November 21, 2022

What's the plan now?

The climate, government, and capital meetings the previous week ended with the soft thud of disappointment and failure. It is very hard to see a way forward given the current state of things, where cynicism reigns and alternatives go unmentioned.

The COP27 will, like all the others before it, go down as the biggest failure yet for humanity to save itself from itself. There was no deal reached and there was significant backsliding on pledges no one intended to keep anyway.

The G20 came off like a bunch of world leaders trying their best to pretend there is not massive wars going on in regards to trade, national economic restructuring, costs of climate change, recession, and one involving real bombs.

The New Economy forum and a few other side meetings of the heads of Western capital outlined their hopes for state aid as their masters at the central bank push the global economy into an unnecessary recession.

It was not a positive end to one of the last weeks of the political working year (USA Thanksgiving is this week).

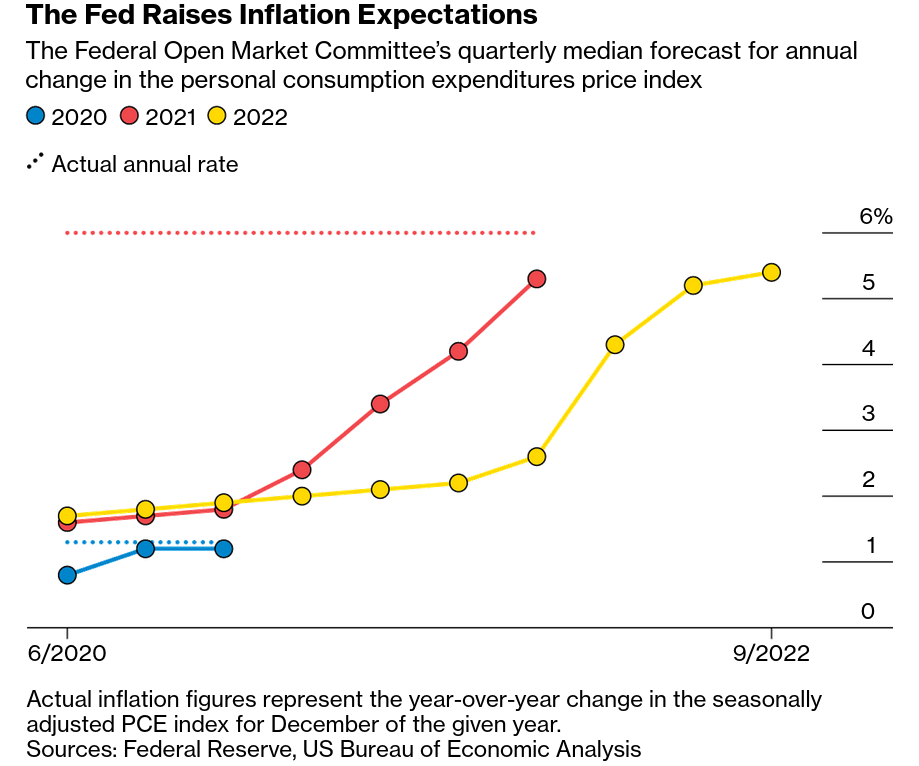

Even the central bankers are trying to rewrite their role in society:

The first step for the newly humbled monetary policymakers is getting prices back under control without creating economic havoc. Next they must transform the way central banks operate. For some experts, that means three things: paring down their mission, simplifying their messaging and preserving flexibility. It follows that the simpler the mission is, the simpler the messaging should be. “Monetary policy is 90% communication and 10% action,” says Bank of Thailand Governor Sethaput Suthiwartnarueput.

