November 28, 2022

Prices

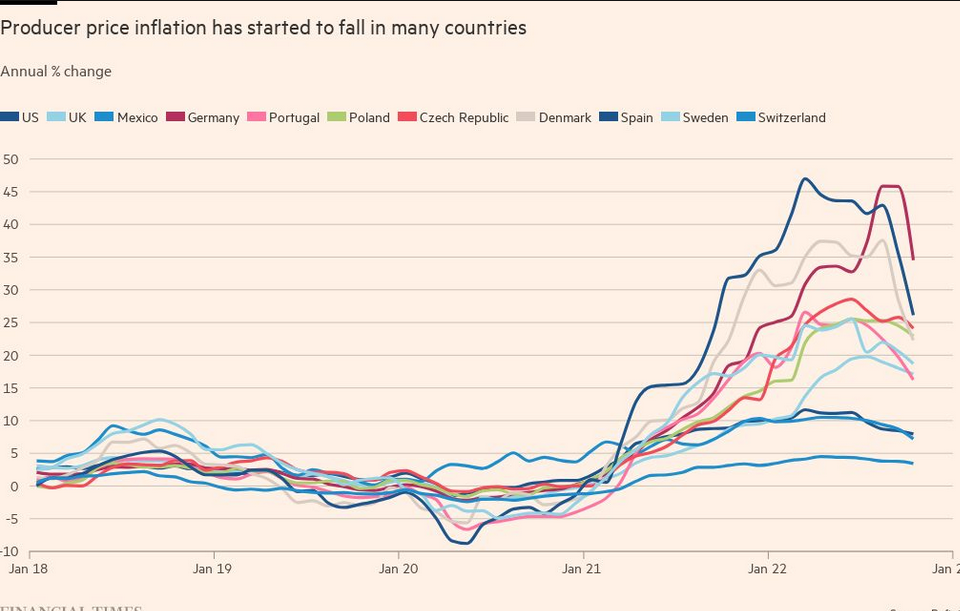

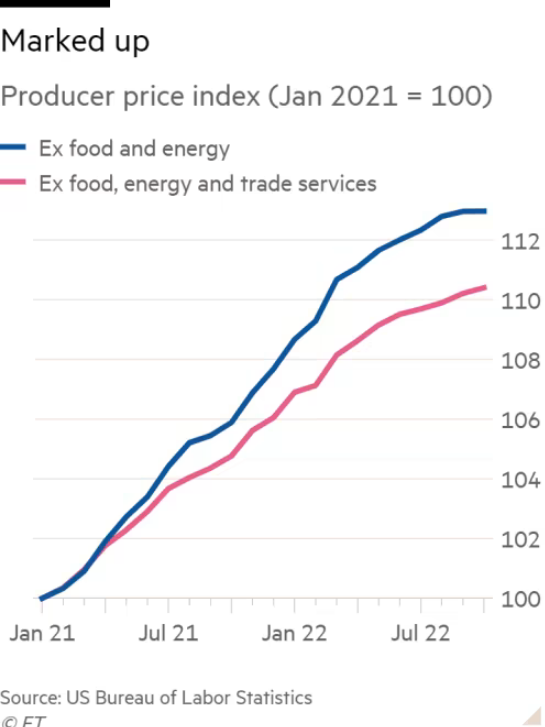

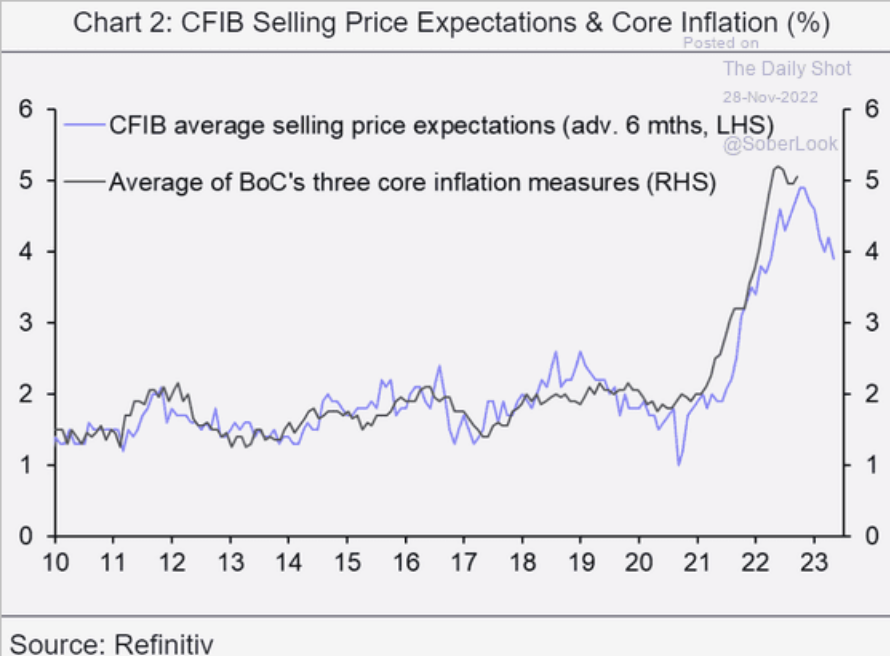

The cost of things is not coming down for consumers. But, maybe for producers.

Price increases might be meditating, but the market is still keeping prices high for consumers. Putting things on shelves is expensive.

Expectations seem to be detaching further from reality. It is unclear if this means actual price decreases in our future.

