November 16, 2022

Investment

We have a problem with investment.

From Bloomberg's New Economy Forum this morning:

Public or Private?

The theme of the day was “rebuilding,” but another topic that ran through many of today’s presentations was that overcoming global shocks like the pandemic, the food crisis, climate change and geopolitical tensions demands a rethinking of the division of labor between the public and private sectors.

How can governments stimulate growth in an era of strapped budgets and monetary tightening?

It is interesting that while governments continue to focus on if they should spend money, capital is asking the correct question: where should the money be spent?

Even to the CEO's meeting this week it seems somewhat clear. They cannot spend the money, but governments can. Their main goal is that it flows through them so they can reap profits.

This narrative is also changing for climate:

“Now the question is does that get passed on to the consumers or does the government step in and try to perform some subsidy to mitigate that early unit cost,” Quinn said at the forum.

(A strange thing to ask about the difference between the "government" and "consumers")

This has set-up a rather stark disconnect between the narrative coming out of the G20 meeting and the one being expressed by the global spokespeople of capital.

It is not what the G20 are focused on—interest rates and recession (that work of destroying the economy has already happened). Instead, the real conversation is about the economic crisis we are in.

The left is also far behind on this. Our leadership are forced to fight yesterday's battles around the economy. The crisis is shifting faster under our feet than we are able to deal with at the bargaining table.

The Bloomberg article has the correct question: public or private? Implicit in this question is the word production.

Capital is in a spot of trouble of its own making right now and the usual tools do not seem to be working. This is why so much pressure is being put on central bankers to destroy the economy.

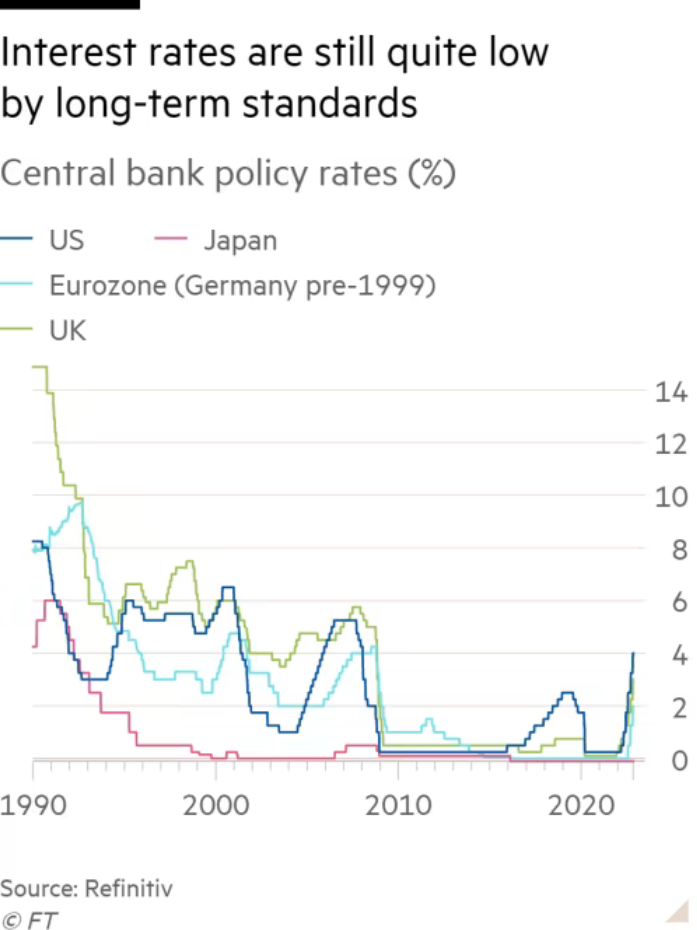

Lana Payne is correct, it is a class war being waged by the central bankers. Rates are heading back to where they were before the great rate reduction of the neoliberal period.

The problem is that it is the same war workers have been losing for decades. Controlling interest rates (i.e., keeping them artificially low) was not good for workers any more than artificially increasing interest rates are.

The "solutions" being presented to solve the current production crisis are just more profit subsidies. The same program that has brought high inflation and done nothing to alter the trajectory of this crisis so far.

The left need to listen to what capital is whispering about in the corners of the financial press. We need a public solution to the failures of private investment into production. We just need to state clearly that this is publicly owned and directed production not recession and profit guarantees.