Mostly because they are trying avoid being always wrong

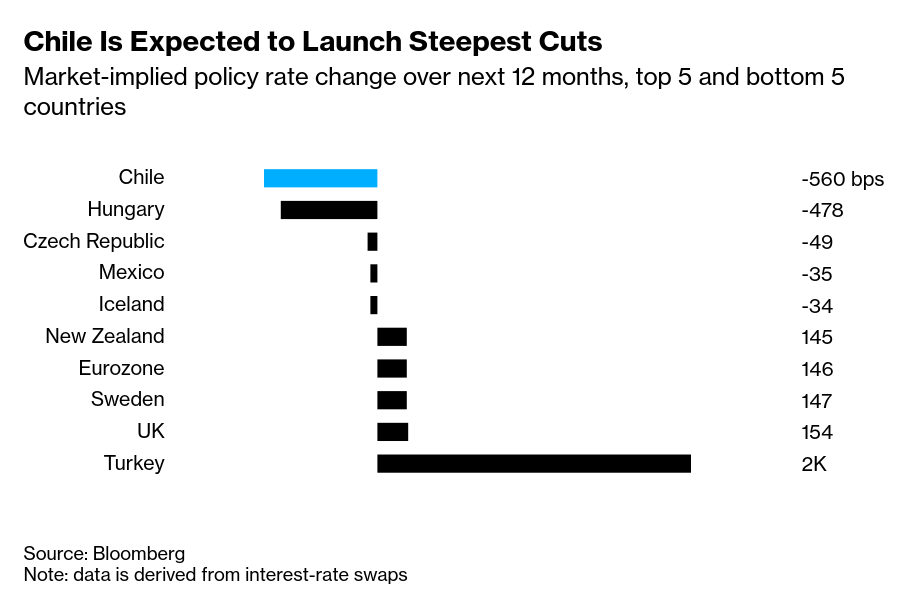

Chile seems to be the first country to win the recession race.

“Inflation will continue easing sharply due to high interest rates, fiscal austerity, decreasing domestic demand and falling commodity prices,” said Andres Abadia, chief economist at Pantheon Macroeconomics in the UK. “It’s very possible we’ll see rate cuts in Chile in the first quarter.”

You are left with the distinct impression that there is no plan. Indeed, there is no plan. There is only hope of it working out by itself mixed with being resigned that it likely will not.

It goes without saying, but melancholia is not leadership any more than false positivity is.

This is all very strange because the path forward is not so opaque and ambiguous. Unfortunately, it takes something that our world leaders do not have: a plurality of opinion.

No one is Left

Labour in the UK has penned an article in the Financial Times outlining that it would be responsible in seeking economic stability were it to win government.

For today’s Labour party, financial stability must be the foundation but is not an end in itself. Instead, it should serve as the platform for the UK to put in place a proper long-term plan for growth

.Business needs certainty and stability after the endless chopping and changing of recent years; a start-up environment which ensures the UK is the best place possible to start and grow a business; a plan that makes the UK a world leader in the transition to cleaner energy and gives the country the energy security it needs.

Not that anyone on the left has looked to the UK/English Labour Party for direction. However, they usually say what other social democrats are thinking. "Stability" and "responsibility" are going to be buzzwords as we head into yet another global economic slowdown.

(Did we ever even escape the previous one?)

With all the problems we are facing as a society, we are in desperate need of someone to start presenting alternatives. It would be helpful if they were ones that might work.

More signs of recession in the USA

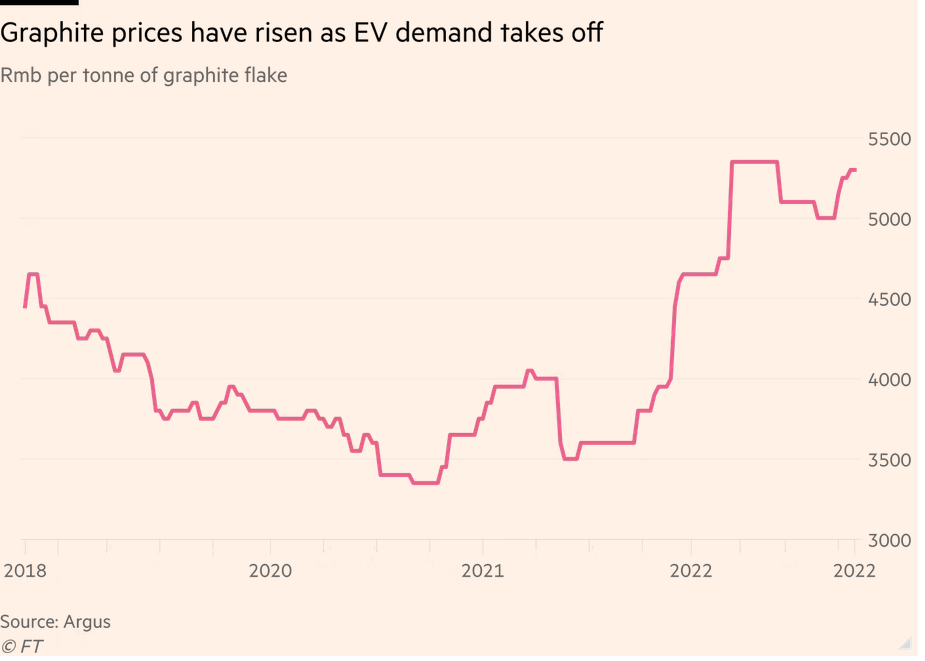

Graphite costs

We write constantly about the costs of inputs to Electric Vehicles. The new costs spike is in graphite (other costs have not come down).

The cost spike is due to the changes in regulation of where graphite needs to come from for EVs made/sold in the USA: it has to be from the USA.

