November 23, 2022

Central bank narrative

Central bankers are playing with different narratives as they seek to avoid blame for inflation and economic recession.

- "more variable inflation"

- "supply-side limited production"

- "below nominal outputs"

- "reversal of globalization"

- "working-age population decline"

- "climate change events"

- "energy transition commodity cost pressures"

It could be a list of things caused by capitalism's inability to deal with the barrage of issues that it has created. But, this is a list of issues that Australia's central banker has outlined as reasons that make it "harder" for central banks to control inflation and speed of the economy.

All the above were mentioned in a speech announcing interest rate increases along a very fast tightening schedule laid-out by the bank.

While it was almost an admission that the central bank is unable (and was never able) to "control" the economy's output, it did not stop the policy from being implemented. Into recession we go!

There is an opening here in the dominant ideology. Even Martin Wolf of the Financial Times agrees that the state needs to step-in and save us from some of these crises:

And no, the market is not going to deliver the needed transition fast enough. But there is now a significant chance of delivering safe, secure, clean and cheap energy to all. Moreover, the possibility might, properly supported, generate a global investment boom that would absorb excess savings for an extended period. (FT)

Unfortunately, the answer is more of the same policies that got us into this mess: profit subsidies.

Broadly speaking, five policy changes do still need to be made, or strengthened: increase investment in scientific research; increase subsidisation of the application of new technologies, with a view to accelerating learning-by-doing in each, as well as speeding up investment in complementary technologies; cease subsidisation of fossil fuels, which amounted to $700bn in 2021, other than in carbon capture and storage; introduce carbon pricing in one of several possible ways, perhaps by preventing prospective declines in energy prices from working their way fully into the market; and de-risk finance especially in developing countries.

This was all in an article outlining that profit is the only way to get any private market investment (which is correct).

The problem is that the direct profit subsidy the state can provide does not drive real investment when there is no profit to be made from the market.

Keynesians believe otherwise. The model for state-supported investment is to spend lots of money in the hope of the magical process of capitalism creates the alternative. So, support "innovation", provide cheap money, and poof a better future appears.

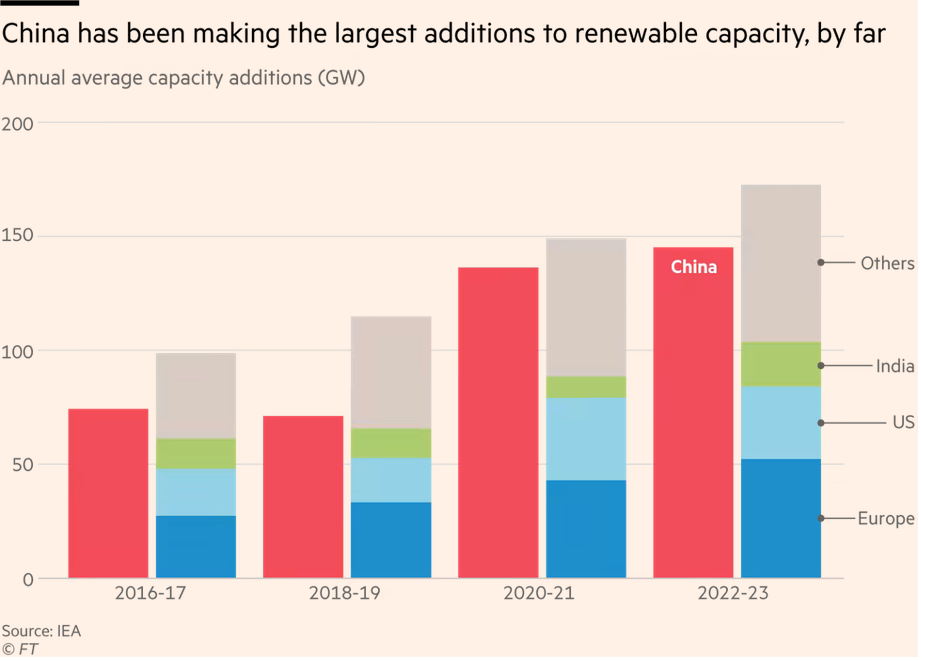

It is nonsense and you cannot help think they know it given Wolf post this graph in the article:

Yes, the model that is working to get investment is the Chinese model.

The Chinese model is state subsidy to industry, but it is hard to call it a profit subsidy model given they own the industry and do not have a private banking system.

There is something to be taken from the investment model that China uses: it uses the old USA and UK and French and every country that got to "developed" country status: direct state investment in production and controlled procurement markets.

I am not suggesting that this is the path that we follow, but it is bizarre to ignore this economic history and pretend that the "Keynesianism" of profit subsidy is an answer here.

It is far from central banker's and post-Keynesian's monetary narrative that we will find the solution. And, we have a short period of time to outline what that will be.

Like inflation-aware wage demands of workers, we must break the dominant narrative on the economy and start demanding real public investment in production.