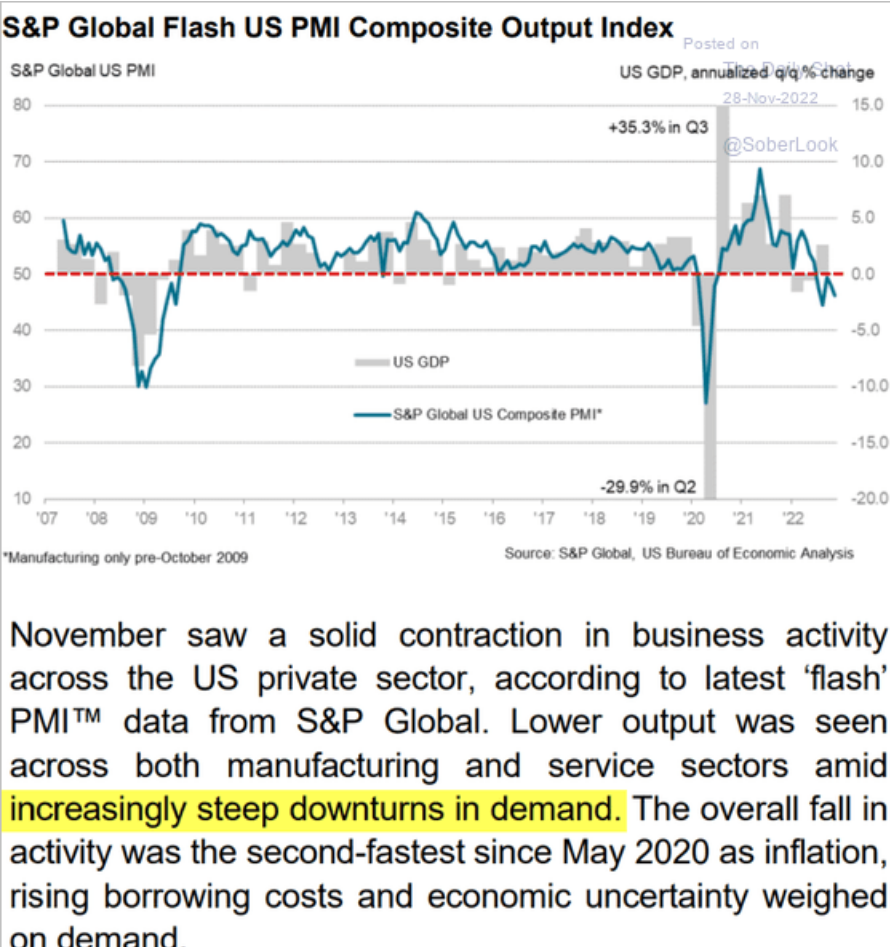

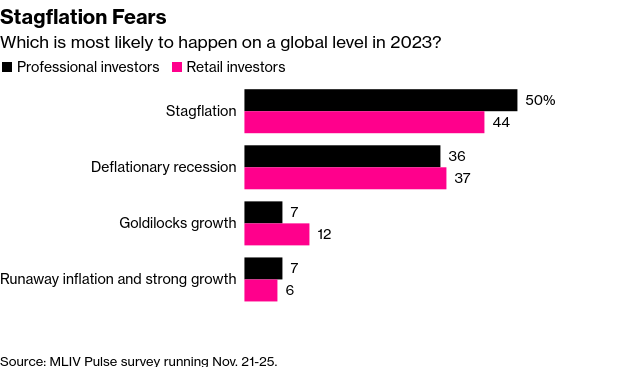

Input prices are mediating from their highest points, but the cause of this will impact prices. If the cause is that no one is buying things being made because of a recession, the price might mediate, but people cannot buy the things. This is the outcome that central bankers are pushing for. It isn't a good outcome.

Decline in jobs/positions

Layoffs continue to be announced by major and minor retailers.

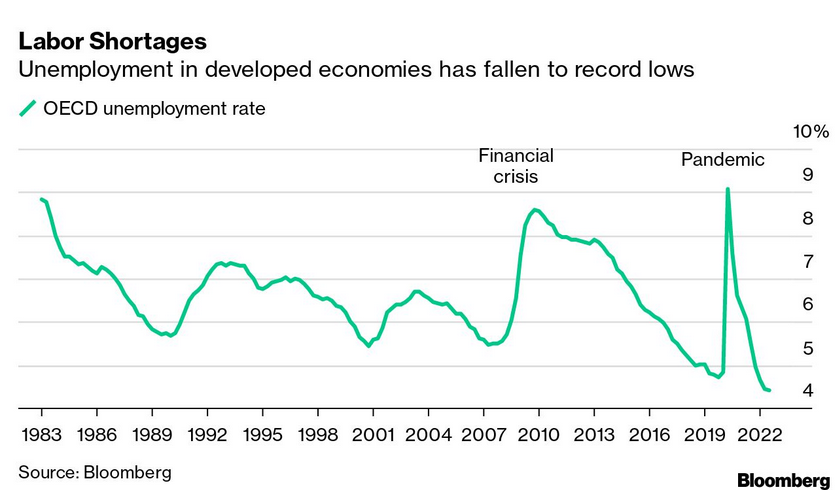

The business press is outlining how this is a "good" thing because it will free up labour mobility even as employees keep their jobs because of "labour market tightness".

This analysis is nonsense and based on the flawed reading of "unemployment". The unemployment numbers should not be read in isolation of labour participation rate. And, the labour participation rate has not reached pre-pandemic levels yet. There are many reasons for this, but simply saying that the most desperate workers are finding jobs so the economy is over heating is bizarre.

As prices go up and wages do not keep pace, "labour shortages" (read: labour shortages at this wage) will continue to be a thing.

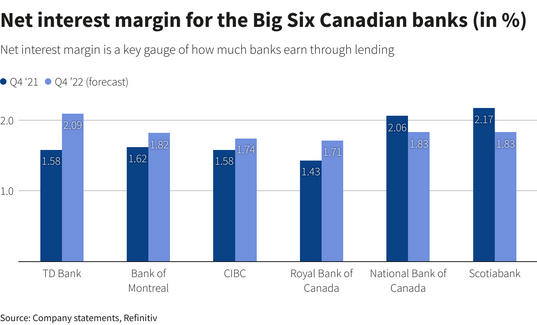

Banks raise rates

It is a multi-pronged economic attack on workers' wallets.

Which will do nothing for the housing market. Mortgages account for nearly 65% of banks' domestic loans.

Work from home

- According to a new study from CEPR in the UK, work from home could spell trouble for cities.

- If there is no change in policy to support access to cheaper housing, London (and other cities) will continue to see an export of those jobs that are able to be done from home.

