November 21, 2023

Housing and inter-generational wealth transfer

Statistics Canada has released a study showing clearly that home ownership is a major piece of the inter-generational wealth transfer system in Canada.

For working class Canadians, owning a home has been a way to increase wealth faster than those who relied on wage growth. Piketty popularized the notion of wage versus investment returns (additive versus multiplicative growth in wealth) and that is what we are seeing in the housing market in Canada from the 1990s to 2020. Those who owned homes were able to expand their wealth much faster.

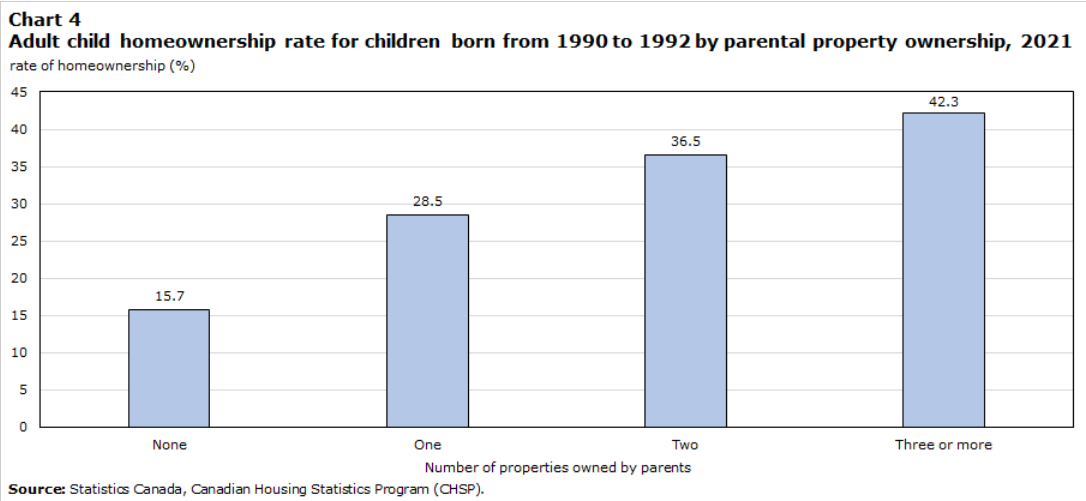

The rather unsurprising result of this wealth growth has been that many were able to transfer that wealth creation mechanism to their children by helping them buy property.

The question is, will this investment class continue to create wealth expansion as it did for their parents.

There is additional part to this analysis. Most of the home owning parents also made more in incomes (only partly due to owning and renting-out homes).

So, this is not exactly about "choices" of owning a home or not. Although, those who were able to own multiple properties and did were able to pass that wealth growth onto their children even at the lower end of the income scale.

Apart from the that small group of property investors, the story is one between the affluent working class and the poor working class:

The average income of non-owners was $36,000 (with a median of $31,000), compared with $65,000 for homeowners (with a median of $59,000).

… those with incomes less than $40,000 had significantly lower chances of being homeowners than those earning $40,000 to $80,000 or over $80,000

Also unsurprising, the provinces that have had the higher property and other costs have the lowest rates of wealth transfer resulting in home ownership.

Is any of this useful in the analysis of housing affordability? Yes. Housing ownership should not be a speculative endeavour where those who are able to get into home ownership are able to leverage that into inter-generational wealth transfer. The result of a property speculation market does several things that are negative:

- there develops a sense that housing is always a good investment over the long term (compared with other investments)

- funding retirement is increasingly looked at as something that can be financed through property asset appreciation (Emily Niles succinctly outlines this issue).

- speculation helps to drive house prices out of reach of home ownership of the poorer end of the working class. The result is affluent workers gaining on the backs of poorer workers through renting.

- the state becomes less interested in investing in housing for working people as property asset appreciation funds rental investor activity.

- investment activity drives the wrong end of the market, focused on expensive property speculators and not affordable housing.

- we end up in a terrible situation when the housing bubble ends.

Housing asset values cannot continue to have high rates of growth. Even in a country like Canada which always has immigration. Or, at least that should not be a desired outcome as it creates both a housing affordability crisis and extreme anxiety around loss of housing value for home owners. Both create perverse incentives for the government trying to deal with broader economic issues.

Exposed in this analysis is the inherent unfairness of wealth creation in society. Wealth creation disparities between financialized investment returns and the real economy are unsustainable and should be unwanted. There should be risk in financial investments—as in you should lose almost as often as you gain—and not a near guaranteed growth in value of that financial side of the economy.

Why?

Because, as Anwar Shaikh outlines, financial asset returns is simply wealth transfer, not wealth creation. The transfer of wealth in the housing market since the 1990s has been between segments of the working class, but if you zoom out it has been much larger still between the working class and capital. The much larger wealth transfer is the story from Piketty and the one that Classical economists have been telling for 150 years.

Urban transit ridership

Revenues are back up and so is ridership.

I am not sure we should be celebrating the revenue side. Transit should be more heavily subsidized that ridership should not be tided to revenue. And, certainly not tied in the way that this graph makes clear: