November 18, 2024

Climate change denier at head of US Department of Energy

Both economically and reality biased CEO of fracking company Liberty Energy Inc has been named as Energy Secretary.

While we will not dwell too much on the government appointments in the USA under Trump, this one is significant.

Loyalty Over Competency is the phrase of the next four years. There is no question that all the appointments of Trump to government are unqualified for the job. The debate now is how detached they are from reality.

Common comments made by Liberty Energy's CEO:

“There is no climate crisis. And we are not in the midst of an energy transition either,” Wright said in a video posted on his LinkedIn page. “Humans, and all complex life on earth, is simply impossible without carbon dioxide — hence the term carbon pollution is outrageous.”

He does not support alternative energy except for SMRs and (weirdly) geothermal.

If the rest of the planet decides to cut emissions (which they are not on course to given the conversations of COP29), then the USA still has the ability to destroy everyone's future.

1.5C is now no longer achievable and the world is on track for 3.1C increase before the end of the century with medium-term estimates well above that. And, this is only if the current climate policy goals are implemented fully—which includes the USA. These are obviously not going to be implemented.

So, the questions is, can we kick the can down the road four (or eight) more years? The answer is no.

None of this will really affect investment in renewables, but growth in renewables with an eye to the replacement of fossil fuels seems to be a policy no one wants to implement.

Now we wonder what the shortfall will be of the $215 trillion over the thirty years that needed to be spent to transition to Net Zero? Such answers affect our interest in this sector.

Self driving cars coming to the USA, even if they don't work

The secret of "self-driving" cars is that they are only on our roads to the extent that manufacturers can absorb liability for them not working a significant portion of the time. Which is why they all have human remote driving backups, workers who sit in an office looking over dozens of cars. They operate the cars when the computer is confused about major decisions being made.

This is because the "automation" is not really fully operational yet.

The argument on the other side is that humans are not particularly good at driving either. But you can hold a person accountable.

How about a company who has developed a killing machine that "hallucinates" while it is driving and decides to run over someone or crash at full speed into to the side of a bus?

The answer to this question is why there are so few self-driving cars on the road and why they are only in a few places where the government has spent a lot of money ensuring lines and signals on the road align with auto-steering manufacture's needs.

legislation faltered when some manufacturers tried to include language that would prevent consumers from suing or forming class-action cases. (BN)

Trump and his pet Musk are about to change this. The liability rules will be relaxed for these automated killing machines to operate on the road. So, start training yourself and your semi-automated car to keep an eye out for malfunctioning cars—especially of the delivery and taxi variety.

The other limitation of self-driving cars is that they are so expensive that it defeats the point of having them "replace" workers who drive them. The reduction of liability allows cheaper technology that Tesla uses to operate in "autonomous" modes. The cheaper technology is not as good as the tech Waymo uses (lidar, etc), but Trump has decided your life is worth Tesla profits.

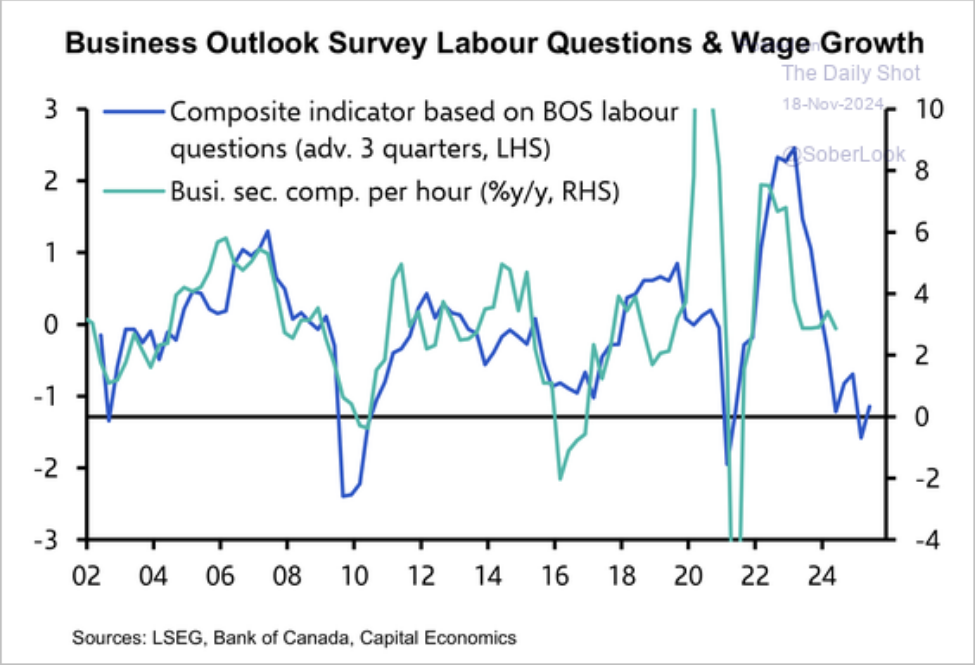

Bank of Canada is estimating wage growth will moderate

What is not looking good for workers is that investors and the BoC are betting wage growth continues to soften through the next quarter in Canada.

Workers have not made-up the difference from the post-pandemic inflation bump. Any softening of wage growth is a direct profit transfer to capital. Which is exactly what the Bank of Canada's policies and the Liberal's immigration policy were about achieving.

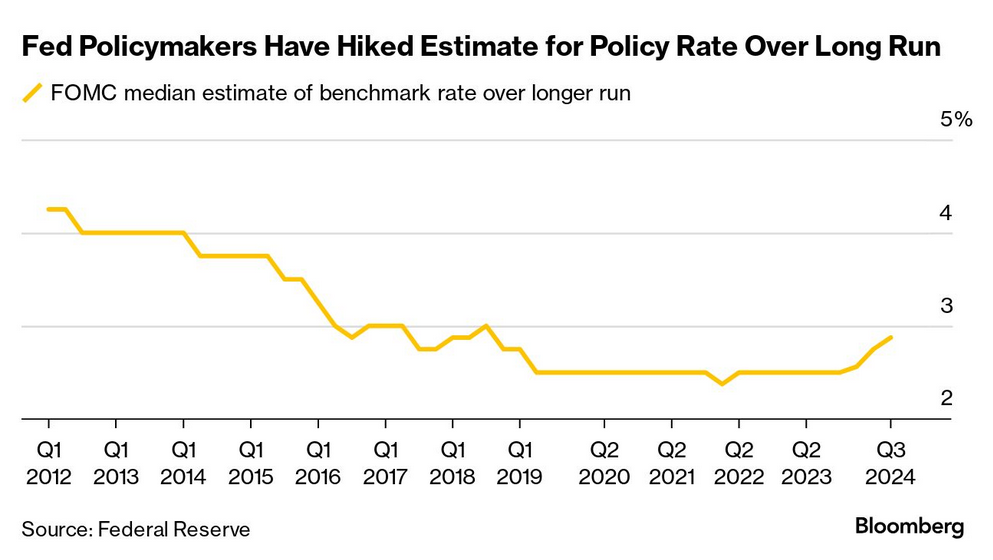

In the USA, the bets on the neutral policy rate at the Federal Reserve are hovering at about 3.1% to 3.8%. We may disagree about the reasons, but this means that interest rates are likely to remain a little higher than people expected.