The legislation says EVs entering the market after 2024 will not be eligible for tax credits — which can go up to $7,500 — if any of the critical minerals are extracted, processed or recycled by a “foreign entity of concern”, which includes China.

Prices of graphite have risen a third compared with a year ago to Rmb5,300 ($740) per tonne, according to Argus. (FT)

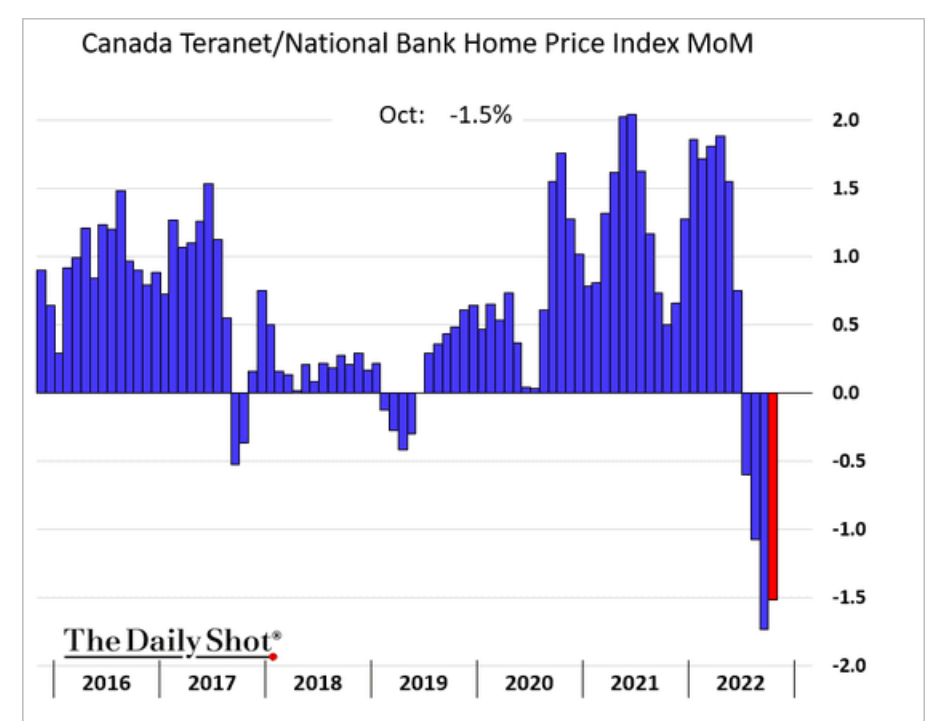

Canadian home prices

No one thinks home prices will ever fall until they do.

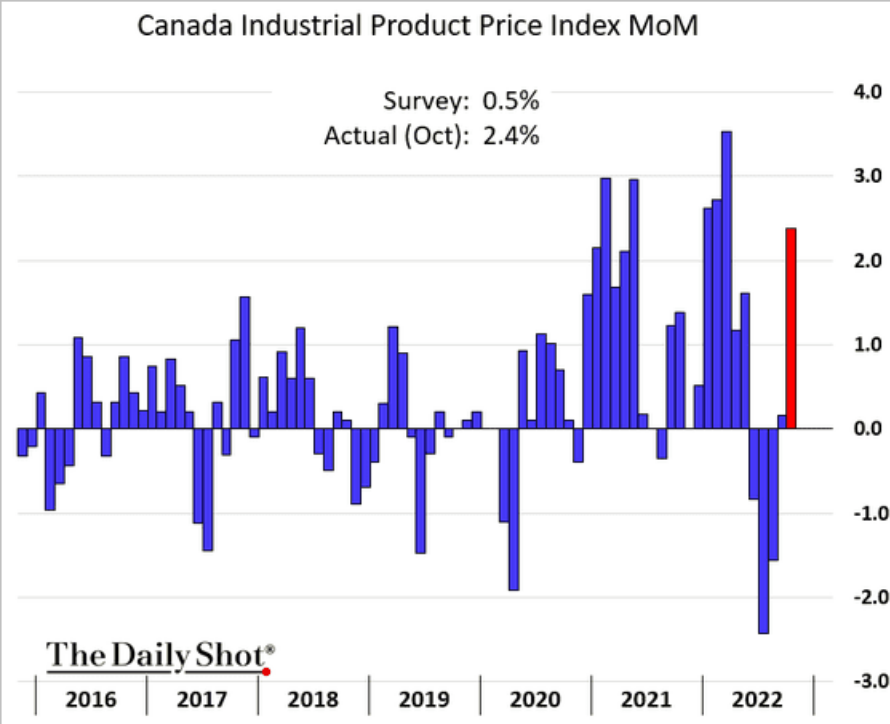

Canadian production

Wild swings in input prices.