Germany

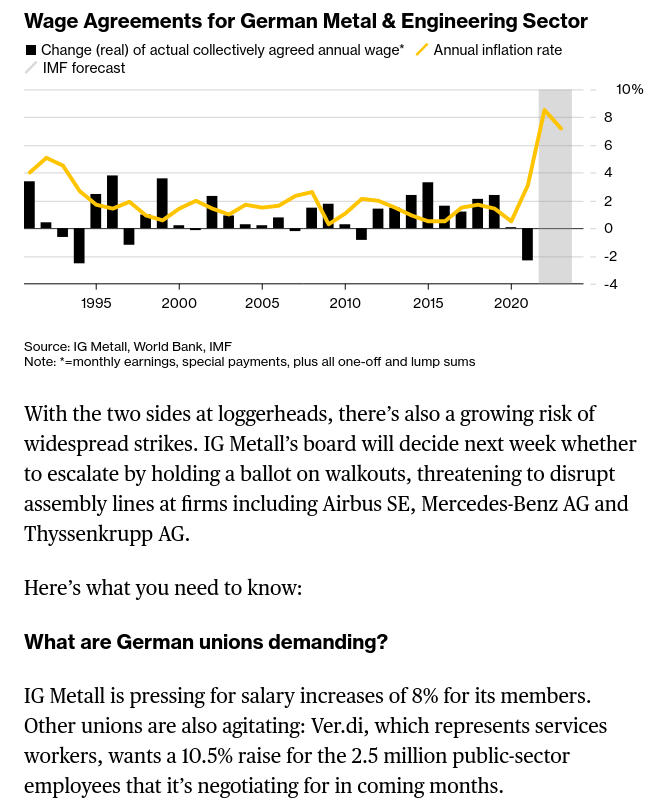

In Germany, the major unions are asking for inflationary increases:

This wage growth is worrying those who still think the wage-price spiral is a thing. The issue is that the government include many people like that—including in the European Central Bank. If wage increases come, the "independent" bank will adjust their interest rates up farther.

UK

Price inflation in the UK reached 11.1% today. This is not a surprise for folks following the costs of doing anything in the UK and the failing exchange rate of the UK pound.

The mismanagement of that economy is now becoming something of a standard position of the government there. The Tories are unable to find a solution that fits their ideological program.

Again, a disconnect between the current reality and the battle they think that they are fighting.

Canada

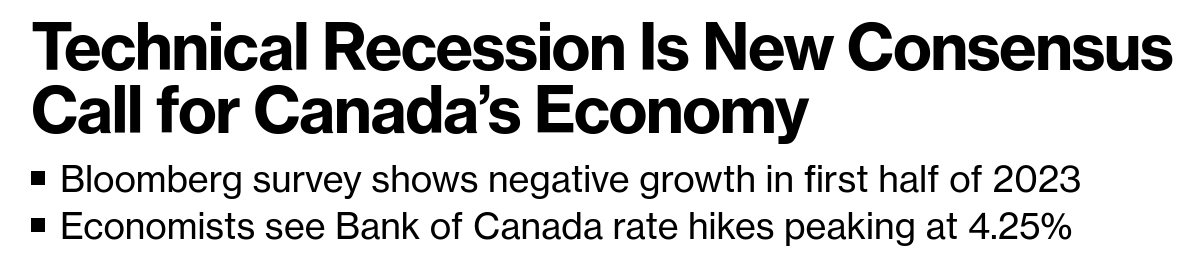

In Canada, we are seeing near consensus that a recession is already baked into the economy:

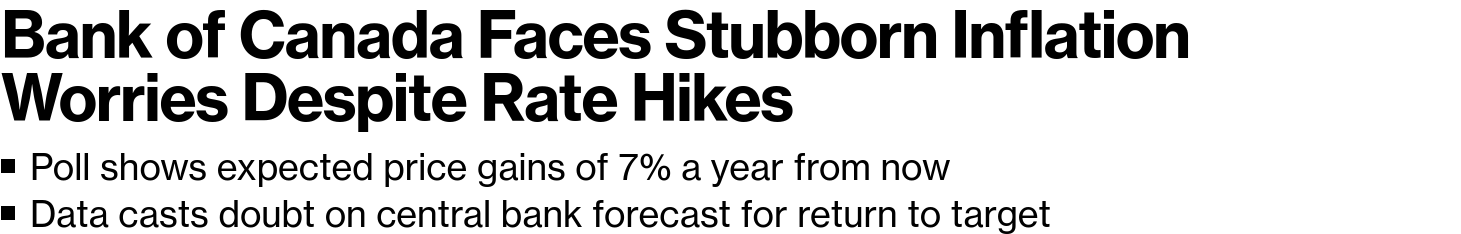

And, that has not stopped inflation (of course):

Artemis Launches

The USA is heading back to the moon to support the extraction of materials from that rock. The first step is the launch of Artemis. This is a very big drone.

The next one will have people in it.