November 2, 2023

The end of interest rate increases?

The focus in the USA yesterday was on rates increases, but the market has not had a chance to digest "higher for longer" impacts. Sure, rates might be stop going higher. That does not mean that there is no increasing negative impacts on the economy as it rolls into 2024 (as we pointed out yesterday).

Powell cheered inflation “progress”, rising labour supply, moderating payroll growth, and inflation expectations in a “good place”.

To be confident that inflation is coming down, the Fed wants to see somewhat lower growth. (FT)

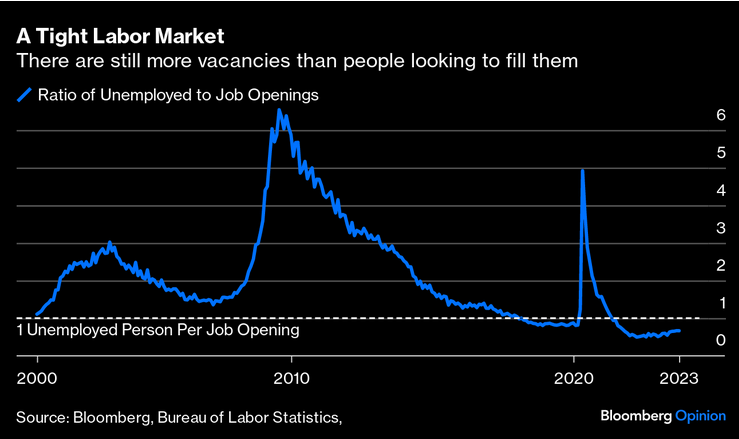

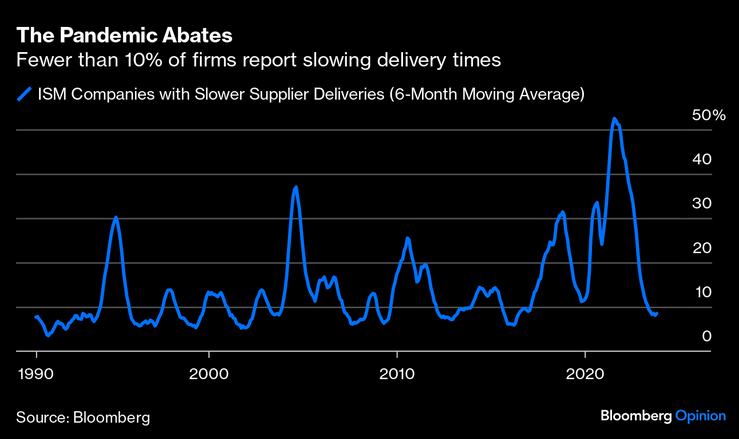

Labor supply is expanding and supply chains are being fixed.

But not everyone buys it. JPMorgan boss Jamie Dimon told Yahoo that another 75 bps of hikes are still possible, while ex-UBS chairman Axel Weber said he sees another increase next month.(BN)

In the USA, the only thing that will get the Federal Reserve to increase rates is the USA consumer. But, with interest rates sky high and their net wealth already heading even farther into the negative zone, it is hard to see how that could bounce.

The concern for workers around the world is if the central bankers are continuing to monitor inflation and adjusting interest rates based on cost increases, we are delaying investment on needed production.

Investments in housing, climate mitigation, energy transition, ending wars, health care, and knowledge expansion must be seen as the driving force for the economy.

Before we were dragged along into the conversation of how much higher interest rates could go, we talked about their impact. They cause reduced investments just as we need them by both governments and industry.

There will be a push for governments to reduce spending because for many "spending" means governments "borrowing" that money from someone. However, with higher costs, borrowing can be replaced with revenue generation.

To do this, we must push to disconnect spending and borrowing. Governments must look to raise revenue through increased taxes on capital (even if capital is doing poorly in a recession) and through supporting endemic economic activity. We have a lot of investments to make and if capitalism cannot facilitate that then the state has an obligation to take-over.

Investments must also be targeted towards production and value creation along with expansion in social protections as this balance is essential to sustain investment in the medium term. The alternative is a world where we watch things get slowly worse while bankers continue to tell us there is not enough money to be made saving society.