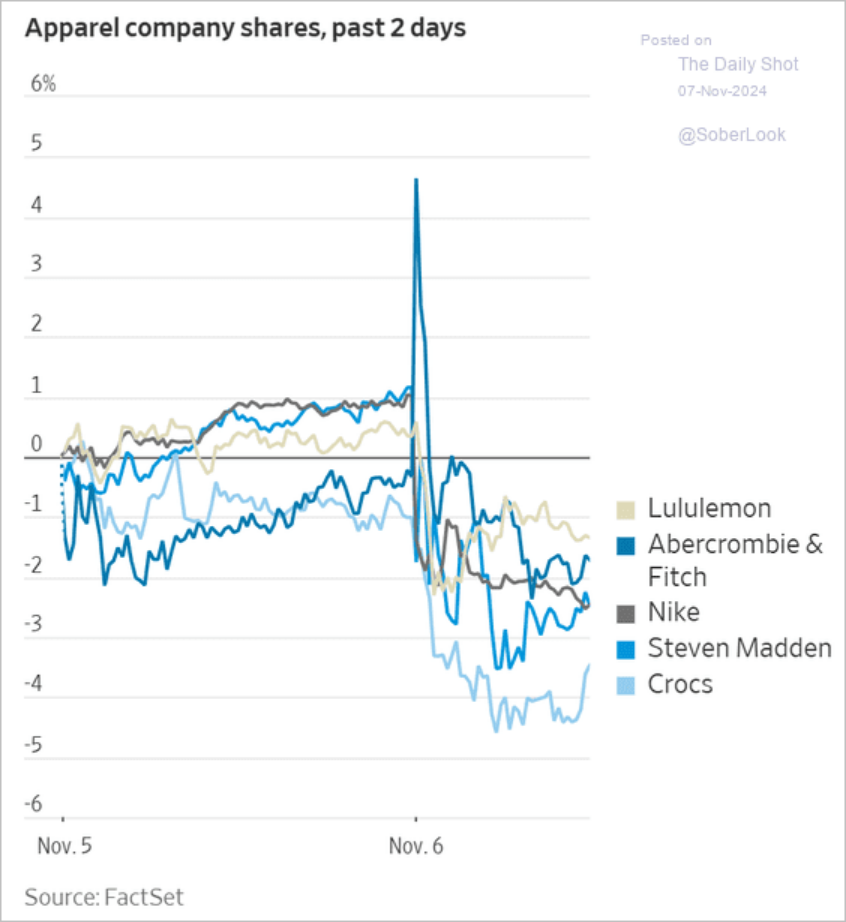

And for those that are offshoring stocks, we see the opposite movement:

Declines were seen across the green economy and cannabis markets, as well as municipal government bonds. Traders shifted their money away from bonds and commodities and into equities.

There were also concerns from the USA's trading partners. Germany, which will also likely see a snap election called, exports 50% of its cars to the US market.

Vaccine manufacturers are having a bad couple of days as there are worries that RFK Jr. will have some sort of role undermining the Food and Drug Administration.

This bubble (and more focused collapse) will ease a little as investors realize that the program is going to be slower coming than they think. Nonetheless, the expectation is a return to the 1990s level of profit subsidies.

The impact on the real economy is not so certain.

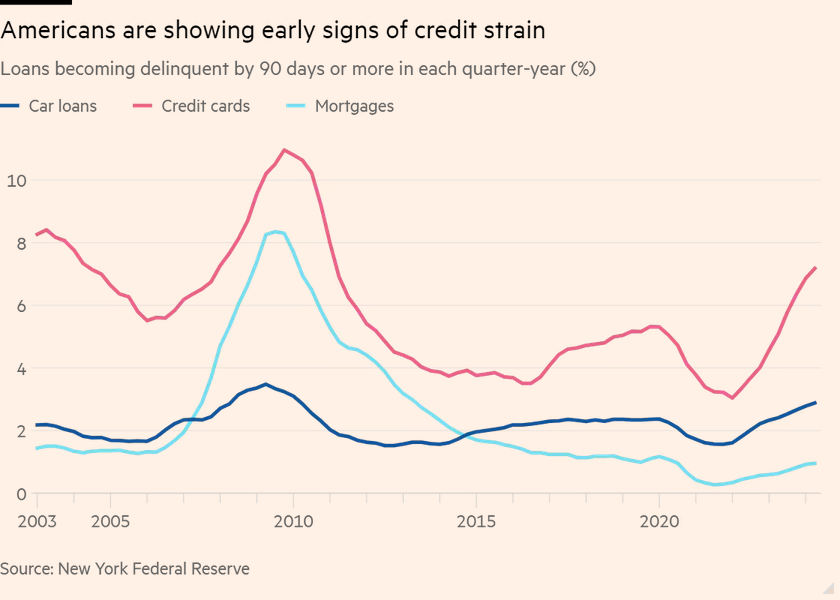

For the American worker, things are not looking so great. With neoclassical folks who run the actual economy and central banks around the world seeing the Trump plan as inflationary, interest rates will not fall as fast as previously planned.

That's not great for the American "consumer":

Canada

What will Canada do in response to the Trump election?

Liberals around the world are wearing down their hands wringing them with worry. Trump upends their dreams of a global technocratic dominance of "sensible" integrated policy.

The Liberal Government is concerned about trade agreements and export markets for Canadian goods and spouts rhetoric about investment in green things.

The Ford government in Ontario has reached out to the Trump folks (Do we even know who they are yet?) to declare their right-wing friendship.

In reality, we do not know what the impacts are going to be. Trump doesn't really have policies, let alone know how to implement them. Like Musk, Trump is an ideas guy. Lots of ideas, most of them completely contradictory. He will leave it up to his sycophants to (pretend to) implement them.

The response from Canada should be the same as it would be to Harris, only now we need to do it with more sophistication and speed.

The ground shifted five years ago; it isn't shifting back.

Industrial strategy will have to be part of our program. It should have been anyway, but it is now a political program that will be forced on us.

A Trump USA is going to upend trade even more. It is going to cause geopolitical instability for its own interests, and it is going to be an aggressor from afar. This means that everyone else is going to have to rely on internal production more.

This is not because the WTO will stop attempting to impose bad policies or because trade will halt. It is because any disruption in those systems will impact economies.

The Canadian economy is coupled to its export market and its export market is mostly to the USA. This will have to change, not because we want it to, but because the Trump administration is going to make it impossible to rely on that market.

That means major changes could be coming to private investment in productive capacity here in Canada. We were already facing closures and over-investment in capital intensity (automation).

The question for the left is where we think investment should be directed.

Environmental groups will say that this means speeding up the energy transition in Canada. But this will be difficult with capital in the energy sector being pulled back into oil and gas.

Transport companies will say that it means we need investment in ports and stability of operations.

Freight rail companies will be impacted by cross-border trade, but will be making absurd amounts of money from a shift in transport in the USA and loosened regulations brought in by the Biden administration.

I believe that the investment should be in production for the Canadian people's needs in the face of unknowns from the USA. That means investing in value-added production and shoring up capacity in sectors whose export markets will be affected by Trump, and in trade programs with countries that are outside that orbit of influence. Most likely, this means Latin America, non-China Asia, and Europe/UK.

That's going to be a hard bargain. Those areas tend to see Canada as America-lite because of the previous 30 years of Canada being America-lite.