- The out come of this null model is increased inequality in terms of access to housing, services, and nice cities.

- I personally do not buy it as higher paid work is also work that can be done from home. And, inequality in pay is the reason that things are still expensive in down town as those with higher pay withstand the recession and inflation easier.

- That said, it will likely push things in the wrong direction.

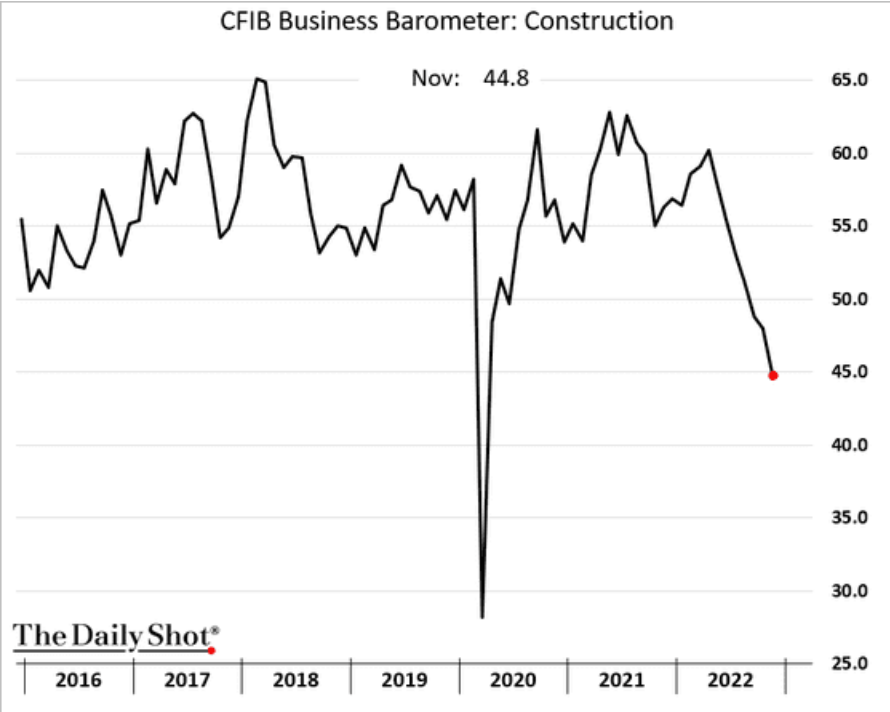

Downward

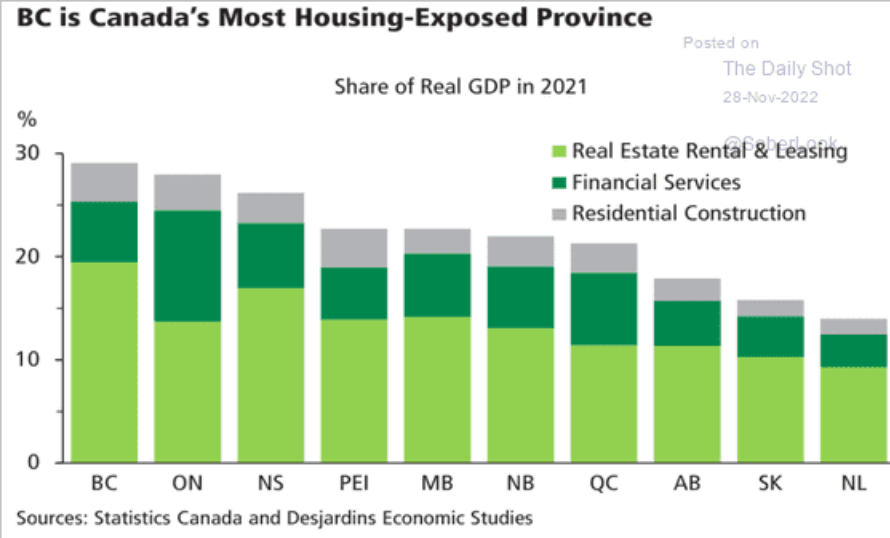

Here is a collection of graphs showing USA and Canada declining economic conditions.