November 29, 2023

Global growth

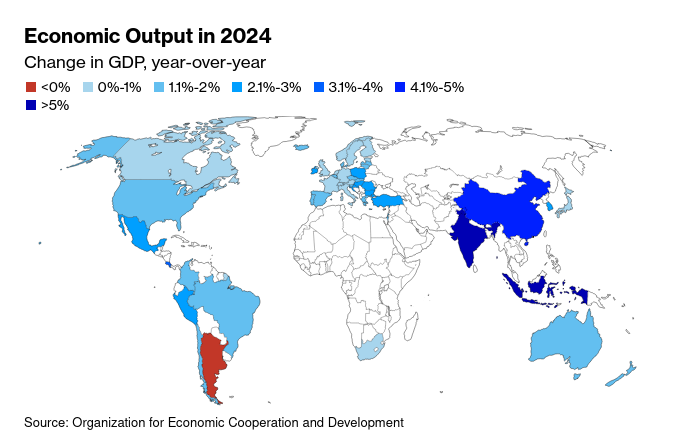

The OECD has released its predictions for global growth scenarios. This is the start of the end-of-year fortune telling season.

The take-home messages:

- Canada had 0.8% growth this year and predicted to have 1.9% next year.

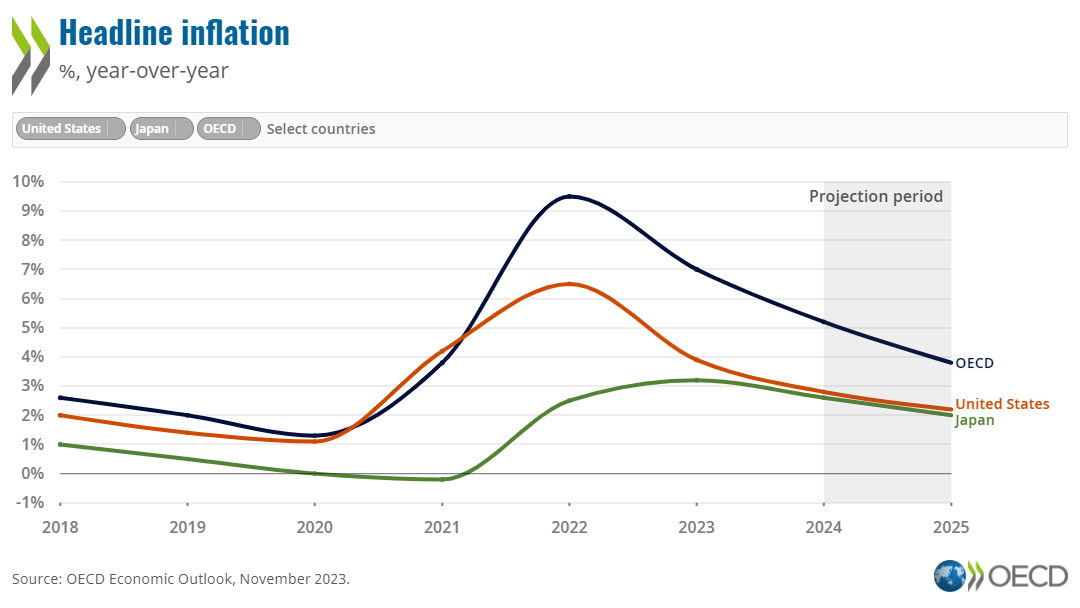

- Inflation is predicted to return to 2% at the end of 2024

- the global economy was likely going to avoid a recession, but that this was not necessarily guaranteed.

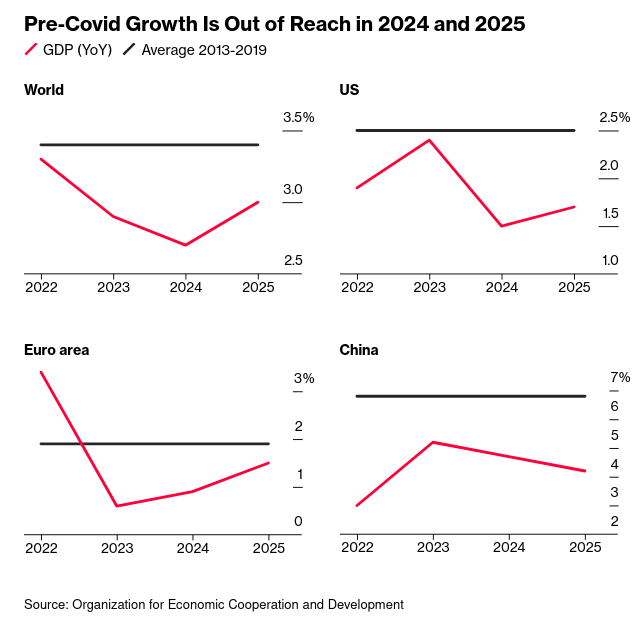

- growth was well below pre-Covid growth

- Central bank interest rates are unlikely to come down until the latter part of 2024 and into 2025 with an optimistic increase in net exports predicted.

The OECD is not great at predictions. They tend to predict the return of the status-quo and they have essentially done that here.

They also tend to write these notes based on their own ideology. This report is no different.

The Country report focuses on borrowing, spending, and "macroeconomic policies" constraining demand. They blame "excess" demand caused by Covid money for price increases.

The OECD's policies recommendations are important review as you will find that the Liberals tend to align their policies with the OECD. Childcare is supported, for example, for all the neoclassical reasons discussed before.

One thing that stands out is the recommendation that Canada increase its "indirect" taxes. Namely, the GST.

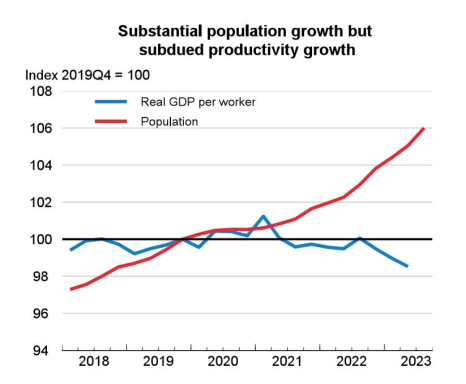

Finally, the OECD predicts that Canada will have an ever increasing population, but that productivity will continue to be stuck in the mud.

It is important to remember that pre-Covid growth was not so great with some economists saying that we were already basically in a depression.

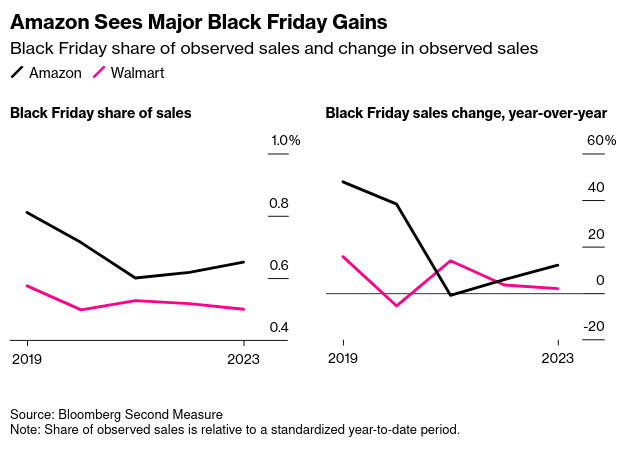

Black Friday and Cyber Monday Sales way down

- 4% drop in sales in the USA.

- Even Amazon and Walmart that rely on this time of year to bolster profits by selling stale, out-of-date items did not fare well.

It would have been a good time for a 90's "Buy Nothing Day" redo so they could claim victory for once.

Drop in Canada's farm expenses

In some rather good news, farm expenses did not rise as fast as expected in 2022 (the year we have data). Of course, there was still a drop in net income of 7.6% in 2022.

All because inflation caught-up to program expenses.

2023 saw an increase of 7.9% in cash receipts (this isn't profit) because of continued re-balancing of production to pre-pandemic levels. StatCan reports declining program costs, but I think that they are really just confusing per-unit production costs with actual total program execution costs.

Realized net income for Canadian farmers fell 7.6% to $11.8 billion in 2022, as growth in expenses outpaced the rise in farm cash receipts.

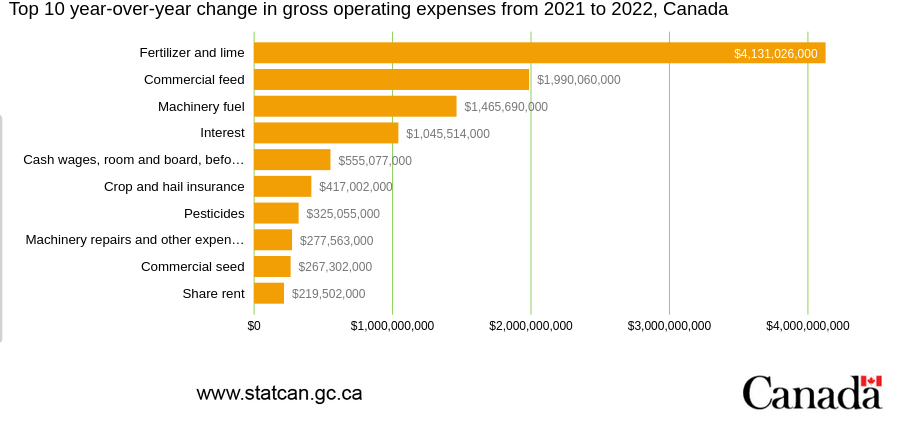

The largest increase in cost for the 2021-2022 was the price of fertilizer and lime. A year-over-year change of 54.4%.